Saudi Arabia Confectionery Market Size, Share, Trends and Forecast by Product Type, Age Group, Price Point, Distribution Channel, and Region, 2025-2033

Saudi Arabia Confectionery Market Overview:

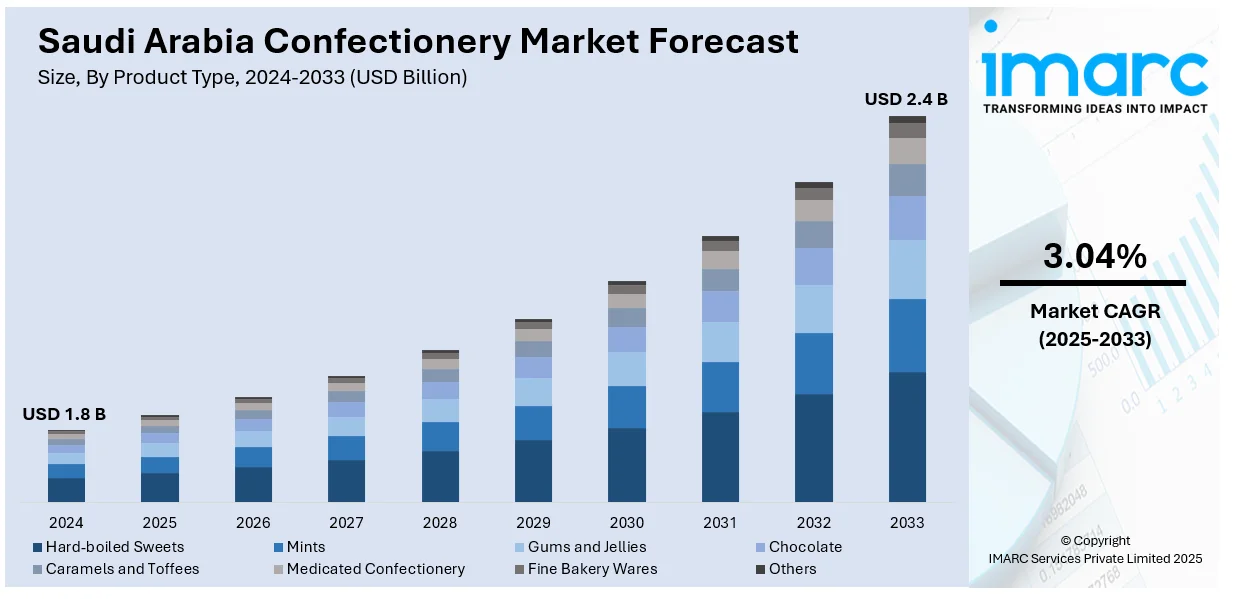

The Saudi Arabia confectionery market size reached USD 1.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.4 Billion by 2033, exhibiting a growth rate (CAGR) of 3.04% during 2025-2033. The market is boosted by growing disposable incomes, high youth population, and urbanization. Shift in consumer tastes toward premium and healthy products, and festive occasions such as Ramadan and celebratory holidays also accelerates the Saudi Arabia confectionery market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.4 Billion |

| Market Growth Rate 2025-2033 | 3.04% |

Saudi Arabia Confectionery Market Trends:

Health-conscious Confectionery Products

With an increasingly health-conscious consumer base in Saudi Arabia, there is a rising need for healthier confectionery. This is fueled by growing awareness about health concerns like obesity and diabetes, especially among the youth. In response, manufacturers are launching confectionery with lower sugar content, natural ingredients, and organic labels. Brands are also testing alternatives such as stevia, honey along with gluten-free versions to accommodate dietary restrictions and preferences. Moreover, functional confectioneries that contain vitamins, minerals, and probiotics are also on the rise, reflecting an overall shift of the Saudi Arabia confectionery market outlook toward health and wellness. Consumers, particularly millennials and Gen Z, are willing to pay a premium for products that combine indulgence with health benefits. This has led to a change in product development and packaging, with greater focus on transparency, clean labels, and nutrition labeling. Health-awareness is therefore transforming the confectionery industry, compelling manufacturers to diversify their products.

Rise of Premium and Artisanal Products

There is a significant increase in Saudi Arabian demand for premium and artisanal confectionery goods. Consumers are looking for high-quality, distinct, and visually compelling treats that provide a more indulgent experience than their mass-market counterparts. This is driven by an emerging middle class with greater disposable income and the aspiration for elite experiences. Handmade sweets, handcrafted chocolates, and high-quality packaged products are gaining popularity, particularly in urban centers such as Riyadh and Jeddah. Local and global brands alike are launching limited edition flavors and artisanal processes, emphasizing craftsmanship and the quality of ingredients used. This move toward premium products is also driven by the growing popularity of gifting during festivals and celebrations such as Eid, when high-end confectionery is regarded as a status symbol. Mall owners are benefiting from this trend with boutique experiences and added product presentations, appealing to a more sophisticated, high-end clientele.

E-commerce Growth and Online Confectionery Sales

The Saudi Arabian e-commerce industry has witnessed tremendous growth, with the confectionery industry reaping the benefits of this digital revolution. According to the IMARC Group, the Saudi Arabia e-commerce market size reached USD 222.9 Billion in 2024 and is further expected to reach USD 708.7 Billion by 2033, exhibiting a growth rate (CAGR) of 12.8% during 2025-2033. Confectionery websites like Souq.com (Amazon), Noon, and other local companies have facilitated greater consumer convenience in the purchase of diverse confectionery items from the comfort of homes. The convenience of home delivery, coupled with in-store promotion discounts and special online offers, has drawn several consumers to online mediums. Moreover, social media and influencer marketing have emerged as strong drivers for advertising confectionery products, enabling brands to touch base with a larger consumer base. The COVID-19 outbreak further hastened the march to online shopping, and its momentum continues unabated. Hence, brands are now investing in e-commerce strategies, creating user-friendly websites, and partnering with delivery platforms to improve customer experience. As digital adoption increases, e-commerce is expected to play a significant role in shaping the future of the Saudi Arabia confectionery market share.

Saudi Arabia Confectionery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, age group, price point, and distribution channel.

Product Type Insights:

- Hard-boiled Sweets

- Mints

- Gums and Jellies

- Chocolate

- Caramels and Toffees

- Medicated Confectionery

- Fine Bakery Wares

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes hard-boiled sweets, mints, gums and jellies, chocolate, caramels and toffees, medicated confectionery, fine bakery wares, and others.

Age Group Insights:

- Children

- Adult

- Geriatric

The report has provided a detailed breakup and analysis of the market based on the age group. This includes children, adult, and geriatric.

Price Point Insights:

- Economy

- Mid-range

- Luxury

The report has provided a detailed breakup and analysis of the market based on the price point. This includes economy, mid-range, and luxury.

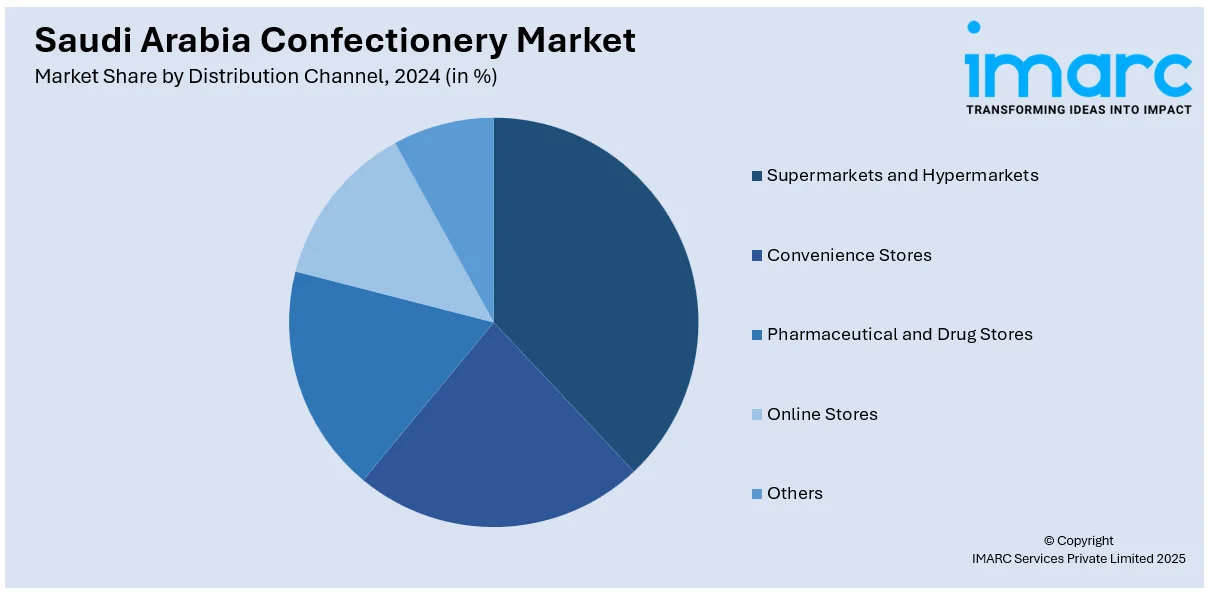

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmaceutical and Drug Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, pharmaceutical and drug stores, online stores, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Confectionery Market News:

- In September 2023, the US-based food producer Mars celebrated a decade of operations in Saudi Arabia with a notable event that included attendees from the Saudi Food & Drug Authority (SFDA), US Consulate General Jeddah, King Abdullah Economic City, and Ministry of Industry and Mineral Resources.

Saudi Arabia Confectionery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Hard-boiled Sweets, Mints, Gums and Jellies, Chocolate, Caramels and Toffees, Medicated Confectionery, Fine Bakery Wares, Others |

| Age Groups Covered | Children, Adult, Geriatric |

| Price Points Covered | Economy, Mid-range, Luxury |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Pharmaceutical and Drug Stores, Online Stores, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia confectionery market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia confectionery market on the basis of product type?

- What is the breakup of the Saudi Arabia confectionery market on the basis of age group?

- What is the breakup of the Saudi Arabia confectionery market on the basis of price point?

- What is the breakup of the Saudi Arabia confectionery market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia confectionery market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia confectionery market?

- What are the key driving factors and challenges in the Saudi Arabia confectionery market?

- What is the structure of the Saudi Arabia confectionery market and who are the key players?

- What is the degree of competition in the Saudi Arabia confectionery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia confectionery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia confectionery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia confectionery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)