Saudi Arabia Diethylene Glycol (DEG) Market Size, Share, Trends and Forecast by Application, End Use Industry, and Region, 2026-2034

Saudi Arabia Diethylene Glycol (DEG) Market Overview:

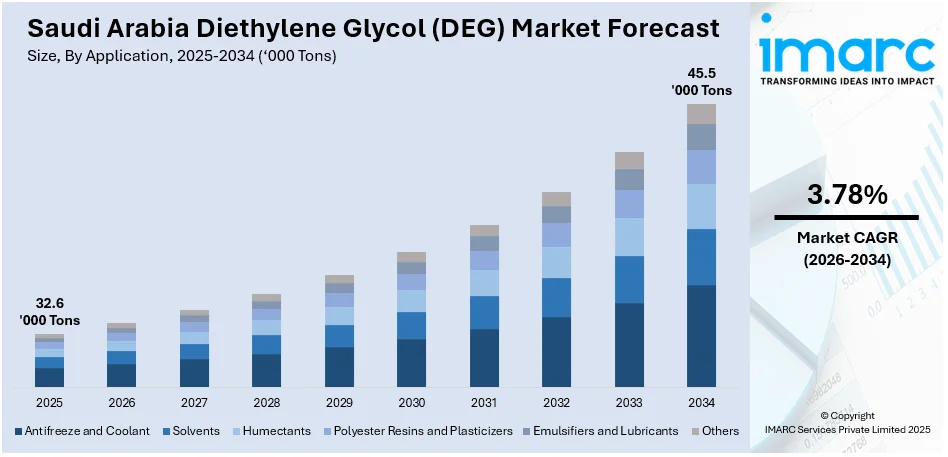

The Saudi Arabia diethylene glycol (DEG) market size reached 32.6 Thousand Tons in 2025. Looking forward, IMARC Group expects the market to reach 45.5 Thousand Tons by 2034, exhibiting a growth rate (CAGR) of 3.78% during 2026-2034. The market is experiencing growth due to the increasing demand from the textile industry. It is also benefiting from innovations in the chemical and petrochemical sectors, driving further consumption. Additionally, growing advancements in the automotive and consumer goods industries are expanding the Saudi Arabia diethylene glycol (DEG) market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 32.6 Thousand Tons |

| Market Forecast in 2034 | 45.5 Thousand Tons |

| Market Growth Rate 2026-2034 | 3.78% |

Saudi Arabia Diethylene Glycol (DEG) Market Trends:

Increasing Demand from Textile Industry

The market for diethylene glycol (DEG) in Saudi Arabia is driven by the increasing usage of the chemical in the textiles industry. DEG is an essential component extensively used to make polyester fibers that are essential for the production of textiles. Since the country's textile industry is focusing on innovations and improvement in product quality owing to the rising use of synthetic fibers, demand for DEG is increasing at a steady pace. Producers are constantly embracing modern technologies that involve the use of DEG during the processing of fibers to increase their durability and flexibility. In response to the increasing focus on economical and long-lasting textile products, the application of DEG is also maximized. Moreover, Saudi Arabia's position as an important player in the international supply chain of the textile industry is catalyzing the DEG demand. Therefore, the textile industry's growth trajectory is directly influencing the sustained demand for DEG in the country. The IMARC Group predicts that the Saudia Arabia textile market size is expected to attain USD 12.9 Billion by 2033.

To get more information on this market Request Sample

Expanding Chemical and Petrochemical Innovations

The rise in innovations in the chemical and petrochemical industries in the country is impelling the Saudi Arabia diethylene glycol (DEG) market growth. Since the country is committing to diversifying its industrial base through extensive investments, the production of DEG is growing. DEG is also employed as a solvent in many chemical processes. Saudi Arabia's petrochemical and chemical industries are constantly creating innovative and effective products, and DEG is a vital ingredient in the production of antifreeze agents, coatings, and resins. As government Vision 2030 improves the growth of the non-oil industrial sectors, the applications of DEG are growing in various industries, catalyzing its demand. Saudi Arabian petrochemical producers are investing in newer technologies to enhance DEG production. They are also enhancing supply chain effectiveness to ensure a steady flow of products to meet the growing industrial needs. In 2024, Hector Casas, the principal at Arthur D. Little Middle East, pointed out during a conference with Arab News that the petrochemical capability of Saudi Arabia's is projected to "double within the next 5 years, from around 75 million tons per annum to over 140 million tons per annum."

Growth in Automotive and Consumer Goods Sectors

The increasing application of DEG in the automotive and consumer goods sectors is contributing to the market growth. DEG is widely used in the automotive industry, particularly in antifreeze and coolant formulations, which are crucial for vehicle maintenance and performance. As the automotive industry in Saudi Arabia is advancing with a rise in vehicle sales, the demand for DEG-based products is increasing. Additionally, DEG is used in the production of various consumer goods, such as paints, coatings, and personal care products, which are experiencing higher consumption levels as living standards improve. As the country's consumer market continues to evolve, the demand for products incorporating DEG is steadily growing, thereby driving the market in Saudi Arabia.

Saudi Arabia Diethylene Glycol (DEG) Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on application and end use industry.

Application Insights:

- Antifreeze and Coolant

- Solvents

- Humectants

- Polyester Resins and Plasticizers

- Emulsifiers and Lubricants

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes antifreeze and coolant, solvents, humectants, polyester resins and plasticizers, emulsifiers and lubricants, and others.

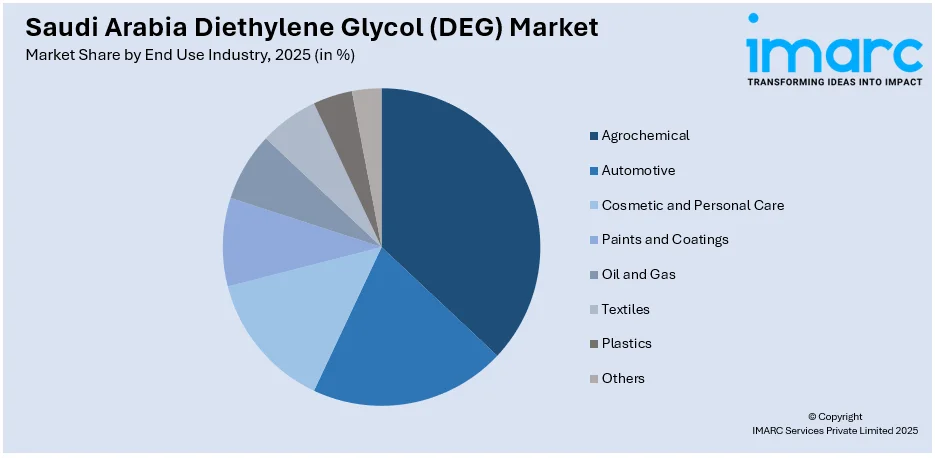

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Agrochemical

- Automotive

- Cosmetic and Personal Care

- Paints and Coatings

- Oil and Gas

- Textiles

- Plastics

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes agrochemical, automotive, cosmetic and personal care, paints and coatings, oil and gas, textiles, plastics, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Diethylene Glycol (DEG) Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Thousand Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Antifreeze and Coolant, Solvents, Humectants, Polyester Resins and Plasticizers, Emulsifiers and Lubricants, Others |

| End Use Industries Covered | Agrochemical, Automotive, Cosmetic and Personal Care, Paints and Coatings, Oil and Gas, Textiles, Plastics, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia diethylene glycol (DEG) market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia diethylene glycol (DEG) market on the basis of application?

- What is the breakup of the Saudi Arabia diethylene glycol (DEG) market on the basis of end use industry?

- What is the breakup of the Saudi Arabia diethylene glycol (DEG) market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia diethylene glycol (DEG) market?

- What are the key driving factors and challenges in the Saudi Arabia diethylene glycol (DEG) market?

- What is the structure of the Saudi Arabia diethylene glycol (DEG) market and who are the key players?

- What is the degree of competition in the Saudi Arabia diethylene glycol (DEG) market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia diethylene glycol (DEG) market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia diethylene glycol (DEG) market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia diethylene glycol (DEG) industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)