Saudi Arabia Diagnostic Imaging Market Size, Share, Trends and Forecast by Modality, Application, End User, and Region, 2026-2034

Saudi Arabia Diagnostic Imaging Market Overview:

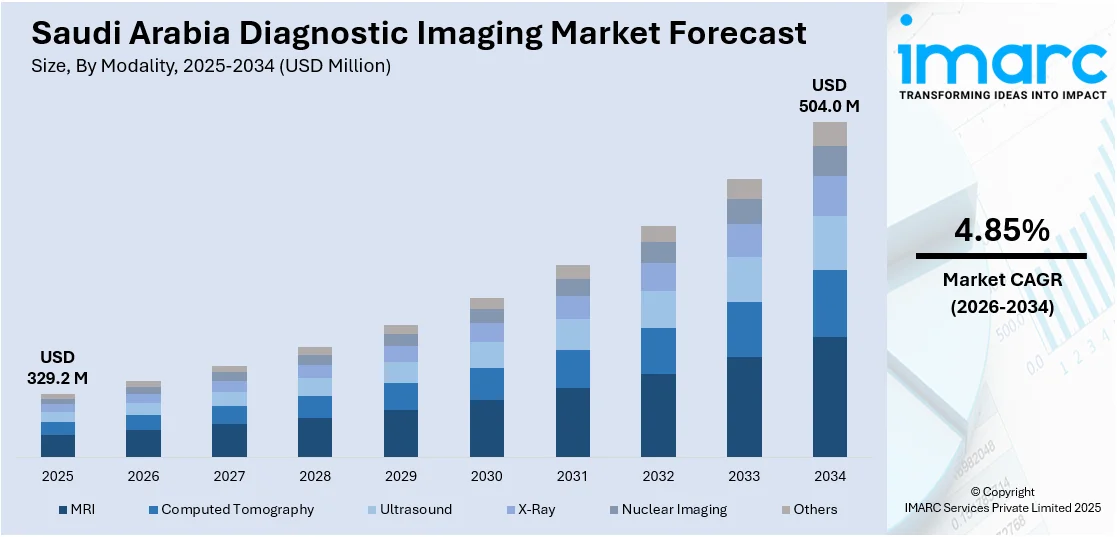

The Saudi Arabia diagnostic imaging market size reached USD 329.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 504.0 Million by 2034, exhibiting a growth rate (CAGR) of 4.85% during 2026-2034. The market is expanding steadily, driven by increasing demand for advanced healthcare services, growing public and private investment, and rising burden of chronic diseases. Technological innovations and digital health integration are enhancing diagnostic capabilities across the country. These developments collectively contribute to the evolving landscape of the Saudi Arabia diagnostic imaging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 329.2 Million |

| Market Forecast in 2034 | USD 504.0 Million |

| Market Growth Rate 2026-2034 | 4.85% |

Saudi Arabia Diagnostic Imaging Market Trends:

Rising Prevalence of Chronic and Lifestyle-Related Diseases

The growing incidence of chronic diseases like cardiovascular conditions, diabetes, and cancer in Saudi Arabia is a primary driver of the diagnostic imaging market. Unhealthy lifestyle patterns, aging demographics, and urbanization have contributed to increased disease burden. As early and accurate diagnosis is essential for effective treatment, there is a rising demand for imaging technologies like MRI, CT, and ultrasound. Government health screening initiatives and awareness campaigns are also encouraging early diagnostic testing. Hospitals and clinics are increasingly equipping themselves with modern imaging systems to manage this surge, thereby boosting the market's growth and strengthening the role of diagnostic imaging in chronic disease management across the country. For instance, in December 2024, King Abdulaziz University (KAU) introduced a novel Alzheimer's disease detection service. This service is provided by the university's investment arm, Wadi Jeddah, through its Molecular Imaging Center (I-One). This service is the first of its kind in Saudi Arabia to use integrated Positron Emission Tomography and Magnetic Resonance Imaging (PET/MRI).

To get more information on this market Request Sample

Technological Advancements and AI Integration in Imaging

Technological progress is significantly influencing the Saudi Arabia diagnostic imaging market growth. Innovations such as 3D imaging, AI-powered diagnostic tools, portable imaging devices, and hybrid modalities (like PET/CT) are transforming radiology practices. AI-based solutions are being introduced for faster, more accurate interpretation of scans, especially in oncology, neurology, and cardiology. These advancements not only improve diagnostic precision but also help reduce radiologists' workload and operational costs. With international and regional players bringing in state-of-the-art imaging solutions, Saudi hospitals are increasingly adopting digital imaging platforms, Picture Archiving and Communication Systems (PACS), and remote interpretation tools. This evolution is positioning the country as a regional hub for advanced medical imaging. For instance, in March 2026, leading AI-powered cancer diagnosis and treatment provider Lunit signed a second deal with Cloud Solutions, a division of the largest medical group in Saudi Arabia, Dr. Sulaiman Al Habib Medical Group (HMG). Building on the success of their 2023 partnership, Lunit will now provide the Kingdom of Saudi Arabia with its AI-powered chest X-ray analysis solution, Lunit INSIGHT CXR, for the next three years, analyzing over one million chest X-ray pictures.

Saudi Arabia Diagnostic Imaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on modality, application, and end user.

Modality Insights:

- MRI

- Low and Mid Field MRI Systems

- High Field MRI Systems

- Very High and Ultra High Field MRI Systems

- Computed Tomography

- Low-end Scanners

- Mid-range Scanners

- High-end Scanners

- Ultrasound

- 2D Ultrasound

- 3D Ultrasound

- Others

- X-Ray

- Analog Systems

- Digital Systems

- Nuclear Imaging

- Positron Emission Tomography (PET)

- Single Photon Emission Computed Tomography (SPECT)

- Others

The report has provided a detailed breakup and analysis of the market based on the modality. This includes MRI (Low and Mid Field MRI Systems, High Field MRI Systems, and Very High and Ultra High Field MRI Systems), Computed Tomography (Low-end Scanners, Mid-range Scanners, and High-end Scanners), Ultrasound (2D Ultrasound, 3D Ultrasound, and Others), X-Ray (Analog Systems and Digital Systems), Nuclear Imaging (Positron Emission Tomography (PET) and Single Photon Emission Computed Tomography (SPECT)), and others.

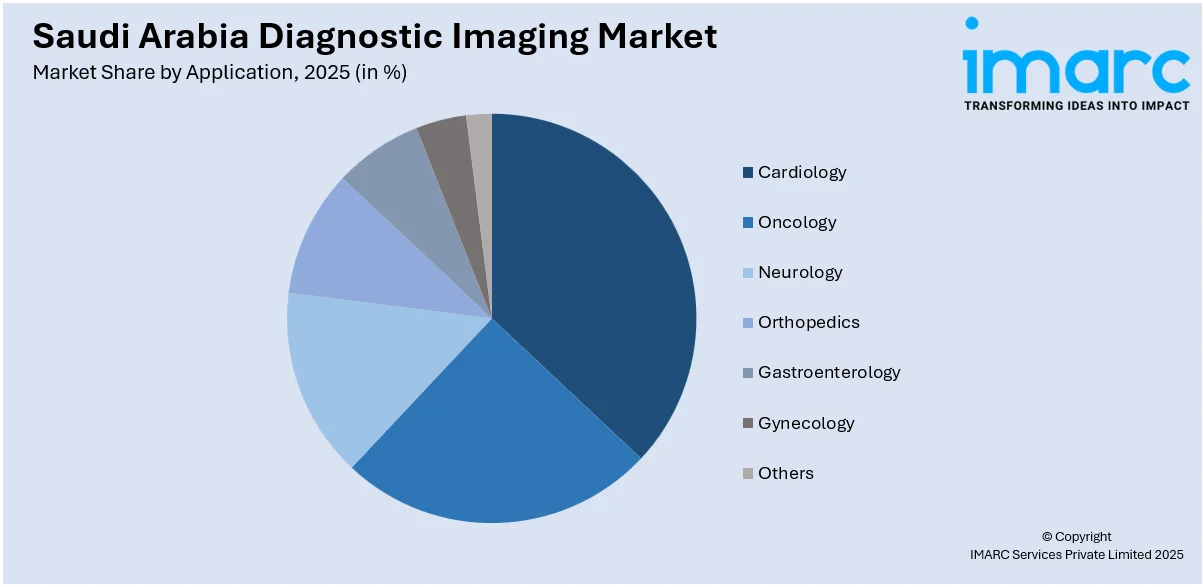

Application Insights:

Access the comprehensive market breakdown Request Sample

- Cardiology

- Oncology

- Neurology

- Orthopedics

- Gastroenterology

- Gynecology

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes cardiology, oncology, neurology, orthopedics, gastroenterology, gynecology, and others.

End User Insights:

- Hospitals

- Diagnostic Centers

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals, diagnostic centers, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include the Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Diagnostic Imaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Modalities Covered |

|

| Applications Covered | Cardiology, Oncology, Neurology, Orthopedics, Gastroenterology, Gynecology, Others |

| End Users Covered | Hospitals, Diagnostic Centers, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia diagnostic imaging market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia diagnostic imaging market on the basis of modality?

- What is the breakup of the Saudi Arabia diagnostic imaging market on the basis of application?

- What is the breakup of the Saudi Arabia diagnostic imaging market on the basis of end user?

- What is the breakup of the Saudi Arabia diagnostic imaging market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia diagnostic imaging market?

- What are the key driving factors and challenges in the Saudi Arabia diagnostic imaging?

- What is the structure of the Saudi Arabia diagnostic imaging market and who are the key players?

- What is the degree of competition in the Saudi Arabia diagnostic imaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia diagnostic imaging market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia diagnostic imaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia diagnostic imaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)