Saudi Arabia Cutlery Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Application, and Region, 2026-2034

Saudi Arabia Cutlery Market Summary:

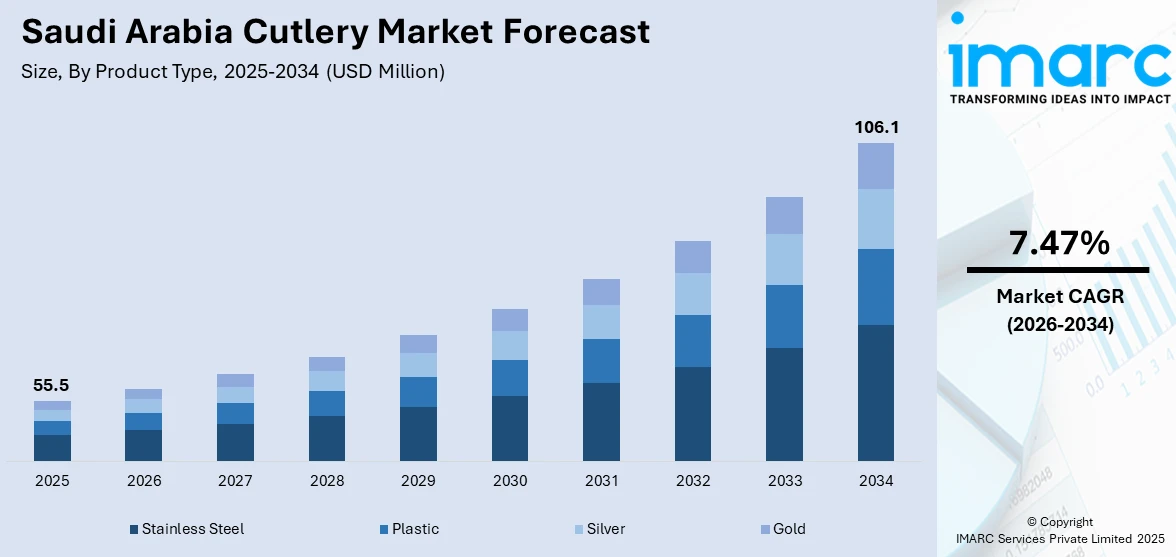

The Saudi Arabia cutlery market size was valued at USD 55.5 Million in 2025 and is projected to reach USD 106.1 Million by 2034, growing at a compound annual growth rate of 7.47% from 2026-2034.

The Saudi Arabia cutlery market is experiencing robust growth driven by rising urbanization, increasing disposable incomes, and evolving consumer lifestyles across the Kingdom. The hospitality sector expansion under Vision 2030, coupled with a flourishing tourism industry, is stimulating demand for premium tableware and dining accessories. Growing interest in home cooking, influenced by social media and culinary shows, is encouraging households to invest in quality cutlery sets. Additionally, the retail sector transformation and expanding e-commerce platforms are enhancing product accessibility, contributing to the Saudi Arabia cutlery market share.

Key Takeaways and Insights:

- By Product Type: Stainless steel dominates the market with a share of 51% in 2025, due to its remarkable robustness, resistance to corrosion, and simplicity of upkeep. Stainless steel cutlery is becoming more and more popular in homes due to consumer preferences for durable kitchenware and contemporary aesthetics.

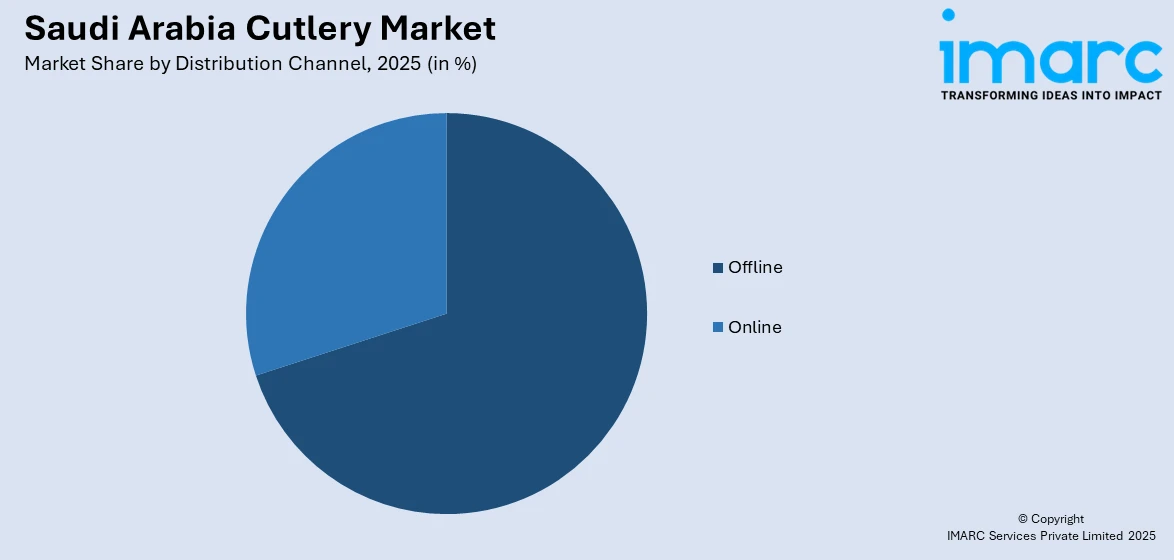

- By Distribution Channel: Offline leads the market with a share of 70% in 2025. This dominance is driven by consumer preference for physically inspecting product quality, immediate availability, and the cultural significance of in-store shopping experiences across supermarkets and specialty stores.

- By Application: Household holds the largest segment with a market share of 48% in 2025, reflecting strong consumer spending on home dining essentials and kitchen upgrades driven by increasing interest in home cooking and family gatherings.

- By Region: Northern and Central Region represents the largest region with 30% share in 2025, driven by Riyadh's dense population, higher disposable incomes, and concentration of retail infrastructure including hypermarkets and specialty kitchenware stores.

- Key Players: Key players drive the Saudi Arabia cutlery market by expanding product portfolios, introducing innovative designs, and strengthening distribution networks. Their investments in premium materials, sustainability initiatives, and strategic partnerships with retailers boost brand visibility and market penetration across diverse consumer segments.

The Saudi Arabia cutlery market is advancing as consumer preferences shift toward premium, durable, and aesthetically appealing dining products. The Kingdom's ambitious Vision 2030 initiative is transforming the retail and hospitality landscape, creating substantial opportunities for cutlery manufacturers and retailers. The tourism sector's remarkable growth, with Saudi Arabia welcoming 116 million visitors in 2024 and targeting 150 million annually by 2030, is driving unprecedented demand for quality tableware across hotels, restaurants, and catering establishments. Meanwhile, household consumption is strengthening as rising disposable incomes and evolving culinary interests encourage consumers to upgrade their kitchenware collections. The growing influence of social media platforms and cooking shows has heightened awareness of premium cutlery brands, motivating households to invest in sophisticated dining accessories that enhance meal presentation and overall dining experiences.

Saudi Arabia Cutlery Market Trends:

Rising Demand for Premium Stainless-Steel Cutlery

Saudi Arabian consumers are increasingly gravitating toward premium stainless-steel cutlery characterized by superior craftsmanship and contemporary designs. The preference for durable, corrosion-resistant materials that complement modern kitchen aesthetics is driving this trend. In November 2024, IKEA Alsulaiman opened its Madinah store spanning over 18,000 square meters, featuring extensive kitchenware collections including cutlery sets, reflecting the growing retail infrastructure supporting premium product accessibility. Health-conscious consumers appreciate stainless steel's non-reactive properties and ease of cleaning, further strengthening the Saudi Arabia cutlery market growth.

Growing Influence of Home Cooking Culture

The rising home cooking culture across Saudi Arabia is significantly influencing cutlery purchasing patterns. Exposure to global cuisines through social media platforms, cooking shows, and celebrity chefs has heightened consumer awareness of quality kitchen tools. The Saudi Arabia kitchenware market size reached USD 1,898.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 3,154.0 Million by 2034, exhibiting a growth rate (CAGR) of 5.80% during 2026-2034, demonstrates the robust demand for culinary accessories including cutlery. Urban households and young professionals are investing in sophisticated cutlery sets to enhance meal preparation experiences and dining presentations.

Expansion of Retail and E-Commerce Channels

The transformation of retail channels is reshaping how consumers access cutlery products in Saudi Arabia. Traditional retail outlets remain dominant, while e-commerce platforms are gaining traction among tech-savvy consumers. Consumer spending increased by 7% year-on-year to SAR 1.41 Trillion in 2024, demonstrating strong purchasing power. Supermarkets, hypermarkets, and specialty stores continue expanding their homeware sections, offering diverse cutlery collections. Online platforms facilitate convenient product comparisons and home delivery, attracting consumers seeking variety and competitive pricing options.

How Vision 2030 is Transforming the Saudi Arabia Cutlery Market:

Saudi Arabia's Vision 2030 is changing the cartography of the cutlery market by giving thrust to the expansion of the hospitality sector and positioning the Kingdom as one of the world's most favorite tourist destinations. Top-down strategic initiatives aimed at fast-tracking economic diversification away from overdependence on oil revenues have quickened the pace of investments in hotels, restaurants, and foodservice establishments, with significantly high demand currently witnessed for good-quality tableware and dining accessories. The mega-projects currently ongoing-NEOM's futuristic hospitality developments, the luxury resort destinations of Red Sea Global, and Diriyah's heritage tourism district-are creating huge demand for high-quality international standard cutlery across commercial operations. The rapid urbanization of Riyadh, coupled with a widening of the modern retail infrastructure that includes lifestyle shopping destinations and specialty kitchenware stores, is developing healthy distribution channels for different types of cutlery products. Meanwhile, the Kingdom's commitment to luring international tourists and hosting big international events unabated continues to fuel consumer behavior in favor of non-disposable, aesthetically pleasing, and professionally designed cutlery products across Saudi Arabia.

Market Outlook 2026-2034:

The outlook for the cutlery industry in Saudi Arabia is highly positive. The country is supported by strong economic fundamentals, a demographically favorable environment, and government policies on diversification. The country's younger generation is very technologically savvy. This offers a fantastic market for modern and trendy utensils. The change in the hospitality industry brought about by Vision 2030, as it readies for hosting major international sports events as well as international forums such as global exhibitions, is expected to create a major commercial market demand for cutlery. The overall development in retail infrastructure, including major lifestyle developments such as extensive retail space development in the main Saudi cities such as Riyadh and Jeddah, will help improve product accessibility and reach. The increasing focus on tourist diversification developments is also giving the industry a thrust towards a growth trajectory. The market generated a revenue of USD 55.5 Million in 2025 and is projected to reach a revenue of USD 106.1 Million by 2034, growing at a compound annual growth rate of 7.47% from 2026-2034.

Saudi Arabia Cutlery Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Stainless Steel |

51% |

|

Distribution Channel |

Offline |

70% |

|

Application |

Household |

48% |

|

Region |

Northern and Central Region |

30% |

Product Type Insights:

- Plastic

- Stainless Steel

- Silver

- Gold

Stainless steel dominates with a market share of 51% of the total Saudi Arabia cutlery market in 2025.

Stainless steel dominates the market for cutlery in the Saudi Arabian market due to the material’s remarkable strength, resistance to corrosion, and sleek designs, which appeal to the current consumer trends. Additionally, stainless steel does not react when exposed to food, thus suitable for all culinary activities. In fact, stainless steel is easy to clean, which suits the busy lifestyles that characterize urban households. Consumers in the Saudi Arabian market increasingly opt for stainless steel due to its cleanliness aspect, compatibility when placed in a dishwasher, as well as the material’s ability to retain a shiny appearance for a longer period.

With the increasing number of hospitality outlets in Saudi Arabia, there is an increasing demand for high-quality stainless steel cutlery in the country. This is because upscale hotel chains, restaurants, and catering businesses in the country prefer the formulation of 18/10 because of its high chromium and nickel compositions. Consumer education on the importance of cleanliness in food preparation is increasing the preference for the product because of its inability to harbor bacteria and its ability to withstand the rigorous cycles of dishwashing. Innovative designs from international upscale brands are currently creating market intrigue in the Saudi market.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

Offline leads with a share of 70% of the total Saudi Arabia cutlery market in 2025.

Offline distribution channels maintain overwhelming dominance in Saudi Arabia's cutlery market, reflecting the cultural significance of in-store shopping experiences and consumer preference for physically evaluating product quality before purchase. Supermarkets, hypermarkets, specialty stores, and home goods outlets provide consumers with extensive product ranges, enabling tactile assessment of material weight, finish quality, and design aesthetics. The Saudi Arabia retail market size was valued at USD 293.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 411.7 Billion by 2034, exhibiting a CAGR of 3.83% during 2026-2034, demonstrates the robust brick-and-mortar retail infrastructure supporting cutlery distribution across the Kingdom.

Major retail chains and specialty kitchenware stores are expanding their homeware sections, dedicating substantial floor space to cutlery displays that showcase diverse brands and price points. The shopping experience in Saudi Arabia often involves family outings and social interactions, making physical retail destinations preferred venues for household purchases. Sales associates provide personalized recommendations, helping consumers navigate product options based on specific requirements. Additionally, immediate product availability and the ability to complete purchases without waiting for delivery enhance offline channel appeal among consumers seeking convenience and instant gratification.

Application Insights:

- Household

- Public Consumption Restaurant

- High-end Restaurant

The household exhibits a clear dominance with a 48% share of the total Saudi Arabia cutlery market in 2025.

Household applications represent the largest segment in Saudi Arabia's cutlery market, driven by rising disposable incomes, evolving lifestyle preferences, and increasing interest in home dining experiences. Saudi Arabian households are investing in quality cutlery sets that enhance meal presentations and reflect personal style preferences. The expanding urban population and growing number of nuclear families are creating sustained demand for comprehensive cutlery collections. Cultural traditions emphasizing hospitality and family gatherings further encourage consumers to maintain impressive cutlery assortments for entertaining guests during celebrations and everyday dining occasions.

The cultural emphasis on hospitality and family gatherings in Saudi society encourages households to maintain impressive cutlery collections for entertaining guests. Gifting cutlery sets during weddings, housewarmings, and religious celebrations like Eid remains a cherished tradition, driving periodic replacement and upgrade purchases. Young professionals establishing independent households are particularly receptive to modern, aesthetically appealing cutlery designs that complement contemporary interior aesthetics. The influence of social media platforms showcasing elaborate table settings further motivates consumers to invest in premium cutlery that elevates everyday dining experiences.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region represents the leading segment with a 30% share of the total Saudi Arabia cutlery market in 2025.

The Northern and Central area, led by Riyadh as the capital city in the Kingdom, leads in the market for cutlery in the Kingdom, owing to a greater population density, advanced retailing setup, and, accordingly, greater buying capacity. Riyadh has the largest shopping mall and hypermarket presence in the Kingdom, offering consumers greater choices in products. The cosmopolitan population in Riyadh, consisting notably of foreigners, brings in diverse eating habits, making them prefer different types of cutleries. Government and private sector employment sources ample discretionary income that gets translated into greater spendings by consumers for good home products.

Employment opportunities in and around Riyadh result in substantial disposable incomes that contribute to a relatively high expenditure on household items, including cutlery. The cosmopolitan population and foreign presence in the national capital result in diversified culinary and utensil demands and styles. Infrastructural development and massive projects are increasing residential areas, which in turn forms new consumer catchments. The organization and staging of massive events by the region lead to hospitality sector investments that trigger commercial cutlery purchases, and projects to expand retails offer improved accessibility to consumer items.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Cutlery Market Growing?

Rapid Hospitality Sector Expansion Under Vision 2030

Saudi Arabia's hospitality sector is undergoing unprecedented transformation as the Kingdom positions itself as a premier global tourism destination under Vision 2030. The government has committed USD 110 Billion to hospitality development, with plans to deliver 362,000 new hotel rooms by 2030. This massive expansion is creating substantial demand for commercial cutlery supplies across hotels, restaurants, and catering establishments. The proliferation of international hotel chains, fine dining establishments, and food service outlets is stimulating consistent procurement of quality cutlery that meets international hospitality standards.

Rising Disposable Incomes and Evolving Consumer Lifestyles

Increasing disposable incomes and evolving consumer lifestyles are significantly driving cutlery market growth in Saudi Arabia. The Kingdom's young population, with over 60% under 35 years old, represents a dynamic consumer segment with sophisticated preferences for quality household products. Rising urbanization, particularly in major cities like Riyadh and Jeddah, is creating demand for modern kitchenware that complements contemporary living spaces. The expanding middle class is increasingly investing in premium cutlery sets that reflect personal style and enhance dining experiences. Growing exposure to international lifestyles through travel, social media, and global content platforms is influencing purchasing decisions toward quality tableware products.

Expansion of Modern Retail Infrastructure

The expansion of modern retail infrastructure is enhancing cutlery product accessibility and driving market growth across Saudi Arabia. Major retailers are expanding their homeware sections, offering diverse cutlery collections from international and domestic brands. Hypermarkets, supermarkets, and specialty stores are strategically located across urban and suburban areas, ensuring convenient access for consumers seeking quality tableware products. The growing e-commerce sector complements physical retail, providing additional purchasing channels that expand market reach and consumer engagement opportunities through detailed product information, customer reviews, and convenient home delivery services.

Market Restraints:

What Challenges the Saudi Arabia Cutlery Market is Facing?

High Cost of Premium Imported Products

The high cost of premium imported cutlery products presents a significant challenge for market expansion in Saudi Arabia. Quality stainless steel cutlery from established international brands commands premium pricing that limits accessibility for price-sensitive consumer segments. Import duties, logistics costs, and currency fluctuations further elevate retail prices, creating barriers for middle-income households seeking quality products. Limited domestic manufacturing capabilities mean the market remains dependent on imports, restricting competitive pricing opportunities and market penetration among broader consumer demographics.

Intense Competition from Low-Cost Alternatives

Intense competition from low-cost cutlery alternatives poses challenges for quality-focused manufacturers and retailers in Saudi Arabia. Budget-conscious consumers often opt for inexpensive imported products that prioritize affordability over durability and design excellence. The proliferation of low-quality counterfeit products imitating premium brands undermines consumer confidence and brand value. Market fragmentation with numerous small vendors offering cheap alternatives creates pricing pressure that affects profit margins for legitimate retailers and discourages investment in premium product categories.

Limited Consumer Awareness about Product Quality Differences

Limited consumer awareness regarding quality differences between cutlery materials and construction standards constrains market development in Saudi Arabia. Many consumers struggle to differentiate between various stainless-steel grades and their implications for durability and food safety. Insufficient understanding of premium product value propositions results in purchasing decisions based primarily on price rather than long-term quality benefits. Educational gaps regarding proper cutlery care and maintenance lead to premature product degradation, affecting consumer satisfaction and willingness to invest in quality alternatives.

Competitive Landscape:

The Saudi Arabia cutlery market features a competitive landscape comprising international premium brands, regional manufacturers, and local distributors vying for market share. Established global players leverage brand reputation, product quality, and extensive distribution networks to maintain market positions. Companies focus on differentiating through innovative designs, premium materials, and sustainability initiatives that resonate with evolving consumer preferences. Strategic partnerships with major retailers, hospitality chains, and e-commerce platforms enhance market penetration. Competitive strategies include expanding product portfolios, introducing localized designs catering to regional aesthetics, and investing in marketing campaigns that highlight quality and craftsmanship. The market witnesses continuous product innovation as manufacturers introduce ergonomic designs, antimicrobial coatings, and aesthetically appealing finishes to capture consumer attention.

Saudi Arabia Cutlery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Plastic, Stainless Steel, Silver, Gold |

| Distribution Channels Covered | Online, Offline |

| Applications Covered | Household, Public Consumption Restaurant, High-end Restaurant |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia cutlery market size was valued at USD 55.5 Million in 2025.

The Saudi Arabia cutlery market is expected to grow at a compound annual growth rate of 7.47% from 2026-2034 to reach USD 106.1 Million by 2034.

Stainless steel dominated the market with a share of 51%, driven by its exceptional durability, corrosion resistance, modern aesthetic appeal, and ease of maintenance that resonates with contemporary consumer preferences.

Key factors driving the Saudi Arabia cutlery market include rapid hospitality sector expansion under Vision 2030, rising disposable incomes, evolving consumer lifestyles, growing home cooking trends, and expansion of modern retail infrastructure.

Major challenges include high costs of premium imported products, intense competition from low-cost alternatives, limited consumer awareness about quality differences, market fragmentation, and dependency on imports affecting competitive pricing.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)