Saudi Arabia Conveyor Belt Market Size, Share, Trends and Forecast by Type, End-Use, and Region, 2026-2034

Saudi Arabia Conveyor Belt Market Summary:

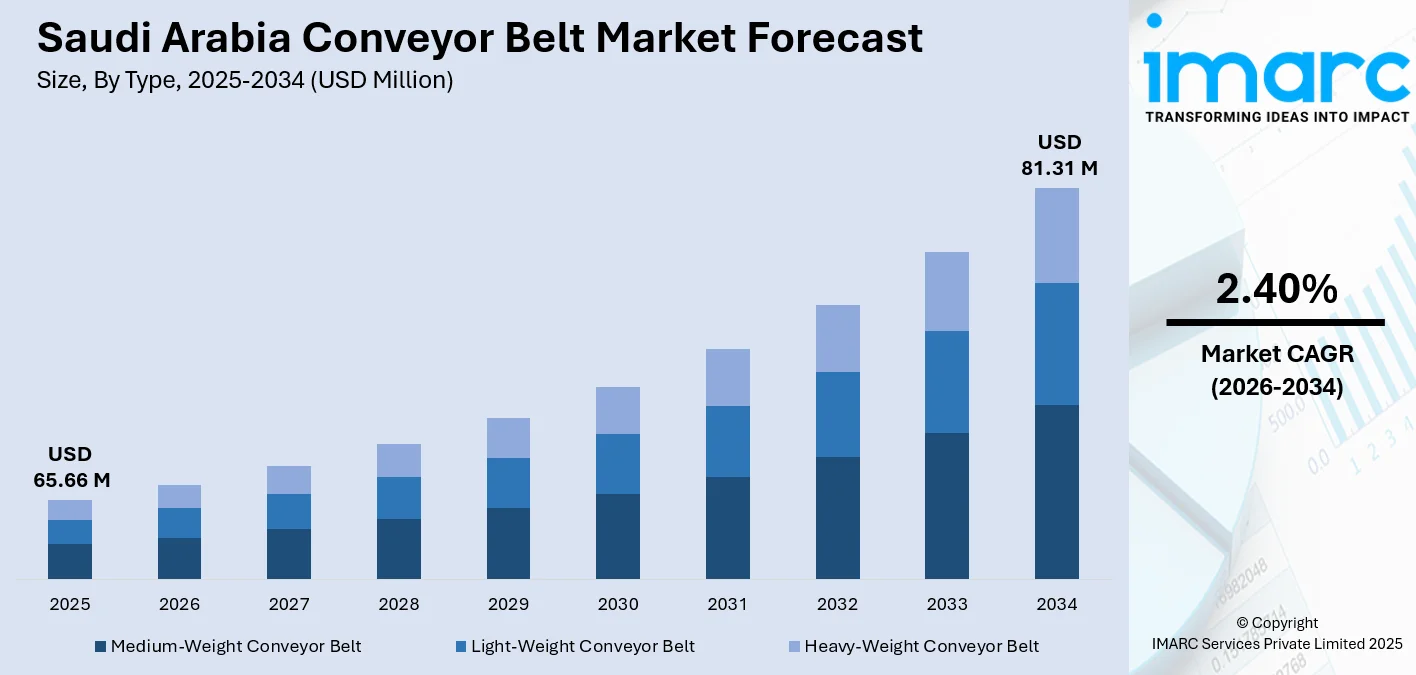

The Saudi Arabia conveyor belt market size was valued at USD 65.66 Million in 2025 and is projected to reach USD 81.31 Million by 2034, growing at a compound annual growth rate of 2.40% from 2026-2034.

The Saudi Arabia conveyor belt market is experiencing steady growth, as the Kingdom accelerates its economic diversification efforts under Vision 2030. Rapid industrialization, expansion of mining activities, and large-scale infrastructure development are driving demand for efficient material handling solutions. The market is further strengthened by increasing automation in manufacturing facilities, growth in the logistics and food processing sectors, and government investments in mega-projects across the construction, mining, and aviation industries.

Key Takeaways and Insights:

- By Type: Medium-weight conveyor belt dominates the market with a share of 45% in 2025, owing to its versatility across multiple industries, cost-effectiveness for medium-load applications, and suitability for the diverse manufacturing and logistics operations expanding throughout the Kingdom.

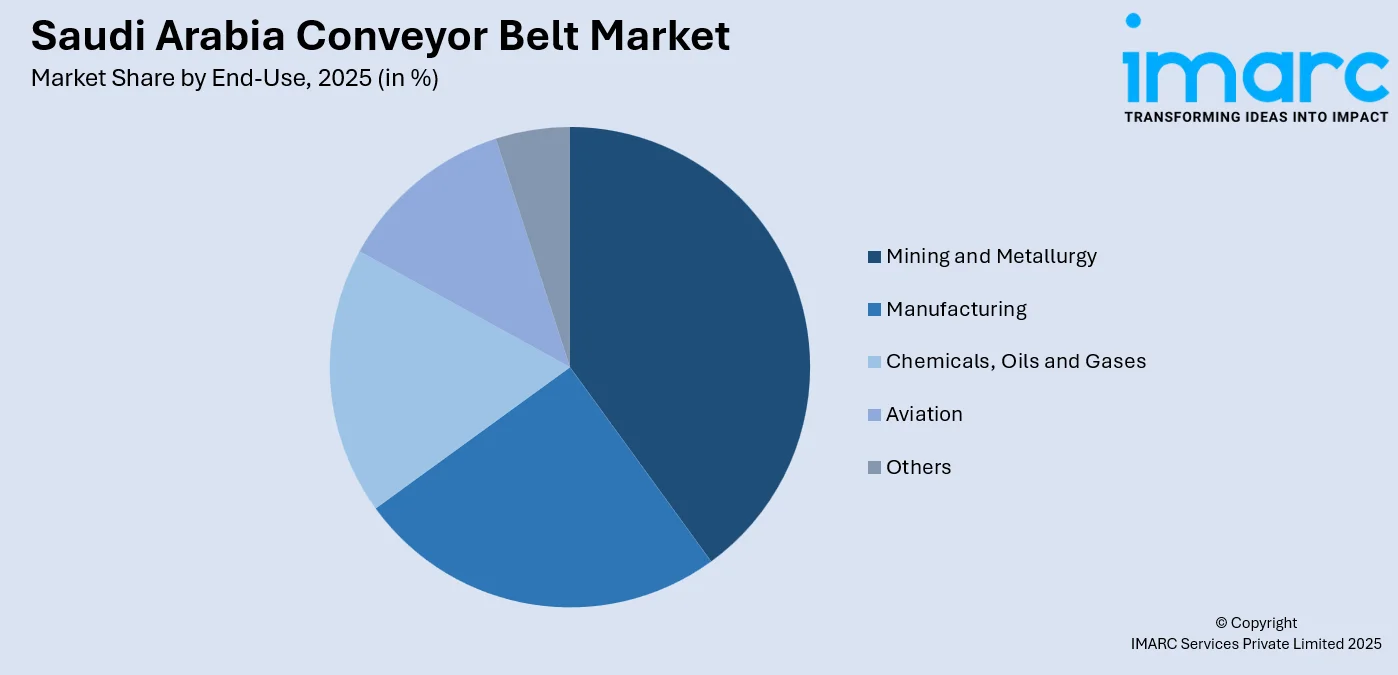

- By End-Use: Mining and metallurgy lead the market with a share of 32% in 2025. This dominance is driven by the Kingdom's aggressive mining expansion under Vision 2030, substantial investments in mineral exploration, and growing demand for efficient ore transportation systems.

- By Region: Western Region represents the largest region with 29% share in 2025, driven by the concentration of industrial cities around Jeddah, major port facilities, and significant infrastructure projects supporting the Red Sea development initiatives.

- Key Players: Key players drive the Saudi Arabia conveyor belt market by expanding product portfolios, improving belt durability and heat resistance technologies, and strengthening distribution networks. Their investments in customization capabilities, partnerships with industrial contractors, and after-sales service excellence boost operational reliability and accelerate adoption across diverse end-use sectors.

To get more information on this market Request Sample

The Saudi Arabia conveyor belt market is advancing, as the Kingdom transforms its industrial landscape through comprehensive economic diversification initiatives and infrastructure modernization programs. The construction sector continues to expand, with major projects reshaping urban centers across Riyadh, Jeddah, and emerging economic cities. Mining sector expansion remains a pivotal growth driver, with the government targeting to increase mining's GDP contribution to USD 75 Billion by 2035. The logistics sector is experiencing rapid transformation, with e-commerce growth driving demand for automated material handling systems in fulfillment centers and distribution hubs. These dynamics are creating sustained demand for conveyor belt solutions that offer durability, energy efficiency, and operational reliability across harsh industrial environments. Additionally, rising investments in food processing, cement, and manufacturing facilities are further strengthening demand for customized and heavy-duty conveyor belt systems across diverse industrial applications.

Saudi Arabia Conveyor Belt Market Trends:

Integration of Smart Conveyor Technologies

The Saudi Arabia conveyor belt market is witnessing increasing adoption of smart technologies featuring Internet of Things (IoT) sensors, real-time monitoring systems, and predictive maintenance capabilities. As per IMARC Group, the Saudi Arabia predictive maintenance market size reached USD 0.11 Billion in 2024. Manufacturers are developing conveyor systems with embedded analytics that enable operators to track belt performance, detect potential failures, and optimize throughput. This technological integration aligns with the Kingdom's broader Industry 4.0 adoption initiatives and supports operational efficiency improvements across manufacturing and logistics facilities.

Sustainability-Focused Belt Manufacturing

Environmental sustainability is emerging as a significant trend shaping conveyor belt development in Saudi Arabia. Manufacturers are increasingly developing belts with eco-friendly rubber compounds, recycled content, and energy-efficient designs to align with corporate sustainability mandates and regulatory requirements. This shift is helping industrial users reduce energy consumption and extend equipment lifecycles. Demand is also growing for low-noise and low-emission conveyor systems in urban and indoor facilities. As sustainability becomes a procurement priority, environmentally optimized conveyor belts are gaining wider adoption across industries.

Customization for Harsh Operating Environments

Growing demand for specialized conveyor belts designed for extreme operating conditions is shaping the Saudi Arabia conveyor belt market growth. The Kingdom's cement plants, mining operations, and petrochemical facilities require high-performance belts resistant to abrasion, heat, and chemical exposure. Manufacturers are responding with customized solutions, featuring advanced material compositions and reinforced construction, to withstand demanding industrial environments. The expansion of mining activities across the Arabian Shield is driving requirements for heavy-duty conveyor systems capable of handling bulk ore transportation over extended distances.

How Vision 2030 is Transforming the Saudi Arabia Conveyor Belt Market:

Vision 2030 is transforming the Saudi Arabia conveyor belt market by accelerating industrial diversification, infrastructure development, and automation adoption across key sectors. Large-scale investments in construction, mining, logistics, and manufacturing are increasing demand for durable and high-performance conveyor systems capable of operating in demanding environments. The expansion of industrial zones, economic cities, and logistics hubs is driving widespread deployment of material handling solutions to improve efficiency and throughput. Localization initiatives are encouraging domestic production and technology transfer, strengthening supply chains and reducing import reliance. Additionally, sustainability goals under Vision 2030 are pushing manufacturers to develop energy-efficient and environmentally friendly conveyor belts.

Market Outlook 2026-2034:

The Saudi Arabia conveyor belt market is positioned for sustained growth, as the Kingdom continues to execute its ambitious industrialization and infrastructure development agenda. The market generated a revenue of USD 65.66 Million in 2025 and is projected to reach a revenue of USD 81.31 Million by 2034, growing at a compound annual growth rate of 2.40% from 2026-2034. The construction sector's expansion will continue to generate demand for material handling equipment. Mining sector investments will drive requirements for heavy-duty conveyor systems. Additionally, the logistics sector's transformation, with e-commerce logistics projected to grow significantly, will create sustained demand for automated conveyor solutions in warehousing and distribution operations. Government initiatives supporting local manufacturing and industrial automation will further strengthen market fundamentals.

Saudi Arabia Conveyor Belt Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Medium-Weight Conveyor Belt |

45% |

|

End-Use |

Mining and Metallurgy |

32% |

|

Region |

Western Region |

29% |

Type Insights:

- Medium-Weight Conveyor Belt

- Light-Weight Conveyor Belt

- Heavy-Weight Conveyor Belt

Medium-weight conveyor belt dominates with a market share of 45% of the total Saudi Arabia conveyor belt market in 2025.

Medium-weight conveyor belt represents the backbone of Saudi Arabia's industrial material handling infrastructure, offering an optimal balance between load capacity and operational flexibility. These belts are extensively deployed across manufacturing facilities, food processing plants, and logistics centers where moderate load requirements combine with diverse application needs. The Kingdom's expanding food manufacturing sector, including the food manufacturing cluster in Jeddah spanning 11 Million square meters with 75 operational factories, relies heavily on medium-weight conveyor belt systems for efficient production line operations and packaging processes.

In addition, medium-weight conveyor belts play a critical role in supporting automation initiatives across Saudi Arabia’s industrial facilities. Their compatibility with automated sorting, inspection, and packaging systems enhances throughput while maintaining consistent product handling. These belts also perform reliably in temperature-controlled and hygienic environments, which is essential for food and pharmaceutical applications. As logistics hubs and distribution centers expand, medium-weight systems offer scalability without excessive capital expenditure. Their balanced performance profile makes them ideal for industries seeking efficient material flow, operational continuity, and adaptability to evolving production requirements under the Kingdom’s industrial modernization agenda.

End-Use Insights:

Access the comprehensive market breakdown Request Sample

- Mining and Metallurgy

- Manufacturing

- Chemicals, Oils and Gases

- Aviation

- Others

Mining and metallurgy lead with a share of 32% of the total Saudi Arabia conveyor belt market in 2025.

Mining and metallurgy dominate the market in Saudi Arabia, driven by the Kingdom's strategic pivot toward mineral resource extraction and processing as part of its economic diversification agenda. Significant investments in mining infrastructure, exploration activities, and downstream processing facilities are increasing demand for heavy-duty conveyor belts capable of handling bulk materials, such as ores, coal, and minerals. These operations require conveyor systems that deliver high load-bearing capacity, abrasion resistance, and reliable performance under extreme temperatures and dusty conditions, reinforcing sustained demand from the mining sector.

Metallurgical operations further strengthen market leadership, as steel, aluminum, and metal processing plants rely extensively on conveyor belts for material transport across smelting, casting, and finishing stages. Continuous production cycles in metallurgical facilities demand conveyor systems with minimal downtime and high operational reliability. Additionally, modernization of existing plants and the introduction of automation technologies are increasing the adoption of advanced conveyor solutions, supporting efficiency improvements and reinforcing the dominance of mining and metallurgy in the Saudi Arabia conveyor belt market.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Western Region exhibits a clear dominance with a 29% share of the total Saudi Arabia conveyor belt market in 2025.

Western Region commands the largest share of the Saudi Arabia conveyor belt market, anchored by the industrial and logistics concentration around Jeddah, the Kingdom's primary commercial hub. The region hosts 16 industrial cities that contribute significantly to the national economy and enhance industrial diversity. Jeddah Islamic Port remains the primary gateway for food imports and exports, driving substantial demand for conveyor systems in port handling operations. In December 2024, the Yanbu Grain Handling Terminal officially opened at Yanbu Commercial Port, featuring a 650-meter conveyor belt with unloading capabilities of 800 Tons per hour.

Furthermore, the Western Region enjoys adequate transportation infrastructure between ports and the industrial areas, making it easier for materials to flow, thereby increasing the usage of conveyor systems. Increasing investments in cold storage, warehousing, food security, and other related sectors are creating an increasing demand for clean and energy-saving conveyor belts. Availability of qualified personnel who offer services in installation, customized services, and equipment supply in Jeddah is expected to promote rapid growth in acceptance of conveyor belts in the Western Region, given that industrial growth initiatives continue in the country.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Conveyor Belt Market Growing?

Accelerated Mining Sector Expansion Under Vision 2030

Saudi Arabia’s strategic push to develop its mining sector has emerged as a major catalyst for conveyor belt demand under Vision 2030. The Kingdom is prioritizing large-scale mineral exploration, extraction, and downstream processing to diversify its economic base beyond hydrocarbons. This transformation requires extensive investment in mining infrastructure, where conveyor systems play a critical role in transporting ores and bulk materials efficiently across vast and often harsh terrains. Dedicated institutional support through geological surveys, centralized data platforms, and sovereign mining investment entities has strengthened project execution and investor confidence. Growing participation from international mining companies highlights the sector’s global competitiveness and scale. As new mines, smelters, and refineries come online, demand is rising for heavy-duty, abrasion-resistant conveyor belts designed for continuous, high-capacity operations. These systems are essential for improving productivity, reducing manual handling, and ensuring safe, cost-effective mineral transport throughout the mining value chain.

Rapid Infrastructure and Construction Sectors Growth

Saudi Arabia’s expanding construction and infrastructure sectors are catalyzing conveyor belt demand, supported by ambitious national development programs. Large-scale urban development, industrial zones, and giga-projects are significantly increasing the need for efficient material handling solutions across cement production, aggregate processing, and construction logistics. Conveyor belts are widely used to transport raw materials, clinker, and finished products, enabling faster throughput and operational efficiency. Mega-projects, spanning residential, commercial, tourism, and industrial infrastructure, are generating continuous demand for construction materials, reinforcing reliance on conveyor systems. The cement industry, in particular, depends heavily on conveyor belts for quarry operations, production lines, and distribution processes. Ongoing plant expansions and modernization initiatives are further accelerating adoption of advanced conveyor technologies, positioning the construction sector as a long-term growth pillar for the Saudi Arabia conveyor belt market.

Logistics Sector Modernization and E-commerce Expansion

The transformation of Saudi Arabia’s logistics sector is creating strong growth opportunities for conveyor belt manufacturers as the Kingdom positions itself as a regional and global logistics hub. National logistics reforms are driving large-scale investments in warehousing, freight handling, airport logistics, and multimodal transport infrastructure. Rapid growth in e-commerce is accelerating demand for automated material handling solutions in fulfillment centers and distribution hubs, where conveyor systems are essential for speed, accuracy, and scalability. In July 2024, CEVA Logistics formed a joint venture with Almajdouie Logistics creating a workforce of 2,000 and a local fleet of over 2,000 assets to serve multiple sectors, including e-commerce. The development of integrated logistics zones with streamlined customs processes and advanced automation further increases the need for high-performance conveyor systems. These facilities require reliable, energy-efficient, and intelligent conveyor technologies to support continuous operations, high parcel volumes, and evolving supply chain complexity across Saudi Arabia.

Market Restraints:

What Challenges the Saudi Arabia Conveyor Belt Market is Facing?

High Customization Requirements Across Diverse Industries

The Saudi Arabia conveyor belt market faces challenges in catering to diverse industries with varying specifications and operational requirements. Mining operations demand heavy-duty belts with exceptional tensile strength and abrasion resistance, while food processing facilities require hygienic belts meeting stringent safety standards. Cement plants necessitate heat-resistant solutions, and aviation applications require precision-engineered systems for baggage handling. This diversity complicates standardization efforts and increases manufacturing complexity, requiring suppliers to maintain broad product portfolios and technical expertise across multiple application domains.

Import Dependency and Supply Chain Vulnerabilities

The Saudi Arabia conveyor belt market remains substantially dependent on imported products, creating exposure to global supply chain disruptions and currency fluctuations. While domestic manufacturing capabilities are developing, advanced conveyor belt technologies and specialized materials often require sourcing from international suppliers. Extended lead times for customized solutions, transportation costs, and potential trade disruptions can impact project timelines and equipment availability. The market's import dependency also limits responsiveness to urgent replacement requirements, potentially affecting operational continuity for critical industrial facilities.

Maintenance Complexity and Operational Expertise Gaps

The sophisticated conveyor systems increasingly deployed across Saudi industries require specialized maintenance expertise and technical capabilities that remain limited within the local workforce. Smart conveyor technologies demand technicians with advanced diagnostic skills. The harsh operating environments prevalent in Saudi industrial settings accelerate wear and tear, necessitating frequent maintenance interventions. Gaps in local technical expertise can lead to suboptimal system performance, increased downtime, and higher operational costs, creating barriers to adopting advanced conveyor solutions.

Competitive Landscape:

The Saudi Arabia conveyor belt market exhibits a moderately competitive structure with both international manufacturers and regional suppliers serving diverse end-use sectors. Companies are focusing on expanding product portfolios to address varied application requirements across the mining, manufacturing, logistics, and construction industries. Strategic investments in technical service capabilities, including installation expertise and maintenance support, differentiate market participants. Partnerships with construction contractors and industrial project developers provide market access for conveyor suppliers. Local distributors play important roles in product availability and customer support, while international manufacturers contribute advanced technologies and specialized solutions.

Saudi Arabia Conveyor Belt Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Medium-Weight Conveyor Belt, Light-Weight Conveyor Belt, Heavy-Weight Conveyor Belt |

| End-Uses Covered | Mining and Metallurgy, Manufacturing, Chemicals, Oils and Gases, Aviation, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia conveyor belt market size was valued at USD 65.66 Million in 2025.

The Saudi Arabia conveyor belt market is expected to grow at a compound annual growth rate of 2.40% from 2026-2034 to reach USD 81.31 Million by 2034.

Medium-weight conveyor belt dominated the market with a share of 45%, owing to its versatility across multiple industries, cost-effectiveness for medium-load applications, and suitability for diverse manufacturing and logistics operations.

Key factors driving the Saudi Arabia conveyor belt market include rapid industrialization under Vision 2030, expansion of mining activities, infrastructure development projects, growth in the logistics and e-commerce sectors, and increasing automation in manufacturing facilities.

Major challenges include high customization requirements across diverse industries, import dependency for advanced technologies, maintenance complexity requiring specialized expertise, harsh operating environment demands, and supply chain vulnerabilities affecting equipment availability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)