Saudi Arabia Customer Relationship Management Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, Application, Industry Vertical, and Region, 2026-2034

Saudi Arabia Customer Relationship Management Market Overview:

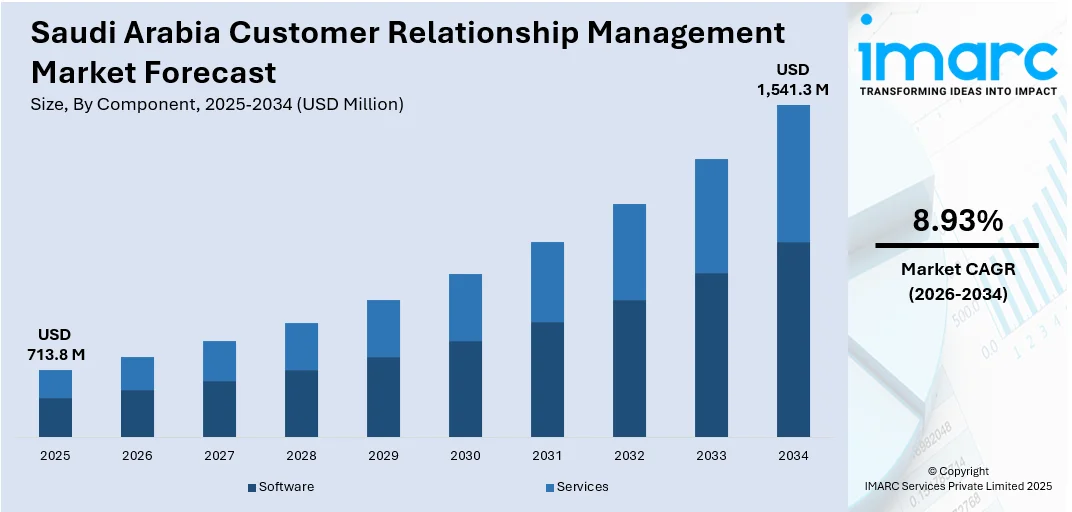

The Saudi Arabia customer relationship management market size reached USD 713.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,541.3 Million by 2034, exhibiting a growth rate (CAGR) of 8.93% during 2026-2034. The market is primarily driven by enterprise digital transformation roadmaps, centralized client data management, operational streamlining, real-time customer engagement, national policy mandates under Vision 2030, data-driven customer engagement strategies, growth of e-commerce and omni-channel platforms, analytics and AI integration, and compliance with data protection regulations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 713.8 Million |

| Market Forecast in 2034 | USD 1,541.3 Million |

| Market Growth Rate 2026-2034 | 8.93% |

Saudi Arabia Customer Relationship Management Market Trends:

Increasing Adoption of Cloud-Based Solutions

Cloud technologies provide companies with considerable flexibility, allowing them to adjust their CRM systems according to demand, lower infrastructure expenses, and guarantee accessibility from any site with internet access. With the rise of cloud platforms, companies can utilize real-time customer information, boosting their capacity to make knowledgeable decisions and foster teamwork among departments. Cloud-based CRM solutions effortlessly connect with other enterprise applications, guaranteeing efficient workflows and data exchange. Additionally, the cloud model offers improved security features, such as strong encryption and access controls, along with automatic software updates and minimized downtime, making it an attractive option for businesses looking for affordable and effective CRM solutions. As cloud computing gains significance and local data centers in Saudi Arabia provide more support, an increasing number of companies are implementing cloud-based CRM systems to maintain competitiveness. This transition is driving the need for these systems, generating novel opportunities for innovation and enhancing CRM abilities across various sectors.

To get more information on this market Request Sample

Growing Demand for Automation and Artificial Intelligence (AI)

The incorporating AI technologies into CRM platforms to improve operational efficiency and minimize manual tasks is offering a favorable market outlook. As per the International Trade Administration (ITA), AI is a major priority in Saudi Arabia, with anticipated sector expenditures exceeding $720 million in 2024 and hitting $1.9 billion by 2027, experiencing a compound annual growth rate (CAGR) of 40%. AI-driven CRM solutions enable the automation of mundane tasks like data input, user questions, and lead supervision, freeing up resources to concentrate on more strategic projects. Moreover, analytics powered by AI provide important insights into client behavior, assisting businesses in forecasting trends, personalizing interactions, and making well-informed decisions. Prioritizing the enhancement of client service via automation and AI is becoming crucial for companies in Saudi Arabia, allowing them to handle significant numbers of clients interactions and provide greater satisfaction.

Expansion of E-commerce and Online User Interactions

With the growth of online shopping, companies are placing greater emphasis on handling client relationships via digital channels. As e-commerce firms aim to connect with a broader, more varied clientele through various channels like websites, social platforms, and mobile applications, CRM systems are becoming vital for enabling these interactions. These systems allow companies to monitor user behaviors, handle orders, enhance online assistance, and tailor marketing strategies according to comprehensive individual profiles. The e-commerce industry in Saudi Arabia is projected to experience significant growth, with the ITA estimating that by 2024, 33.6 million online users will participate in e-commerce. With online interactions as the main way to engage clients, CRM solutions designed for digital contexts are crucial for companies aiming to uphold robust individual connections. This movement towards digital interaction is further driving the need for CRM systems in Saudi Arabia’s swiftly expanding e-commerce sector.

Saudi Arabia Customer Relationship Management Market Growth Drivers:

Digital Transformation and Technological Advancements

With the growing adoption of digital technologies by businesses in different sectors, the urgency to optimize user interactions and improve service delivery is increasing. The incorporation of state-of-the-art technologies like AI, machine learning (ML), and sophisticated data analytics into CRM systems is helping firms enhance their individual interaction approaches and make better-informed choices. These technological innovations enable companies to craft highly tailored experiences for their clients, streamline daily tasks, and achieve a deeper understanding of user preferences and actions. As a result, businesses can cultivate enduring relationships and enhance individual loyalty. Moreover, the initiatives by the government that focus on promoting innovation and digitalization further improve the extensive acceptance of CRM solutions. This assistance renders CRM systems a crucial asset for companies aiming to stay competitive and succeed in a progressively digital market.

Focus on Client Retention and Loyalty

With the market becoming more competitive, businesses now realize that nurturing long-term relationships with current clients is as crucial. CRM systems allow companies to develop personalized marketing tactics, user service interactions, and customized support services that cater to the unique needs and preferences of their clients. Through the use of data-informed insights, companies can more effectively predict individual demands, address problems swiftly, and provide tailored solutions that enhance satisfaction and encourage stronger loyalty. This focus on client retention corresponds with wider business strategies that seek to decrease churn, improve user lifetime value, and optimize profitability. In a market where user trust is crucial, CRM tools are vital for achieving sustainable growth by assisting businesses in developing and maintaining robust, long-term connections with their individuals, ultimately gaining a competitive edge.

Rising Demand for Patient-Centric Solutions

With the ongoing evolution of the healthcare sector, providers are placing greater emphasis on patient-centric care, necessitating sophisticated systems to manage patient relationships efficiently. CRM systems are essential for optimizing patient data handling, boosting communication, and improving the overall quality of care provided. These systems enable healthcare facilities to develop tailored care plans, monitor patient interactions, and guarantee prompt follow-ups, ultimately enhancing patient satisfaction and retention. The healthcare CRM market is anticipated to reach USD 405.5 Million by 2033, as per the IMARC Group, leading to increase in the demand for these solutions as hospitals, clinics, and healthcare providers aim to enhance operational efficiency and provide high-quality care. The growing focus on digital healthcare transformation, along with the demand for improved patient outcomes and experiences, is encouraging the adoption of CRM utilization in Saudi Arabia's healthcare industry.

Saudi Arabia Customer Relationship Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on component, deployment mode, organization size, application, and industry vertical.

Component Insights:

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes software and services.

Deployment Mode Insights:

- On-premises

- Cloud-based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

Organization Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes small and medium-sized enterprises and large enterprises.

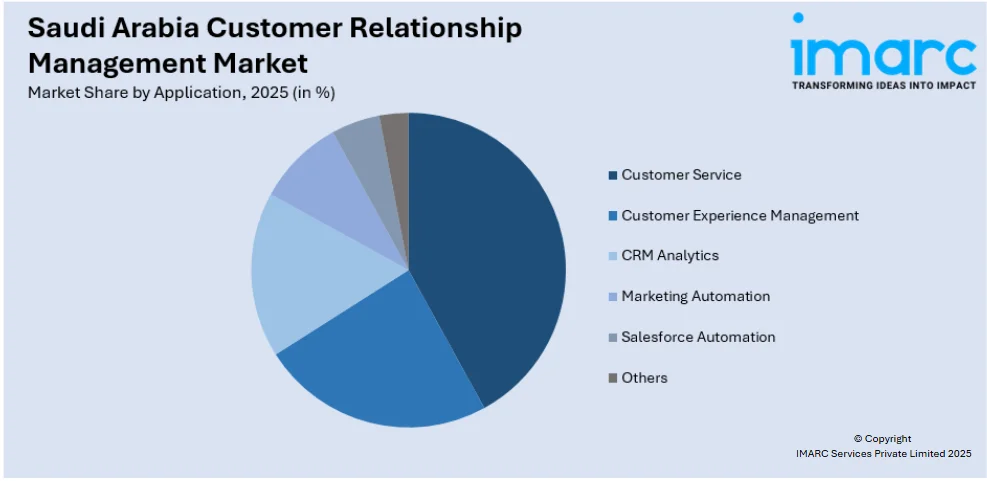

Application Insights:

Access the comprehensive market breakdown Request Sample

- Customer Service

- Customer Experience Management

- CRM Analytics

- Marketing Automation

- Salesforce Automation

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes customer service, customer experience management, CRM analytics, marketing automation, salesforce automation, and others.

Industry Vertical Insights:

- BFSI

- Retail

- Healthcare

- IT and Telecom

- Discrete Manufacturing

- Government and Education

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes BFSI, retail, healthcare, IT and telecom, discrete manufacturing, government and education, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central region, Western region, Eastern region, and Southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Customer Relationship Management Market News:

- June 2025: Healthcare tech firm Doctorna announced its expansion into Saudi Arabia, launching healthcare CRM and telehealth services. The move supports Saudi Vision 2030 by enhancing digital health infrastructure with AI-powered, compliant solutions. Doctorna aims to improve patient care and clinic efficiency across the Kingdom.

- January 2025: Saudi-based CRM platform Hollat launched its cloud-based CRM after graduating from the Flat6Labs accelerator, alongside announcing a $3 million seed investment round. The platform supports multichannel ticketing, SLA configuration, and government-grade compliance. Hollat aims to lead CRM innovation in line with Vision 2030.

- January 21, 2025: Salesforce announced the opening of its new regional office in Riyadh, marking a strategic expansion to support digital transformation efforts across Saudi Arabia. The company aims to collaborate with public and private sector organizations to advance cloud, AI, data, and CRM adoption in alignment with Vision 2030. This development is expected to strengthen the Saudi Arabia Customer Relationship Management market by enhancing local access to Salesforce’s enterprise solutions and fostering regional ecosystem growth.

Saudi Arabia Customer Relationship Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Services |

| Deployment Modes Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Applications Covered | Customer Service, Customer Experience Management, CRM Analytics, Marketing Automation, Salesforce Automation, Others |

| Industry Verticals Covered | BFSI, Retail, Healthcare, IT and Telecom, Discrete Manufacturing, Government and Education, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia customer relationship management market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia customer relationship management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia customer relationship management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The customer relationship management market in Saudi Arabia was valued at USD 713.8 Million in 2025.

The Saudi Arabia customer relationship management market is projected to exhibit a CAGR of 8.93% during 2026-2034, reaching a value of USD 1,541.3 Million by 2034.

The Saudi Arabia customer relationship management market is driven by increasing digital transformation, rising demand for personalized client experiences, and the need for businesses to improve user retention and loyalty. The growing adoption of advanced CRM technologies, combined with a supportive business environment and strong government initiatives, is influencing the market and innovation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)