Saudi Arabia Dental Implants Market Size, Share, Trends and Forecast by Material, Product, End Use, and Region, 2026-2034

Saudi Arabia Dental Implants Market Overview:

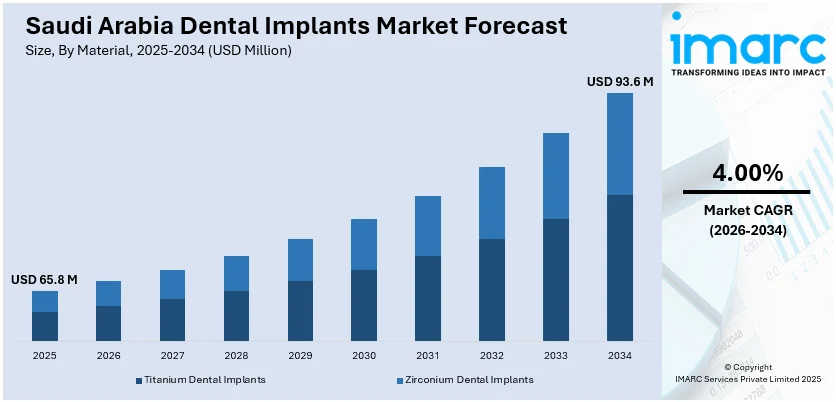

The Saudi Arabia dental implants market size reached USD 65.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 93.6 Million by 2034, exhibiting a growth rate (CAGR) of 4.00% during 2026-2034. The market is experiencing significant growth due to rising demand for cosmetic dentistry, growing elderly population, and increased healthcare investment. Moreover, advancements in technology and wider access to private dental services support the market growth across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 65.8 Million |

| Market Forecast in 2034 | USD 93.6 Million |

| Market Growth Rate 2026-2034 | 4.00% |

Saudi Arabia Dental Implants Market Trends:

Increasing Incidence of Oral Health Disorders

The Saudi Arabia dental implants market is influenced by the increasing incidence of oral health disorders, which is constantly generating demand for sophisticated restorative dental treatments. Tooth decay, periodontal diseases, and tooth loss are increasingly prevalent because of shifting dietary patterns, increased consumption of sugar, and poor preventive dental awareness. Since oral health problems are ongoing, patients are now in greater need of long-term and consistent solutions, with dental implants being seen as an advanced substitute for removable bridges and dentures. The growing older population is also fueling this trend, with old people being more susceptible to losing teeth and needing restorative procedures. As per Trading Economics, male population age 65 and above was recorded as 574235 Persons in 2024. With oral diseases still among the most prevalent non-communicable diseases in the nation, the health system is witnessing ongoing demand for up-to-date dental care, thus underpinning sustained growth within the dental implants industry throughout Saudi Arabia.

To get more information on this market Request Sample

Increased Demand for Cosmetic and Aesthetic Dentistry

The demand for cosmetic and aesthetic dentistry is driving the market, as physical appearance and dental aesthetics are gaining prominence in Saudi Arabia. Social presentation and personal image are becoming more culturally significant, so patients are demanding not only restorative oral function but also facial aesthetics. Dental implants are increasingly becoming an effective option for gaining natural teeth, causing sustained adoption across the younger and middle-aged populations. Social media and access to worldwide beauty standards are also hastening the uptake of cosmetic dental procedures, with patients opting for implants rather than conventional dentures because of their long-term durability and beauty. Dental clinics and specialty centers in key cities are constantly investing in cutting-edge implant technology to meet this increasing aesthetic demand, thus increasing the country's overall market size. In 2024, Magrabi Health declared its acquisition of Saudi Dent during the Global Health Exhibition in Riyadh, representing a crucial advancement in its growth strategy. This purchase enhanced Magrabi Health's status as a top healthcare provider in the MENA region and is in line with its long-term goals for growth and excellence in healthcare.

Widening Healthcare Infrastructure and Investments

The Saudi Arabia market is driven by the widening healthcare infrastructure and increased investments in specialty dental care. The Vision 2030 reforms of the Kingdom are regularly setting priorities for modernizing healthcare, and this has resulted in more funding for public and private dental centers. High-tech diagnostic and implant-based dental clinics are being set up, thus making more people access high-end restorative dental work. Medical tourism is also being encouraged, with Saudi Arabia becoming a regional medical tourism hub for various medical services, including dental care. Government-led efforts are inviting the involvement of the private sector, and this is inducing major investment in dental tools, computer-aided implant technology, and educational programs for dental practitioners. This growth is making dental implant surgeries more accessible, efficient, and cost-effective, thus fueling the growth of the market and taking care of the increased oral health needs of the populace. IMARC Group predicts that the Saudi Arabia medical tourism market is projected to reach USD 7,918.6 Million by 2033.

Saudi Arabia Dental Implants Market Growth Drivers:

Growing Use of Technological Upgrades

The use of technological developments is a key driver of the Saudi dental implants market, with clinics and hospitals adopting digital dentistry and sophisticated implant methods. Technologies like computer-aided design (CAD), computer-aided manufacturing (CAM), and 3D printing are being added to implant procedures, enabling enhanced precision, quicker turnaround times, and better patient outcomes. Employment of guided surgery and digital imaging is reducing complications, optimizing implant success rates, and optimizing patient satisfaction in general. With technology becoming increasingly accessible, dental practitioners are always embracing new implant systems and minimally invasive surgical techniques, rendering the procedures less painful and more effective. This continuous digital revolution in the dental industry is also drawing in patients looking for newer treatment alternatives, thus fueling the adoption of implants as a desired option. The large-scale use of technology is thus becoming a key growth driver for the market.

Increasing Disposable Income and Altering Lifestyle Trends

The market in Saudi Arabia is driven by increasing disposable incomes and evolving lifestyle trends, which are allowing patients to spend more money on sophisticated dental treatment and discretionary procedures. With rising economic diversification efforts improving purchasing power among the masses, people are becoming more inclined to spend on high-end healthcare services, such as dental implants. Lifestyle evolution, along with increased exposure to universal healthcare standards, is driving the demand for high-quality and durable restorative treatments. The ability to pay for high-tech cosmetic and implant treatments is growing among middle and upper-income segments, who are giving equal importance to oral health and personal appearance. This socio-economic evolution is creating sustained favorable conditions for the adoption of dental implants, with demand not confined to medical necessity but also found in aesthetic improvement.

Increasing Awareness and Education on Dental Care

The increasing awareness and educational campaigns for oral care and sophisticated dental procedures is supporting the market growth. Public health campaigns, private sector programs, and professional dental organizations are making serious efforts to project the need to keep oral cavities clean and undergo timely treatments for tooth loss. Patients are being increasingly educated about the long-term advantages of dental implants versus conventional dentures, causing a step-by-step shift in demand towards permanent restorative options. School and community health programs are also enhancing early education about preventive treatment, thus indirectly curbing extreme oral diseases but growing awareness of restorative options. The spread of social media and online health resources is also facilitating patients to research and know about implant procedures, benefits, and prices before making informed choices.

Saudi Arabia Dental Implants Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on material, product, and end use.

Material Insights:

- Titanium Dental Implants

- Zirconium Dental Implants

The report has provided a detailed breakup and analysis of the market based on the material. This includes Titanium Dental Implants and Zirconium Dental Implants.

Product Insights:

- Endosteal Implants

- Subperiosteal Implants

- Transosteal Implants

- Intramucosal Implants

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes endosteal implants, subperiosteal implants, transosteal implants, and intramucosal implants.

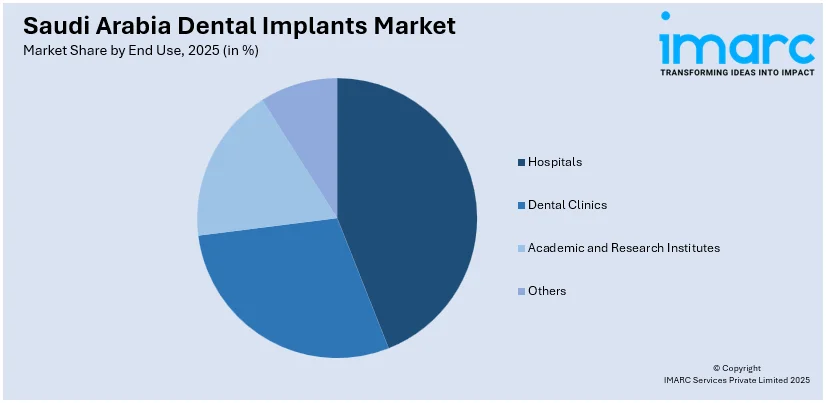

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Hospitals

- Dental Clinics

- Academic and Research Institutes

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes hospitals, dental clinics, academic and research institutes, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Dental Implants Market News:

- In February 2024, Dentakay is announced its plans to expand into Saudi Arabia with its first clinic opening in Riyadh amid rising demand for dental care. The clinic will address urgent pediatric dental issues and provide a full range of services, including implants and cosmetic procedures like the “Hollywood Smile,” leveraging advanced technology to enhance patient outcomes.

Saudi Arabia Dental Implants Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Titanium Dental Implants, Zirconium Dental Implants |

| Products Covered | Endosteal Implants, Subperiosteal Implants, Transosteal Implants, Intramucosal Implants |

| End Uses Covered | Hospitals, Dental Clinics, Academic and Research Institutes, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia dental implants market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia dental implants market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia dental implants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The dental implants market in Saudi Arabia was valued at USD 65.8 Million in 2025.

The Saudi Arabia dental implants market is projected to exhibit a CAGR of 4.00% during 2026-2034, reaching a value of USD 93.6 Million by 2034.

The Saudi Arabia dental implants market is driven by rising demand for advanced dental restoration, increasing prevalence of oral diseases, growing aesthetic awareness, and expanding medical tourism. Additionally, technological advancements, higher disposable incomes, and government investments in healthcare infrastructure further support market growth across the region.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)