Saudi Arabia Copper Alloys Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2026-2034

Saudi Arabia Copper Alloys Market Overview:

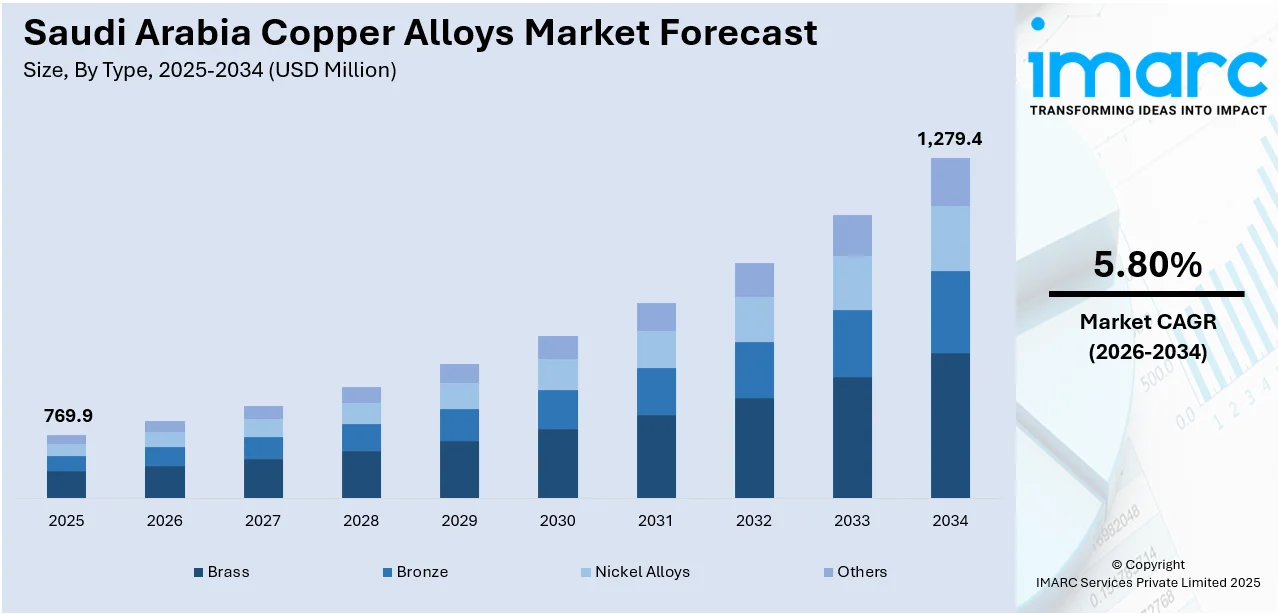

The Saudi Arabia copper alloys market size reached USD 769.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,279.4 Million by 2034, exhibiting a growth rate (CAGR) of 5.80% during 2026-2034. The market is driven by expanding infrastructure projects, rising demand from the electrical and plumbing sectors, and increased focus on local manufacturing under Vision 2030. Technological advancements and energy sector investments also support growth, significantly impacting the Saudi Arabia copper alloys market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 769.9 Million |

| Market Forecast in 2034 | USD 1,279.4 Million |

| Market Growth Rate 2026-2034 | 5.80% |

Saudi Arabia Copper Alloys Market Trends:

Rising Use in Advanced Water Desalination Technologies

Copper alloys are increasingly used in Saudi Arabia’s advanced water desalination plants due to their anti-corrosive properties and long lifecycle under harsh environmental conditions. With the Kingdom being one of the world’s largest producers of desalinated water, ongoing investments in efficient, low-maintenance piping and heat exchange systems are fueling demand for specialty copper alloys. Modern desalination facilities require materials that withstand saline and high-pressure environments, making copper-nickel alloys a preferred choice. For instance, in March 2024, Saudi Arabia built its first copper smelter and refinery, the Rifd Project, in collaboration with Glencore Technology. The facility, designed to produce 400,000 tons of copper cathodes annually, will utilize advanced technologies such as ISASMELT™, ISACONVERT™, IsaKidd™, and OxiLeach™. This expanding application in the water sector, driven by population growth and water scarcity, underlines a long-term structural demand. Such utility-focused developments are expected to significantly contribute to Saudi Arabia copper alloys market growth in the infrastructure and utilities segments.

To get more information on this market Request Sample

Localization of Copper Alloy Manufacturing Capabilities

To reduce reliance on imports and strengthen industrial self-sufficiency, Saudi Arabia is witnessing a growing trend toward local copper alloy manufacturing. Incentivized by Vision 2030, domestic firms are increasingly investing in foundries and advanced metallurgical capabilities to produce copper alloys tailored to local industry requirements. This localization effort is particularly evident in the construction, defense, and automotive sectors, where customized alloy grades are essential. Government-backed programs to develop industrial zones and special economic clusters are providing technical and financial support for such ventures. This strategic move not only improves lead times and reduces costs but also fosters technological innovation within the country. Consequently, these developments are playing a crucial role in bolstering Saudi Arabia copper alloys market growth through enhanced domestic production capacity. For instance, in January 2025, Ma’aden discovered significant copper deposits at Jabal Shayban in Saudi Arabia’s Arabian Shield, with shallow mineralization extending deeper, highlighting strong exploration potential. These findings support Saudi Arabia’s Vision 2030 by boosting local copper resources, positioning Ma’aden to advance further drilling and resource development.

Saudi Arabia Copper Alloys Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2026-2034. Our report has categorized the market based on type and end use.

Type Insights:

- Brass

- Bronze

- Nickel Alloys

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes brass, bronze, nickel alloys, and others.

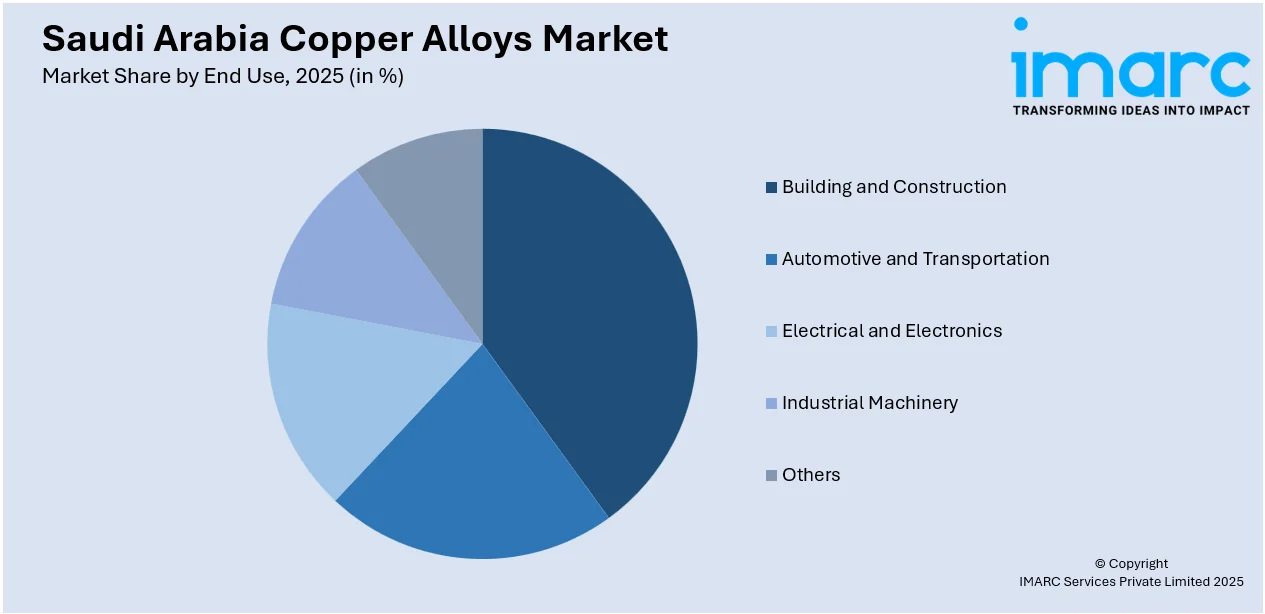

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Building and Construction

- Automotive and Transportation

- Electrical and Electronics

- Industrial Machinery

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes building and construction, automotive and transportation, electrical and electronics, industrial machinery, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Copper Alloys Market News:

- In January 2025, Codelco announced plans about joint copper investments with Saudi Arabia, aiming for a 70,000-tonne production increase in 2025. These discussions align with Saudi Arabia's goal to secure critical minerals for its battery and EV sectors. The partnership may include technology transfers and AI integration in mining.

- In November 2024, Vedanta invested $2 billion in Saudi Arabia’s copper sector, building a smelter and refinery at Ras Al-Khair to produce 400,000 tpa of refined copper and 300,000 tpa of copper rods. This is part of Saudi Arabia’s $9.32 billion mining investment drive announced at the World Investment Conference.

Saudi Arabia Copper Alloys Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Brass, Bronze, Nickel Alloys, Others |

| End Uses Covered | Building and Construction, Automotive and Transportation, Electrical and Electronics, Industrial Machinery, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia copper alloys market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia copper alloys market on the basis of type?

- What is the breakup of the Saudi Arabia copper alloys market on the basis of end use?

- What is the breakup of the Saudi Arabia copper alloys market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia copper alloys market?

- What are the key driving factors and challenges in the Saudi Arabia copper alloys market?

- What is the structure of the Saudi Arabia copper alloys market and who are the key players?

- What is the degree of competition in the Saudi Arabia copper alloys market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia copper alloys market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia copper alloys market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia copper alloys industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)