Saudi Arabia Diesel Genset Market Size, Share, Trends and Forecast by Power Output, Power Rating, Application, End User, and Region, 2026-2034

Saudi Arabia Diesel Genset Market Summary:

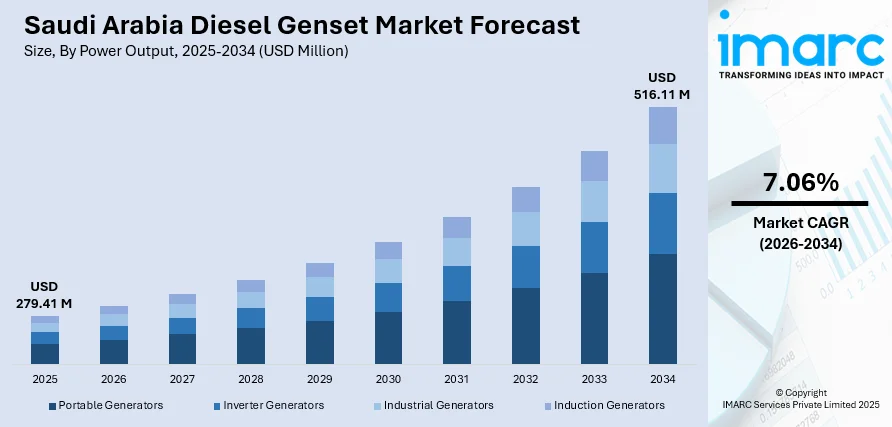

The Saudi Arabia diesel genset market size was valued at USD 279.41 Million in 2025 and is projected to reach USD 516.11 Million by 2034, growing at a compound annual growth rate of 7.06% from 2026-2034.

The market expansion is driven by extensive infrastructure development under Vision 2030, unprecedented growth in construction activities, and rising demand from oil and gas exploration projects requiring reliable backup power solutions. The Eastern Region's concentration of industrial facilities and energy sector operations, coupled with ongoing megaprojects such as NEOM and King Abdullah Economic City, creates substantial demand for standby and prime power gensets. Industrial applications dominate usage patterns as manufacturing plants, petrochemical facilities, and energy sector operations prioritize uninterrupted power supply to maintain production continuity and operational efficiency, thereby expanding the Saudi Arabia diesel genset market share.

Key Takeaways and Insights:

-

By Power Output: Industrial generators dominate the market with a share of 43% in 2025, driven by their superior power output capabilities, extended runtime performance for continuous industrial operations, and robust construction suitable for harsh environmental conditions prevalent in Saudi Arabia's industrial zones and remote energy facilities.

-

By Power Rating: 76 kVA–375 kVA leads the market with a share of 36% in 2025, offering optimal balance between power capacity and operational flexibility for mid-sized industrial facilities, commercial establishments, construction sites, and telecommunications infrastructure.

-

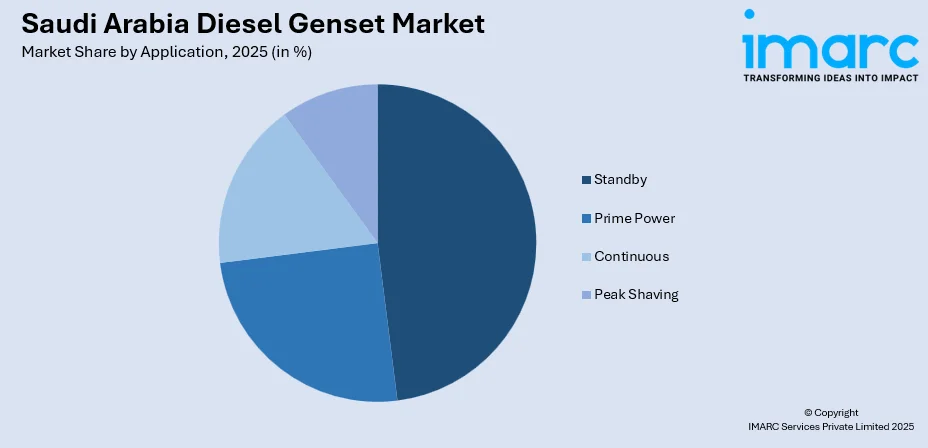

By Application: Standby represents the largest segment with a market share of 48% in 2025, essential for critical infrastructure including hospitals, data centers, telecommunications networks, and industrial plants.

-

By End User: Industrial leads the market with a share of 47% in 2025, encompassing oil refineries, petrochemical complexes, manufacturing plants, and mining operations that depend on continuous power supply.

-

By Region: Eastern region represents the largest segment with a market share of 34% in 2025, concentrated in industrial hubs including Dammam, Dhahran, and Jubail hosting major oil and gas facilities, petrochemical plants, and port operations requiring extensive backup power infrastructure.

-

Key Players: The competitive landscape features established global manufacturers and regional specialists competing through product innovation, after-sales support, and local distribution networks. They are also focusing on collaborations to expand their operations in the country.

To get more information on this market Request Sample

The Saudi Arabia diesel genset market benefits from multiple growth catalysts including massive construction activity increment, expansion of telecommunications infrastructure with 5G network deployments across 18 major cities by 2027-2030, and healthcare sector investments for constructing and privatizing hospitals requiring reliable emergency power systems. Initiatives under Vision 2030 expected non-oil GDP to increase to almost $700bn by 2024 from a starting point of just above $530bn and it is anticipated that this will nearly double by 2030. Total GDP will increase from $956 billion to $1.73 trillion during that timeframe. The market also responds to extreme summer temperatures driving peak electricity consumption that strains grid capacity, particularly in regions experiencing rapid urbanization and industrial expansion. Apart from this, Saudi Arabia is focussing on the launch of artificial intelligence (AI)-enabled smart genset systems improving fuel efficiency through predictive maintenance algorithms and remote monitoring capabilities, demonstrating industry commitment to technological advancement and operational optimization.

Saudi Arabia Diesel Genset Market Trends:

Integration of AI and Internet of Internet of Things (IoT)-Based Remote Monitoring Systems

Advanced technological integration transforms diesel genset operations through artificial intelligence-driven predictive maintenance systems, Internet of Things connectivity enabling real-time performance tracking, and cloud-based monitoring platforms providing centralized control across distributed installations. These smart systems optimize fuel consumption, detect potential failures before breakdowns occur, reduce maintenance costs, and improve overall equipment effectiveness. In 2025, Saudi Arabia is enhancing its AI goals with the introduction of HUMAIN, a key initiative supported by the Public Investment Fund, as part of its larger effort to become a worldwide AI leader. With over $40 billion allocated for AI investments through Vision 2030, the Kingdom is enhancing its infrastructure, establishing worldwide tech collaborations, and aiming to be a center for advanced AI implementations throughout the Middle East and beyond.

Rising Adoption of Hybrid Power Systems Combining Diesel with Renewable Energy

Hybrid power systems that combine diesel generators with solar photovoltaic panels and wind turbines are gaining popularity as companies aim to cut fuel expenses and decrease carbon emissions and align with Vision 2030 sustainability objectives while maintaining power reliability. These systems leverage renewable energy for base load requirements while retaining diesel backup for peak demand periods and weather-related generation gaps. Moreover, several infrastructure projects across NEOM deployed solar-diesel hybrid generator systems ensuring continuous power for construction activities while reducing carbon footprints, demonstrating practical application of hybrid technology in large-scale development projects requiring reliable power in remote locations without grid connectivity. Sadd II Solar PV Park is a 1,125 MW solar power facility that will be constructed in Saad, Central Province. At present in the planning stage and expected to start construction in 2025. ACWA Power is advancing this initiative as a solar PV project mounted on the ground, executed in one phase. ACWA Power holds a 50% interest in this project, and the power produced will be sold to Saudi Power Procurement Co through a PPA. Saad II Solar PV Park is set to begin its commercial operations in 2026.

Expansion of Telecommunications Infrastructure Driving Generator Demand

Telecommunications sector expansion fuels significant demand for backup power solutions as network operators deploy extensive 5G infrastructure, expand mobile base stations, and establish data centers requiring uninterrupted electricity for maintaining service uptime. In 2024, Zain Saudi Arabia announced plans to accelerate 5G-Advanced services deployment across 18 key cities by 2027-2030. These telecommunications infrastructure buildouts necessitate thousands of backup generators protecting critical network equipment from power disruptions that compromise service quality and customer connectivity across rapidly expanding coverage areas.

How Vision 2030 is Transforming the Saudi Arabia Diesel Genset Market:

Vision 2030 is reshaping the Saudi Arabia diesel genset market by changing how and where power solutions are used. Large investments in industrial cities, mining zones, tourism projects, and logistics hubs are increasing short-term and standby power needs during construction and early operations. Mega projects across NEOM, the Red Sea coast, and industrial clusters rely on diesel gensets to support sites before permanent grid connections are completed. This has pushed demand for mobile, high-capacity, and fuel-efficient units. At the same time, Vision 2030 places strong emphasis on efficiency, emissions control, and localization. Genset suppliers are responding with cleaner engines, hybrid configurations, and improved fuel management systems. Local assembly, servicing, and rental models are gaining traction as part of the push to strengthen domestic manufacturing and job creation. While renewables are expanding, diesel gensets remain critical for reliability, backup power, and remote operations, keeping them relevant within the Vision 2030 transition phase.

Market Outlook 2026-2034:

The Saudi Arabia diesel genset market demonstrates strong growth trajectory through 2034, propelled by continued infrastructure megaproject execution, industrial sector expansion, and telecommunications network densification requiring extensive backup power installations. The market generated a revenue of USD 279.41 Million in 2025 and is projected to reach a revenue of USD 516.11 Million by 2034, growing at a compound annual growth rate of 7.06% from 2026-2034. Technological advancement toward fuel-efficient models, emission control systems, and hybrid configurations address environmental regulations while meeting reliability requirements for critical applications across industrial, commercial, and institutional sectors.

Saudi Arabia Diesel Genset Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Power Output | Industrial Generators | 43% |

| Power Rating | 76 kVA–375 kVA | 36% |

| Application | Standby | 48% |

| End User | Industrial | 47% |

| Region | Eastern Region | 34% |

Power Output Insights:

- Portable Generators

- Inverter Generators

- Industrial Generators

- Induction Generators

Industrial generators dominate with a market share of 43% of the total Saudi Arabia diesel genset market in 2025.

These high-capacity units deliver robust power output ranging from 200 kVA to several megawatts, engineered for continuous operation in demanding industrial environments including oil refineries, petrochemical plants, manufacturing facilities, and mining operations. Industrial generators feature heavy-duty construction withstanding harsh climate conditions, advanced cooling systems managing extreme ambient temperatures, and sophisticated control panels integrating with facility management systems. The segment benefits from Saudi Aramco's massive capital investments including USD 25 billion in contracts awarded in 2024 for gas production expansion and infrastructure development across Jafurah field and Master Gas System, driving demand for reliable backup power protecting critical equipment and maintaining production continuity.

Industrial generators also serve construction megaprojects including NEOM's construction, requiring substantial temporary power generation during construction phases in remote locations lacking grid infrastructure. Saudi Arabia's ambitious NEOM initiative, particularly its flagship project 'The Line,' has attracted worldwide interest as a daring move towards futuristic urban existence. Spanning 170 kilometers in Tabuk province, 'The Line' is proposed as a linear city featuring mirrored surfaces, no vehicles, and completely reliant on renewable energy. Nonetheless, by 2025, the project is facing several challenges, having accomplished important developments and milestones.

Power Rating Insights:

- 5 kVA–75 kVA

- 76 kVA–375 kVA

- 376 kVA–750 kVA

- Above 750 kVA

The 76 kVA–375 kVA leads with a share of 36% of the total Saudi Arabia diesel genset market in 2025.

This power rating category serves diverse applications including mid-sized commercial buildings, hotels, hospitals, retail centers, telecommunications base stations, and construction sites requiring substantial backup capacity without excessive infrastructure costs. The segment's versatility enables deployment across healthcare facilities where the country is planning to open five new hospitals by 2025, adding 963 beds across key provinces as part of a broader SR260 billion ($69.3 billion) budget apportionment to the health and social development sector, necessitating reliable backup power for critical medical equipment, operating rooms, and emergency departments.

The power rating range also supports telecommunications infrastructure expansion as operators install thousands of base stations for 5G network coverage, with each facility requiring dedicated backup generators maintaining network uptime during grid disruptions. Commercial sector growth including hospitality development, supporting tourism targets of 150 million annual visitors by 2030 drives substantial demand for generators in this power category, providing backup for hotels, restaurants, entertainment venues, and retail complexes where power interruptions disrupt operations and customer experience.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Standby

- Prime Power

- Continuous

- Peak Shaving

Standby exhibits a clear dominance with a 48% share of the total Saudi Arabia diesel genset market in 2025.

Standby generators remain in ready state activating automatically within seconds of grid power failure, providing immediate backup for critical facilities including hospitals, data centers, telecommunications networks, financial institutions, and industrial plants where even brief power interruptions cause significant operational disruptions, equipment damage, or safety hazards. The application dominates healthcare sector installations where government investments exceeding USD 65 billion announced in April 2024 for privatizing 290 hospitals and 2,300 primary health centers create extensive demand for emergency power systems protecting patient care continuity, medical equipment functionality, and life support systems.

Standby generators also serve telecommunications infrastructure where network uptime requirements exceed 99.9% availability, necessitating reliable backup during grid disturbances that would otherwise compromise mobile services, internet connectivity, and emergency communications across urban and remote coverage areas. Commercial buildings including hotels, shopping centers, and office towers increasingly install standby capacity protecting tenant operations, preserving perishable inventory, and maintaining security systems during outages that occur with greater frequency during peak summer demand periods.

End User Insights:

- Residential

- Commercial

- Industrial

Industrial leads with a share of 47% of the total Saudi Arabia diesel genset market in 2025.

Industrial applications encompass oil refineries, petrochemical complexes, manufacturing plants, mining operations, and energy production facilities requiring continuous power supply for process equipment, safety systems, and production operations where power disruptions cause production losses, equipment damage, and safety hazards. The segment benefits from Saudi Arabia's oil and gas sector expansion including Jafurah gas field development targeting 2 billion cubic feet daily production by 2030, Marjan offshore oil field expansion adding 600,000 barrels daily capacity, and Fadhili gas plant capacity increase from 2.5 to 4 billion cubic feet daily by end-2027, driving extensive demand for backup and prime power generation at remote production facilities.

Industrial segment growth also stems from King Salman Energy Park development in Eastern Province attracting investments for energy and industrial complex hosting numerous manufacturing facilities requiring reliable power infrastructure. Construction sector activity creates temporary industrial power demand supporting concrete batching plants, aggregate processing equipment, welding operations, and heavy machinery across megaproject sites including New Murabba in Riyadh featuring world-class urban development requiring substantial construction power throughout multi-year execution periods.

Region Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Eastern region exhibits a clear dominance with a 34% share of the total Saudi Arabia diesel genset market in 2025.

This region concentrates Saudi Arabia's oil and gas industry including major production facilities in Dammam, Dhahran, Al-Khobar, and Jubail industrial city hosting extensive petrochemical complexes, refineries, and energy infrastructure requiring substantial backup power capacity. The region benefits from King Salman Energy Park development attracting global energy companies and industrial manufacturers establishing facilities requiring reliable power systems for production operations and process equipment. Jubail industrial city alone hosts hundreds of manufacturing plants, petrochemical facilities, and logistics operations dependent on diesel generators maintaining operational continuity during grid disturbances or maintenance periods affecting utility infrastructure.

In addition, the Eastern Region benefits from strong infrastructure development and commercial activity. Major ports, logistics hubs, and industrial zones require dependable power to avoid operational downtime, especially during grid disturbances. Ongoing investments in petrochemicals, metals, and construction projects continue to support genset installations across varied capacity ranges. Together, energy-intensive industries, large-scale projects, and critical infrastructure needs position the Eastern Region as the dominant contributor to diesel genset demand in Saudi Arabia.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Diesel Genset Market Growing?

Massive Infrastructure Development Under Vision 2030 Initiative

Saudi Arabia's transformative Vision 2030 program drives extraordinary infrastructure development requiring extensive diesel generator deployments across construction sites, permanent facilities, and remote project locations lacking immediate grid connectivity. The initiative encompasses giga-scale projects including NEOM futuristic city development estimated at USD 500 billion cost and Red Sea Project delivering 50 resorts and 8000 hotel rooms and more than 1,000 residential properties across 22 islands. Construction activity is increasing, demonstrating sustained momentum through forecast period. These megaprojects require thousands of generators providing temporary construction power for equipment operations, worker facilities, and site lighting across remote desert locations, followed by permanent backup installations serving completed facilities including hotels, commercial centers, residential communities, and institutional buildings throughout operational lifespans.

Expansion of Oil and Gas Sector Operations

Saudi Arabia's energy sector undergoes substantial expansion necessitating extensive backup power installations protecting critical production equipment, processing facilities, and operational infrastructure from power disruptions compromising safety systems, production continuity, and equipment integrity. In 2024, Saudi Aramco granted $25 billion in contracts to boost its natural gas output, aligning with Saudi Arabia's goals to secure the necessary supplies for expected increased demand. Aramco announced in a statement on June 30 that sixteen contracts worth $12.4 billion have been granted for the second phase of development of the Jafurah unconventional gas field, which holds an estimated 229 Tcf of raw gas and 75 billion stock tank barrels of condensate. These developments occur predominantly in remote locations requiring diesel generators providing prime power during construction phases and backup capacity protecting completed facilities from grid instabilities.

Rapid Expansion of Telecommunications Infrastructure and Data Center Development

Telecommunications sector expansion creates substantial diesel generator demand as network operators deploy extensive 5G infrastructure, expand mobile coverage, and establish data centers requiring uninterrupted power maintaining service uptime and equipment functionality. In 2025, stc Group, a prominent digital enabler in Saudi Arabia, entered into a five-year Master Frame Agreement (MFA) with Ericsson (NASDAQ: ERIC) to expedite the deployment of sophisticated digital infrastructure and enhance technology adoption throughout the Kingdom of Saudi Arabia. By means of the agreement, stc Group will access Ericsson’s newest portfolio products, which include 5G hardware and software, cloud-native solutions, advanced managed services, and infrastructure and network support (which encompasses third-party product (3PP) components).

Market Restraints:

What Challenges the Saudi Arabia Diesel Genset Market is Facing?

Stringent Environmental Regulations and Emissions Standards Increasing Compliance Costs

Government implementation of progressively stricter emission standards addresses air pollution concerns and promotes cleaner energy sources, compelling manufacturers and operators to invest substantially in advanced emission control technologies, fuel management systems, and monitoring equipment increasing acquisition and operational costs. Diesel generators traditionally generate higher emissions compared to alternative power sources, requiring continuous technology upgrades meeting evolving regulatory requirements including exhaust emissions standards, noise level restrictions, and fuel efficiency mandates. Regulatory compliance necessitates ongoing equipment modifications, emissions testing, and documentation adding operational complexity for industrial users, commercial establishments, and construction contractors operating generator fleets across multiple locations.

Growing Competition from Renewable Energy Sources and Hybrid Power Systems

Renewable energy expansion threatens traditional diesel generator market share as organizations increasingly adopt solar photovoltaic systems, wind turbines, and hybrid configurations combining renewables with energy storage reducing dependence on diesel fuel and lowering operational costs. Battery storage systems advancing in capacity and affordability enable renewable energy providing reliable backup without diesel fuel consumption, appealing to environmentally conscious organizations seeking to reduce carbon footprints while maintaining power security for critical operations and facilities.

Volatility in Diesel Fuel Prices Affecting Operational Economics and Total Cost of Ownership

Fluctuating diesel fuel prices create uncertainty in operating cost projections, capital investment decisions, and long-term ownership economics for organizations dependent on diesel generators for backup or prime power applications. Fuel price volatility stems from global crude oil market dynamics, refining capacity constraints, regional supply disruptions, and geopolitical events affecting petroleum product availability and pricing across Middle East markets. Organizations operating large generator fleets including telecommunications operators, construction contractors, and industrial facilities face substantial fuel expenditures representing significant portion of total operating costs, with price increases directly impacting profitability and operational budgets. Import dependency for generator equipment and components also exposes market participants to foreign exchange fluctuations, supply chain disruptions, and international trade dynamics affecting equipment availability and acquisition costs for manufacturing companies, rental equipment providers, and end-user organizations planning power infrastructure investments.

Competitive Landscape:

The Saudi Arabia diesel genset market features intensely competitive dynamics characterized by presence of established global manufacturers and specialized regional distributors competing through product innovation, technical support capabilities, and extensive service networks. International leaders leverage brand reputation, comprehensive product portfolios, and advanced engineering capabilities delivering solutions spanning portable units to multi-megawatt industrial systems. Regional specialist Saudi Diesel Equipment Co. Ltd. maintains strong market position through local market knowledge, established customer relationships, and responsive after-sales support addressing unique requirements of Saudi industrial and commercial sectors. Competitive strategies emphasize fuel efficiency improvements, emission reduction technologies, remote monitoring integration, and hybrid system offerings aligning with environmental regulations and customer sustainability objectives. Companies invest substantially in local service infrastructure, parts inventory, and technical training supporting rapid response requirements for critical applications in oil and gas facilities, telecommunications networks, and healthcare institutions where generator downtime compromises operations and safety.

Saudi Arabia Diesel Genset Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Power Outputs Covered | Portable Generators, Inverter Generators, Industrial Generators, Induction Generators |

| Power Ratings Covered | 5 kVA–75 kVA, 76 kVA–375 kVA, 376 kVA–750 kVA, Above 750 kVA |

| Applications Covered | Standby, Prime Power, Continuous, Peak Shaving |

| End Users Covered | Residential, Commercial, Industrial |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia diesel genset market size was valued at USD 279.41 Million in 2025.

The Saudi Arabia diesel genset market is expected to grow at a compound annual growth rate of 7.06% from 2026-2034 to reach USD 516.11 Million by 2034.

Industrial generators dominate the Saudi Arabia diesel genset market with 43% share, driven by superior power output capabilities, extended runtime performance for continuous industrial operations, and robust construction suitable for harsh environmental conditions prevalent in industrial zones and remote energy facilities across the Kingdom.

Key factors driving the Saudi Arabia diesel genset market include massive infrastructure development under Vision 2030 initiative creating unprecedented construction and facility power demand, expansion of oil and gas sector operations requiring reliable backup power for production facilities and processing plants, rapid telecommunications infrastructure buildout necessitating thousands of base station backup systems, and substantial healthcare sector investments requiring emergency power installations across hospitals and medical centers throughout the Kingdom.

Major challenges include stringent environmental regulations and emissions standards increasing compliance costs through required emission control technologies and monitoring equipment, growing competition from renewable energy sources and hybrid power systems reducing diesel generator dependence as solar and wind installations expand, volatility in diesel fuel prices affecting operational economics and total cost of ownership for organizations operating generator fleets, and regulatory pressure encouraging phase-out of outdated diesel gensets particularly in urban areas promoting adoption of cleaner power alternatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)