Saudi Arabia Concrete Reinforcement Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2026-2034

Saudi Arabia Concrete Reinforcement Market Overview:

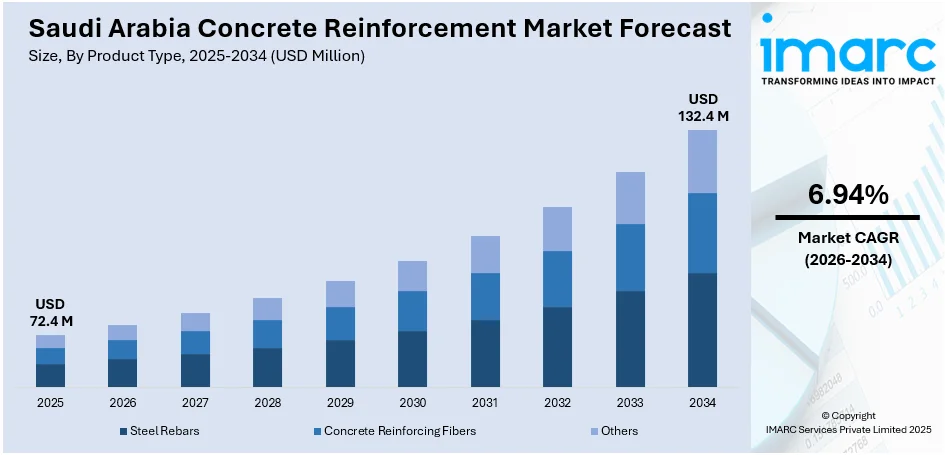

The Saudi Arabia concrete reinforcement market size reached USD 72.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 132.4 Million by 2034, exhibiting a growth rate (CAGR) of 6.94% during 2026-2034. The market is driven by Vision 2030-led infrastructure expansion, necessitating high-strength, corrosion-resistant reinforcement materials for mega-projects such as NEOM and coastal developments. Growing adoption of prefabricated construction techniques accelerates demand for precision-engineered rebar cages and welded wire mesh, enhancing efficiency in large-scale housing and commercial projects. Stricter regulations and a shift toward sustainable construction further incentivize advanced reinforcement solutions, further augmenting the Saudi Arabia concrete reinforcement market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 72.4 Million |

|

Market Forecast in 2034

|

USD 132.4 Million |

| Market Growth Rate 2026-2034 | 6.94% |

Saudi Arabia Concrete Reinforcement Market Trends:

Escalating Demand for High-Strength Reinforcement Materials

The market is witnessing a growing demand for high-strength materials such as epoxy-coated rebar and fiber-reinforced polymer (FRP) rebars. This trend is driven by the need for durable and corrosion-resistant solutions in infrastructure projects, particularly in coastal and industrial areas where environmental factors accelerate structural degradation. Fiber-reinforced polymer (FRP) rebars have tensile strengths of up to 1,380 MPa. They are 75% less heavy than steel, having above 80% strength retention rates in environments with saline, alkaline, and freeze-thaw conditions. Glass/vinyl-ester and carbon/epoxy FRPs outperform conventional materials in environments prone to corrosion, making them well-suited to the concrete reinforcement industry in Saudi Arabia. The newest ACI 440.11 design specifications indicate an environmental factor of 0.85, suggesting a service life of 75 to 100 years for FRP-reinforced concrete in infrastructure that is exposed to harsh climatic conditions. The government Vision 2030 initiative, with an emphasis on sustainable urban development and mega-projects, including NEOM and the Red Sea Project, is compounding this demand. Also, the government's use of more stringent building codes is forcing contractors to utilize modern reinforcement techniques that provide buildings with longer service lives. Manufacturers are responding by developing advanced reinforcement materials that meet global building standards through research and development investments. Consequently, this direction is pushing the market beyond using traditional steel rebars, toward high-performance and innovative reinforcement alternatives lasting longer and requiring less maintenance, in line with Saudi Arabian aspirations toward advanced and sustainable building processes.

To get more information on this market Request Sample

Rising Adoption of Modular and Prefabricated Construction Techniques

The accelerating demand of modular and prefabricated construction methods is significantly supporting the Saudi Arabia concrete reinforcement market growth. These techniques require precise and high-quality reinforcement solutions to ensure structural integrity while reducing on-site construction time. With the government accelerating housing and commercial projects to meet Vision 2030 goals, off-site construction is gaining traction due to its efficiency and cost-effectiveness. Saudi Arabia's housing supply is expected to grow to 3.9 million units by 2028 from its existing 3.5 million units, driven by initiatives such as Sakani and Wafi, along with a national rate of homeownership at 63.7% in 2023. Riyadh alone needs an extra 305,000 houses, while apartment prices have been appreciated by 75% to SAR 5,780 per square meter and villa prices by 40% to SAR 5,190 per square meter since 2019. This growth in residential development makes advanced concrete reinforcement systems more critical for Saudi Arabia's expanding urban centers. Reinforcement materials used in precast concrete elements, such as welded wire mesh and pre-assembled rebar cages, are seeing higher demand as they enhance construction speed and quality control. Additionally, the use of automation and digital design tools (such as BIM) is optimizing reinforcement placement in prefabricated structures. This trend is reshaping the market, with suppliers focusing on providing customized reinforcement solutions tailored for modular construction, supporting Saudi Arabia’s push for rapid infrastructure development and smart city initiatives.

Saudi Arabia Concrete Reinforcement Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type and application.

Product Type Insights:

- Steel Rebars

- Concrete Reinforcing Fibers

- Polypropylene Fibers

- Steel Fibers

- Basalt Fibers

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes steel rebars, concrete reinforcing fibers (polypropylene fibers, steel fibers, basalt fibers, and others), and others.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Infrastructure

- Residential Construction

- Commercial Construction

- Industrial Construction

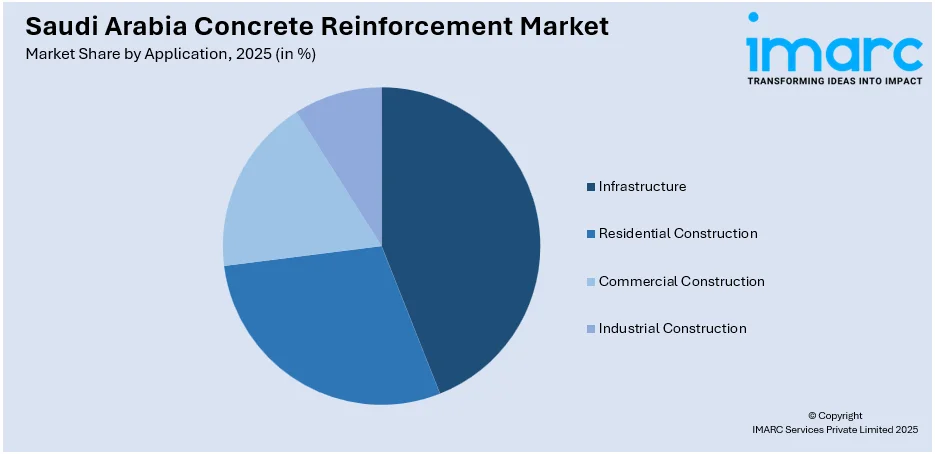

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes infrastructure, residential construction, commercial construction, and industrial construction.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Concrete Reinforcement Market News:

- December 30, 2024: Al Jouf Cement, in partnership with Asas Al Muhailb, launched a sustainable cement for NEOM projects, registering a 30% decrease in CO₂ emissions and eliminating the requirement for imported fly ash and GGBS. The product has improved compressive strength, resistance to chloride, and thermal insulation. Its low heat of hydration and reduced permeability make it appropriate for cost-effective, high-durability uses in accordance with Vision 2030.

Saudi Arabia Concrete Reinforcement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Applications Covered | Infrastructure, Residential Construction, Commercial Construction, Industrial Construction |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia concrete reinforcement market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia concrete reinforcement market on the basis of product type?

- What is the breakup of the Saudi Arabia concrete reinforcement market on the basis of application?

- What is the breakup of the Saudi Arabia concrete reinforcement market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia concrete reinforcement market?

- What are the key driving factors and challenges in the Saudi Arabia concrete reinforcement market?

- What is the structure of the Saudi Arabia concrete reinforcement market and who are the key players?

- What is the degree of competition in the Saudi Arabia concrete reinforcement market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia concrete reinforcement market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia concrete reinforcement market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia concrete reinforcement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)