Saudi Arabia Dairy Products Market Report by Category (Butter, Cheese, Cream, Dairy Desserts, Milk, Sour Milk Drinks, Yogurt), Distribution Channel (Off-Trade, On-Trade), and Region 2026-2034

Saudi Arabia Dairy Products Market:

Saudi Arabia dairy products market size reached USD 6,003.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 8,544.1 Million by 2034, exhibiting a growth rate (CAGR) of 4.00% during 2026-2034. The growing awareness among individuals about health and nutrition, coupled with the shifting dietary preferences, is primarily driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 6,003.0 Million |

| Market Forecast in 2034 | USD 8,544.1 Million |

| Market Growth Rate 2026-2034 | 4.00% |

Saudi Arabia Dairy Products Market Analysis:

- Major Market Drivers: Growing preference for organic and hormone-free products, ongoing technological advancements, numerous cultural preferences, and rising consumers health consciousness are proliferating the market growth.

- Key Market Trends: The launch of favorable initiatives by government bodies for promoting the consumption of dairy for its nutritional value, coupled with the escalating demand for organically sourced variants, are anticipated to propel Saudi Arabia dairy products market demand.

- Challenges and Opportunities: Water scarcity, hot climate, competition with plant-based milk, and regulatory compliance are some of the key challenges that the market is facing. However, there is a growing demand for healthy and nutritious dairy products in the country, stimulating the companies to innovate and introduce new products, thus adding to the Saudi Arabia dairy products market opportunities. This includes low-fat and fortified dairy products, as well as organic and natural options.

Saudi Arabia Dairy Products Market Trends:

Demand for Dairy-Based Products

Saudi Arabia has experienced steady population growth over the years, driven by factors such as high birth rates and immigration. The population of Saudi Arabia reached 32.2 million in 2022, 42% of whom are foreign nationals, with 63% of Saudis under age 30. According to the latest census data, annual population growth since 2010 has been 2.5% on average, with the total population jumping 34.2% since that year. A larger population base leads to higher demand for food products, including dairy. For instance, the majority of the population in Saudi Arabia consumed milk with their tea, coffee, shakes, or other beverages. Thus, the country's per capita milk consumption increased by 1.69% between 2021 and 2022. Moreover, urbanization and the influence of Western lifestyles have led to a shift in dietary preferences. As more people move to urban areas and adopt modern lifestyles, there is a greater demand for convenience foods, including dairy-based snacks and beverages. According to the report published by UN Habitat, Saudi Arabia's cities are rapidly urbanizing, with urban populations nearly tripling from 9.32 million in 1980 to 29.8 million in 2014. Urbanization is anticipated to expand to 97.6% by 2030. Apart from this, various Saudi Arabia dairy product market companies are taking initiatives to provide premium and high-quality dairy products, which are further driving the demand for the market. For instance, in May 2024, Sawani firm opened its first outlets in Riyadh under the "Noug" name, which specialized in camel dairy products. The store would sell all of Noug's high-quality products to customers eager to reap the nutritional benefits of camel dairy products. These factors are positively influencing the Saudi Arabia dairy products market forecast.

Government Initiatives and Subsidies

The Saudi government invests in dairy industry infrastructure, including modern farms, processing facilities, and distribution networks. This helps improve efficiency, productivity, and the overall competitiveness of the dairy sector. For instance, in April 2024, the Ministry of Environment, Water and Agriculture launched an urban vertical farm project in Saudi Arabia. The ministry also aimed to launch nearly 600 to 1000 farms over the next five years. Moreover, the government provides subsidies and financial support to dairy farmers to encourage domestic production and ensure food security. These subsidies may include assistance with feed costs, veterinary services, and equipment procurement, which incentivizes farmers to expand their operations. For instance, government subsidies cover 30% of dairy farm equipment expenses, 100% of shipping costs, including airfreight for at least 50 imported cows, and 50% of the cost of irrigation engines and pumps in Saudi Arabia. In line with this, in 2023, the Ministry of Environment, Water, and Agriculture, as well as the Agricultural Development Fund (ADF), offered farmers attractive financing and incentives for investing in high-tech processes and technology. Nature-inclusive agricultural practices may demand significant upfront investments. ADF provided subsidies for producing organic fertilizers and other organic inputs. In addition, government-funded research and development programs support innovation in the dairy industry. This includes initiatives aimed at improving animal genetics and feed, feed efficiency, disease management, and product development. For instance, in February 2024, scientists at King Abdullah University of Science and Technology in Saudi Arabia developed a new method of producing microalgae, in order to reduce the dependence on imported animal feed products. These factors are adding to the Saudi Arabia dairy products market share.

Technological Advancements

Technological advancements enable dairy farmers in Saudi Arabia to adopt precision farming techniques. This includes the use of climate-smart technology, sensors, drones, and satellite imagery to monitor crops, soil conditions, and livestock health. For instance, in April 2023, FarmERP, an Agri-Tech company, expanded its footprints in Saudi Arabia in order to revolutionize agriculture with climate-smart technology. Moreover, modern dairy farms in Saudi Arabia are increasingly adopting automated systems for feeding, milking, and monitoring livestock. These technologies enable dairy farmers to maximize output while minimizing manual labor. For instance, in February 2020, Cainthus, a Dublin-based agtech company, launched ALUS Nutrition, which allows a producer to track accessibility of feed 24/7. Furthermore, the rising adoption of modern packaging technologies such as modified atmosphere packaging (MAP) and vacuum packing that assist dairy products to last longer by forming a protective barrier against oxygen, moisture, and light, is acting as one of the Saudi Arabia dairy products market recent developments. Extended shelf-life lowers food waste, increases product availability, and boosts consumer satisfaction. Several Saudi dairy firms are exploring effective packaging options. For example, in December 2023, the IFFCO Group signed a Memorandum of Understanding (MOU) with Tetra Pak, the world's biggest food processing and packaging solutions company, to advance sustainability initiatives across the group's industrial plants. The plant first focused on producing culinary creams and maximizing efficiency while ensuring quality and food safety. These factors are bolstering the Saudi Arabia dairy products market revenue.

Saudi Arabia Dairy Products Market Growth Drivers:

Increasing demand for value-added and premium dairy products

The Saudi Arabian dairy products market is reaping gains from increasing disposable incomes, which are driving demand for high-end, specialty, and value-added dairy products. Consumers are going for higher-taste, better-nutritional, or specialty options like organic, lactose-free, or probiotic content. This trend is very evident in middle- and upper-income households, as purchasing power enables a shift from basic consumption of dairy products to indulgent and lifestyle-oriented choices. Premium varieties of cheese, flavored yogurts, and innovative dairy-based beverages are gaining popularity as consumers who are willing to spend more for quality and differentiation are on the rise. Multinational dairy companies are broadening portfolios in the market, with domestic producers accelerating product innovation to respond to changing expectations. With incomes further rising in tandem with economic diversification and employment expansion, consumer expenditure on premium dairy products is consistently growing, making this segment one of the prime growth drivers.

Emerging retail infrastructure

The fast growth of retail infrastructure in Saudi Arabia is highly increasing the availability and visibility of dairy items throughout the nation. Emerging retail formats like hypermarkets, supermarkets, and convenience stores are increasing their footprints, providing consumers a large number of local and foreign dairy brands under single-stop shops. Concurrently, the growth in online grocery delivery services and e-commerce sites is increasing the convenience with which urban and semi-urban consumers are able to buy dairy products. Nice in-store offers, value-added packaging, and cold-chain logistics are keeping dairy products fresh and attractive in the market. All this improved retail environment is also allowing companies to try out premium positioning and product diversification, thus expanding market coverage. Through the reinforcement of distribution networks and enhancing last-mile delivery, the growth of the retail environment is increasingly promoting greater consumption of dairy products throughout Saudi Arabia.

Growing demand for Western diets

Changing food habits in Saudi Arabia are increasingly tilting towards Western-style eating habits, which is fueling demand for cheese, butter, cream, and other specialty dairy products. The fast food culture, casual dining, and bakery culture are leading to a robust market for dairy ingredients used in such foods. Cheese, in fact, is seeing increasing consumption because of its application in pizzas, burgers, and sandwiches, which are quintessentially mainstays in quick-service eating as well as at home. Butter and cream are also becoming pantry staples for cooking and baking with increasing popularity of home-based gourmet food preparation and café culture. Global food chains and local eateries are also adding more dairy-based items to their menus, further commending the trend. Consequently, the growing demand for Western diets is constantly driving demand for varied dairy products, making this category an essential driver of market growth.

Saudi Arabia Dairy Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on category and distribution channel.

Breakup by Category:

To get more information on this market, Request Sample

- Butter

- Cultured Butter

- Uncultured Butter

- Cheese

- Natural Cheese

- Processed Cheese

- Cream

- Double Cream

- Single Cream

- Whipping Cream

- Others

- Dairy Desserts

- Cheesecakes

- Frozen Desserts

- Ice Cream

- Mousses

- Others

- Milk

- Condensed Milk

- Flavored Milk

- Fresh Milk

- Powdered Milk

- UHT Milk

- Sour Milk Drinks

- Yogurt

- Flavored Yogurt

- Unflavored Yogurt

The report has provided a detailed breakup and analysis of the market based on the category. This includes butter (cultured butter and uncultured butter), cheese (natural cheese and processed cheese), cream (double cream, single cream, whipping cream, and others), dairy desserts (cheesecakes, frozen desserts, ice cream, mousses, and others), milk (condensed milk, flavored milk, fresh milk, powdered milk, and UHT milk), sour milk drinks, yogurt (flavored yogurt and unflavored yogurt).

According to the Saudi Arabia dairy products market overview, butter is widely used in Saudi Arabian cuisine for cooking, baking, and flavoring dishes. It is used in traditional recipes such as rice dishes, pastries, and desserts. Additionally, butter is often spread on bread or served alongside dishes for added flavor. While cheese is a versatile ingredient in Saudi Arabian cooking and is used in a variety of dishes. Soft cheeses like labneh and feta are commonly used in salads, appetizers, and sandwiches. In contrast, hard cheeses like cheddar and mozzarella are used in pasta dishes, pizzas, and savory pastries. Moreover, cream is used to enrich sauces, soups, and desserts in Saudi Arabian cuisine. It adds richness and creaminess to dishes like creamy pasta sauces, soups, and desserts such as puddings and cakes. Whipped cream is also used as a topping for desserts and beverages. Furthermore, milk is a staple beverage in Saudi Arabia and is consumed on its own or used as an ingredient in various recipes. It is commonly served with breakfast or as a refreshing drink throughout the day. Milk is also used in cooking and baking, particularly in recipes for desserts, custards, and beverages.

Breakup by Distribution Channel:

- Off-Trade

- Convenience Stores

- Online Retail

- Specialist Retailers

- Supermarkets and Hypermarkets

- Others

- On-Trade

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes off-trade (convenience stores, online retail, specialist retailers, supermarkets and hypermarkets, and others) and on-trade.

According to the Saudi Arabia dairy products market outlook, convenience stores are small retail outlets that offer a selection of dairy products such as milk, yogurt, cheese, butter, and cream. These stores cater to consumers looking for quick and convenient shopping options. Online retail platforms have gained popularity in Saudi Arabia, offering a wide range of dairy products for purchase over the internet. Consumers can order dairy items through e-commerce websites and have them delivered to their doorstep, providing convenience and accessibility. While on-trade channels, including restaurants and cafés serve dairy-based dishes and beverages to customers dining in or ordering for takeaway. Dairy products are used in various menu items such as desserts, sauces, beverages, and breakfast dishes.

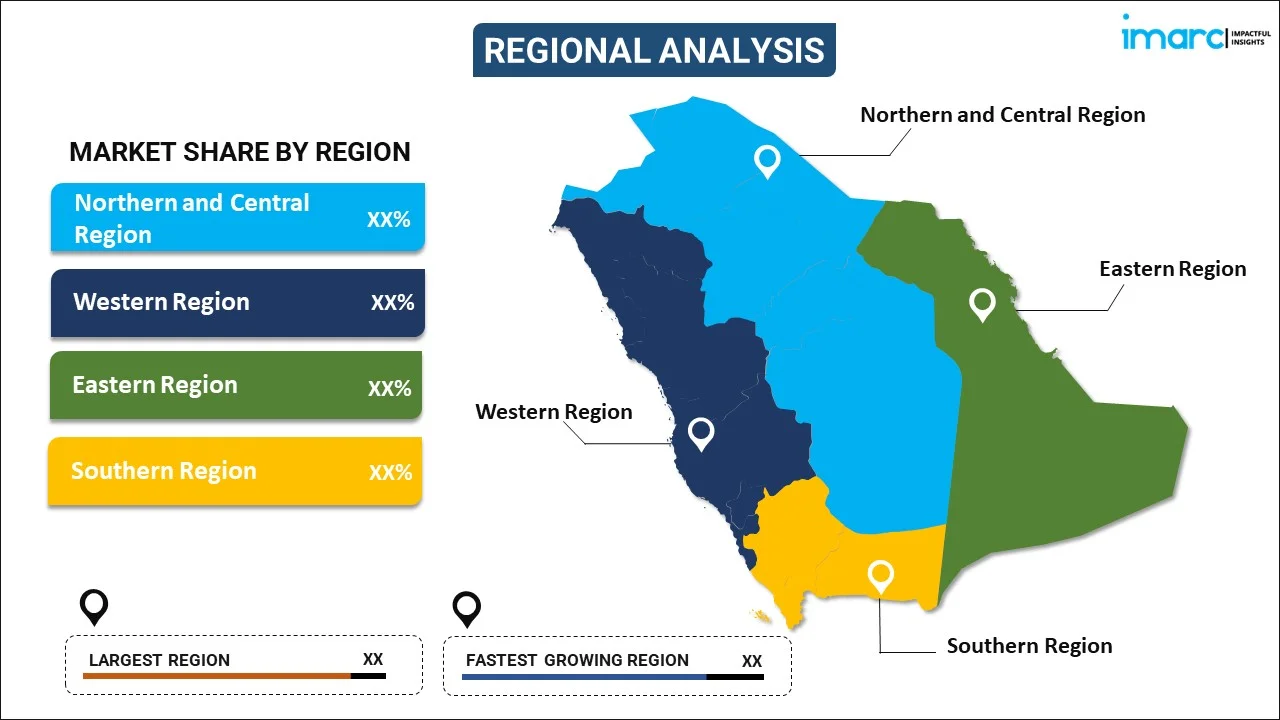

Breakup by Region:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

According to the Saudi Arabia dairy products market statistics, demand for dairy products in the Northern and Central Region is influenced by the presence of supermarkets, hypermarkets, and convenience stores catering to urban consumers. Moreover, the demand for dairy products in the Western Region is influenced by the presence of expatriate communities from various countries, contributing to the demand for international dairy products and specialty cheeses. Moreover, the eastern region experiences demand for dairy products from the petrochemical industry, as well as from the hospitality sector, due to its large expatriate population. The demand for dairy products in the Southern Region is influenced by traditional dietary habits, with a preference for locally produced dairy items, such as laban (fermented yogurt drink) and fresh milk.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major Saudi Arabia dairy products market recent companies have been provided.

Saudi Arabia Dairy Products Market Recent Developments:

- June 2025: Saudi dairy leader Almarai has reached an agreement to fully purchase Pure Beverages Industry Co. for SR1.04 billion ($277 million), with the goal of diversifying its products and strengthening its market presence. Pure Beverages Industry Co. is a producer of bottled water in the Kingdom, recognized for its “Ival” and “Oska” brands. The company runs contemporary facilities and adheres to set production standards, emphasizing quality and sustainability.

- May 2025: Saudia Dairy and Foodstuff Company, or SADAFCO, a prominent producer and distributor of premium dairy and food items, is taking part in the Saudi Food Show 2025, taking place from May 12–14 at the Riyadh Front Exhibition and Conference Center. SADAFCO invites guests to Booth #C4-2, where it is highlighting essential products with the goal of engaging clients, partners, and industry leaders in the Kingdom’s top F&B trade setting.

- April 2025: The Saudi Authority for Industrial Cities and Technology Zones (MODON) initiated today, April 23, a dairy industrial cluster in Al-Kharj Industrial City. Covering 2 million square meters, the cluster intends to establish a cohesive production setting that enhances food security to world-class standards. MODON states that the cluster will showcase a sustainable and entirely integrated ecosystem, comprising dairy processing plants, packaging facilities, and feed production farms. It will also encompass dairy farms, maintenance and service providers, along with feed mills and storage facilities.

- March 2025: Tetra Pak, a top global provider of food processing and packaging solutions, has commenced an important initiative with Al Rabie, a prominent Saudi company in juices, nectar, still drinks (JNSD), and dairy products in cartons, after an agreement was finalized in November 2024. The significant agreement to be executed over three years aims to fully modernize and digitalize Al Rabie’s manufacturing plants by utilizing Tetra Pak’s cutting-edge technology and sustainability efforts in Saudi Arabia.

Saudi Arabia Dairy Products Market Report:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Categories Covered |

|

| Distribution Channels Covered |

|

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia dairy products market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia dairy products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia dairy products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The dairy products market in Saudi Arabia was valued at USD 6,003.0 Million in 2025.

The Saudi Arabia dairy products market is projected to exhibit a CAGR of 4.00% during 2026-2034, reaching a value of USD 8,544.1 Million by 2034.

The Saudi Arabia dairy products market is driven by rising health awareness, growing disposable incomes, and increasing demand for convenient packaged foods. Expanding urban developments, government support for food security, and investments in advanced farming and processing technologies are further accelerating growth, alongside evolving consumer preferences for premium and innovative dairy offerings.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)