Saudi Arabia Cryptocurrency Exchange Market Size, Share, Trends and Forecast by Exchange Type, Cryptocurrency Type, User Type, Revenue Model, Trading Service, and Region, 2026-2034

Saudi Arabia Cryptocurrency Exchange Market Summary:

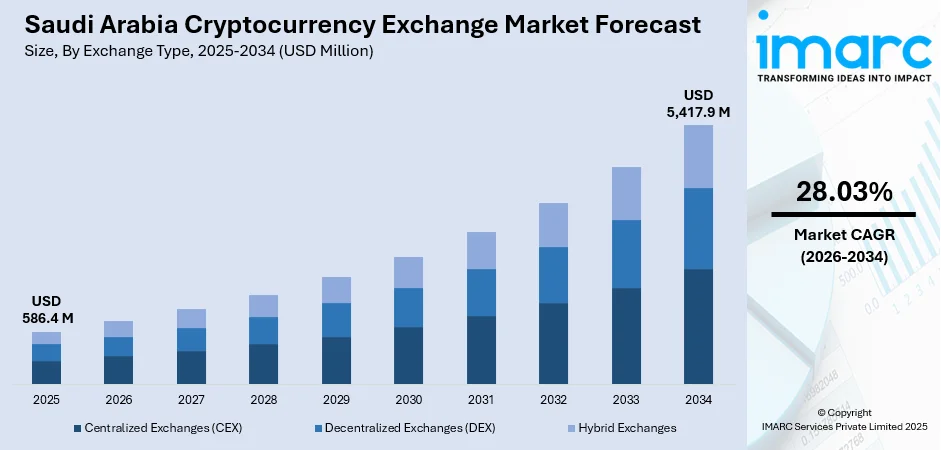

The Saudi Arabia cryptocurrency exchange market size was valued at USD 586.4 Million in 2025 and is projected to reach USD 5,417.9 Million by 2034, growing at a compound annual growth rate of 28.03% from 2026-2034.

The market is expanding rapidly driven by increasing digital adoption, favorable government stance on blockchain technology under Vision 2030, growing institutional interest in digital assets, and rising cryptocurrency awareness among retail investors. The development of central bank digital currency initiatives alongside evolving regulatory frameworks supporting fintech innovation is accelerating market growth. Shariah-compliant cryptocurrency solutions and strategic partnerships with international blockchain firms are further expanding the Saudi Arabia cryptocurrency exchange market share.

Key Takeaways and Insights:

- By Exchange Type: Centralized exchanges (CEX) dominate the market with a share of 59% in 2025, driven by superior liquidity, user-friendly interfaces, and comprehensive trading services.

- By Cryptocurrency Type: Bitcoin (BTC) leads the market with a share of 34% in 2025, reflecting its position as the most recognized and widely traded digital asset.

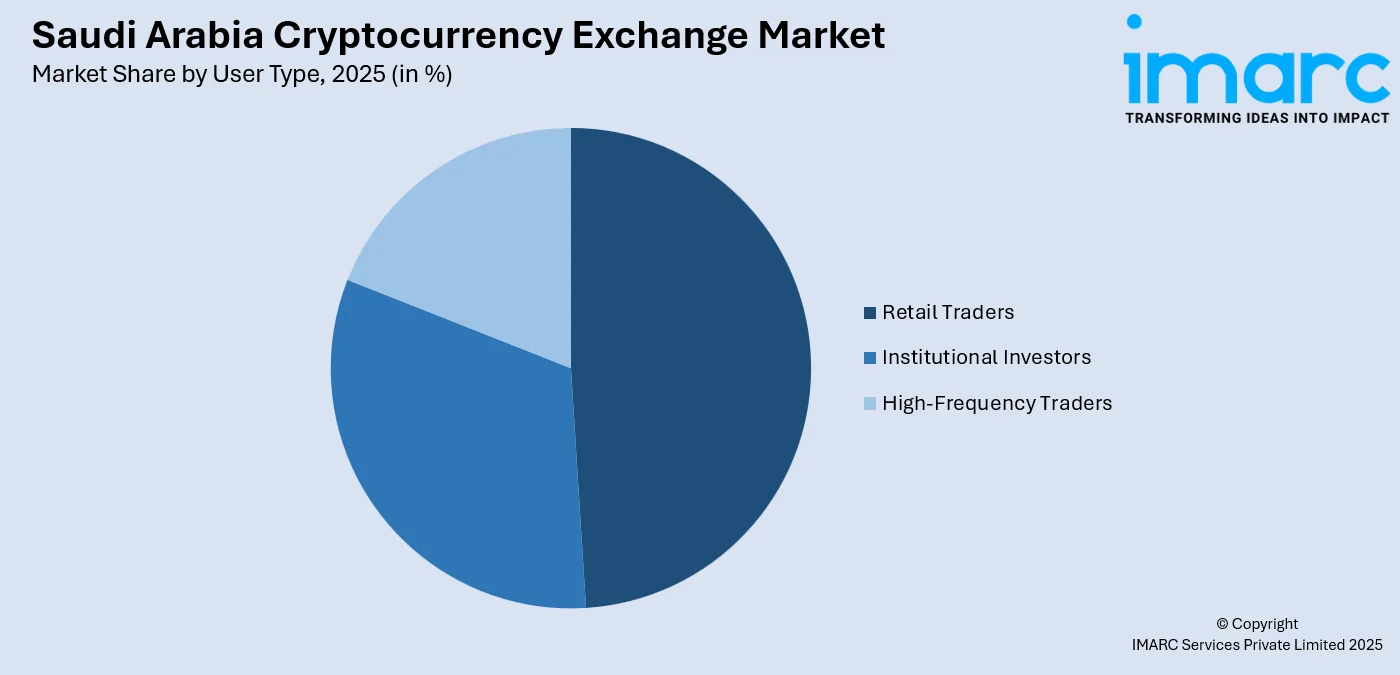

- By User Type: Retail traders represent the largest segment with a market share of 49% in 2025, fueled by growing digital literacy and accessible mobile trading platforms.

- By Revenue Model: Transaction fees lead the market with a share of 41% in 2025, reflecting the pay-per-trade business model preferred by most exchanges.

- By Trading Service: Spot trading represents the largest segment with a market share of 47% in 2025, as investors prefer direct cryptocurrency purchases over derivative products.

- By Region: Northern and central region leads the market with a share of 31% in 2025, driven by Riyadh's position as the Kingdom's financial and technology hub.

- Key Players: Crypto exchanges in Saudi Arabia are focusing on regulatory alignment, launching Sharia-compliant products, expanding SAR on-ramps, strengthening cybersecurity, partnering with local institutions, and investing in user education and infrastructure to build trust and scale adoption.

To get more information on this market Request Sample

Saudi Arabia is rapidly turning out to be one of the foremost hubs for cryptocurrency trading purposes within the Middle East and African region. A rising number of people within the Kingdom are turning to digital currencies. Apart from this, the heightened use of digital currencies indicates a growing interest in the use of the blockchain network. Furthermore, the rising number of people investigating the opportunities offered by digital currencies is increasing the level of trading at exchanges. For example, the acquisition of Strategy (formerly MicroStrategy), an indirect holding of 568,840 Bitcoins valued at USD 68 billion through 25,656 shares by the Saudi Central Bank in May 2025 indicates the Kingdom's moves to access the benefits of Bitcoins. The incorporation of digital currencies into traditional institutions is assisting the Kingdom of Saudi Arabia in shaping the future of finance.

Saudi Arabia Cryptocurrency Exchange Market Trends:

Central Bank Digital Currency (CBDC) Development and Blockchain Integration

Saudi Arabia is actively advancing its central bank digital currency initiatives, positioning itself at the forefront of blockchain-based financial innovation in the Middle East. The Kingdom's participation in international CBDC projects demonstrates its commitment to modernizing cross-border payment systems and exploring digital currency infrastructure. For instance, in 2024, the Saudi Central Bank joined the Bank for International Settlements' Project mBridge as a full participant, collaborating with UAE, China, Thailand, and Hong Kong banks to evaluate the viability of central bank digital currencies using blockchain technology for cross-border payments, reflecting the Kingdom's growing interest in digital currencies.

Rapid Growth in Cryptocurrency Transaction Volume and User Adoption

The Saudi Arabia cryptocurrency exchange market is experiencing unprecedented growth in transaction volumes and active user participation, establishing the Kingdom as the fastest-growing crypto economy in the MENA region. Rising digital literacy, increasing smartphone penetration, and growing interest in alternative investment opportunities are driving retail and institutional participation in cryptocurrency trading. According to Chainalysis, between July 2023 and June 2024, Saudi Arabia experienced remarkable 154% year-over-year growth in cryptocurrency activity, reaching an estimated USD 31 billion in transaction value. The Kingdom recorded a rise in daily crypto, demonstrating strong and sustained interest in digital asset trading across the population.

Regulatory Framework Evolution and Fintech Sector Expansion

Saudi Arabia is witnessing significant evolution in its cryptocurrency regulatory landscape, with government authorities actively working toward comprehensive frameworks that balance innovation with investor protection. The Kingdom's fintech sector is expanding rapidly, supported by Vision 2030 initiatives that prioritize digital transformation and economic diversification. In November 2024, Saudi Arabia's Minister of Municipal, Rural Affairs and Housing announced that the government is looking to launch stablecoins soon in partnership with the Capital Market Authority and Central Bank, noting that if digital currencies are developed within Saudi values and regulations, it will create a faster financial system.

How Vision 2030 is Transforming the Saudi Arabia Cryptocurrency Exchange Market:

Vision 2030 is reshaping Saudi Arabia’s cryptocurrency exchange market by pushing digital finance, fintech innovation, and economic diversification. Government focus on cashless payments, blockchain adoption, and financial inclusion is encouraging exchanges to operate within structured regulatory boundaries. Clearer oversight improves confidence among retail and institutional participants, supporting higher trading volumes. Vision 2030 also promotes local talent development, leading exchanges to invest in education, compliance teams, and Arabic-language platforms. Growing interest in tokenization, digital assets, and regulated stablecoins aligns with national goals to modernize capital markets and payment systems. Partnerships between exchanges, banks, and technology firms are expanding secure on-ramps using the Saudi riyal. Strong emphasis on cybersecurity and consumer protection is shaping platform design and governance. Overall, Vision 2030 is steering the crypto exchange market toward regulated growth, transparency, and integration with the broader financial ecosystem, positioning digital assets as a supportive pillar within Saudi Arabia’s long-term economic transformation.

Market Outlook 2026-2034:

The Saudi Arabia cryptocurrency exchange market is poised for substantial expansion over the forecast period, driven by anticipated regulatory clarity, continued Vision 2030 digital transformation initiatives, and growing mainstream acceptance of digital assets. The Kingdom's strategic positioning as a regional fintech hub, coupled with increasing institutional participation and sovereign wealth fund interest in blockchain technology, will create favorable conditions for market growth. The market generated a revenue of USD 586.4 Million in 2025 and is projected to reach a revenue of USD 5,417.9 Million by 2034, growing at a compound annual growth rate of 28.03% from 2026-2034. The integration of Shariah-compliant cryptocurrency products will unlock conservative investor segments previously hesitant about digital asset participation. Strategic partnerships between international cryptocurrency exchanges and Saudi financial institutions will enhance service quality, security standards, and regulatory compliance.

Saudi Arabia Cryptocurrency Exchange Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Exchange Type |

Centralized Exchanges (CEX) |

59% |

|

Cryptocurrency Type |

Bitcoin (BTC) |

34% |

|

User Type |

Retail Traders |

49% |

|

Revenue Model |

Transaction Fees |

41% |

|

Trading Service |

Spot Trading |

47% |

|

Region |

Northern and Central Region |

31% |

Exchange Type Insights:

- Centralized Exchanges (CEX)

- Decentralized Exchanges (DEX)

- Hybrid Exchanges

Centralized exchanges (CEX) dominate with a market share of 59% of the total Saudi Arabia cryptocurrency exchange market in 2025.

Centralized exchanges (CEX) hold a strong position in the Saudi Arabia cryptocurrency exchange market due to their ease of use, liquidity depth, and regulatory compatibility. These platforms act as intermediaries, managing order matching, custody, and security, which appeals to users seeking reliability. Saudi users prefer CEX platforms that support Saudi riyal deposits, offer quick settlement, and integrate with local payment systems. Strong compliance practices, including KYC and AML checks, align with the Kingdom’s financial regulations and help build confidence. Advanced trading tools, mobile apps, and Arabic-language support further strengthen adoption among retail and professional traders.

CEX operators in Saudi Arabia are also expanding their offerings to align with Vision 2030 goals. Many are investing in cybersecurity, institutional-grade custody solutions, and educational initiatives to encourage responsible participation. Partnerships with banks, fintech firms, and global blockchain players are helping exchanges improve infrastructure and product breadth. Features such as staking, derivatives, and tokenized assets are being introduced under controlled environments. By prioritizing transparency, user protection, and operational stability, centralized exchanges continue to lead the market and serve as the primary gateway for crypto adoption in Saudi Arabia.

Cryptocurrency Type Insights:

- Bitcoin (BTC)

- Ethereum (ETH)

- Stablecoins

- Altcoins

- Meme Coins and Emerging Tokens

Bitcoin (BTC) leads with a share of 34% of the total Saudi Arabia cryptocurrency exchange market in 2025.

Bitcoin usage is rising steadily in Saudi Arabia, supported by growing interest in digital assets and wider awareness of blockchain-based value storage. Retail traders view Bitcoin as a long-term asset and a hedge against inflation, while younger investors are drawn to its global acceptance. Improved access through regulated centralized exchanges, Saudi riyal trading pairs, and mobile apps has lowered entry barriers. Educational initiatives and clearer guidance around digital finance are also helping users understand risks and opportunities. Higher media coverage and institutional discussions around digital currencies further contribute to Bitcoin’s growing visibility and credibility.

Cryptocurrency exchanges in Saudi Arabia are responding to this trend by strengthening Bitcoin-focused services. Enhanced liquidity, faster execution, and advanced trading tools are being introduced to handle higher demand. Platforms are improving custody solutions, cold storage practices, and transaction monitoring to address security concerns. Bitcoin-based products, including recurring purchase plans and staking-like yield options, are gaining traction among long-term holders. As confidence improves and infrastructure matures, Bitcoin continues to drive trading volumes and user engagement, reinforcing its role as the primary entry asset in the Saudi cryptocurrency exchange market.

User Type Insights:

Access the comprehensive market breakdown Request Sample

- Retail Traders

- Institutional Investors

- High-Frequency Traders

Retail traders exhibit a clear dominance with a 49% share of the total Saudi Arabia cryptocurrency exchange market in 2025.

Retail traders form the largest user segment in the Saudi Arabia cryptocurrency exchange market, driven by rising digital awareness, mobile-first platforms, and interest in alternative investments. Easy account setup, Saudi riyal trading pairs, and intuitive interfaces attract new users. Many retail participants trade popular cryptocurrencies for portfolio diversification and short-term opportunities. Educational content, demo tools, and localized customer support help first-time traders gain confidence. Social media influence and growing acceptance of digital payments also support participation. Retail traders prefer centralized exchanges that provide security, transparency, and regulatory alignment, reducing perceived risks while enabling convenient access to crypto markets.

Saudi retail traders are increasingly selective, prioritizing platform credibility, asset safety, and compliance. Exchanges respond by strengthening identity verification, cybersecurity controls, and consumer protection measures. Loyalty programs, low trading fees, and promotional campaigns are used to retain users. Growing interest in staking, rewards, and long-term holding strategies reflects a shift toward more informed participation. Mobile apps with real-time tracking and alerts suit on-the-go trading habits. As financial literacy improves under national digital initiatives, retail traders continue to drive volume, liquidity, and overall growth in the Saudi cryptocurrency exchange market.

Revenue Model Insights:

- Transaction Fees

- Subscription-Based Models

- Listing Fees

- Staking and Yield Farming Services

Transaction fees lead with a share of 41% of the total Saudi Arabia cryptocurrency exchange market in 2025.

Transaction fees represent the largest revenue source in the Saudi Arabia cryptocurrency exchange market, supported by strong retail participation and rising trading volumes. Centralized exchanges earn fees from spot trading, margin trades, and derivatives, typically structured as maker and taker charges. High liquidity in popular trading pairs increases daily transactions, generating consistent income. Saudi users accept transaction-based pricing due to platform reliability, security, and regulatory alignment. Fee transparency and predictable costs build trust, especially among new users. As trading activity grows, exchanges focus on optimizing execution speed and uptime to protect this steady revenue stream.

Exchanges operating in Saudi Arabia are refining transaction fee models to stay competitive while maintaining profitability. Tiered fee structures based on trading volume encourage frequent activity and user retention. Discounts for native tokens or loyalty programs further boost engagement. Strong regulatory oversight places emphasis on clear pricing disclosures, pushing exchanges to avoid hidden charges. Rising participation from active retail and professional traders supports fee-based revenues. Even as alternative income streams grow, transaction fees remain the core driver due to their direct link with market activity and user demand.

Trading Service Insights:

- Spot Trading

- Futures and Derivatives Trading

- Margin Trading

- Peer-to-Peer (P2P) Trading

Spot trading exhibits a clear dominance with a 47% share of the total Saudi Arabia cryptocurrency exchange market in 2025.

Spot trading maintains dominance in the Saudi cryptocurrency exchange market as it represents the most straightforward and accessible method for investors to gain direct ownership of digital assets. This segment appeals to both conservative long-term holders and active traders seeking to capitalize on price movements without leverage exposure. Most cryptocurrency trading in Saudi Arabia occurs through spot trading on centralized exchanges, with platforms prioritizing spot trading accessibility for retail users through intuitive interfaces and simplified order execution processes. Binance supports spot trading alongside margin, futures, and staking, but spot trading remains the dominant service utilized by the majority of platform participants.

The preference for spot trading reflects risk-conscious investment approaches common among Saudi retail investors who prioritize asset ownership over speculative derivatives exposure. Spot markets provide transparent price discovery mechanisms and eliminate liquidation risks associated with leveraged products. The segment benefits from clear Shariah compliance as direct asset ownership aligns with Islamic finance principles better than derivative instruments. Lower complexity and reduced counterparty risks make spot trading ideal for cryptocurrency market newcomers building foundational understanding. As regulatory frameworks evolve, spot trading is likely to maintain its leadership position while complementary services like staking and lending gain incremental market share among sophisticated investors.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and central region leads with a share of 31% of the total Saudi Arabia cryptocurrency exchange market in 2025.

The Northern and Central Region leads the Saudi Arabia cryptocurrency exchange market, anchored by Riyadh's position as the Kingdom's political, economic, and technological epicenter. The capital city hosts the highest concentration of fintech companies, blockchain startups, and cryptocurrency service providers. Riyadh serves as the primary hub for cryptocurrency activity and blockchain innovation, with major crypto companies including Binance establishing ground operations in the city. Goldman Sachs and Rothschild have expanded operations in Riyadh focusing on tokenization projects, reflecting institutional confidence in the region's digital asset ecosystem.

The region benefits from superior digital infrastructure, higher disposable incomes, and greater exposure to international financial markets compared to other Saudi regions. Government ministries and regulatory bodies headquartered in Riyadh drive policy development and fintech innovation initiatives aligned with Vision 2030 objectives. The concentration of universities, technology parks, and entrepreneurship programs creates talent pipelines supporting cryptocurrency exchange development. Major blockchain conferences and industry events hosted in Riyadh, such as the Leap Summit that drew over 215,000 attendees in February 2024, position the Northern and Central Region as the Kingdom's gateway to global cryptocurrency markets and blockchain technology advancement.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Cryptocurrency Exchange Market Growing?

Vision 2030 Digital Transformation Initiatives and Blockchain Technology Adoption

Saudi Arabia's Vision 2030 economic diversification strategy is driving substantial investments in digital infrastructure, fintech innovation, and blockchain technology applications across public and private sectors. The Kingdom's commitment to reducing oil dependency and developing knowledge-based industries has created favorable conditions for cryptocurrency market development. Government-led initiatives supporting blockchain integration in supply chain management, government services, and financial systems are building ecosystem foundations for widespread digital asset adoption. In July 2024, Droppgroup and Superteam announced a partnership to advance Web3 and blockchain adoption in Saudi Arabia, supporting Vision 2030 by delivering innovative blockchain solutions and educational initiatives to empower the Kingdom's digital currency landscape and technological development.

Institutional Investment and Sovereign Wealth Fund Participation in Digital Assets

Growing institutional confidence in cryptocurrency as a legitimate asset class is attracting significant capital from traditional financial institutions, family offices, and sovereign wealth funds in Saudi Arabia. The entry of respected institutional players validates cryptocurrency markets and encourages broader participation from conservative investors previously skeptical of digital assets. The region surpassed 500,000 average daily crypto traders in February 2024, reflecting sustained institutional and retail participation. Major financial institutions including Goldman Sachs and Rothschild expanding operations in Riyadh and spearheading tokenization projects signal deepening institutional engagement with blockchain technology and digital asset markets.

Shariah-Compliant Cryptocurrency Solutions and Islamic Finance Integration

The development and proliferation of Shariah-compliant cryptocurrency products and services is removing religious barriers that previously limited market participation among conservative Muslim investors in Saudi Arabia. Islamic finance compatibility has become a critical differentiator for cryptocurrency exchanges operating in the Kingdom, with platforms pursuing Shariah certification to access broader customer segments. CoinMENA, a Bahrain-licensed Shariah-compliant digital assets exchange regulated by the Central Bank of Bahrain, is building presence in Saudi Arabia, UAE, Oman, and Kuwait, offering retail and institutional investors access to major cryptocurrencies including Bitcoin, Ethereum, Ripple, Litecoin, and Bitcoin Cash through a platform certified by Shariyah Review Bureau. In September 2024, Mesh partnered with CoinMENA to enhance crypto transfers and account management across the Middle East including Saudi Arabia, leveraging API-based solutions that enable seamless and secure transactions while removing needs for lengthy crypto addresses, QR codes, and seed phrases.

Market Restraints:

What Challenges the Saudi Arabia Cryptocurrency Exchange Market is Facing?

Regulatory Uncertainty and Banking Sector Restrictions

The absence of comprehensive cryptocurrency regulations creates uncertainty for market participants and limits institutional adoption. SAMA's 2018 rule prohibits banks from processing cryptocurrency payments without explicit approval, restricting seamless fiat-to-crypto conversion. Virtual currencies remain unrecognized as legal tender, creating legal ambiguity for businesses and investors. No domestic cryptocurrency exchanges are currently licensed in Saudi Arabia, forcing traders to rely on international platforms subject to foreign regulatory frameworks.

Security Vulnerabilities and Fraud Risk Perceptions

High-profile security incidents affecting regional exchanges raise concerns about asset safety and platform reliability. Rain, a Bahrain-regulated exchange, suffered a USD 14.8 million hack in May 2024, damaging user confidence. The Standing Committee warns about regulatory, security, and market risks involved in virtual currency trading. Phishing scams, fraudulent schemes, and technical vulnerabilities continue to threaten inexperienced traders, creating barriers to mainstream adoption and requiring enhanced security measures and investor education.

Limited Local Exchange Infrastructure and Payment Gateway Challenges

The absence of locally licensed cryptocurrency exchanges creates dependency on foreign platforms and regulatory frameworks. Saudi banks may flag or reject transfers to crypto platforms, complicating fiat-to-crypto onramps for retail investors. Limited integration between traditional banking systems and cryptocurrency exchanges increases transaction friction. The lack of direct Saudi Riyal deposit and withdrawal capabilities on major platforms forces users to utilize peer-to-peer trading or international wire transfers, adding costs and complexity to cryptocurrency transactions.

Competitive Landscape:

The Saudi Arabia cryptocurrency exchange market exhibits moderate competitive intensity, characterized by international platform dominance and emerging regional players competing through localized services and regulatory compliance. Binance maintains market leadership through extensive cryptocurrency offerings, competitive fee structures, and Arabic language support. Major international players compete for market share by emphasizing different value propositions including Shariah compliance, regional licensing, and specialized trading services. The absence of domestic licensed exchanges creates opportunities for both global platforms and regional fintech companies to establish strong positions. Market participants are investing in customer education, mobile applications, security enhancements, and regulatory engagement to build sustainable competitive advantages. Strategic partnerships with traditional financial institutions and blockchain technology providers are enabling exchanges to expand service offerings and strengthen market positioning as the Saudi cryptocurrency ecosystem matures.

Saudi Arabia Cryptocurrency Exchange Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Exchange Types Covered | Centralized Exchanges (CEX), Decentralized Exchanges (DEX), Hybrid Exchanges |

| Cryptocurrency Types Covered | Bitcoin (BTC), Ethereum (ETH), Stablecoins, Altcoins, Meme Coins and Emerging Tokens |

| User Types Covered | Retail Traders, Institutional Investors, High-Frequency Traders |

| Revenue Models Covered | Transaction Fees, Subscription-Based Models, Listing Fees, Staking and Yield Farming Services |

| Trading Services Covered | Spot Trading, Futures and Derivatives Trading, Margin Trading, Peer-to-Peer (P2P) Trading |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia cryptocurrency exchange market size was valued at USD 586.4 Million in 2025.

The Saudi Arabia cryptocurrency exchange market is expected to grow at a compound annual growth rate of 28.03% from 2026-2034 to reach USD 5,417.9 Million by 2034.

Centralized exchanges (CEX) dominated the market with a 59% share in 2025, driven by superior liquidity, user-friendly interfaces, comprehensive customer support, and institutional-grade security features that appeal to both retail and institutional investors across the Kingdom.

Key factors driving the Saudi Arabia cryptocurrency exchange market include Vision 2030 digital transformation initiatives and blockchain technology adoption, institutional investment and sovereign wealth fund participation in digital assets, and Shariah-compliant cryptocurrency solutions enabling Islamic finance integration.

Major challenges include regulatory uncertainty and banking sector restrictions limiting institutional adoption, security vulnerabilities and fraud risk perceptions damaging user confidence, and limited local exchange infrastructure creating dependency on foreign platforms and complicating fiat-to-crypto conversion processes.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)