Saudi Arabia Courier, Express, and Parcel (CEP) Market Report by Destination (Domestic, International), Business (Business-to-Business (B2B), Business-to-Customer (B2C)), End User (Services, Wholesale and Retail Trade, Life Sciences/Healthcare, Industrial Manufacturing, and Others), and Region 2025-2033

Market Overview:

Saudi Arabia courier, express, and parcel (CEP) market size reached USD 4,237.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 9,324.9 Million by 2033, exhibiting a growth rate (CAGR) of 9.16% during 2025-2033. The expanding e-commerce sector, along with the increasing utilization of on-demand delivery, is primarily driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4,237.7 Million |

| Market Forecast in 2033 | USD 9,324.9 Million |

| Market Growth Rate 2025-2033 | 9.16% |

Courier, express, and parcel offerings cover an array of transportation and logistics measures tailored for the prompt and effective shipment of documents and packages. Such services are distinguished by their quickness, dependability, and traceability. Generally, CEP providers utilize cutting-edge technologies and systems to guarantee deliveries, frequently within a day or by the subsequent day. They serve both corporate and personal clientele, providing multiple shipping choices, encompassing overseas transport. Courier, express, and parcel offerings are crucial in the international supply chain, aiding e-commerce, production, and distribution sectors by enabling the rapid transfer of products and data.

Saudi Arabia Courier, Express, and Parcel (CEP) Market Trends:

Fast Expansion of E-commerce Market

The Saudi Arabia CEP market is driven significantly by the fast expansion of the e-commerce sector, which is growing persistently with rising internet penetration, smartphone usage, and shifting shopping habits. People are choosing to buy fashion, electronics, groceries, and personal care products online, leading to parcel volume growth. E-retailers and online shopping platforms are increasingly turning to CEP providers for offering quick, secure, and low-cost delivery services. The flash sales trend, same-day delivery, and free returns have consistently added to the reliance of online retailers on logistics partners. In addition, government efforts like Saudi Vision 2030 are promoting digital transformation and retail modernization, further driving online buying activity. With the increasing growth of online shopping, CEP businesses are continually investing in infrastructure, last-mile networks, and technology platforms to address the increasing need for fast and efficient delivery services. IMARC group predicts that the Saudi Arabia e-commerce market is projected to attain USD 708.7 Billion by 2033.

Increase in Cross-Border Trade and Global Deliveries

The need for cross-border shipping is on a steady rise due to Saudi consumers buying more products from global e-commerce websites and international retailers. Foreign brands are aggressively courting Saudi Arabia because of its purchasing power, and this is resulting in increased volumes of imports. Meanwhile, national companies are increasingly shipping exports out to regional and global markets, further driving the demand for international parcel and courier services. Foreign courier majors are consolidating their positions in the Kingdom, while national players are collaborating with foreign logistics companies to raise their global presence. The expansion of free trade agreements, more efficient customs clearance procedures, and advancements in logistics infrastructure in Saudi Arabia are also facilitating quicker and more secure cross-border deliveries. In a clear indication of the growth of Saudi Arabia’s digital economy, over 50 million packages were successfully delivered throughout the Kingdom in the second quarter of 2025, as reported by the Transport General Authority (TGA). These numbers signify the largest quarterly parcel volume ever documented, indicating an increasing reliance on e-commerce and door-to-door logistics services. With global trade being a crucial part of the economy, the CEP market is continually leveraging the demand for cross-border and international parcel delivery.

Technological Improvements in Logistics and Delivery Services

The Saudi CEP market is being constantly upgraded with the adoption of latest technologies like artificial intelligence (AI), big data, Internet of Things (IoT), and automation within logistics operations. Businesses are increasingly implementing smart tracking systems, route optimization tools, and automated warehouses to enhance efficiency and lower delivery times. Customers are requesting more transparency over their parcels, and live tracking tools are increasing transparency and consumer satisfaction. Contactless deliveries, online payments, and automatic delivery lockers are also becoming increasingly popular, making the customer more convenient. Drone deliveries and autonomous cars are being piloted as potential future innovations in delivery. For instance, in 2025, Saudi Arabia revealed the successful trial launch of drone-operated medical deliveries between primary healthcare facilities and hospitals at the holy sites, signifying an important achievement and a unique initiative.

Saudi Arabia Courier, Express, and Parcel (CEP) Growth Drivers:

Growing Urbanization and Increasing Consumer Expectations

Saudi Arabia is witnessing fast-growing urban developments, with cities such as Riyadh, Jeddah, and Dammam continuously growing and experiencing increasing population density. This metropolitan expansion is generating immense demand for cost-effective logistics and last-mile delivery solutions, as increasing numbers of customers are looking for quicker, more convenient parcel delivery in cities. Meanwhile, customer expectations are growing, with shoppers increasingly favoring same-day or next-day deliveries, flexible delivery slots, and convenient return policies. CEP companies are responding to these pressures by building out last-mile delivery infrastructure, adding new distribution centers, and developing customer service innovations. Retailers and e-commerce sites are working hand-in-hand with logistics companies to satisfy customer demand for speed and reliability. With urban consumers prioritizing convenience and speed, the CEP business is constantly reaping the benefits of the increasing desire for premium deliveries throughout Saudi cities.

Government Initiatives and Vision 2030 Reforms

The Saudi government is continually investing in infrastructure development and logistics as part of its Vision 2030, which seeks to make the Kingdom a logistics hub for the world. Major-scale infrastructure projects, such as the development of airports, seaports, and roads, are enhancing efficiency and connectivity in parcel transport. The government is also simplifying customs clearance processes and encouraging log digitalization, which is increasing the velocity of cross-border trade. Efforts to enhance the ecosystem for e-commerce, postal services, and investment by the private sector are directly impacting the CEP market. In addition, public-private sector collaboration is pushing innovation in log solutions, while regulatory liberalization is increasing the competitiveness and appeal of the market for global logistics players. With Vision 2030 putting focus on diversification and modernization, the CEP sector is steadily picking up steam as a critical component of Saudi Arabia's economic renewal.

Growing Demand for Business-to-Business (B2B) and Business-to-Consumer (B2C) Deliveries

Demand for both B2B and B2C parcel deliveries is steadily rising in Saudi Arabia, driven by robust retail, wholesale, and industrial activity. Companies are now more dependent on CEP providers to ensure supply chain efficiency, inventory management, and on-time delivery of products to distributors and partners. The B2C segment is also expanding exponentially because of the boom in e-commerce, where individual buyers want quick and convenient delivery of goods. CEP firms are diversifying their portfolios of services to address these twin demands by providing specialized offerings like bulk parcel transportation, express delivery, reverse logistics, and subscription-based delivery solutions. The inclusion of flexible delivery modes, including doorstep delivery and pick-up points, is also underpinning expansion. With both businesses and consumers expecting high-quality delivery services, the rising demand for B2B and B2C shipments is continuously driving the CEP market in Saudi Arabia.

Saudi Arabia Courier, Express, and Parcel (CEP) Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on destination, business, and end user.

Destination Insights:

To get more information on this market, Request Sample

- Domestic

- International

The report has provided a detailed breakup and analysis of the market based on the destination. This includes domestic and international.

Business Insights:

- Business-to-Business (B2B)

- Business-to-Customer (B2C)

A detailed breakup and analysis of the market based on the business have also been provided in the report. This includes business-to-business (B2B) and business-to-customer (B2C).

End User Insights:

- Services (includes BFSI (Banking, Financial Services and Insurance), etc.)

- Wholesale and Retail Trade (including E-commerce)

- Life Sciences/Healthcare

- Industrial Manufacturing

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes services (includes BFSI (banking, financial services and insurance), etc.), wholesale and retail trade (including e-commerce), life sciences/healthcare, industrial manufacturing, and others.

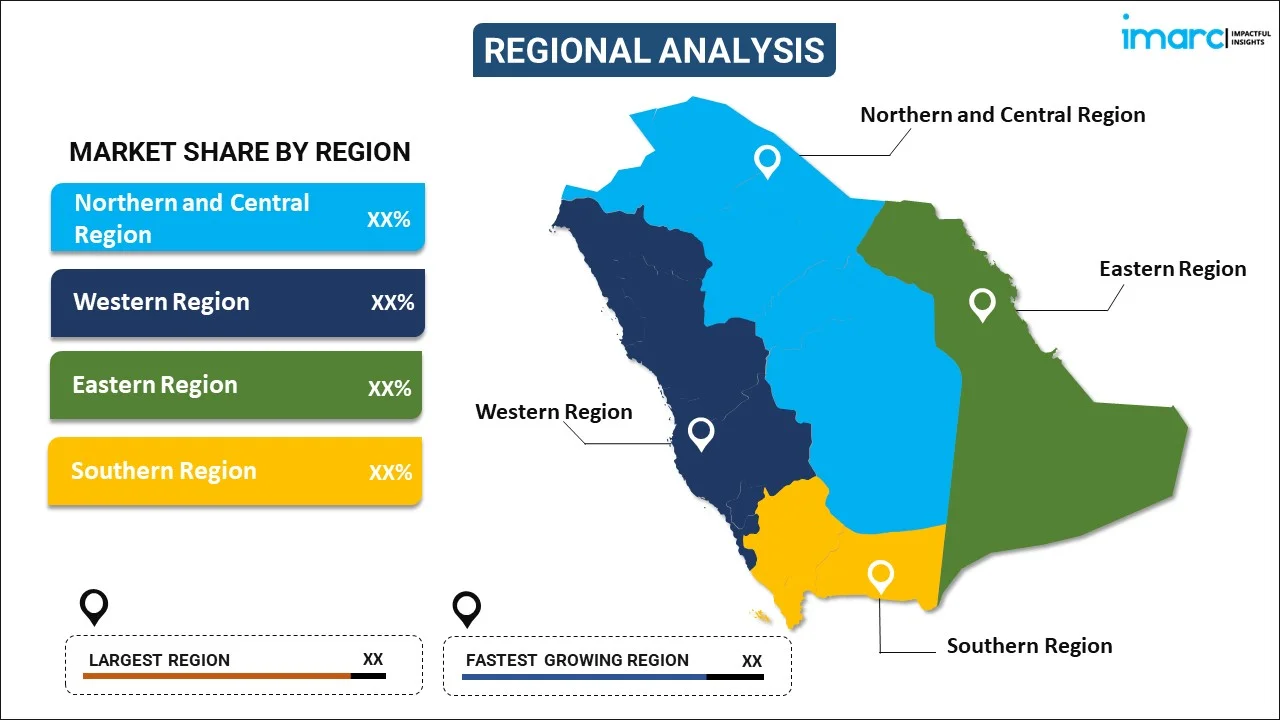

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Courier, Express, and Parcel (CEP) Market News:

- July 2025: EMX, a top logistics provider under 7X, revealed the introduction of "EMX International," its new solution for international eCommerce parcel delivery throughout the Gulf Cooperation Council (GCC) area. This service is designed to simplify the delivery processes for businesses looking to expand their access to clients in Saudi Arabia, along with Oman, Kuwait, Bahrain, Qatar, and Jordan.

- June 2025: JD Logistics of China has established a regional operations hub in Riyadh, facilitating same-day and next-day deliveries throughout Saudi Arabia via its own express service, JoyExpress. JD announced in a press release that its new 8,000-square-meter smart warehouse — the first of its kind in the region — will function as a logistics hub for its business-to-consumer delivery network, bolstered by cutting-edge automation and a strong supply chain system.

- May 2025: Emirates Post, the authorized postal service provider of the United Arab Emirates, has formed a strategic alliance with Aramex, a prominent global logistics and transport firm. This partnership will allow access to Aramex services at certain Emirates Post locations. This initiative supports Emirates Post's larger vision to convert its national branch network into a cohesive center for convenient, customer-focused shipping solutions, enhancing local communities and fostering the growth of the national economy.

Saudi Arabia Courier, Express, and Parcel (CEP) Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Destinations Covered | Domestic, International |

| Businesses Covered | Business-to-Business (B2B), Business-to-Customer (B2C) |

| End Users Covered | Services, Wholesale and Retail Trade, Life Sciences/Healthcare, Industrial Manufacturing, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, and Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia courier, express, and parcel (CEP) market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia courier, express, and parcel (CEP) market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia courier, express, and parcel (CEP) industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The courier, express, and parcel (CEP) market in Saudi Arabia was valued at USD 4,237.7 Million in 2024.

The Saudi Arabia courier, express, and parcel (CEP) market is projected to exhibit a CAGR of 9.16% during 2025-2033, reaching a value of USD 9,324.9 Million by 2033.

The Saudi Arabia courier, express, and parcel (CEP) market is driven by booming e-commerce growth, rising cross-border trade, and increasing demand for fast and reliable deliveries. Government Vision 2030 reforms, infrastructure investments, and adoption of advanced logistics technologies are further accelerating market expansion and enhancing last-mile delivery efficiency.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)