Saudi Arabia Data Center Chip Market Size, Share, Trends and Forecast by Chip Type, Data Center Size, Industry Vertical, and Region, 2026-2034

Saudi Arabia Data Center Chip Market Overview:

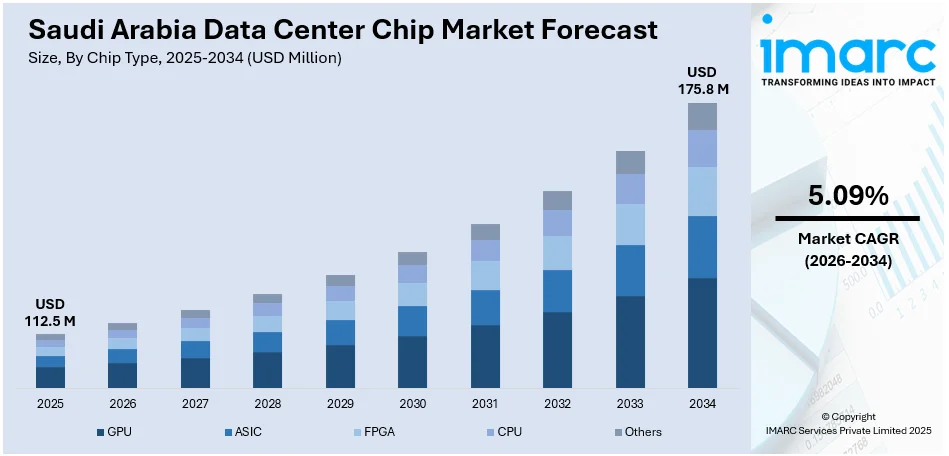

The Saudi Arabia data center chip market size reached USD 112.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 175.8 Million by 2034, exhibiting a growth rate (CAGR) of 5.09% during 2026-2034. The market is growing due to rising AI adoption, cloud infrastructure expansion, and demand for high-performance inference and training systems. Strategic investments and national digital goals are driving chip usage across government, enterprise, and technology sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 112.5 Million |

| Market Forecast in 2034 | USD 175.8 Million |

| Market Growth Rate 2026-2034 | 5.09% |

Saudi Arabia Data Center Chip Market Trends:

Expanding AI Inference Requirements

Saudi Arabia's rising focus on AI applications is pushing demand for efficient, high-performance data center chips. The need to support real-time decision-making, voice processing, and large-scale inference tasks is encouraging investment in infrastructure tailored to AI workloads. This includes accelerators and processors that can manage language models, deep learning algorithms, and other compute-intensive tasks. As public and private organizations turn to AI-driven operations, there's greater emphasis on fast data processing and lower latency, which has driven interest in dedicated AI inference chips. In February 2025, Groq secured USD 1.5 Billion from Saudi Arabia to enhance its AI inference infrastructure. The expansion included the Damman data center, where Groq deployed thousands of its LPU-based chips to support projects like the Arabic Large Language Model (ALLaM). This initiative, backed by Aramco Digital and aligned with Vision 2030, reinforced the shift toward inference-focused chip demand rather than training-heavy solutions. The strategic deployment of such AI inference chips has elevated Saudi Arabia's position in AI computing. It also laid the groundwork for new public sector and enterprise deployments that require scalable, chip-intensive environments, directly contributing to the local data center chip market's growth.

To get more information on this market Request Sample

Strengthening Cloud-Based AI Models

The expansion of cloud infrastructure for AI development is significantly shaping Saudi Arabia's data center chip landscape. Cloud providers are integrating specialized chips into their architectures to meet the increasing demand for training and deploying large AI models. These chips enable seamless scaling, faster processing, and enhanced resource utilization—essential for supporting multilingual models, industry-specific tools, and digital public services. The emphasis is not only on computing power but also on efficiency and security, in line with data sovereignty goals. In September 2024, Huawei Cloud launched its AI-ready infrastructure in Saudi Arabia, boosting chip demand by introducing advanced training and inference capabilities. This rollout supported projects like the Pangu model for government services, and an Arabic LLM used across more than 20 AI applications. Huawei's ecosystem investments, including AI development tools and sector-specific deployments, further encouraged chip adoption at scale. The focus on localized cloud solutions with embedded AI capacity has helped diversify chip usage across industries like retail, finance, and telecom. As cloud platforms take center stage in Saudi Arabia's digital shift, chipmakers are finding new demand streams tied to scalable inference and training performance within cloud-native environments.

Saudi Arabia Data Center Chip Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on chip type, data center size, and industry vertical.

Chip Type Insights:

- GPU

- ASIC

- FPGA

- CPU

- Others

The report has provided a detailed breakup and analysis of the market based on the chip type. This includes GPU, ASIC, FPGA, CPU, and others.

Data Center Size Insights:

- Small and Medium Size

- Large Size

A detailed breakup and analysis of the market based on the data center size have also been provided in the report. This includes small and medium size and large size.

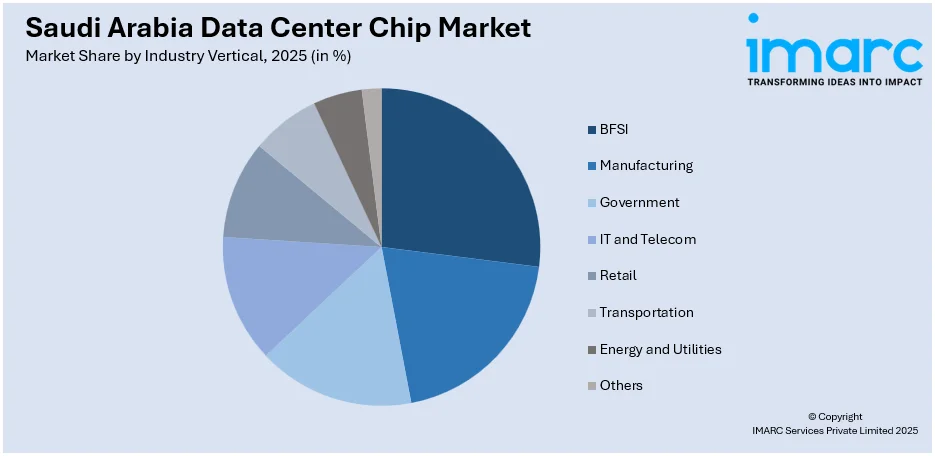

Industry Vertical Insights:

Access the comprehensive market breakdown Request Sample

- BFSI

- Manufacturing

- Government

- IT and Telecom

- Retail

- Transportation

- Energy and Utilities

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes BFSI, manufacturing, government, IT and telecom, retail, transportation, energy and utilities, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central region, Western region, Eastern region, and Southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Data Center Chip Market News:

- March 2025: Alfanar announced a USD 1.4 Billion investment to build four data centers in Riyadh and Dammam. This boosted demand for data center chips, supporting AI-driven infrastructure and cloud services, and strengthened Saudi Arabia’s positioning in digital technology and chip-intensive computing environments.

- February 2025: DataVolt leased 55,000 sqm from MODON in Riyadh to build an AI-ready data center. Designed for advanced AI processing, it increased demand for high-performance data center chips, supporting hyperscalers and enterprise needs while promoting sustainable infrastructure within Saudi Arabia’s digital ecosystem.

Saudi Arabia Data Center Chip Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Chip Types Covered | GPU, ASIC, FPGA, CPU, Others |

| Data Center Sizes Covered | Small and Medium Size, Large Size |

| Industry Verticals Covered | BFSI, Manufacturing, Government, IT and Telecom, Retail, Transportation, Energy and Utilities, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia data center chip market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia data center chip market on the basis of the chip type?

- What is the breakup of the Saudi Arabia data center chip market on the basis of data center size?

- What is the breakup of the Saudi Arabia data center chip market on the basis of industry vertical?

- What are the various stages in the value chain of the Saudi Arabia data center chip market?

- What are the key driving factors and challenges in the Saudi Arabia data center chip market?

- What is the structure of the Saudi Arabia data center chip market and who are the key players?

- What is the degree of competition in the Saudi Arabia data center chip market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia data center chip market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia data center chip market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia data center chip industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)