Saudi Arabia Crop Insurance Market Size, Share, Trends and Forecast by Coverage, Distribution Channel, and Region, 2026-2034

Saudi Arabia Crop Insurance Market Overview:

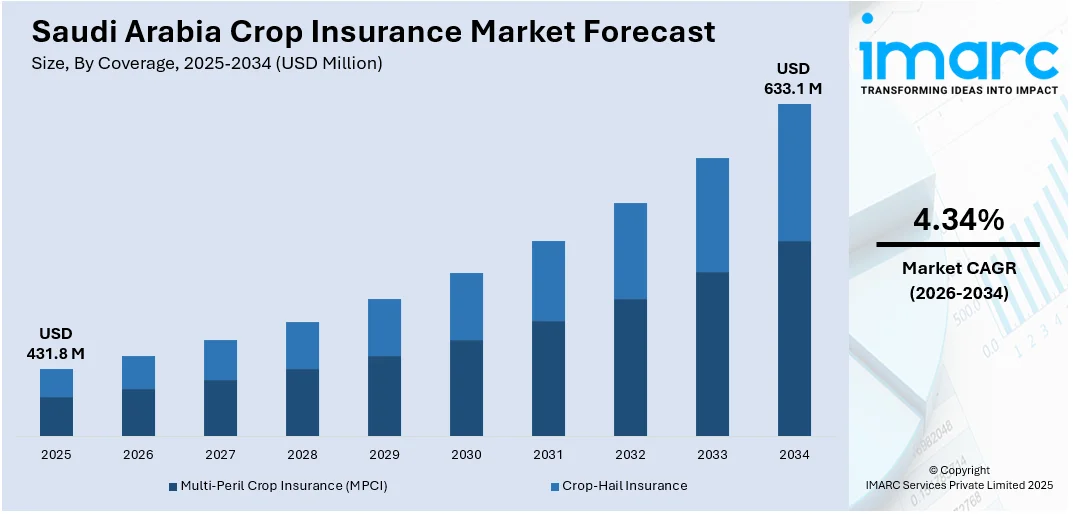

The Saudi Arabia crop insurance market size reached USD 431.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 633.1 Million by 2034, exhibiting a growth rate (CAGR) of 4.34% during 2026-2034. The market is driven by climate change-related risks, rising awareness among farmers, government subsidies, technological integration in agriculture, and increasing demand for food security. These factors are pushing stakeholders to adopt risk mitigation tools and expand insurance coverage across key agricultural regions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 431.8 Million |

| Market Forecast in 2034 | USD 633.1 Million |

| Market Growth Rate 2026-2034 | 4.34% |

Saudi Arabia Crop Insurance Market Trends:

Growing Focus on Agricultural Risk Mitigation

There is a noticeable shift toward structured protection mechanisms in agriculture, driven by the need to manage uncertainties in crop production. With the global market for these solutions projected to expand steadily over the next decade, similar developments are expected in regions like Saudi Arabia. Increasing climate unpredictability, changing rainfall patterns, and a rising awareness of income protection tools are prompting broader adoption. Supportive policies and efforts to strengthen rural financial systems are also contributing to this momentum. As agricultural practices become more technology-driven and data-informed, the appeal of risk coverage solutions is likely to rise. This shift reflects a larger move toward building resilience in farming systems and ensuring economic stability for growers. The coming years may see stronger integration of such mechanisms into agricultural planning and investment decisions, especially in areas prioritizing food security and sustainable rural development. For example, the global crop insurance market size reached USD 46.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 73.8 Billion by 2033, exhibiting a growth rate CAGR of 4.85% during 2025-2033.

To get more information on this market Request Sample

Strengthening Agricultural Risk Solutions through Strategic Collaboration

Recent partnerships are paving the way for enhanced protection in agriculture, with a focus on building technical capabilities and supporting financial stability across the sector. In Saudi Arabia, initiatives aimed at improving awareness and application of Shariah-compliant insurance are gaining momentum, particularly through institutional collaborations. These efforts are designed to support farmers, agribusinesses, and other value chain players by improving access to structured financial safeguards. By encouraging knowledge exchange and integrating localized insurance models, such moves contribute to a more resilient agricultural environment. As these capacity-building measures continue, the broader agricultural ecosystem in the region is expected to benefit through improved risk management practices and a stronger foundation for sustainable growth. For instance, in May 2024, the Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC) and Saudi Arabia's Agricultural Development Fund (ADF) formalized a partnership to strengthen the Kingdom's agricultural sector. The agreement includes initiatives like capacity building on Islamic insurance and aims to bolster the agricultural value chain within Saudi Arabia and other ICIEC member states.

Saudi Arabia Crop Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on coverage and distribution channel.

Coverage Insights:

- Multi-Peril Crop Insurance (MPCI)

- Crop-Hail Insurance

The report has provided a detailed breakup and analysis of the market based on the coverage. This includes multi-peril crop insurance (MPCI) and crop-hail insurance.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

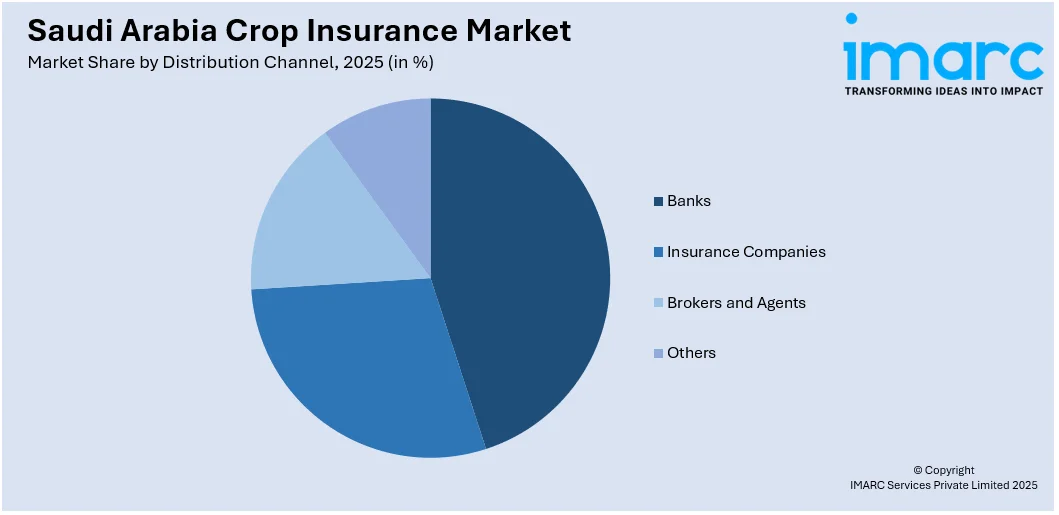

- Banks

- Insurance Companies

- Brokers and Agents

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes banks, insurance companies, brokers and agents, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Crop Insurance Market News:

- In July 2024, Saudi Arabia launched a cooperative agricultural insurance initiative to mitigate losses from plant pests and animal diseases. Implemented by the Weqaa Center under the National Transformation Program, the scheme targets economic losses in the agricultural sector.

Saudi Arabia Crop Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Coverages Covered | Multi-Peril Crop Insurance (MPCI), Crop-Hail Insurance |

| Distribution Channels Covered | Banks, Insurance Companies, Brokers and Agents, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia crop insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia crop insurance market on the basis of coverage?

- What is the breakup of the Saudi Arabia crop insurance market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia crop insurance market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia crop insurance market?

- What are the key driving factors and challenges in the Saudi Arabia crop insurance?

- What is the structure of the Saudi Arabia crop insurance market and who are the key players?

- What is the degree of competition in the Saudi Arabia crop insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia crop insurance market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia crop insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia crop insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)