Saudi Arabia Dental Consumables Market Size, Share, Trends and Forecast by Product, Treatment, Material, End User, and Region, 2026-2034

Saudi Arabia Dental Consumables Market Overview:

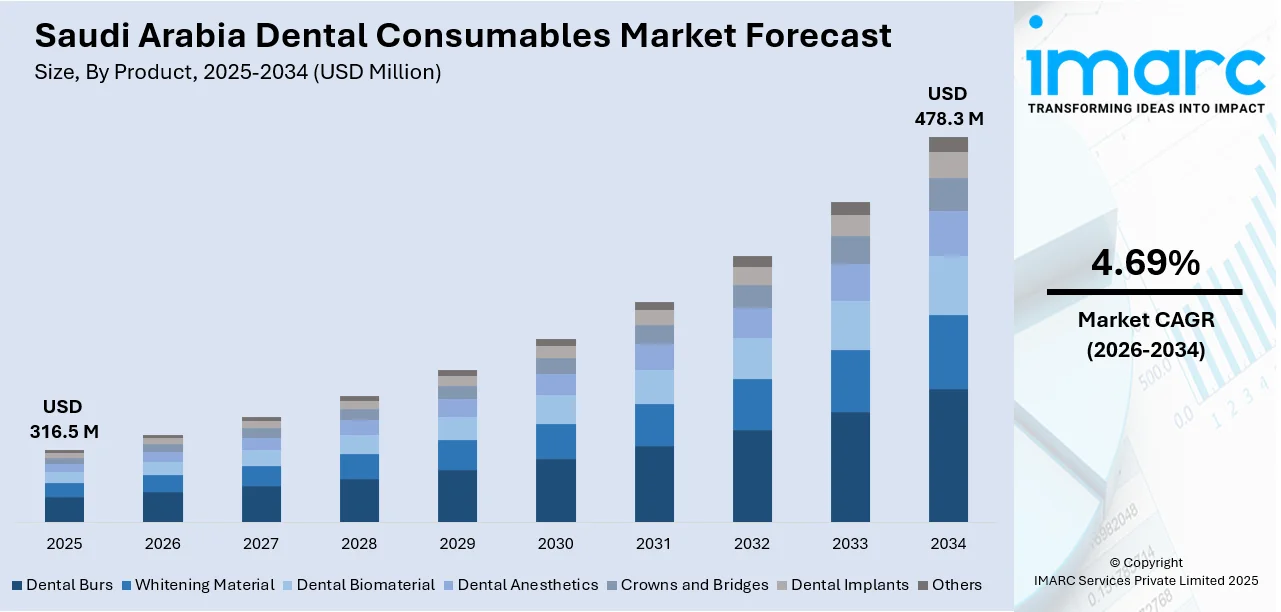

The Saudi Arabia dental consumables market size reached USD 316.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 478.3 Million by 2034, exhibiting a growth rate (CAGR) of 4.69% during 2026-2034. Growing population, rising awareness of oral hygiene, and increasing disposable incomes are supporting the market growth. Government investment in healthcare infrastructure and the expansion of private dental services are enhancing access to dental care. The prevalence of dental diseases, growth in dental tourism, and the rising number of dental clinics further contribute to market demand. Apart from this, technological advancements, a shift toward preventive care, an aging population, and the popularity of cosmetic dental procedures are boosting the Saudi Arabia dental consumables market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 316.5 Million |

| Market Forecast in 2034 | USD 478.3 Million |

| Market Growth Rate 2026-2034 | 4.69% |

Saudi Arabia Dental Consumables Market Trends:

Growing Population and Increased Awareness of Oral Hygiene

Saudi Arabia's growing population is one of the key factors for the rise in demand for dental consumables. As more people are living in the country, there are more individuals who need dental care, which includes things like toothbrushes, toothpaste, and dental floss. Moreover, there has been a massive increase in people’s awareness of the importance of good oral hygiene, which is propelling the Saudi Arabia dental consumables market growth. Consumers are now more focused on taking care of their teeth and gums, and they are seeking out products that can help them do so. Furthermore, government campaigns and education about the importance of dental health have also helped people understand the need for regular check-ups and proper cleaning, which is creating a positive outlook for the market. In line with these efforts, the Saudi Ministry of Health actively participated in World Oral Health Day on March 20, 2024, aiming to raise awareness about oral hygiene and encourage preventive measures among the population.

To get more information on this market Request Sample

Growing Disposable Incomes and Use of Advanced Dental Procedures

As the economy of Saudi Arabia expands, so is the disposable income, further propelling the spending on dental care. More incomes mean more people can invest in higher forms of dental care, which necessitate dental consumables such as crowns, fillings, and other dental products. These treatments also go beyond oral care to cover cosmetic treatments such as teeth whitening, which have become highly popular. With more people being able to afford such services, the demand for high-quality dental products has also risen accordingly. With the middle class increasing, customers are now spending money on better oral care products, which is driving the dental consumables market. Other than this, increased disposable income has accelerated people visits to dentists, which in turn boosts the consumption of dental consumables.

Government Investment in Healthcare Infrastructure

The Saudi government has been spending heavily on healthcare, including the development of dental services across the nation. According to the Vision 2030 strategy, the government is enlarging its health system, ensuring it is convenient for individuals to get dental treatment. This involves the construction of new dental clinics, the updating of equipment, and enhancing dentist training. All these changes are making dental care more affordable for greater numbers of people, and hence, those are driving the demand for dental consumables higher. With the government promoting growth in the dental industry, plenty of new dental experts are entering the market, so more demand is being created for dental products. With more clinics being established and older ones spreading their wings, there is greater demand for everything ranging from simple oral care items to more advanced consumables employed in more sophisticated dental treatments.

Saudi Arabia Dental Consumables Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product, treatment, material, and end user.

Product Insights:

- Dental Burs

- Whitening Material

- Dental Biomaterial

- Dental Anesthetics

- Crowns and Bridges

- Dental Implants

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes dental burs, whitening material, dental biomaterial, dental anesthetics, crowns and bridges, dental implants, and other.

Treatment Insights:

- Orthodontic

- Endodontic

- Periodontic

- Prosthodontic

A detailed breakup and analysis of the market based on the treatment have also been provided in the report. This includes orthodontic, endodontic, periodontic, and prosthodontic.

Material Insights:

- Metals

- Polymers

- Ceramics

- Biomaterials

The report has provided a detailed breakup and analysis of the market based on the material. This includes metals, polymers, ceramics, and biomaterials.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Dental Hospitals and Clinics

- Dental Laboratories

- Others

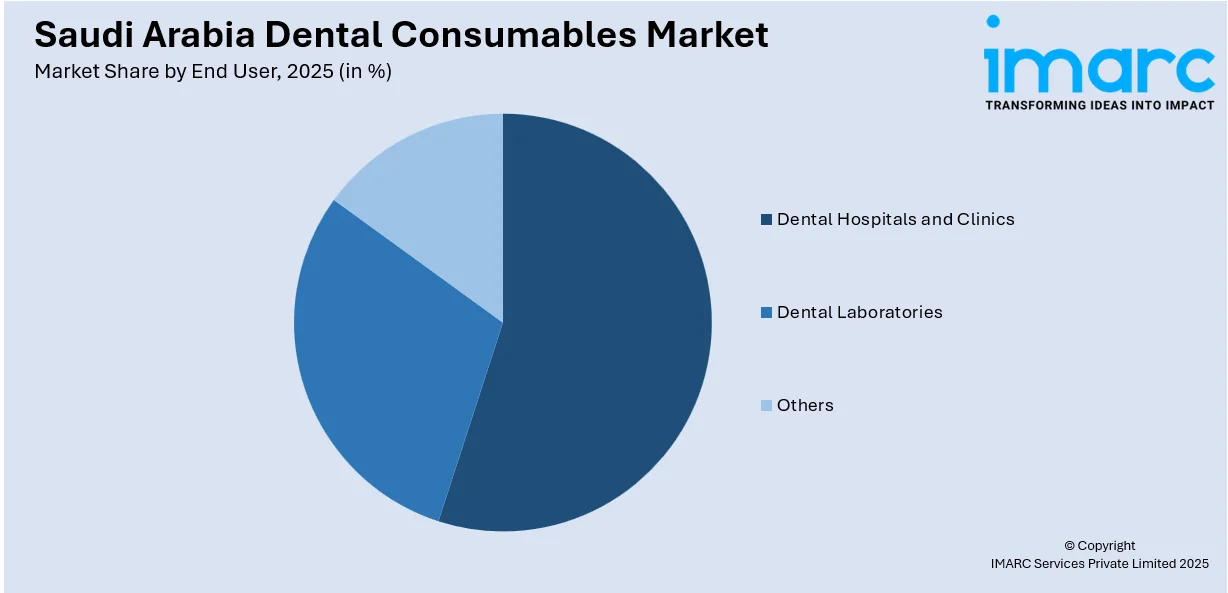

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes dental hospitals and clinics, dental laboratories, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Dental Consumables Market News:

- In 2023, W&H expanded its hygiene product offerings in Saudi Arabia with the introduction of the Lexa Plus Class B sterilizer and Assistina One maintenance equipment. These additions aim to improve workflow in dental practices by reducing infection risk and enhancing reprocessing efficiency.

Saudi Arabia Dental Consumables Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Dental Burs, Whitening Material, Dental Biomaterial, Dental Anesthetics, Crowns and Bridges, Dental Implants, Others |

| Treatments Covered | Orthodontic, Endodontic, Periodontic, Prosthodontic |

| Materials Covered | Metals, Polymers, Ceramics, Biomaterials |

| End Users Covered | Dental Hospitals and Clinics, Dental Laboratories, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia dental consumables market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia dental consumables market on the basis of product?

- What is the breakup of the Saudi Arabia dental consumables market on the basis of treatment?

- What is the breakup of the Saudi Arabia dental consumables market on the basis of material?

- What is the breakup of the Saudi Arabia dental consumables market on the basis of end user?

- What is the breakup of the Saudi Arabia dental consumables market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia dental consumables market?

- What are the key driving factors and challenges in the Saudi Arabia dental consumables?

- What is the structure of the Saudi Arabia dental consumables market and who are the key players?

- What is the degree of competition in the Saudi Arabia dental consumables market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia dental consumables market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia dental consumables market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia dental consumables industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)