Saudi Arabia Cutting Tools Market Size, Share, Trends and Forecast by Type, Material Type, Application, and Region, 2026-2034

Saudi Arabia Cutting Tools Market Overview:

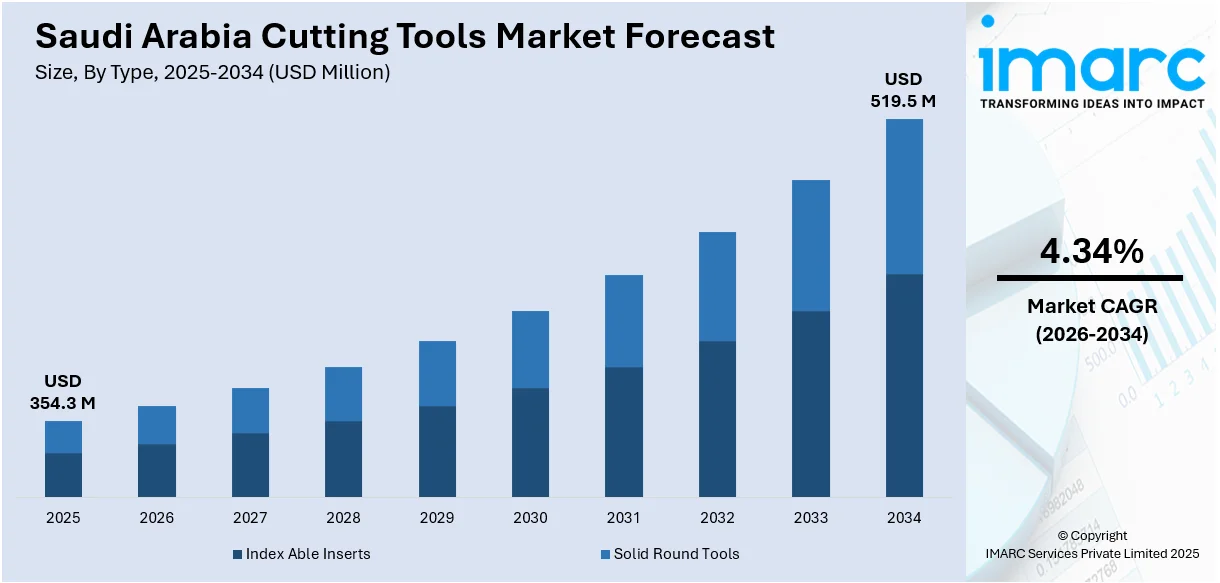

The Saudi Arabia cutting tools market size reached USD 354.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 519.5 Million by 2034, exhibiting a growth rate (CAGR) of 4.34% during 2026-2034. Rapid industrialization, increased demand in automotive and aerospace sectors, and government-backed infrastructure projects are fueling the growth of the market. Advancements in CNC machining and rising investments in oil and gas exploration also influence the Saudi Arabia cutting tools market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 354.3 Million |

| Market Forecast in 2034 | USD 519.5 Million |

| Market Growth Rate 2026-2034 | 4.34% |

Saudi Arabia Cutting Tools Market Trends:

Integration of Smart Manufacturing in Precision Machining

The Saudi Arabia cutting tools market is experiencing notable evolution due to the integration of smart manufacturing technologies, particularly in precision machining. As Industry 4.0 gains traction, manufacturers are increasingly deploying data-driven systems and AI-enabled machines to enhance productivity and tool accuracy. These smart systems allow for real-time monitoring and predictive maintenance, reducing operational downtime and tool wear. The result is improved production efficiency and cost-effectiveness, which is essential in high-precision industries like aerospace and automotive manufacturing. Saudi Arabia’s growing emphasis on automation and digital transformation under Vision 2030 is further accelerating the shift toward intelligent machining environments. For instance, at IMTS 2024, Star Cutter unveiled the TRU TECH T93XM centerless grinder, marking the integration of TRU TECH’s grinding systems into its technology portfolio. This strategic acquisition expands Star Cutter’s capabilities in centerless and cylindrical grinding, enhancing solutions across the full grinding lifecycle. The TRU TECH line offers rapid setup, high uptime, and precision through Perimetric™ and CNC Pick-N-Place™ technologies. Serving industries like aerospace and medical, the TRU TECH brand strengthens Star Cutter’s leadership in high-precision grinding systems.

To get more information on this market Request Sample

Rising Localization and Domestic Manufacturing Initiatives

A key trend influencing the Saudi Arabia cutting tools market growth is the increasing focus on localization and domestic production. The Kingdom’s Vision 2030 emphasizes reducing reliance on imports by fostering a robust local manufacturing base. As a result, there has been a surge in domestic tool manufacturing facilities and partnerships with global technology providers. These efforts aim to build local expertise, reduce lead times, and enhance supply chain resilience. Moreover, the government's support through subsidies and industrial zones like MODON is encouraging new entrants and SMEs to participate in the sector. For instance, Mach & Tools Saudi 2025, organized by MIE Events DMCC, is a leading B2B exhibition set for December at Dhahran Expo, Dammam. The event will showcase advanced industrial machinery, tools, and automation technologies, attracting manufacturers, suppliers, and industry professionals globally. With thousands of products, exhibitors, and networking opportunities, it aims to support Saudi Arabia’s industrial transformation under Vision 2030. The exhibition also features co-located shows like CTW Saudi and Gulf 4P, promoting collaboration, innovation, and business growth across key manufacturing sectors.

Saudi Arabia Cutting Tools Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2026-2034. Our report has categorized the market based on type, material type, and application.

Type Insights:

- Index Able Inserts

- Solid Round Tools

The report has provided a detailed breakup and analysis of the market based on the type. This includes index able inserts and solid round tools.

Material Type Insights:

- Cemented Carbide

- High-Speed Steel

- Ceramics

- Stainless Steel

- Polycrystalline Diamond

- Cubic Boron Nitride

- Exotic Materials

A detailed breakup and analysis of the market based on material type have also been provided in the report. This includes cemented carbide, high-speed steel, ceramics, stainless steel, polycrystalline diamond, cubic boron nitride, and exotic materials.

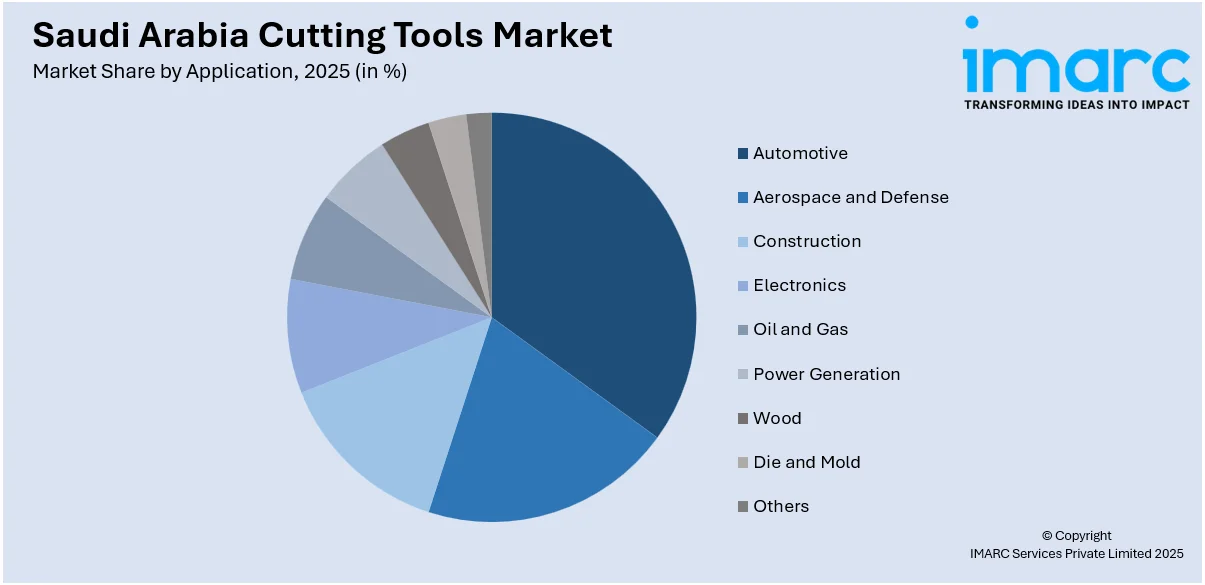

Application Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Aerospace and Defense

- Construction

- Electronics

- Oil and Gas

- Power Generation

- Wood

- Die and Mold

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes automotive, aerospace and defense, construction, electronics, oil and gas, power generation, wood, die and mold, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Cutting Tools Market News:

- In May 2025, Star SU, the sales and service arm of Star Cutter Company, partnered with the REGO-FIX Center for Machining Excellence to showcase its Louis Belet Swiss micro cutting tools. This collaboration enhances Star SU's product offerings with ultra-precise tools as small as 0.02 mm in diameter. This partnership aims to improve machining performance and promote cutting-edge solutions across industries.

- In February 2025, Seco Tools introduced the new Octomill 06 Face Milling Cutter, offering enhanced flexibility, stability, and ease of use. Featuring self-centering inserts, a multi-insert pocket design, and a high helix angle, it reduces tool wear and ensures high-quality machining even on unstable setups. Designed for diverse applications like face milling and helical interpolation, it supports multiple insert types and materials. Octomill 06 enables smoother cutting, extended tool life, and improved precision across various industries and machining conditions.

Saudi Arabia Cutting Tools Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Index Able Inserts, Solid Round Tools |

| Material Types Covered | Cemented Carbide, High-Speed Steel, Ceramics, Stainless Steel, Polycrystalline Diamond, Cubic Boron Nitride, Exotic Materials |

| Applications Covered | Automotive, Aerospace and Defense, Construction, Electronics, Oil and Gas, Power Generation, Wood, Die and Mold, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia cutting tools market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia cutting tools market on the basis of type?

- What is the breakup of the Saudi Arabia cutting tools market on the basis of material type?

- What is the breakup of the Saudi Arabia cutting tools market on the basis of application?

- What is the breakup of the Saudi Arabia cutting tools market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia cutting tools market?

- What are the key driving factors and challenges in the Saudi Arabia cutting tools market?

- What is the structure of the Saudi Arabia cutting tools market and who are the key players?

- What is the degree of competition in the Saudi Arabia cutting tools market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia cutting tools market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia cutting tools market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia cutting tools industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)