Saudi Arabia Construction Materials Market Size, Share, Trends and Forecast by Material Type, End User, and Region, 2026-2034

Saudi Arabia Construction Materials Market Overview:

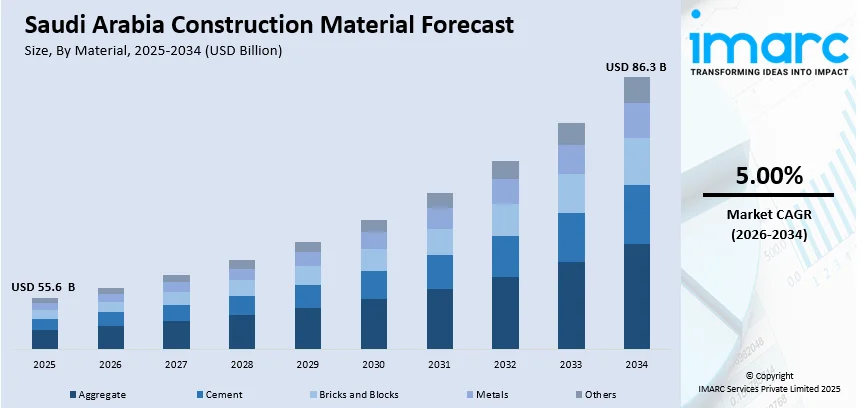

The Saudi Arabia construction materials market size reached USD 55.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 86.3 Billion by 2034, exhibiting a growth rate (CAGR) of 5.00% during 2026-2034. The market is being driven by rapid urbanization, government infrastructure developments driven by Vision 2030, foreign investments, and an upsurge in demand for sustainable construction solutions. Expansion in residential demand and construction technologies also contributes significantly to growth in the market. These drivers are augmenting Saudi Arabia construction materials market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 55.6 Billion |

| Market Forecast in 2034 | USD 86.3 Billion |

| Market Growth Rate 2026-2034 | 5.00% |

Saudi Arabia Construction Materials Market Trends:

Expansion of smart city infrastructure

The broadening of smart city infrastructure is positively influencing the Saudi Arabia construction products market. In February 2025, Diriyah Company deployed IBM Maximo Application Suite to improve asset management in the USD 63.2 Billion Diriyah Project, which focused on developing a smart city close to Riyadh. Utilizing IBM Maximo allowed Diriyah to harness artificial intelligence (AI)-based predictive maintenance and continuous monitoring, leading to a substantial decrease in downtime and enhanced sustainability of the urban infrastructure. With projects like NEOM and other futuristic urban developments, there is a growing requirement for high-performance materials, such as precast concrete, glass, composites, and energy-efficient insulation products. Smart city projects emphasize sustainability, digital integration, and modern architecture, which directly translates into higher usage of technologically advanced and durable materials. These developments also demand materials with improved energy efficiency and environmental compatibility to align with Vision 2030’s sustainability goals.

Broadening of warehousing and logistics hubs

As per the Saudi Arabia construction market analysis, the rapid expansion of warehousing and logistics hubs is strengthening the industry. Driven by e-commerce growth and trade diversification under Vision 2030, large-scale logistics parks and distribution centers are being developed to strengthen supply chains. These facilities require durable flooring, roofing, and structural materials to support heavy loads and large-scale storage needs. Additionally, modern warehouses often incorporate climate control and automation systems, further catalyzing the demand for specialized materials. With Saudi Arabia positioning itself as a regional trade and distribution hub, the development of warehouses and logistics facilities is becoming a major growth driver for the market. As per the IMARC Group, the Saudi Arabia warehouse market is set to attain USD 2.46 Billion by 2033, exhibiting a growth rate (CAGR) of 8.30% during 2025-2033.

Ongoing development of renewable energy projects

The rise of renewable energy projects in Saudi Arabia, including solar and wind farms, is strongly driving the demand for construction materials. In July 2025, the Minister of Energy, ACWA Power, the Water and Electricity Holding Company (Badeel), and Saudi Aramco Power Company (SAPCO) formalized power purchase agreements (PPAs) for seven new renewable energy initiatives with the Saudi Power Procurement Company (SPPC). With an estimated worth of around USD 8.3 Billion (SAR 31 Billion), the initiatives would provide 15,000 megawatts of renewable energy capacity: 12,000 MW generated from solar PV and 3,000 MW from wind. Large-scale solar power plants require vast quantities of glass, aluminum frames, steel, and concrete for panel installation and supporting infrastructure. Similarly, wind energy projects demand specialized steel, composites, and foundation materials for turbines and transmission lines. These projects also involve the construction of substations, access roads, and energy storage facilities, further increasing material requirements.

Key Growth Drivers of Saudi Arabia Construction Materials Market:

Investments in oil and gas infrastructure

According to the Saudi Arabia construction industry analysis, continued spending on oil and gas infrastructure is propelling the market growth. As the Kingdom is strengthening its position as a global energy leader, massive investments are being directed towards refineries, petrochemical complexes, pipelines, and storage facilities. These projects require substantial quantities of steel, cement, concrete, and advanced composites to withstand harsh operating environments. Offshore platforms, onshore drilling facilities, and export terminals also utilize specialized corrosion-resistant and high-strength materials. Furthermore, the modernization of existing oil and gas infrastructure is demanding significant construction input to improve efficiency and safety. As the sector remains central to Saudi Arabia’s economy, construction materials benefit from consistent requirements linked to both expansion and upgrading of energy infrastructure, reinforcing long-term market growth.

Rising renovation and maintenance activities

Rising renovation and maintenance activities across residential, commercial, and institutional sectors are driving the demand for construction materials in Saudi Arabia. With an increasing focus on modernizing aging infrastructure and upgrading urban facilities, materials, such as tiles, paints, glass, flooring, and cement-based products, are witnessing higher utilization. Homeowners are investing in remodeling projects to improve living spaces, while commercial properties undergo refurbishments to meet modern standards. The thriving retail and hospitality sectors are also contributing to frequent renovation cycles, ensuring steady demand for interior and exterior construction materials. Additionally, sustainability-driven retrofitting and energy-efficiency upgrades in buildings are further expanding material use. As maintenance and renovation are becoming integral to long-term infrastructure value, this trend is acting as a consistent growth driver for the market.

Government initiatives promoting sustainable construction materials

Government initiatives promoting the adoption of sustainable and eco-friendly construction materials are offering a favorable market outlook. In line with Vision 2030, the Kingdom is encouraging green building practices, energy-efficient designs, and low-carbon materials to support environmental goals. This shift is catalyzing the demand for recycled aggregates, eco-cement, energy-efficient insulation, and solar-integrated glass. Green certifications and regulatory incentives are also encouraging contractors and developers to integrate sustainable materials into new projects. Additionally, large-scale developments are being designed with sustainability at the core, further boosting material usage. By promoting eco-conscious construction practices, government initiatives are not only stimulating innovations but also ensuring long-term growth opportunities for manufacturers and suppliers in the market.

Saudi Arabia Construction Materials Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on material type and end user.

To get more information on this market Request Sample

Material Types Insights:

- Aggregate

- Cement

- Bricks and Blocks

- Metals

- Others

The report has provided a detailed breakup and analysis of the market based on the material types. This includes aggregate, cement, bricks and blocks, metals, and others.

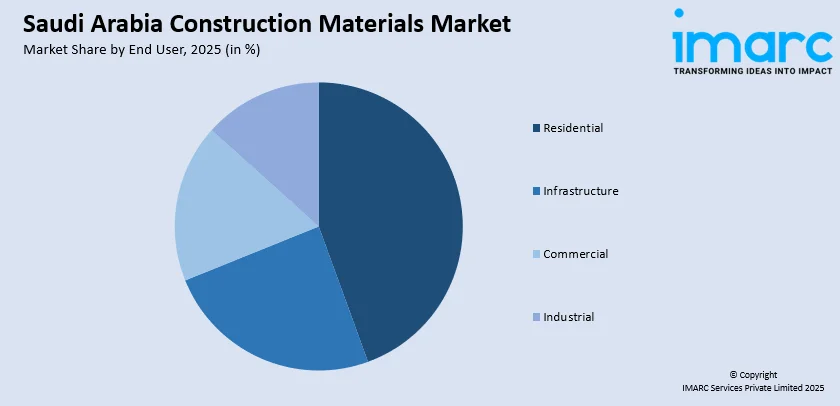

End User Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Infrastructure

- Roads

- Bridges

- Waste Management

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential, infrastructure (roads, bridges, and waste management), commercial, and industrial.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Construction Materials Market News:

- February 2025: The Saudi sovereign wealth fund announced significant investments, including a 30% ownership in Masdar Building Materials Co. and a USD 1.5 Billion (USD 400.5) agreement to construct the Riyadh Sedra community. PIF aimed to strengthen local supply chains, emphasize key products and services, and enhance the localization of advanced technologies and skills.

- October 2024: Asas Al-Mohileb, a Saudi building materials firm, revealed plans to construct a concrete plant valued at USD 186 Million as part of the extensive Neom development initiative in the Tabuk Province of northwestern Saudi Arabia. The Line’s foundational and elevated structures would be constructed using concrete. The facility with multiple plants would include carbon capture and utilization technology.

- September 2024: Aramco entered into a five-year strategic Cooperation Framework Agreement with China National Building Material Group (CNBM) to investigate collaborative prospects in advanced materials and industrial growth. Plans involved setting up production in Saudi Arabia for wind turbine blades, hydrogen storage solutions, and sustainable construction materials.

Saudi Arabia Construction Materials Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Aggregate, Cement, Bricks and Blocks, Metals, Others |

| End Users Covered |

|

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia construction materials market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia construction materials market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia construction materials industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The construction materials market in Saudi Arabia was valued at USD 55.6 Billion in 2025.

The Saudi Arabia construction materials market is projected to exhibit a CAGR of 5.00% during 2026-2034, reaching a value of USD 86.3 Billion by 2034.

Large-scale developments in transportation, energy, and tourism sectors are driving strong demand for essential construction materials, such as cement, steel, glass, and concrete. Additionally, government support for megaprojects like NEOM city, Red Sea development, and entertainment hubs is creating sustained requirements for diverse materials. Increasing adoption of sustainable and advanced building materials is also reshaping the market, as green construction is gaining traction.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)