Saudi Arabia Diagnostic Testing Market Size, Share, Trends and Forecast by Test Type, Technology, Sample Type, Mode of Testing, Application, End User, and Region, 2026-2034

Saudi Arabia Diagnostic Testing Market Overview:

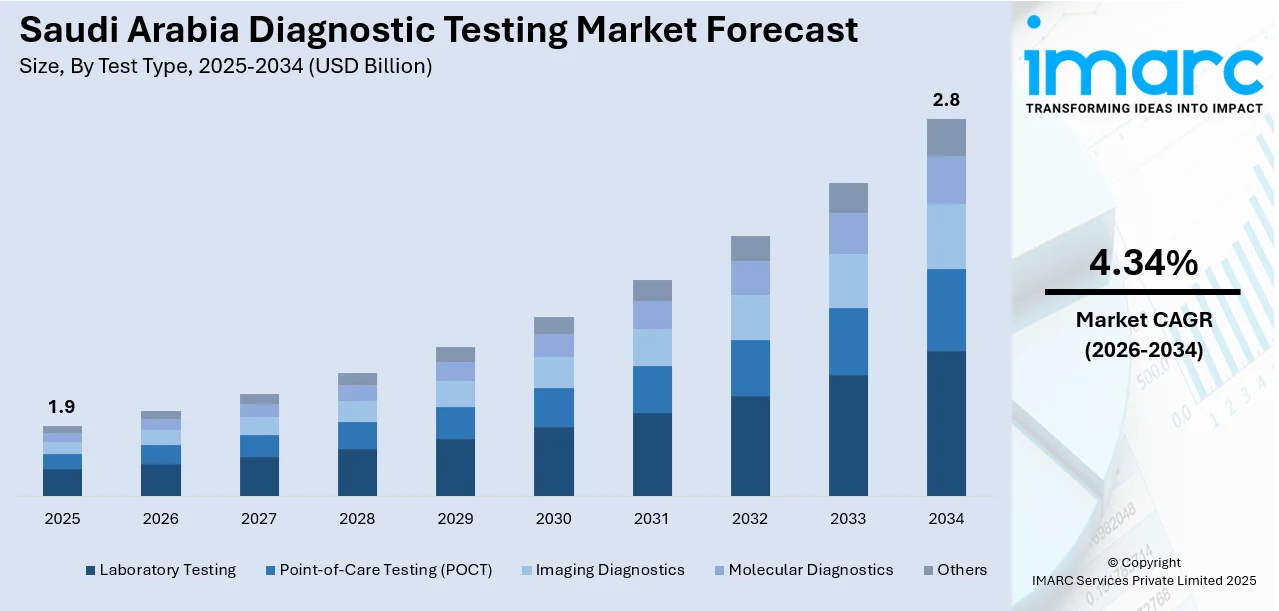

The Saudi Arabia diagnostic testing market size reached USD 1.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 2.8 Billion by 2034, exhibiting a growth rate (CAGR) of 4.34% during 2026-2034. The market is witnessing significant growth, driven by advancements in medical technology, increasing healthcare investments, and rising awareness about early disease detection. Innovations in molecular diagnostics, point-of-care testing, and imaging technologies are propelling market growth. With a strong healthcare infrastructure and a focus on improving diagnostic accuracy, the market is poised for expansion, further boosting Saudi Arabia diagnostic testing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.9 Billion |

| Market Forecast in 2034 | USD 2.8 Billion |

| Market Growth Rate 2026-2034 | 4.34% |

Saudi Arabia Diagnostic Testing Market Trends:

Government Investment in Healthcare

The Saudi Arabian government is making significant investments to strengthen the country’s healthcare infrastructure, driving the adoption of advanced diagnostic technologies. As part of its Vision 2030 initiative, the government has been focusing on improving healthcare services, including expanding hospital networks, upgrading medical facilities, and integrating state-of-the-art diagnostic tools. For instance, in October 2024, at the Global Health Exhibition in Riyadh, Saudi Arabia announced over SR50 Billion ($13.3 billion) in healthcare investments. Key deals include an SR4 Billion pharmaceuticals partnership, SR5 Billion expansion by Fakeeh Care, and SR3 Billion for new facilities by Almoosa Health. Dallah Health will also acquire hospitals, adding 749 beds. This also encompasses investments in emerging technologies such as molecular diagnostics, point-of-care diagnostics, and imaging systems, which play a vital role in improving diagnosis accuracy and speed. Training healthcare professionals to effectively utilize these new technologies is also a priority being set by the government. Moreover, with increased emphasis on early disease detection and preventive medicine, these investments are likely to enhance public health and save long-term healthcare expenses. By creating a conducive setting for technological growth, Saudi Arabia is becoming the health care innovation leader in the region.

To get more information on this market Request Sample

Rise in Chronic Disease Prevalence

The increasing prevalence of chronic diseases, such as diabetes, cardiovascular disorders, and obesity, is driving demand for diagnostic testing in Saudi Arabia. The General Authority for Statistics (GASTAT) announced the 2024 Health Status Statistics, revealing that chronic diseases affect 18.95% of adults, with diabetes being the most common. Severe depression impacts 1.8%, while 9.4% of children have chronic conditions, primarily asthma. With a growing aging population and shifting lifestyle habits, the incidence of these conditions is rising, leading to a greater need for early detection and ongoing monitoring. Diagnostic testing plays a critical role in managing these diseases, as timely diagnosis enables more effective treatment and prevention strategies. For example, regular blood glucose testing for diabetes and imaging technologies for heart conditions are essential for managing these chronic health issues. As the healthcare system adapts to these challenges, the demand for advanced diagnostic tools and services continues to grow. This trend is contributing to the Saudi Arabia diagnostic testing market growth, which is forecasted to experience sustained growth, driven by the increasing need for accurate, efficient diagnostic solutions in chronic disease management.

Saudi Arabia Diagnostic Testing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on test type, technology, sample type, mode of testing, application and end user.

Test Type Insights:

- Laboratory Testing

- Point-of-Care Testing (POCT)

- Imaging Diagnostics

- Molecular Diagnostics

- Others

The report has provided a detailed breakup and analysis of the market based on the test type. This includes laboratory testing, point-of-care testing (POCT), imaging diagnostics, molecular diagnostics, and others.

Technology Insights:

- Immunoassay-Based

- PCR-Based

- Next Gen Sequencing

- Spectroscopy-Based

- Chromatography-Based

- Microfluidics

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes immunoassay-based, PCR-based, next gen sequencing, spectroscopy-based, chromatography-based, microfluidics, and others.

Sample Type Insights:

- Blood

- Urine

- Saliva

- Sweat

- Hair

- Others

A detailed breakup and analysis of the market based on the sample type have also been provided in the report. This includes blood, urine, saliva, sweat, hair, and others.

Mode of Testing Insights:

- Prescription Based Testing

- OTC Testing

A detailed breakup and analysis of the market based on the mode of testing have also been provided in the report. This includes prescription based testing and OTC testing.

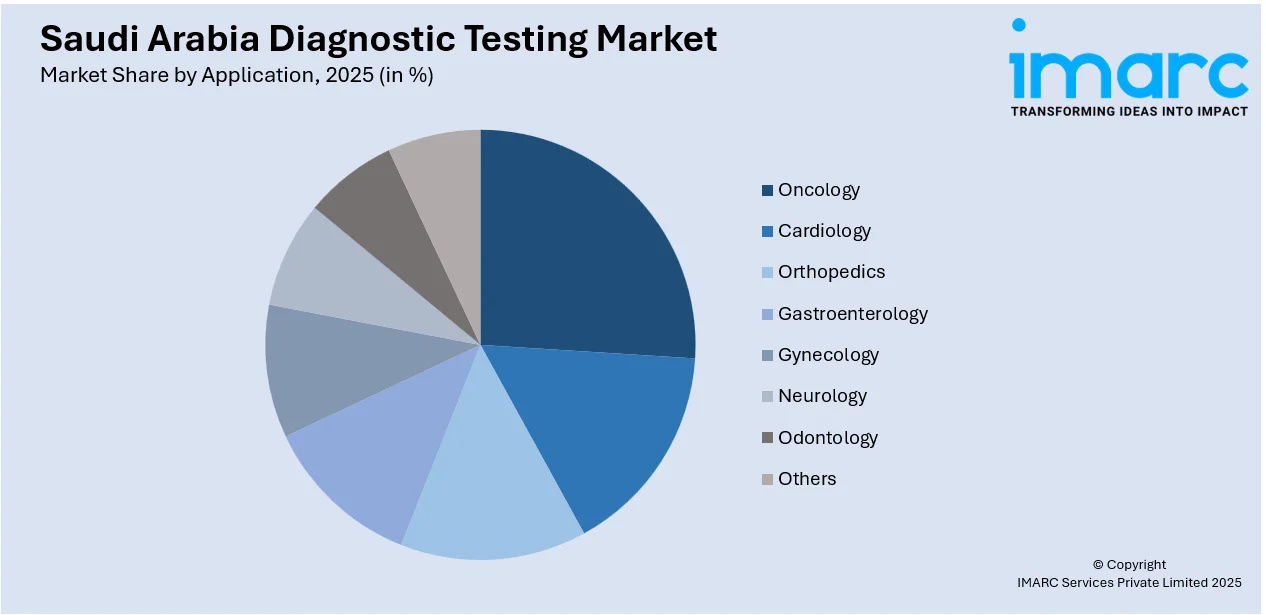

Application Insights:

Access the comprehensive market breakdown Request Sample

- Oncology

- Cardiology

- Orthopedics

- Gastroenterology

- Gynecology

- Neurology

- Odontology

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes oncology, cardiology, orthopedics, gastroenterology, gynecology, neurology, odontology, and others.

End User Insights:

- Hospitals

- Diagnostic Centers

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

- Homecare

- Blood Banks

- Research Labs and Institutes

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals, diagnostic center, ambulatory surgical centers (ASCs), specialty clinics, homecare, blood banks, research labs and institutes, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Diagnostic Testing Market News:

- In May 2025, Saudi Arabia announced the launch of the world’s first AI-powered medical clinic by Synyi AI, featuring "Dr Hua," an AI system that autonomously diagnoses and prescribes treatments, with human doctors reviewing plans for accuracy. Currently in trial, it focuses on respiratory illnesses and aims to expand its capabilities soon.

- In December 2024, King Faisal Specialist Hospital & Research Centre (KFSHRC) inaugurated the MENA region's first advanced hematology diagnostics laboratory. Featuring the largest automated hematology track and AI-driven analysis, the facility enhances diagnostic precision and supports research and education in hematology and immunology.

Saudi Arabia Diagnostic Testing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Test Types Covered | Laboratory Testing, Point-of-Care Testing (POCT), Imaging Diagnostics, Molecular Diagnostics, Others |

| Technologies Covered | Immunoassay-Based, PCR-Based, Next Gen Sequencing, Spectroscopy-Based, Chromatography-Based, Microfluidics, Others |

| Sample Types Covered | Blood, Urine, Saliva, Sweat, Hair, Others |

| Mode of Testings Covered | Prescription Based Testing, OTC Testing |

| Applications Covered | Oncology, Cardiology, Orthopedics, Gastroenterology, Gynecology, Neurology, Odontology, Others |

| End Users Covered | Hospitals, Diagnostic Center, Ambulatory Surgical Centers (ASCs), Specialty Clinics, Homecare, Blood Banks, Research Labs and Institutes, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia diagnostic testing market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia diagnostic testing market on the basis of test type?

- What is the breakup of the Saudi Arabia diagnostic testing market on the basis of technology?

- What is the breakup of the Saudi Arabia diagnostic testing market on the basis of sample type?

- What is the breakup of the Saudi Arabia diagnostic testing market on the basis of mode of testing?

- What is the breakup of the Saudi Arabia diagnostic testing market on the basis of application?

- What is the breakup of the Saudi Arabia diagnostic testing market on the basis of end user?

- What is the breakup of the Saudi Arabia diagnostic testing market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia diagnostic testing market?

- What are the key driving factors and challenges in the Saudi Arabia diagnostic testing?

- What is the structure of the Saudi Arabia diagnostic testing market and who are the key players?

- What is the degree of competition in the Saudi Arabia diagnostic testing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia diagnostic testing market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia diagnostic testing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia diagnostic testing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)