Saudi Arabia Corporate Training Market Size, Share, Trends and Forecast by Technical Training, End Use Industry, and Region, 2026-2034

Saudi Arabia Corporate Training Market Summary:

The Saudi Arabia corporate training market size was valued at USD 3,846.7 Million in 2025 and is projected to reach USD 6,921.8 Million by 2034, growing at a compound annual growth rate of 6.75% from 2026-2034.

The Kingdom's Vision 2030 project, which places a strong emphasis on workforce nationalization and human capital development, is driving the market for corporate training in Saudi Arabia. To increase productivity and competitiveness, businesses from all industries are making significant investments in staff development initiatives. The need for technology-focused training solutions has increased because to the growing emphasis on digital transformation, and soft skills and leadership development programs are still becoming more and more popular. Furthermore, the growing number of women in the workforce has opened up new avenues for inclusive training programs, which has increased Saudi Arabia's market share for corporate training.

Key Takeaways and Insights:

-

By Technical Training: Soft skills dominate the market with a share of 42% in 2025, owing to the growing recognition that leadership, communication, and interpersonal abilities are essential for career advancement and organizational success. Companies are prioritizing emotional intelligence and collaboration skills to build future-ready leaders capable of navigating complex business environments.

-

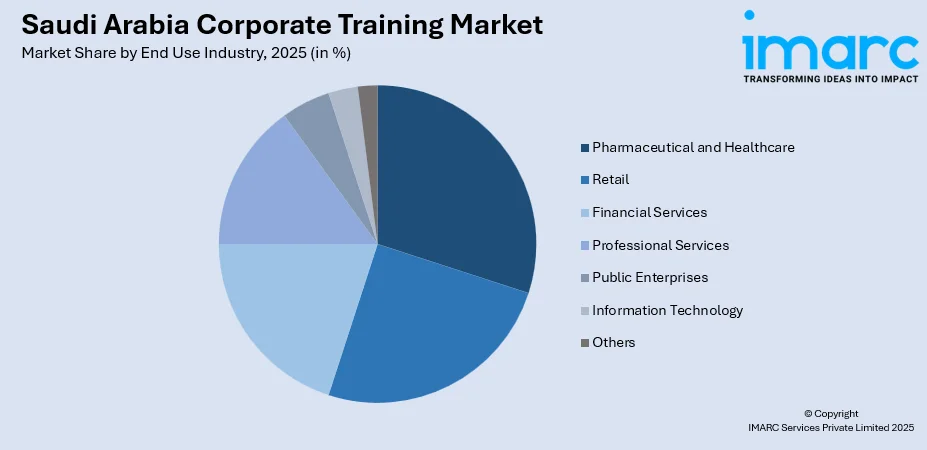

By End Use Industry: Pharmaceutical and healthcare lead the market with a share of 24% in 2025. This dominance is driven by stringent regulatory compliance requirements, rapid technological advancements in medical practices, and the continuous need for specialized clinical training to ensure patient safety and quality healthcare delivery across the Kingdom.

-

By Region: Northern and Central Region is the largest region with 40% share in 2025, driven by the concentration of government ministries, multinational corporations, and major business headquarters in Riyadh. The region's advanced infrastructure and strong economic activity create substantial demand for professional development programs.

-

Key Players: Key players drive the Saudi Arabia corporate training market by expanding service portfolios, integrating advanced learning technologies, and developing customized training solutions. Their investments in digital platforms, strategic partnerships with educational institutions, and alignment with Saudization policies enhance market reach and strengthen workforce capabilities across diverse industry sectors.

To get more information on this market Request Sample

A number of convergent elements that represent the Kingdom's vision for economic change are driving the corporate training market in Saudi Arabia. The focus of Vision 2030 on creating a knowledge-based economy has pushed the public and commercial sectors to significantly boost spending in workforce development programs across a variety of industries. Additionally, there is now a greater need for inclusive leadership and professional development programs that assist women in entering a variety of professional fields due to the notable rise in female labor involvement in recent years. Global training standards and best practices have been introduced by the increasing number of multinational firms setting up regional headquarters in the Kingdom, raising the bar for workforce competence. Organizations invest in comprehensive training solutions that address both functional competencies and behavioral capabilities necessary for thriving in a competitive global business environment and attaining sustainable organizational growth because they understand that technical skills alone are insufficient for long-term success.

Saudi Arabia Corporate Training Market Trends:

Integration of Artificial Intelligence in Learning Platforms

Artificial intelligence is revolutionizing corporate training delivery across Saudi Arabia by enabling personalized learning experiences tailored to individual employee needs and learning styles. AI-powered platforms analyze performance data to create adaptive learning paths that optimize knowledge retention and skill development. The National eLearning Center launched the AI Sandbox in Digital Learning program to promote innovation in AI-based solutions for online education, supporting researchers and developers in advancing digital learning practices. This initiative enhances support for organizations seeking to improve educational quality and investment in the digital economy aligned with national transformation objectives.

Rising Demand for Digital Skills Training

The rapid pace of digital transformation across Saudi industries has created substantial demand for training programs focused on cybersecurity, data analytics, cloud computing, and digital literacy. Organizations are prioritizing upskilling initiatives to address technology-driven business requirements and protect critical infrastructure from emerging cyber threats. The Kingdom's AI-powered National Skills Platform aims to equip the workforce with future-ready digital capabilities and align national talent development with global technological trends. This government-led initiative demonstrates commitment to building comprehensive digital competencies across all sectors of the economy.

Growth of Hybrid and Virtual Training Solutions

The adoption of hybrid and virtual training models has accelerated significantly as organizations in Saudi Arabia are seeking flexible, scalable learning solutions that accommodate diverse employee schedules and geographic locations. E-learning platforms, virtual instructor-led training, and microlearning modules have become integral components of corporate training strategies across industries. The Saudi corporate e-learning market continues to experience robust growth, reflecting strong demand for digital learning solutions that complement traditional face-to-face training approaches and enable organizations to deliver consistent training experiences across geographically dispersed workforces.

How Vision 2030 is Transforming the Saudi Arabia Corporate Training Market:

Vision 2030 serves as the foundational catalyst reshaping the corporate training landscape across Saudi Arabia by prioritizing human capital development as a strategic pillar of economic diversification. The national transformation agenda has prompted government ministries, public enterprises, and private sector organizations to significantly expand workforce development budgets and implement comprehensive training programs aligned with emerging industry requirements. Saudization policies embedded within Vision 2030 have accelerated demand for nationalization training initiatives that prepare Saudi citizens for leadership roles traditionally held by expatriate professionals. The emphasis on creating a vibrant society and thriving economy has driven investments in soft skills development, digital literacy programs, and specialized technical training across priority sectors including tourism, entertainment, technology, and renewable energy, fundamentally transforming how organizations approach employee development and talent management.

Market Outlook 2026-2034:

The Saudi Arabia corporate training market demonstrates strong growth potential driven by sustained government investment in workforce development and accelerating digital transformation across industries. Organizations continue to expand training budgets to address evolving skill requirements and maintain competitive advantage in increasingly technology-driven business environments. The market generated a revenue of USD 3,846.7 Million in 2025 and is projected to reach a revenue of USD 6,921.8 Million by 2034, growing at a compound annual growth rate of 6.75% from 2026-2034. The proliferation of AI-powered learning platforms and immersive training technologies will further enhance training effectiveness and learner engagement throughout the forecast period.

Saudi Arabia Corporate Training Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Technical Training | Soft Skills | 42% |

| End-Use Industry | Pharmaceutical and Healthcare | 24% |

| Region | Northern and Central Region | 40% |

Technical Training Insights:

- Soft Skills

- Quality Training

- Compliance

- Others

Soft skills dominate with a market share of 42% of the total Saudi Arabia corporate training market in 2025.

Soft skills training has emerged as the cornerstone of corporate development programs across Saudi Arabia as organizations increasingly recognize the critical importance of interpersonal competencies in driving business success and achieving sustainable growth. Leadership development, emotional intelligence, communication effectiveness, and team collaboration represent priority areas for organizational investment as companies seek to build resilient workforces capable of adapting to evolving market conditions. According to labor statistics provided by the General Authority for Statistics (GASTAT), the employment rate for Saudi women reached 36.2%, creating substantial demand for inclusive leadership training programs that foster workplace diversity and support career advancement opportunities for female professionals entering the workforce.

The emphasis on soft skills reflects a fundamental shift in how Saudi organizations approach workforce development and talent management strategies. Companies are investing in executive coaching, mentorship programs, and immersive workshops to cultivate future-ready leaders capable of navigating complex business challenges, managing cross-functional teams effectively, and driving organizational transformation initiatives aligned with national economic diversification objectives.

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Retail

- Pharmaceutical and Healthcare

- Financial Services

- Professional Services

- Public Enterprises

- Information Technology

- Others

Pharmaceutical and healthcare leads with a share of 24% of the total Saudi Arabia corporate training market in 2025.

The pharmaceutical and healthcare sector demonstrates the strongest demand for corporate training services due to stringent regulatory requirements, rapid technological advancements, and the critical nature of patient care responsibilities. Healthcare facilities invest substantially in clinical skills development, compliance training, and specialized certifications to maintain service quality standards and ensure patient safety across all care settings. The Ministry of Finance allocated SAR 260 Billion for Health and Social Development in its official 2025 budget, supporting continued investment in healthcare workforce capabilities and infrastructure modernization initiatives throughout the Kingdom.

Healthcare organizations across Saudi Arabia prioritize continuous professional development to address evolving medical practices, emerging treatment protocols, and digital health integration requirements essential for delivering world-class patient care. Training programs encompass clinical competencies, patient safety protocols, healthcare technology utilization, and regulatory compliance aligned with international standards. The Saudi Food and Drug Authority's expansion of pharmaceutical manufacturing requirements has increased demand for quality assurance and Good Manufacturing Practice training programs, driving healthcare providers and pharmaceutical companies to enhance employee competencies through comprehensive certification and professional development initiatives.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region exhibits a clear dominance with a 40% share of the total Saudi Arabia corporate training market in 2025.

The Northern and Central Region, anchored by Riyadh, serves as the primary hub for corporate training activities due to its concentration of government institutions, multinational corporations, and major business headquarters driving the Kingdom's economic transformation. The region benefits from advanced digital infrastructure, established educational institutions, and proximity to key decision-makers driving workforce development policies and national training initiatives. Riyadh saw over USD 5.89 Billion in foreign direct investment during Q4 2024, attracting international training providers and expanding professional development opportunities.

The region hosts numerous industry conferences, professional development events, and corporate training facilities that support its dominant market position in the Kingdom. Organizations such as Monsha'at have supported over 1.24 Million small and medium-sized businesses across the Kingdom, with Riyadh serving as the central location for entrepreneurship training and business development programs. The region's economic diversification initiatives aligned with Vision 2030 objectives continue to generate sustained demand for specialized training programs across emerging sectors including technology, finance, and entertainment.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Corporate Training Market Growing?

Expansion of Mega-Projects Requiring Specialized Workforce Training

Saudi Arabia's ambitious portfolio of mega-projects and giga-developments has created substantial demand for specialized corporate training programs across multiple industries. Large-scale initiatives such as NEOM, Qiddiya, Red Sea Global, and the Diriyah Gate project require hundreds of thousands of skilled workers trained in hospitality, tourism, entertainment, construction management, and advanced technologies. The workforce requirements for NEOM alone are projected to exceed significant numbers during peak development phases, necessitating comprehensive training infrastructure to prepare employees for diverse operational roles. Qiddiya Investment Company launched its Playmakers Training Programmes specifically to improve the capabilities of Saudi nationals in vital industries such as hospitality and entertainment, aiming to create substantial employment opportunities across the Kingdom. These development projects attract international hospitality brands, entertainment operators, and technology companies that bring global training standards and best practices to the local workforce. The scale and complexity of these initiatives require ongoing investment in technical training, customer service excellence, safety protocols, and specialized certifications, ensuring sustained demand for corporate training services throughout the construction and operational phases of these transformative projects.

Accelerating Digital Transformation Across Industries

The rapid integration of digital technologies across Saudi industries has created unprecedented demand for training programs focused on artificial intelligence, cybersecurity, data analytics, and cloud computing competencies. Organizations recognize that digital literacy is essential for maintaining competitive advantage and meeting evolving customer expectations in an increasingly technology-driven business environment. The Kingdom has experienced significant cyber incidents in recent years, underscoring the urgent need for cybersecurity training and compliance programs to protect national infrastructure and sensitive organizational data. Companies are investing substantially in e-learning platforms, virtual instructor-led training, and microlearning solutions to build digital capabilities efficiently across their workforces. The government's substantial allocation for educational technology initiatives under Vision 2030 further accelerates digital skills development across the workforce. The National eLearning Center continues to promote innovation in AI-based solutions for online education, supporting researchers and developers in advancing digital learning practices aligned with national transformation objectives and preparing employees for the demands of modern technology-enabled workplaces.

Increasing Female Workforce Participation

The significant increase in female workforce participation represents a transformative driver of corporate training demand across Saudi Arabia. Women's labor force participation has grown substantially in recent years, exceeding original Vision 2030 targets and creating substantial new demand for professional development programs designed to support career advancement and leadership development. Multiple major policy changes have led to the establishment of numerous international technical colleges for girls, female technical colleges, and digital technical colleges across the Kingdom, dramatically expanding educational opportunities for women. These educational reforms have resulted in tens of thousands of female students enrolling in technical and vocational programs, preparing them for careers in sectors such as aircraft maintenance, cybersecurity, renewable energy, and healthcare. Organizations are investing in inclusive leadership training and mentorship programs to attract, retain, and develop female talent capable of contributing to the Kingdom's economic diversification goals. The International Aviation Technical College in Riyadh exemplifies this transformation, having integrated female students who partner with future private sector employers including emerging airlines and technology companies.

Market Restraints:

What Challenges the Saudi Arabia Corporate Training Market is Facing?

Skill Mismatch Between Training and Industry Requirements

Despite growth in training programs, challenges persist in ensuring skills acquired align with evolving industry demands and emerging technological requirements. Continuous collaboration between training providers and businesses is essential to address this gap and develop curriculum that meets emerging workforce requirements effectively. Rapid advancements in technology and shifting market dynamics require frequent program updates to maintain training relevance and effectiveness.

High Costs and Shortage of Qualified Trainers

Corporate training requires highly skilled professionals to deliver quality programs, and recruiting qualified trainers involves substantial costs that impact organizational budgets significantly. This expense structure limits accessibility for smaller organizations and creates dependency on foreign trainers, potentially reducing cultural relevance of training content. Additionally, competition for experienced training professionals intensifies cost pressures across the market.

Cultural Adaptation Requirements for Training Programs

Tailoring training programs to align with Saudi Arabia's cultural values and workplace norms presents ongoing challenges for international providers entering the market. Understanding and respecting local customs while maintaining global best practices requires careful program design and localization efforts. Providers must invest additional resources in content adaptation to ensure training materials resonate effectively with Saudi participants.

Competitive Landscape:

The Saudi Arabia corporate training market features a dynamic mix of international training organizations, regional service providers, and specialized consultancies competing for market share. Major players differentiate through technology integration, industry-specific expertise, and customized program development capabilities. Strategic partnerships with government entities, educational institutions, and multinational corporations enable providers to expand reach and enhance service offerings. The market witnesses ongoing consolidation as established providers acquire specialized capabilities while new entrants leverage digital platforms to disrupt traditional training delivery models. Investment in AI-powered learning technologies and virtual training solutions represents a key competitive differentiator.

Recent Developments:

-

In August 2025, Saudi Arabia's Public Investment Fund launched the 'azm' workforce development program to build skills, address labor market needs, and support economic diversification. The initiative was unveiled with partners including the Technical and Vocational Training Corporation, Colleges of Excellence, Human Resources Development Fund, and Roshn Group, demonstrating comprehensive commitment to developing national talent capabilities.

Saudi Arabia Corporate Training Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technical Trainings Covered | Soft Skills, Quality Training, Compliance, Others |

| End Use Industries Covered | Retail, Pharmaceutical and Healthcare, Financial Services, Professional Services, Public Enterprises, Information Technology, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia corporate training market size was valued at USD 3,846.7 Million in 2025.

The Saudi Arabia corporate training market is expected to grow at a compound annual growth rate of 6.75% from 2026-2034 to reach USD 6,921.8 Million by 2034.

Soft skills dominated the market with a share of 42%, driven by growing demand for leadership development, communication skills, and interpersonal competencies essential for organizational success and career advancement.

Key factors driving the Saudi Arabia corporate training market include Vision 2030 emphasis on human capital development, accelerating digital transformation across industries, and increasing female workforce participation requiring specialized training programs.

Major challenges include skill mismatch between training programs and industry requirements, high costs and shortage of qualified local trainers, cultural adaptation requirements for international training content, and infrastructure limitations in remote areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)