Saudi Arabia Customer Data Platform Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, Application, Vertical, and Region, 2026-2034

Saudi Arabia Customer Data Platform Market Overview:

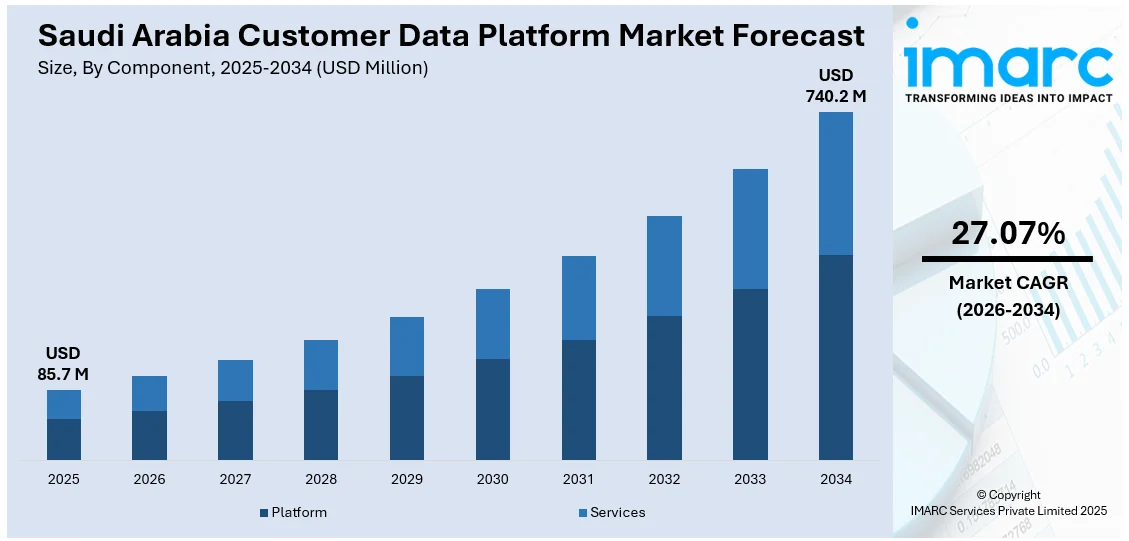

The Saudi Arabia customer data platform market size reached USD 85.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 740.2 Million by 2034, exhibiting a growth rate (CAGR) of 27.07% during 2026-2034. The rising digital transformation initiatives, increasing adoption of omnichannel marketing strategies, expanding e-commerce activity, growing demand for personalized customer experiences, rising cloud-based solution deployment, and regulatory focus on data privacy and customer consent management are some of the key factors driving market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 85.7 Million |

| Market Forecast in 2034 | USD 740.2 Million |

| Market Growth Rate 2026-2034 | 27.07% |

Saudi Arabia Customer Data Platform Market Trends:

Emphasis on Data Privacy and Compliance

The growing emphasis on data privacy and regulatory compliance is a significant factor augmenting Saudi Arabia customer data platform market share. Data privacy and compliance have become central concerns with the implementation of government laws. For instance, on September 14, 2023, the Kingdom of Saudi Arabia (KSA) implemented the Personal Data Protection Law (PDPL). This legislation mandates strict guidelines for the collection, processing, and storage of personal data. In turn, companies are increasingly demanding CDP solutions that meet such legal requirements. Thus, organizations are giving foremost importance to platforms that provide strong data governance capabilities, such as consent management and data anonymization, to help prevent risks related to non-compliance. The emphasis on data privacy is not only a legal requirement but also a strategic move to instill consumer trust within a market where digital interactions are growing exponentially. Consequently, CDP vendors are enriching their products to meet regulatory compliance, positioning themselves as essential partners for businesses navigating the complex landscape of data protection in Saudi Arabia.

To get more information on this market Request Sample

Growth of Cloud-Based CDP Deployments

The adoption of cloud-based CDP solutions is positively impacting Saudi Arabia customer data platform market outlook. The cloud-based CDP deployment is driven by the flexibility, scalability, and cost-effectiveness. Cloud deployments allow companies to consolidate data from various sources without any hassle, supporting real-time analytics and faster marketing approaches. This trend is especially prevalent in small and medium-sized businesses (SMEs) seeking to harness customer data without the significant investment needed for on-premises infrastructure. CDP providers are focusing on cloud-native offerings to address the changing requirements of the market, with improved features like automated data integration, sophisticated analytics, and intuitive interfaces available to help companies deliver customized customer experiences. The shift to cloud is expected to dominate over the coming years, particularly as public and private sector initiatives under Vision 2030 push for cloud adoption across industries. This momentum is also expected to encourage the domestic development of localized CDP ecosystems tailored to regional needs.

Integration of Artificial Intelligence and Machine Learning in CDP Solutions

The market is increasingly incorporating artificial intelligence (AI) and machine learning (ML) to enhance data processing and customer engagement strategies. According to industry reports, the Saudi Arabia artificial intelligence market is expected to reach USD 4,018 Million by 2033, exhibiting a CAGR of 15.80% from 2025-2033. This growth aligns with the growing need for CDP solutions that consolidate first-party customer information from various sources into one, actionable customer profile. Along with this, the convergence of AI and ML allows companies to forecast customer behavior, target audiences more accurately, and automate marketing efforts, resulting in enhanced customer satisfaction and loyalty. Companies are investing heavily in the region, with plans to introduce AI-powered platforms. This is contributing to the Saudi Arabia customer data platform market growth as organizations shift towards more intelligent, data-centric strategies. AI implementation is not just enhancing customer experiences but also making decision-making at marketing and sales channels faster.

Saudi Arabia Customer Data Platform Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on component, deployment mode, organization size, application, and vertical.

Component Insights:

- Platform

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes platform and services.

Deployment Mode Insights:

- Cloud -based

- On-premises

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes cloud-based and on-premises.

Organization Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes large enterprises and small and medium-sized enterprises (SMEs).

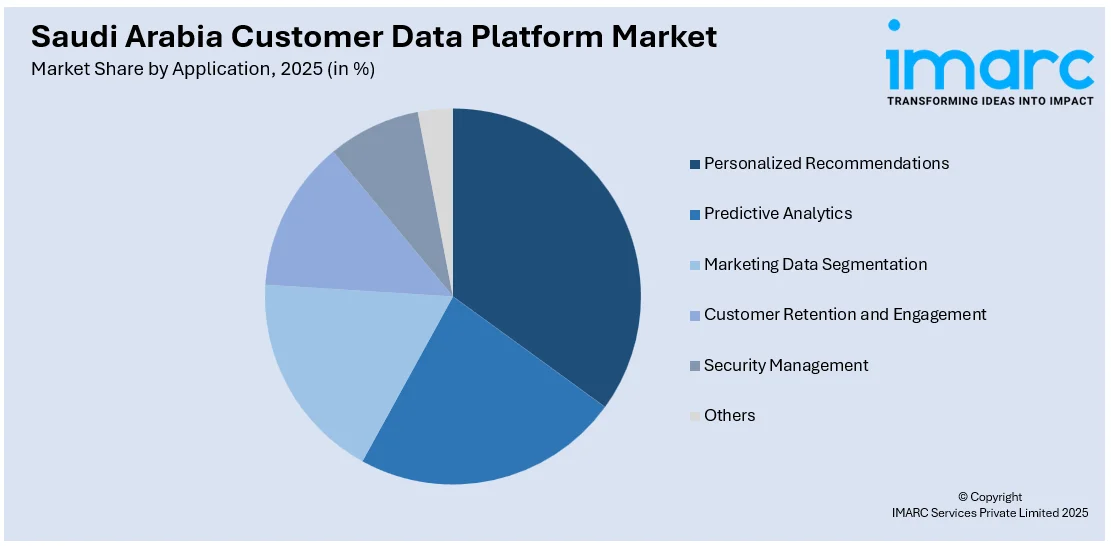

Application Insights:

Access the comprehensive market breakdown Request Sample

- Personalized Recommendations

- Predictive Analytics

- Marketing Data Segmentation

- Customer Retention and Engagement

- Security Management

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes personalized recommendations, predictive analytics, marketing data segmentation, customer retention and engagement, security engagement, and others.

Vertical Insights:

- Retail and E-commerce

- BFSI

- Media and Entertainment

- IT and Telecommunications

- Others

The report has provided a detailed breakup and analysis of the market based on the vertical. This includes retail and e-commerce, BFSI, media and entertainment, IT and telecommunications, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Customer Data Platform Market News:

- On February 5, 2025, Abdul Latif Jameel Electronics announced a strategic partnership with a customer data platform, WebEngage, to enhance customer engagement across Saudi Arabia's electronics sector. This collaboration aims to deliver personalized, omnichannel experiences by leveraging WebEngage's AI-driven platform, which integrates customer data management, behavioral segmentation, and multi-channel engagement tools. The initiative is expected to improve customer retention, re-engage inactive users, and strengthen brand loyalty through tailored marketing and seamless post-purchase support.

Saudi Arabia Customer Data Platform Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Platform, Services |

| Deployment Modes Covered | Cloud-based, On-premises |

| Organization Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises (SMEs) |

| Applications Covered | Personalized Recommendations, Predictive Analytics, Marketing Data Segmentation, Customer Retention and Engagement, Security Management, Others |

| Verticals Covered | Retail and E-commerce, BFSI, Media and Entertainment, IT and Telecommunications, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia customer data platform market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia customer data platform market on the basis of component?

- What is the breakup of the Saudi Arabia customer data platform market on the basis of deployment mode?

- What is the breakup of the Saudi Arabia customer data platform market on the basis of organization size?

- What is the breakup of the Saudi Arabia customer data platform market on the basis of application?

- What is the breakup of the Saudi Arabia customer data platform market on the basis of vertical?

- What is the breakup of the Saudi Arabia customer data platform market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia customer data platform market?

- What are the key driving factors and challenges in the Saudi Arabia customer data platform market?

- What is the structure of the Saudi Arabia customer data platform market and who are the key players?

- What is the degree of competition in the Saudi Arabia customer data platform market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia customer data platform market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia customer data platform market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia customer data platform industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)