Saudi Arabia Confectionery Packaging Market Size, Share, Trends and Forecast by Product, Material, Application, and Region, 2026-2034

Saudi Arabia Confectionery Packaging Market Summary:

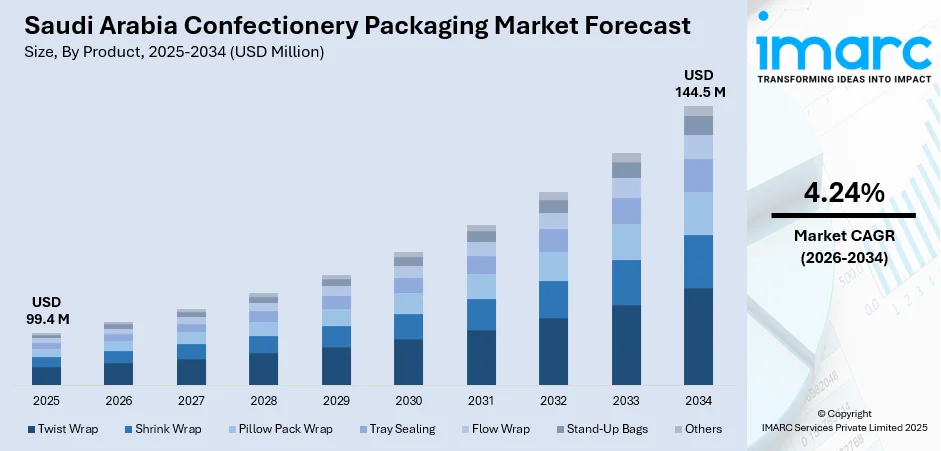

The Saudi Arabia confectionery packaging market size was valued at USD 99.4 Million in 2025 and is projected to reach USD 144.5 Million by 2034, growing at a compound annual growth rate of 4.24% from 2026-2034.

Saudi Arabia's confectionery packaging market reflects the Kingdom's expanding consumer goods sector, driven by urbanization patterns and evolving retail landscapes that prioritize convenience and product presentation. The market encompasses diverse packaging solutions designed to preserve product freshness, enhance brand visibility, and meet consumer convenience expectations across chocolate, candy, and gum categories. Packaging manufacturers serve both international confectionery brands, creating a dynamic competitive environment where innovation meets cultural authenticity in design execution and material selection strategies, thereby expanding the Saudi Arabia confectionery packaging market share.

Key Takeaways and Insights:

- By Product: Twist wrap dominates the market with a share of 28% in 2025, offering cost-effective sealing capabilities and nostalgic appeal for traditional candy formats across retail channels.

- By Material: Plastic leads the market with a share of 60% in 2025, providing superior moisture barrier properties and flexibility for intricate confectionery shapes and portion sizes.

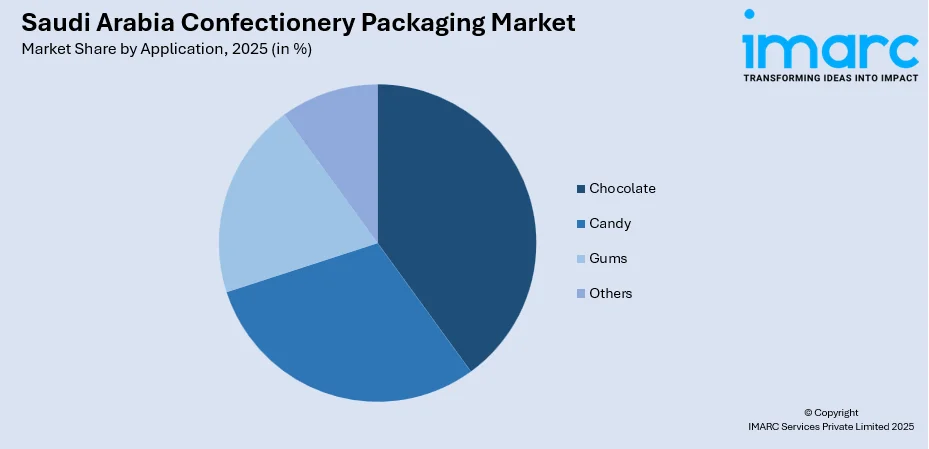

- By Application: Chocolate represents the largest segment with a market share of 39% in 2025, reflecting premium positioning requirements and temperature-sensitive protection needs for cocoa-based products.

- By Region: Northern and central region exhibits dominance with 31% market share in 2025, concentrated around Riyadh's metropolitan consumption patterns and distribution infrastructure.

- Key Players: The Saudi Arabia confectionery packaging market features multinational packaging corporations competing alongside regional converters, with players differentiating through material innovation, printing capabilities, and supply chain responsiveness to meet seasonal demand fluctuations during Ramadan and Eid celebrations.

To get more information on this market Request Sample

The Kingdom's confectionery packaging sector is experiencing transformation as manufacturers balance traditional packaging aesthetics with modern sustainability expectations while navigating complex regulatory environments. The market serves as a critical enabler for international confectionery brands entering the Saudi market while supporting domestic producers in meeting regulatory compliance standards established by the Saudi Food and Drug Authority. Packaging innovation is increasingly concentrating on prolonging shelf life in warm climates while integrating cultural design features that appeal to local consumers, especially Arabic calligraphy and traditional motifs. The sector's evolution mirrors broader economic diversification initiatives under Vision 2030, with growing emphasis on local manufacturing capabilities and reduced import dependency for packaging materials. In 2024, Saudi Arabia granted 1,346 new industrial licenses, drawing more than SR50 billion ($13.3 billion) in fresh investments. Moreover, major confectionery manufacturers are establishing regional packaging procurement centers in Riyadh, consolidating supplier relationships and leveraging economies of scale to negotiate favorable pricing structures. The market demonstrates resilience through economic cycles due to confectionery's positioning as an affordable luxury category that maintains consumption during moderate downturns, with packaging quality remaining non-negotiable for brand equity preservation across price segments.

Saudi Arabia Confectionery Packaging Market Trends:

Integration of Sustainable Packaging Materials

The Saudi confectionery packaging landscape is witnessing gradual adoption of recyclable and compostable materials as manufacturers respond to global sustainability movements and emerging local environmental awareness. Brands are exploring paper-based alternatives for outer wrapping layers while maintaining functional plastic barriers for product protection. This transition reflects alignment with the Kingdom's circular economy aspirations, where packaging waste management is becoming increasingly prioritized in urban centers. Converters are investing in material research to develop solutions that maintain the visual appeal and protective properties essential for confectionery products while reducing environmental footprint, particularly for premium chocolate segments where packaging integrity directly influences purchase decisions. IMARC Group predicts that the Saudi Arabia green packaging market is projected to attain USD 3,692.45 Million by 2033.

Personalization and Limited-Edition Packaging Designs

Confectionery manufacturers are leveraging packaging as a strategic marketing tool through culturally relevant designs and seasonal variations tailored to Saudi celebrations. Packaging featuring Arabic calligraphy, heritage motifs, and regional color palettes enhances emotional connections with consumers during key gifting occasions. Digital printing technologies enable shorter production runs for limited edition releases, allowing brands to test market responses without significant inventory commitments. For instance, in 2024, Tenaui, a frontrunner in digital commercial printing solutions within the Saudi Arabian printing industry, has opened the largest digital commercial printing press in the Middle East. Situated in Ali Ibn Al Mufaddal, And Noor, Riyadh 14271, the developed Tenaui Commercial Digital Printing Centre is the first facility of its kind in the kingdom. The facility is driven by Canon's newest inkjet technology, which caters to the varied and expanding digital print demands of the Saudi market. This prominent facility signifies a strategic investment in the printing sector of Saudi Arabia, in line with the nation's Vision 2030 objectives for economic diversification and technological progress.

Smart Packaging Integration for Supply Chain Transparency

Advanced packaging solutions incorporating QR codes and temperature-sensitive indicators are gaining traction as supply chain stakeholders seek enhanced traceability from manufacturing facilities to retail shelves. These technologies address quality assurance concerns in Saudi Arabia's challenging climate conditions, where temperature fluctuations during distribution can compromise product integrity. Smart packaging features enable consumers to verify product authenticity and access nutritional information through smartphone interactions, building brand trust in an increasingly quality-conscious market. The adoption is most evident among international brands establishing direct consumer communication channels while meeting regulatory requirements for ingredient transparency and allergen disclosure. In 2024, SABIC, a worldwide frontrunner in the chemical sector, revealed last week the successful launch of the initial circular packaging project in Saudi Arabia as a component of its TRUCIRCLE initiative to promote the advancement of a circular plastic economy. FONTE, a significant entity in the bakery sector of the Kingdom of Saudi Arabia (KSA), has launched bread bags created from SABIC’s certified circular polyethylene (PE) for their Oat Arabic Bread. The bags are manufactured by Napco National, a Saudi firm that integrates the production of flexible film and packaging products, using two food-contact certified circular polyethylene resin types (LLDPE) from SABIC's TRUCIRCLE range.

How Vision 2030 is Transforming the Saudi Arabia Confectionery Packaging Market:

Saudi Arabia’s Vision 2030 is reshaping the confectionery packaging market in practical, visible ways. The push to diversify away from oil has strengthened food manufacturing, pulling more confectionery production inside the Kingdom and raising demand for locally sourced packaging. Investments in industrial zones and logistics hubs have made it easier for packaging suppliers to serve domestic brands and export-focused manufacturers. Sustainability targets under Vision 2030 are also influencing material choices. Confectionery companies are shifting toward recyclable paper, mono-material plastics, and lightweight flexible packaging to align with waste reduction goals. This shift is supported by tighter regulations on packaging waste and growing pressure from retailers to meet environmental benchmarks. At the same time, a young, urban population and rising tourism are driving premium confectionery consumption. Brands are responding with better shelf appeal, smarter portion packs, and packaging that supports gifting and travel retail. Digital printing and automation are gaining ground, helping manufacturers manage shorter runs and faster product launches. Together, these changes are steadily modernizing the confectionery packaging market.

Market Outlook 2026-2034:

The Saudi Arabia confectionery packaging market is positioned for steady expansion driven by demographic shifts toward younger populations with higher disposable incomes and evolving snacking habits influenced by international exposure. Urbanization patterns are reshaping distribution channels, with modern retail formats demanding packaging solutions that facilitate efficient shelf merchandising and consumer self-service selection. The market generated a revenue of USD 99.4 Million in 2025 and is projected to reach a revenue of USD 144.5 Million by 2034, growing at a compound annual growth rate of 4.24% from 2026-2034. The Northern and Central Region's commercial infrastructure development will continue anchoring market growth, while emerging consumption centers in Western and Eastern regions present opportunities for geographic expansion.

Saudi Arabia Confectionery Packaging Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Twist Wrap | 28% |

| Material | Plastic | 60% |

| Application | Chocolate | 39% |

| Region | Northern and Central Region | 31% |

Product Insights:

- Twist Wrap

- Shrink Wrap

- Pillow Pack Wrap

- Tray Sealing

- Flow Wrap

- Stand-Up Bags

- Others

Twist wrap dominates with a market share of 28% of the total Saudi Arabia confectionery packaging market in 2025.

Twist wrap packaging maintains its leading position through inherent cost advantages and operational simplicity that appeals to both large-scale manufacturers and smaller confectionery producers across the Kingdom. The format's versatility accommodates various candy shapes and sizes while enabling high-speed automated wrapping processes that maximize production efficiency. Traditional consumer familiarity with twist-wrapped candies creates psychological associations with authentic confectionery experiences, particularly for nostalgic product categories that evoke childhood memories. The packaging style's material efficiency minimizes waste generation during manufacturing while providing adequate protection against humidity and contamination during retail display periods.

The twist wrap segment benefits from minimal equipment investment requirements compared to more complex packaging systems, making it particularly attractive for regional manufacturers serving local distribution networks. The format's tactile unwrapping experience creates sensory engagement that enhances product enjoyment, a factor particularly relevant for impulse purchase categories positioned near checkout counters. Twist wrap's compatibility with both transparent and opaque films enables manufacturers to showcase product appearance or create premium perceptions through metallic finishes, supporting diverse brand positioning strategies. The segment's resilience stems from its fundamental ability to balance functionality, aesthetics, and economic viability across price-sensitive and premium confectionery segments simultaneously.

Material Insights:

- Plastic

- Paper and Paperboard

- Others

Plastic leads with a share of 60% of the total Saudi Arabia confectionery packaging market in 2025.

Plastic materials dominate Saudi Arabia's confectionery packaging landscape due to superior barrier properties essential for preserving product quality in the Kingdom's extreme temperature conditions where summer heat can compromise confectionery integrity. Plastic films offer exceptional flexibility in thickness customization, enabling manufacturers to optimize material usage while maintaining protective performance standards required for extended shelf life expectations. The material's compatibility with high-speed packaging machinery ensures production efficiency that meets demand fluctuations during peak seasonal periods, particularly Ramadan when confectionery consumption experiences dramatic increases. Plastic packaging facilitates intricate printing capabilities that support brand differentiation through vibrant graphics and metallic effects impossible to achieve with alternative materials.

The plastic segment's dominance reflects its unmatched versatility in accommodating diverse confectionery formats, from individually wrapped hard candies to flow-wrapped chocolate bars requiring moisture and oxygen barrier properties. Modern plastic formulations incorporate improved sealability characteristics that reduce package failure rates during distribution across Saudi Arabia's vast geographic distances and challenging logistics infrastructure. The material enables portion control packaging formats aligned with health-conscious consumption trends while supporting single-serve convenience formats preferred by on-the-go consumers in urban centers. Despite emerging sustainability concerns, plastic's functional superiority and established supply chain infrastructure maintain its market leadership, with gradual evolution toward recyclable variants rather than wholesale material substitution.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Chocolate

- Candy

- Gums

- Others

Chocolate exhibits a clear dominance with a 39% share of the total Saudi Arabia confectionery packaging market in 2025.

Chocolate packaging requirements drive substantial market value due to the product's sensitivity to temperature fluctuations and light exposure, necessitating sophisticated multi-layer packaging systems that command premium pricing compared to simpler candy wrapping solutions. The segment's prominence reflects chocolate's cultural significance as a prestigious gifting option during celebrations, where elaborate packaging designs enhance perceived value and justify higher price points essential for premium brand positioning. Saudi consumers associate chocolate quality with packaging presentation quality, creating strong market incentives for manufacturers to invest in visually striking wrapper designs featuring gold foiling, embossing, and intricate patterns that communicate luxury and indulgence.

The chocolate application segment benefits from the product category's year-round consumption patterns supplemented by intense seasonal demand spikes during religious holidays and national celebrations when elaborately packaged chocolate assortments dominate gifting traditions. Packaging innovations specifically address chocolate's technical challenges, including developing wrappers that maintain product integrity during temperature-controlled storage and distribution while providing tactile premium experiences during unwrapping moments. The segment's growth trajectory aligns with increasing Saudi consumer exposure to international chocolate brands and evolving taste preferences toward premium cocoa content varieties that warrant sophisticated packaging systems. Chocolate packaging serves dual functions of product protection and brand storytelling, with outer cartons and inner wrappers working synergistically to create memorable unboxing experiences that encourage brand loyalty and repeat purchases.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and central region leads with a share of 31% of the total Saudi Arabia confectionery packaging market in 2025.

The Northern and central region's market leadership stems from Riyadh's position as Saudi Arabia's commercial and administrative capital, concentrating major confectionery manufacturers, packaging converters, and distribution headquarters within its metropolitan infrastructure. The region's dense population centers create concentrated demand that attracts packaging suppliers seeking proximity to end-user facilities, reducing logistics costs and enabling responsive technical support for production operations. Riyadh's established industrial zones facilitate packaging material imports through efficient customs processing and warehousing capabilities, providing supply chain advantages over peripheral regions. The capital's cosmopolitan consumer base exhibits higher willingness to experiment with premium confectionery products requiring sophisticated packaging solutions, driving market innovation and value growth.

The region benefits from superior retail infrastructure encompassing modern hypermarkets, specialty confectionery boutiques, and traditional souks that collectively demand diverse packaging formats suited to varying merchandising environments. Corporate headquarters concentrated in Riyadh centralize procurement decisions for nationwide confectionery distribution networks, amplifying the region's influence on packaging specification standards and supplier relationships. The Northern and Central Region's educational institutions and healthcare facilities generate institutional demand for individually wrapped confectionery items meeting hygiene standards, creating consistent baseline consumption independent of seasonal fluctuations. Government initiatives promoting local manufacturing capabilities further entrench the region's dominance through industrial development programs that attract packaging technology investments and skilled workforce development focused on advanced converting operations.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Confectionery Packaging Market Growing?

Rising Disposable Incomes and Premiumization Trends

Saudi Arabia's economic development trajectory has elevated household purchasing power, enabling consumers to allocate increasing expenditure toward premium confectionery products that justify sophisticated packaging investments. In Saudi Arabia, the GDP is expected to increase by 3.7% annually in 2025, continuing to exceed global GDP growth, which is predicted at 3.2% – a slight rise from 3.1% in 2024. At the same time, it is anticipated that consumer expenditure in the Kingdom will increase by 4.5%, while consumer price inflation is expected to hit 2%. The growing middle class exhibits preferences for internationally recognized chocolate brands and specialty confectionery items where packaging quality signals product authenticity and justifies price premiums over economy alternatives. This wealth accumulation effect is particularly pronounced among younger demographics entering peak earning years, who demonstrate willingness to pay for convenient single-serve packaging formats and aesthetically appealing designs that enhance social media sharing experiences. The premiumization trend extends beyond product formulation to encompass packaging as an integral component of perceived value, driving manufacturers to adopt advanced materials and printing technologies that differentiate their offerings in increasingly competitive retail environments.

Expansion of Modern Retail Infrastructure

The proliferation of international hypermarket chains, shopping malls, and convenience store networks across Saudi Arabian cities is fundamentally transforming confectionery merchandising practices and packaging requirements. Modern retail formats demand standardized packaging dimensions that facilitate efficient shelf allocation algorithms and automated inventory management systems, pushing manufacturers toward packaging uniformity that enables multi-channel distribution efficiency. These retail environments emphasize visual merchandising where packaging serves as the primary communication tool for capturing consumer attention amid crowded confectionery aisles featuring hundreds of competing options. The shift from traditional bulk purchasing toward pre-packaged portions aligns with hygiene consciousness and convenience preferences among urban consumers, creating sustained demand for individually wrapped formats that modern retailers prioritize in their assortment strategies. IMARC Group predicts that the Saudi Arabia retail market is expected to reach USD 411.7 Billion by 2034.

Cultural Celebration Intensity and Gifting Traditions

Saudi Arabia's calendar features numerous religious and national celebrations that trigger concentrated confectionery consumption periods where premium packaging becomes essential for gifting propriety and social etiquette. Ramadan and Eid festivities generate extraordinary demand for elaborately packaged chocolate assortments and decorative candy boxes that serve as traditional gifts exchanged among family networks and business associates. These cultural practices create predictable demand surges that require packaging suppliers to maintain flexible production capacities while supporting manufacturers' seasonal product line extensions featuring celebration-specific designs. The gifting tradition's importance in Saudi social structures ensures confectionery packaging transcends functional protection to embody symbolic value, where presentation quality communicates respect and strengthens interpersonal relationships, thereby sustaining premium packaging demand regardless of broader economic fluctuations. In 2025, to commemorate the 95th Saudi National Day, Bateel offers two special gift sets packed with high-quality sweets. Created to celebrate the Kingdom’s vibrant heritage and the kindness of the Saudi populace, the exclusive designs showcase premium organic dates from Bateel’s Saudi orchards alongside artisanal single-origin chocolates.

Market Restraints:

What Challenges the Saudi Arabia Confectionery Packaging Market is Facing?

Environmental Concerns and Regulatory Uncertainty

Growing global awareness regarding plastic waste management is creating reputational pressures on confectionery manufacturers operating in Saudi Arabia, despite limited domestic regulatory enforcement currently mandating sustainable packaging transitions. International parent companies of multinational brands face stakeholder expectations to implement uniform sustainability policies across global operations, potentially forcing premature adoption of alternative materials before local supply chains develop adequate capacity. The absence of comprehensive recycling infrastructure across Saudi regions complicates sustainable packaging implementation, as recyclable materials fail to achieve environmental benefits without collection and processing systems. This regulatory uncertainty inhibits long-term packaging investment decisions as manufacturers hesitate between continuing established plastic-based systems versus prematurely transitioning to unproven alternatives.

Raw Material Price Volatility and Import Dependency

Saudi Arabia's confectionery packaging sector relies heavily on imported raw materials, particularly plastic resins and specialty papers, exposing manufacturers to international commodity price fluctuations and currency exchange rate variations beyond their control. Petroleum-based packaging materials experience price volatility correlated with global energy markets, creating unpredictable cost structures that complicate pricing strategies and margin management. The Kingdom's limited domestic production capacity for packaging-grade materials necessitates maintaining substantial inventory buffers to mitigate supply disruptions, tying up working capital and increasing operational complexity. Trade policy uncertainties and potential tariff implementations on packaging material imports create additional cost pressures that manufacturers struggle to pass through to price-sensitive consumer markets.

Technical Limitations in Extreme Climate Conditions

Saudi Arabia's harsh summer temperatures exceeding forty-five degrees Celsius present extraordinary challenges for confectionery packaging systems required to maintain product integrity throughout distribution chains lacking consistent temperature control. Adhesive failures, seal delamination, and material degradation occur more frequently under extreme heat exposure, necessitating overengineered packaging solutions that increase material costs without adding consumer-perceived value. The technical requirements for chocolate packaging become particularly demanding, requiring specialized heat-resistant coatings and barrier layers that limit material supplier options and increase procurement complexity. These climate-specific challenges disadvantage local manufacturers relative to imports packaged in controlled environments, creating competitive pressures that constrain market development opportunities.

Competitive Landscape:

The Saudi Arabia confectionery packaging market exhibits moderate competitive intensity characterized by multinational packaging corporations operating alongside established regional converters serving local and international confectionery brands. Market participants differentiate through technological capabilities in flexographic and digital printing, enabling short-run customization and rapid design iterations that support marketing campaign flexibility. Vertical integration strategies among larger players encompass resin procurement through to finished packaging conversion, providing cost advantages and supply chain security during peak demand periods. The competitive environment rewards suppliers offering comprehensive technical support services including packaging design consultation, material compatibility testing, and equipment maintenance partnerships that reduce manufacturers' operational complexities. Geographic positioning near major confectionery production clusters in Riyadh and Jeddah creates competitive advantages through logistics cost minimization and responsive customer service capabilities essential for managing urgent packaging requirements during seasonal surges.

Saudi Arabia Confectionery Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Twist Wrap, Shrink Wrap, Pillow Pack Wrap, Tray Sealing, Flow Wrap, Stand-Up Bags, Others |

| Materials Covered | Plastic, Paper and Paperboard, Others |

| Applications Covered | Chocolate, Candy, Gums, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia confectionery packaging market size was valued at USD 99.4 Million in 2025.

The Saudi Arabia confectionery packaging market is expected to grow at a compound annual growth rate of 4.24% from 2026-2034 to reach USD 144.5 Million by 2034.

A Twist wrap dominated the product segment with a market share of 28% in 2025, driven by its cost-effectiveness, operational simplicity, and compatibility with high-speed automated packaging lines serving both traditional candy formats and diverse confectionery categories across the Kingdom's manufacturing facilities.

Key factors driving the Saudi Arabia confectionery packaging market include rising disposable incomes enabling premiumization trends, expansion of modern retail infrastructure demanding standardized packaging solutions, and intense cultural celebration periods requiring elaborate gifting packaging aligned with social traditions.

Major challenges include environmental concerns creating pressure for sustainable packaging transitions despite limited recycling infrastructure, raw material price volatility stemming from import dependency, and technical limitations imposed by extreme climate conditions requiring specialized packaging solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)