Saudi Arabia Dietary Supplements Market Size, Share, Trends and Forecast by Product Type, Form, Distribution Channel, Application, End-Use, and Region, 2026-2034

Saudi Arabia Dietary Supplements Market Overview:

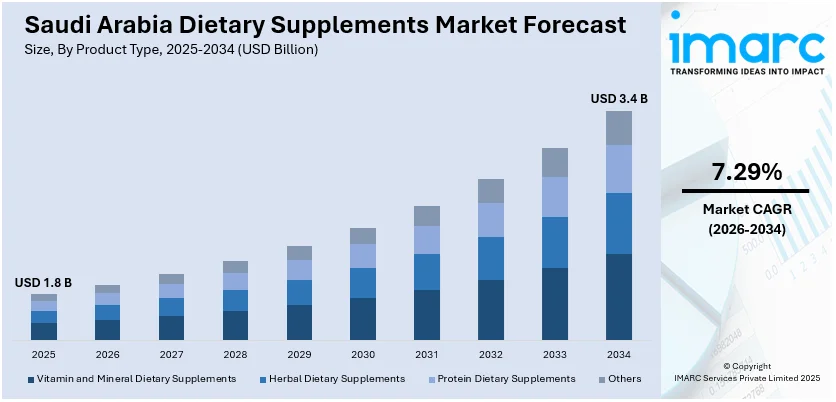

The Saudi Arabia dietary supplements market size reached USD 1.8 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 3.4 Billion by 2034, exhibiting a growth rate (CAGR) of 7.29% during 2026-2034. Chronic disease concerns, national health campaigns, digital nutrition awareness, global product acceptance, retail modernization, hypermarket expansion, e-commerce optimization, and regionalized brand strategies are some of the factors positively impacting the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.8 Billion |

| Market Forecast in 2034 | USD 3.4 Billion |

| Market Growth Rate 2026-2034 | 7.29% |

Saudi Arabia Dietary Supplements Market Trends:

Rising Preventive Healthcare Awareness and Lifestyle Shifts

In Saudi Arabia, the growing burden of chronic diseases such as obesity, hypertension, and diabetes has pushed preventive healthcare into the national spotlight. As a result, dietary supplements have become more widely adopted among individuals aiming to manage or prevent these conditions without immediately relying on prescription drugs. Government initiatives promoting health education, combined with targeted awareness campaigns from pharmaceutical companies, have increased consumer exposure to supplements as part of wellness routines. On April 17, 2025, a 4-month human study in Saudi Arabia involving 80 healthy adults showed that consuming omega-3 DHA-enriched chicken and eggs four times weekly raised the Omega-3 Index by 0.9%, with a fourfold increase in participants reaching protective levels (>6%). Conducted by King Abdulaziz University and RCSI, and sponsored by Mara Renewables, the study highlights the role of functional foods in supporting cardiovascular and cognitive health within Saudi Arabia’s dietary supplements and fortified foods market. Vitamins, omega-3 capsules, probiotics, and mineral blends are becoming part of daily intake patterns among both men and women, with particularly strong traction in the 25–45 age bracket. The influence of digital platforms has accelerated awareness, with influencers, nutritionists, and medical professionals using social media to explain the benefits of routine supplementation. Importantly, cultural openness to global health trends has made international brands more welcome in the market. As consumers gain familiarity with ingredient benefits and product formats, the Saudi Arabia dietary supplements market share continues to expand, particularly in urban centers such as Riyadh and Jeddah. Retailers report consistent interest in immune support, energy boosters, and supplements tailored to lifestyle-related deficiencies, establishing the category as a regular feature in Saudi health management behavior.

To get more information on this market Request Sample

Expansion of Distribution Infrastructure and Brand Localization

Modernization of the retail ecosystem in Saudi Arabia has opened new pathways for dietary supplement accessibility. Pharmacies remain the leading point of purchase, but hypermarkets, wellness boutiques, and digitally native platforms have gained prominence. With increasing consumer demand for convenience, online platforms have optimized mobile-first interfaces and subscription plans, enabling repeat purchases without physical interaction. These developments have created favorable conditions for Saudi Arabia dietary supplements market growth, particularly by connecting health-conscious consumers with relevant products in more engaging and accessible ways. Simultaneously, large-scale investments in supply chain systems have improved distribution speed, regional availability, and stock consistency. Global brands are also partnering with local players to adapt packaging, language, and formulations to regional preferences. This tailored approach has improved consumer trust and deepened brand penetration. The rise of wellness-focused retail zones in malls and commercial hubs has further contributed to visibility. As both local and international players continue to refine go-to-market strategies, the Saudi Arabia dietary supplements market outlook remains promising. On January 13, 2025, Global Edge announced its participation in Arab Health 2025 to introduce three international healthcare brands focused on natural plant-based nutrition, healthy aging, and dietary supplements to the Middle East. The initiative aims to meet growing demand for wellness products driven by lifestyle-related health issues and rising consumer interest in natural solutions. With the UAE’s health and wellness retail market projected to reach USD 2.57 Billion by 2025, the move reflects broader momentum in the dietary supplements market across the Gulf region, including Saudi Arabia. Local manufacturing support and regulatory clarity are expected to enhance product availability, while digital expansion ensures broad market reach and stronger brand-consumer relationships.

Saudi Arabia Dietary Supplements Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product type, form, distribution channel, application, and end-use.

Product Type Insights:

- Vitamin and Mineral Dietary Supplements

- Herbal Dietary Supplements

- Protein Dietary Supplements

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes vitamin and mineral dietary supplements, herbal dietary supplements, protein dietary supplements, and others.

Form Insights:

- Tablets

- Capsules

- Powders

- Liquids

- Soft Gels

- Gel Caps

The report has provided a detailed breakup and analysis of the market based on the form. This includes tablets, capsules, powders, liquids, soft gels, and gel caps.

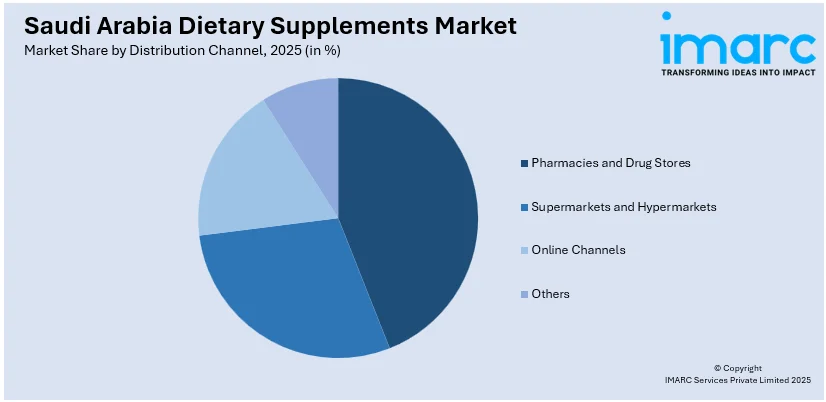

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Pharmacies and Drug Stores

- Supermarkets and Hypermarkets

- Online Channels

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes pharmacies and drug stores, supermarkets and hypermarkets, online channels, and others.

Application Insights:

- Additional Supplements

- Medicinal Supplement

- Sports Nutrition

The report has provided a detailed breakup and analysis of the market based on the application. This includes additional supplements, medicinal supplement, and sports nutrition.

End-Use Insights:

- Infant

- Children

- Adults

- Pregnant Women

- Old-Aged

The report has provided a detailed breakup and analysis of the market based on the end-use. This includes infant, children, adults, pregnant women, and old-aged.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Dietary Supplements Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Vitamin and Mineral Dietary Supplements, Herbal Dietary Supplements, Protein Dietary Supplements, Others |

| Forms Covered | Tablets, Capsules, Powders, Liquids, Soft Gels, Gel Caps |

| Distribution Channels Covered | Pharmacies and Drug Stores, Supermarkets and Hypermarkets, Online Channels, Others |

| Applications Covered | Additional Supplements, Medicinal Supplement, Sports Nutrition |

| End-Uses Covered | Infant, Children, Adults, Pregnant Women, Old-Aged |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia dietary supplements market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia dietary supplements market on the basis of product type?

- What is the breakup of the Saudi Arabia dietary supplements market on the basis of form?

- What is the breakup of the Saudi Arabia dietary supplements market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia dietary supplements market on the basis of application?

- What is the breakup of the Saudi Arabia dietary supplements market on the basis of end-use?

- What is the breakup of the Saudi Arabia dietary supplements market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia dietary supplements market?

- What are the key driving factors and challenges in the Saudi Arabia dietary supplements market?

- What is the structure of the Saudi Arabia dietary supplements market and who are the key players?

- What is the degree of competition in the Saudi Arabia dietary supplements market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia dietary supplements market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia dietary supplements market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia dietary supplements industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)