Saudi Arabia Dialysis Equipment Market Size, Share, Trends and Forecast by Type, End User, and Region, 2026-2034

Saudi Arabia Dialysis Equipment Market Overview:

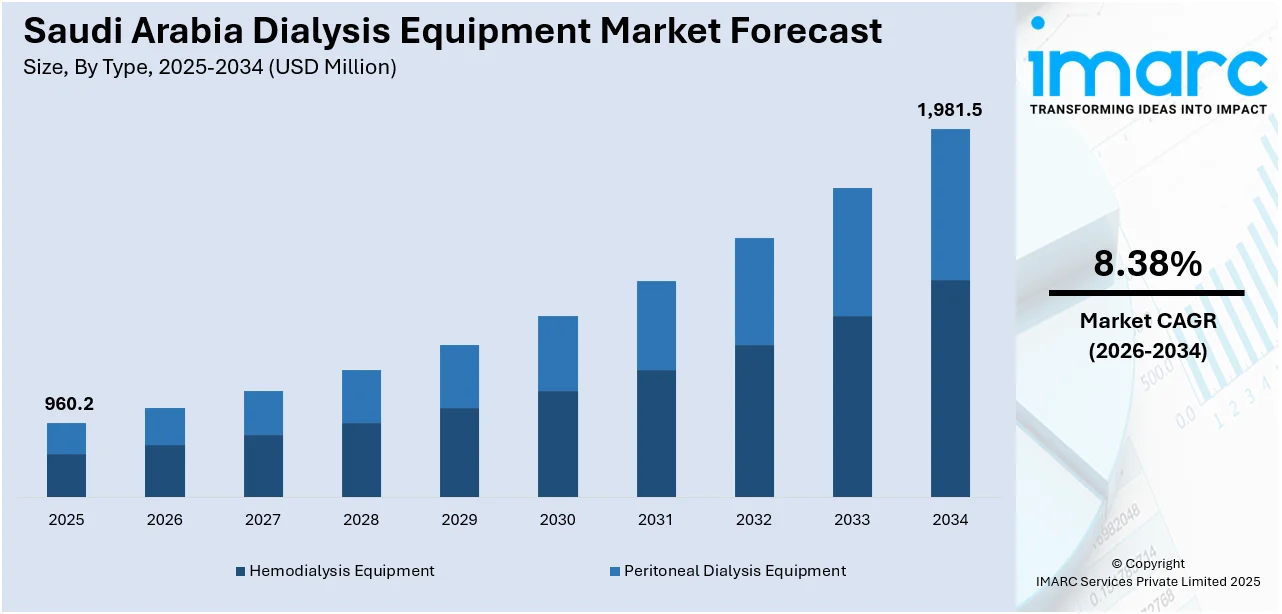

The Saudi Arabia dialysis equipment market size reached USD 960.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,981.5 Million by 2034, exhibiting a growth rate (CAGR) of 8.38% during 2026-2034. The market is expanding due to the rising prevalence of chronic kidney diseases, driven by diabetes and hypertension. Government healthcare investments, increased dialysis centers, and adoption of advanced technologies are enhancing treatment accessibility. Growing partnerships between the public and private healthcare sectors further contribute to the Saudi Arabia dialysis equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 960.2 Million |

| Market Forecast in 2034 | USD 1,981.5 Million |

| Market Growth Rate 2026-2034 | 8.38% |

Saudi Arabia Dialysis Equipment Market Trends:

Government Healthcare Initiatives and Vision 2030 Reforms

Saudi Arabia’s government is heavily investing in healthcare infrastructure as part of its Vision 2030 initiative, aiming to improve the quality of life and diversify the economy. Dialysis care is a priority due to the country’s high CKD rates. The Ministry of Health has increased funding for kidney care, including the construction of dialysis centers, equipment procurement, and staff training. Public-private partnerships are encouraged, attracting local and international players to invest in the dialysis sector. Regulatory frameworks have been updated to ensure safety and efficiency, promoting the adoption of modern equipment. These reforms not only enhance access to care for patients across urban and rural regions but also stimulate steady demand for dialysis technologies, strengthening the overall Saudi Arabia dialysis equipment market growth.

To get more information on this market Request Sample

Technological Advancements and Equipment Modernization

The Saudi dialysis equipment market is benefiting from rapid technological advancements aimed at improving treatment efficiency, patient comfort, and clinical outcomes. Modern dialysis machines now feature automation, real-time monitoring, data integration, and user-friendly interfaces. These technologies reduce human error, enable personalized care, and improve treatment consistency. The country’s healthcare providers are increasingly shifting from older, manual systems to advanced hemodialysis and peritoneal dialysis units, often supported by AI and remote monitoring capabilities. Such innovation also helps manage the growing patient base more efficiently. Equipment manufacturers are responding by offering customizable and scalable solutions tailored for Saudi hospitals and clinics. This technological evolution, aligned with national healthcare goals, is a key driver accelerating market demand and reshaping care delivery.

Growth of Private Healthcare Sector and Insurance Coverage

The expansion of Saudi Arabia’s private healthcare sector is creating new avenues for dialysis care and equipment demand. With rising disposable income and improved insurance coverage, more patients are seeking treatment in private hospitals and specialized renal clinics. These facilities prioritize high-quality, efficient, and patient-centered care, driving investments in state-of-the-art dialysis machines and infrastructure. The introduction of mandatory health insurance for expatriates and citizens in some regions has also enhanced access to advanced therapies. Additionally, private sector involvement often leads to faster adoption of global best practices and new technologies. As a result, the growing number of private healthcare facilities is both meeting the increasing patient demand and fostering a competitive environment that fuels the Saudi Arabia dialysis equipment market.

Saudi Arabia Dialysis Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and end user.

Type Insights:

- Hemodialysis Equipment

- Hemodialysis Machines

- n-Center Hemodialysis Machines

- Home-Based Hemodialysis Machines

- Hemodialysis Consumables

- Dialyzers

- Dialysate

- Access Products

- Others

- Hemodialysis Machines

- Peritoneal Dialysis Equipment

- Peritoneal Dialysis Equipment Type

- Continuous Ambulatory Peritoneal Dialysis (CAPD)

- Automated Peritoneal Dialysis (APD)

- Peritoneal Dialysis Product

- Cyclers

- Fluids

- Others

- Peritoneal Dialysis Equipment Type

The report has provided a detailed breakup and analysis of the market based on the type. This includes hemodialysis equipment [hemodialysis machines (n-center hemodialysis machines and home-based hemodialysis machines) and hemodialysis consumables (dialyzers, dialysate, access products, and others)] and peritoneal dialysis equipment [peritoneal dialysis equipment type (continuous ambulatory peritoneal dialysis (CAPD) and automated peritoneal dialysis (APD)) and peritoneal dialysis product (cyclers, fluids, and others)].

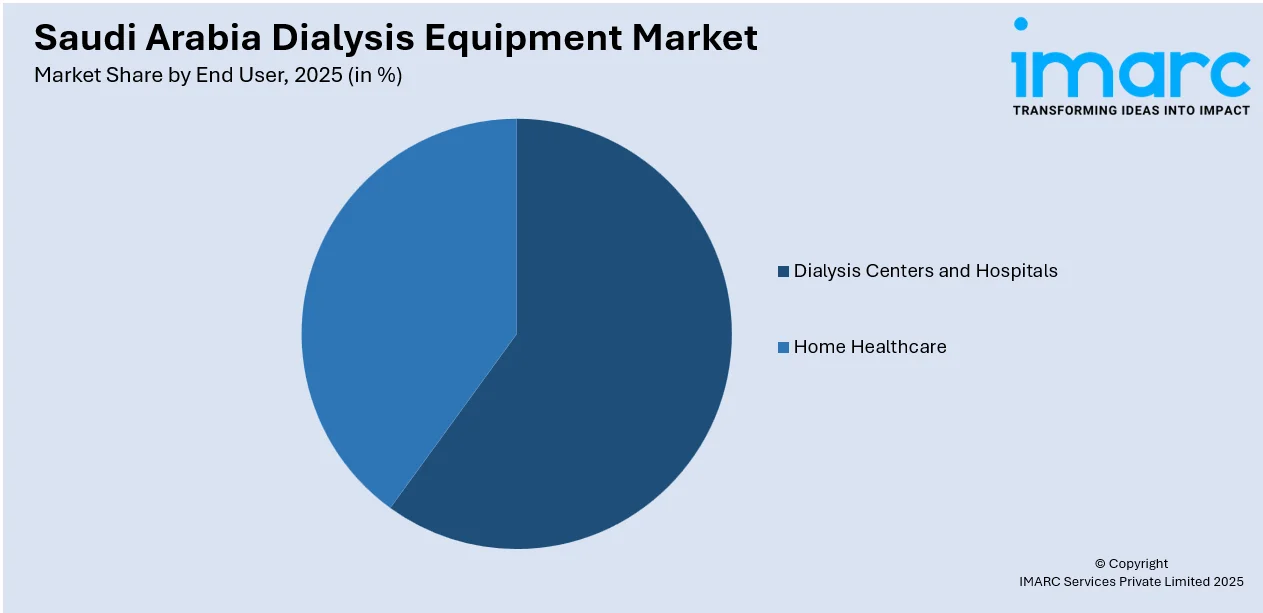

End User Insights:

Access the comprehensive market breakdown Request Sample

- Dialysis Centers and Hospitals

- Home Healthcare

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes dialysis centers and hospitals and home healthcare.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include the Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Dialysis Equipment Market News:

- In February 2025, NephroPlus, Asia’s largest dialysis network and a leader in transforming dialysis care, is anticipated to launch its center in Middle Eastern countries by the end of this year, with revenue reaching Rs 750 crore for the fiscal year 2023-24. They declared plans to launch their center in Saudi Arabia before December 2025.

Saudi Arabia Dialysis Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| End Users Covered | Dialysis Centers and Hospitals, Home Healthcare |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia dialysis equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia dialysis equipment market on the basis of type?

- What is the breakup of the Saudi Arabia dialysis equipment market on the basis of end user?

- What is the breakup of the Saudi Arabia dialysis equipment market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia dialysis equipment market?

- What are the key driving factors and challenges in the Saudi Arabia dialysis equipment market?

- What is the structure of the Saudi Arabia dialysis equipment market and who are the key players?

- What is the degree of competition in the Saudi Arabia dialysis equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia dialysis equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia dialysis equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia dialysis equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)