Saudi Arabia Craft Spirits Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2026-2034

Saudi Arabia Craft Spirits Market Overview:

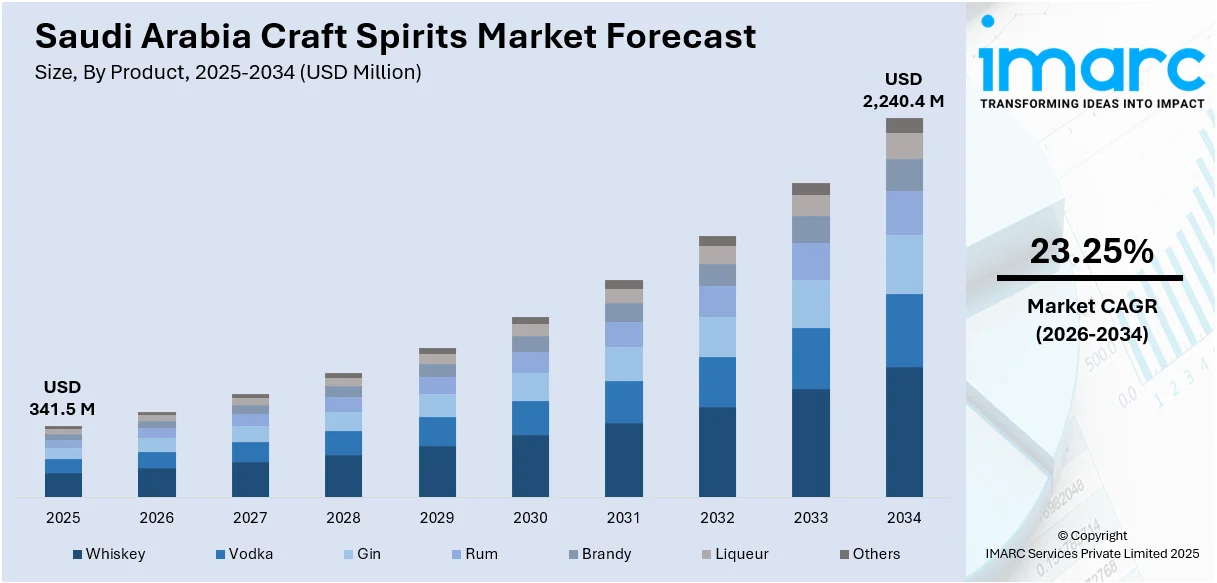

The Saudi Arabia craft spirits market size reached USD 341.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,240.4 Million by 2034, exhibiting a growth rate (CAGR) of 23.25% during 2026-2034. The market is driven by Vision 2030 reforms, rapid tourism and hospitality growth, and rising influence from a large expatriate population. These factors are catalyzing the demand for premium, non-alcoholic, and globally inspired artisanal beverage experiences. As a result, the Saudi Arabia craft spirits market share is growing steadily as consumer preferences continue to shift toward high-quality, culturally aligned alternatives.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 341.5 Million |

| Market Forecast in 2034 | USD 2,240.4 Million |

| Market Growth Rate 2026-2034 | 23.25% |

Saudi Arabia Craft Spirits Market Trends:

Regulatory Reforms and Vision 2030 Initiatives

Saudi Arabia’s Vision 2030 initiative is a transformative socio-economic reform plan focused on diversifying the economy and modernizing social structures. A key aspect of this strategy is the development of sectors like tourism, hospitality, and entertainment, which are gradually creating a more receptive environment for premium and niche markets, such as craft spirits, particularly non-alcoholic or alcohol-free varieties. The kingdom’s increased openness to international investment and cultural exchange is encouraging innovation in food and drinks experiences, including Western-style dining and artisanal drink offerings. In 2024, Saudi Arabia opened its first commercial alcohol outlet in over 70 years, an off-licence in Riyadh's diplomatic quarter, selling only to non-Muslim diplomats under strict controls. This move was seen as a tentative step toward relaxing alcohol laws as part of Vision 2030, aimed at boosting tourism and attracting skilled expatriates. Such developments are indirectly fostering a more accommodating landscape for sophisticated, creatively branded craft beverages.

To get more information on this market Request Sample

Tourism Growth and Hospitality Sector Development

The swift growth of tourism and hospitality sector, which often has a variety of refined beverage choices, such as craft spirits, is bolstering the Saudi Arabia craft spirits market growth. Through significant government funding in high-end resorts, entertainment venues, and top-tier events, the kingdom is drawing a more international and discerning audience that seeks premium culinary and beverage experiences meeting global standards. As a result, luxury hotels, gourmet restaurants, and exclusive lounges are progressively presenting sophisticated drink menus, featuring non-alcoholic and artisanal spirit options tailored for a discerning taste. This change is also influencing local preferences, as consumers in the region are increasingly exposed to international hospitality trends. The momentum is supported by the remarkable expansion of the Saudi hospitality sector, which was valued at USD 48.6 billion in 2024 and is estimated to hit USD 109.6 billion by 2033, with a CAGR of 9.5% from 2025 to 2033. This flourishing industry is significantly influencing consumer expectations and driving sustainable demand for handcrafted beverage experiences.

Influence of Expat Communities

The swiftly increasing expatriate population in Saudi Arabia is significantly influencing consumer demand, especially in the food and beverage (F&B) industry. Numerous expatriates come from areas where craft spirits and artisanal beverages are integral to everyday life, carrying expectations for refined, internationally influenced, and culturally suitable drink selections. This demographic acts as a driving force for market variety, motivating retailers, restaurants, and hotels to include premium, non-alcoholic craft spirits as regular offerings on their menus. Their choices also shape local trends via daily interactions, business connections, and hospitality environments. Government statistics indicate that the count of non-Saudi inhabitants reached around 15.7 million in 2024, increasing from 14.5 million in 2023, accounting for 75.6% of the overall population growth in the kingdom. Non-Saudis constitute 44.4% of the population, and their cultural and economic impact is significant, which is driving the demand for artisanal drinks and elevating standards for quality, variety, and global-style service.

Saudi Arabia Craft Spirits Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product and distribution channel.

Product Insights:

- Whiskey

- Vodka

- Gin

- Rum

- Brandy

- Liqueur

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes whiskey, vodka, gin, rum, brandy, liqueur, and others.

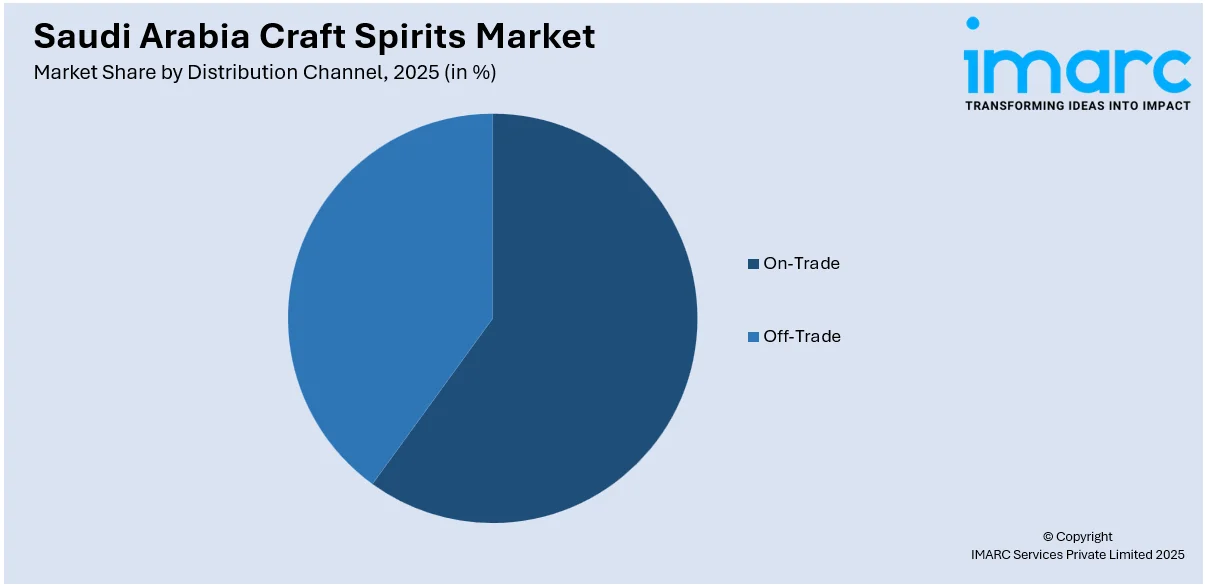

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- On-Trade

- Off-Trade

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes on-trade and off-trade.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Craft Spirits Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Whiskey, Vodka, Gin, Rum, Brandy, Liqueur, Others |

| Distribution Channels Covered | On-Trade, Off-Trade |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia craft spirits market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia craft spirits market on the basis of product?

- What is the breakup of the Saudi Arabia craft spirits market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia craft spirits market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia craft spirits market?

- What are the key driving factors and challenges in the Saudi Arabia craft spirits market?

- What is the structure of the Saudi Arabia craft spirits market and who are the key players?

- What is the degree of competition in the Saudi Arabia craft spirits market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia craft spirits market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia craft spirits market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia craft spirits industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)