Saudi Arabia Digital Asset Management Market Size, Share, Trends and Forecast by Type, Component, Application, Deployment, Organization Size, End-Use Sector, and Region, 2026-2034

Saudi Arabia Digital Asset Management Market Summary:

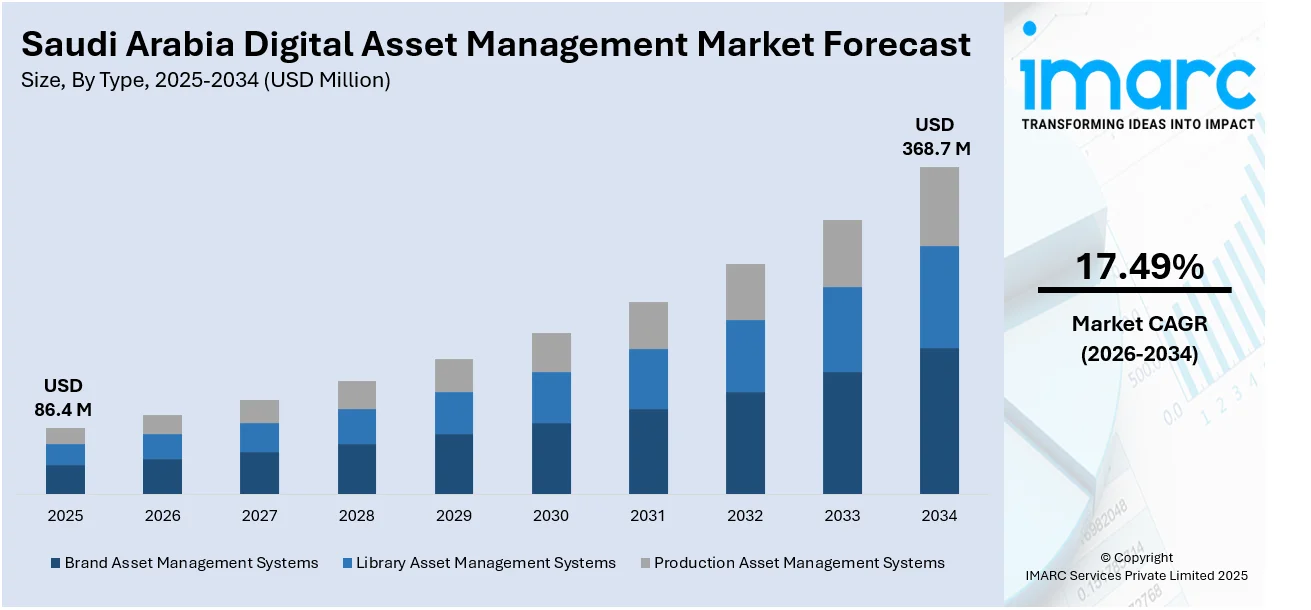

The Saudi Arabia digital asset management market size was valued at USD 86.42 Million in 2025 and is projected to reach USD 368.74 Million by 2034, growing at a compound annual growth rate of 17.49% from 2026-2034.

The Saudi Arabia market is experiencing robust growth driven by the Kingdom's ambitious Vision 2030 digital transformation agenda, government mandates for cloud-first strategies, and escalating demand for centralized content management systems across enterprises. Organizations are rapidly adopting digital asset management (DAM) solutions to safeguard sensitive digital assets, ensure regulatory compliance, and streamline content workflows across increasingly complex multichannel marketing environments. The convergence of cloud infrastructure investments, artificial intelligence (AI) integration initiatives, and expanding media production capabilities is expanding the Saudi Arabia digital asset management market share.

Key Takeaways and Insights:

- By Type: Brand asset management systems dominate the market with a share of 38.06% in 2025, driven by heightened focus on brand consistency across digital channels and stringent content governance requirements.

- By Component: Solution leads with 63.68% market share in 2025, reflecting comprehensive demand for integrated platforms rather than standalone services.

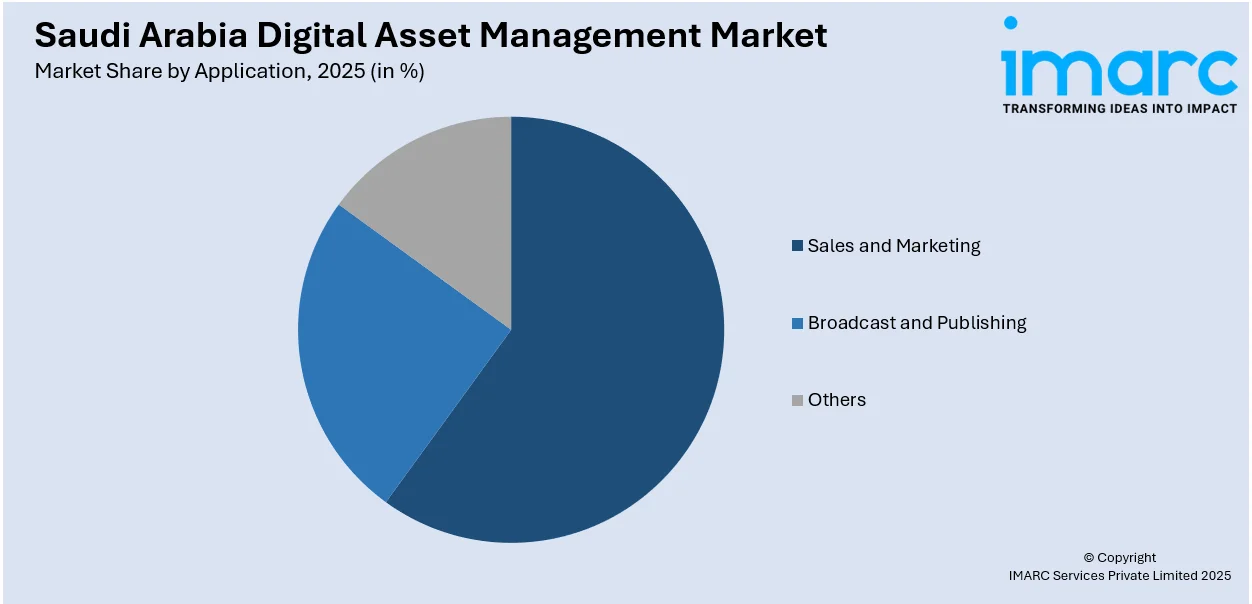

- By Application: Sales and marketing represent 46.79% share in 2025, fueled by the Kingdom's youthful, digitally-engaged population and rapid e-commerce expansion.

- By Deployment: Cloud holds 59.05% market share in 2025, accelerated by government Cloud First policy mandates and data sovereignty requirements.

- By Organization Size: Large enterprises account for 62.1% share in 2025, as large companies focus on top-tier security, compliance capabilities, and growth potential.

- By End-Use Sector: Media and entertainment sector represents 37.68% market share in 2025, supported by substantial government investments in content creation infrastructure.

- Key Players: The Saudi Arabia digital asset management market exhibits moderate competitive intensity, with global enterprise software providers competing alongside regional technology integrators across pricing tiers and deployment models.

To get more information on this market, Request Sample

The Saudi Arabia digital asset management market is fundamentally shaped by the Kingdom's ambitious economic diversification initiatives under Vision 2030. Organizations across sectors face mounting pressure to digitize operations while navigating stringent data protection regulations and cybersecurity requirements. The market benefits from unprecedented government support for digital infrastructure, with the establishment of specialized cloud computing economic zones and substantial investments in AI capabilities. Saudi Arabia's ranking as first in the United Nations Global Cybersecurity Index in 2024 underscores the critical importance of secure content management systems. With over 97% of government services digitized and the Kingdom climbing to fourth position globally in the UN E-Government Development Index, public sector demand for DAM solutions continues to accelerate. The convergence of high internet penetration, young demographics, and expanding content creation ecosystems creates favorable conditions for sustained DAM adoption across both public and private sectors.

Saudi Arabia Digital Asset Management Market Trends:

Accelerated Cloud-Based DAM Adoption

Cloud deployment is rapidly becoming the dominant infrastructure model for digital asset management in Saudi Arabia, driven by government mandates and enterprise digital transformation initiatives. The Cloud First policy, implemented in 2020, requires civilian government entities to prioritize cloud solutions over traditional on-premise systems for all new IT investments. This regulatory push has catalyzed widespread cloud adoption across the private sector as well. In December 2024, Microsoft completed construction of three data center facilities in Saudi Arabia's Eastern Province scheduled to launch in 2026, while Amazon Web Services announced a USD 5.3 billion investment for a new cloud infrastructure region in the Kingdom. These hyperscale investments demonstrate strong confidence in Saudi Arabia's cloud computing trajectory and provide the foundational infrastructure necessary for scalable DAM deployment.

AI-Powered Content Management Integration

Artificial intelligence is increasingly being integrated into digital asset management platforms to enhance metadata tagging, content categorization, and intelligent search capabilities. Saudi Arabia's commitment to AI leadership is evident in its ranking as first among Arab countries in Tortoise Media's Government Strategy Index for Artificial Intelligence in 2024. Government spending on AI is projected to reach USD 40 billion in 2025, supporting development of next-generation content management capabilities. In May 2025, the Saudi government launched the HUMAIN project, an AI startup backed by the Public Investment Fund focused on developing AI data center infrastructure. This initiative exemplifies how AI is being embedded into the Kingdom's digital ecosystem, enabling organizations to process vast content libraries more efficiently while improving asset discoverability and enabling automated workflow optimization across marketing and production teams.

Media and Entertainment Sector Digital Transformation

The media and entertainment industry is undergoing dramatic expansion in Saudi Arabia, creating substantial demand for sophisticated digital asset management systems. The General Authority for Media Regulation projects the Kingdom's media sector will contribute approximately USD 12 billion to national GDP by 2030, effectively doubling from USD 6 billion in 2023. Media-related employment reached 67,000 positions at the end of 2024, representing 22% year-over-year growth. To support this expansion, the Cultural Development Fund launched a USD 234 million film financing program promoting investment in digital content creation infrastructure. Production companies, broadcasters, and digital content creators require robust DAM platforms to manage growing volumes of high-resolution video, audio, graphics, and other multimedia assets throughout complex production workflows and distribution channels.

How Vision 2030 is Transforming the Saudi Arabia Digital Asset Management Market:

Saudi Vision 2030 is playing a major role in transforming the Digital Asset Management (DAM) market in Saudi Arabia by accelerating digitalization across industries. As the Kingdom invests heavily in media, entertainment, tourism, and smart city projects, the volume of digital content being created is expanding rapidly. Organizations are increasingly adopting DAM platforms to manage, store, and distribute videos, images, marketing materials, and corporate content efficiently. Vision 2030’s focus on building a modern digital economy is also driving demand for advanced cloud-based technologies, secure data management, and improved collaboration tools. Government-led initiatives supporting cultural development, international events, and digital transformation are further boosting adoption among public and private sectors. Media companies, tourism operators, and enterprises require DAM solutions to ensure consistent branding, protect intellectual property, and enable faster multi-channel delivery. With ongoing infrastructure modernization and rising content production, Vision 2030 continues to strengthen the growth outlook for the Saudi Arabia DAM market.

Market Outlook 2026-2034:

The Saudi Arabia digital asset management market is positioned for sustained expansion through the forecast period as organizations progressively embrace comprehensive digital transformation strategies. Government initiatives including the revised Digital Government Strategy and ambitious data center infrastructure projects will continue driving demand for cloud-based DAM solutions. The market generated a revenue of USD 86.42 Million in 2025 and is projected to reach a revenue of USD 368.74 Million by 2034, growing at a compound annual growth rate of 17.49% from 2026-2034. The convergence of AI capabilities, expanding media production ecosystems, and heightened cybersecurity requirements will elevate the sophistication of DAM platforms deployed across the Kingdom. With hyperscale technology providers establishing local presence and the government targeting positioning among the top three countries globally in digital government maturity by 2030, the foundational infrastructure supporting DAM adoption continues strengthening.

Saudi Arabia Digital Asset Management Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Brand Asset Management System |

38.06% |

|

Component |

Solution |

63.68% |

|

Application |

Sales and Marketing |

46.79% |

|

Deployment |

Cloud |

59.05% |

|

Organization Size |

Large Enterprises |

62.1% |

|

End-Use Sector |

Media and Entertainment |

37.68% |

Type Insights:

- Brand Asset Management Systems

- Library Asset Management Systems

- Production Asset Management Systems

Brand asset management systems dominate with a market share of 38.06% of the total Saudi Arabia digital asset management market in 2025.

Brand asset management systems lead the Saudi Arabia digital asset management market as organizations prioritize maintaining consistent brand identity across rapidly proliferating digital channels. The segment's dominance reflects enterprises' focus on centralized control over brand assets including logos, marketing collateral, product imagery, and approved messaging templates. With digital advertising expenditure increasing as companies shift budgets from traditional to digital channels, marketing teams require sophisticated platforms ensuring brand consistency while enabling rapid campaign deployment. The Kingdom's youthful populationdemonstrates high engagement with social media platforms including Instagram, Snapchat, and YouTube, compelling brands to maintain rigorous asset governance across diverse content formats.

Brand asset management adoption is further accelerated by government digital content development programs that allocated funds in 2024 to support local content creation initiatives. Organizations recognize that brand equity built through substantial marketing investments can be jeopardized by inconsistent asset usage, unauthorized modifications, or outdated collateral distribution. Enterprise brand teams increasingly demand DAM solutions featuring granular permission controls, automated approval workflows, and comprehensive usage analytics. The convergence of omnichannel marketing strategies, heightened competitive pressure, and expanding digital touchpoints positions brand asset management as the most critical DAM category for Saudi organizations seeking to maximize return on marketing investments while protecting brand integrity.

Component Insights:

- Solution

- Services

- Consulting

- System Integration

- Support and Maintenance

Solution leads with a share of 63.68% of the total Saudi Arabia digital asset management market in 2025.

The solutions component dominates Saudi Arabia's digital asset management market as organizations seek comprehensive integrated platforms rather than fragmented point services. This preference reflects the complexity of enterprise content management requirements spanning storage, metadata management, workflow automation, rights management, and distribution capabilities. The government Cloud First policy implemented in 2020 mandates that civilian entities prioritize integrated cloud solutions, driving solution sales over standalone consulting or implementation services. A major percentage of government services have been digitized, requiring sophisticated DAM platforms supporting complex compliance, multilingual content management, and seamless integration with e-government infrastructure.

Enterprise buyers increasingly favor solution packages offering immediate deployment capabilities, pre-configured workflows, and comprehensive feature sets addressing diverse use cases from marketing campaign management to legal document archiving. Large enterprises conducting active cloud migration projects demand proven solutions minimizing implementation risk and accelerating time-to-value. The solutions segment benefits from recurring subscription revenue models aligned with cloud deployment preferences, providing vendors with predictable income streams while enabling customers to scale infrastructure dynamically based on evolving content volume requirements and organizational growth trajectories.

Application Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Sales and Marketing

- Broadcast and Publishing

- Others

Sales and marketing exhibit a clear dominance with a 46.79% share of the total Saudi Arabia digital asset management market in 2025.

Sales and marketing teams represent the primary users of digital asset management systems in Saudi Arabia, driven by the Kingdom's dynamic consumer economy and rapid e-commerce expansion. Online retail sales increased, reflecting consumers' accelerated digital adoption and preference for online purchasing channels. Marketing departments require centralized repositories enabling rapid access to product images, promotional videos, sales presentations, and campaign assets across geographically distributed teams. The Saudi population's status as one of the most engaged social media users compels marketers to maintain extensive libraries of platform-optimized content variants.

Organizations shift toward data-driven marketing strategies necessitates DAM platforms providing comprehensive analytics on asset performance, usage patterns, and campaign effectiveness. Sales teams increasingly depend on DAM systems for delivering personalized content to prospects, accessing updated product collateral, and maintaining brand consistency across customer touchpoints. As enterprises expand multichannel marketing operations encompassing traditional media, digital advertising, social platforms, and emerging channels, the imperative for centralized marketing asset management intensifies. Marketing organizations' budgets for digital infrastructure continue expanding in alignment with rising content production volumes and increasingly sophisticated customer engagement strategies.

Deployment Insights:

- On-premises

- Cloud

Cloud leads with a share of 59.05% of the total Saudi Arabia digital asset management market in 2025.

Cloud deployment dominates the Saudi Arabia digital asset management market driven by government mandates, infrastructure investments, and operational advantages over traditional on-premise systems. The Cloud First policy requires civilian government entities to prioritize cloud solutions for new IT investments, creating strong regulatory tailwinds for cloud-based DAM adoption. This policy framework ensures government buyers, representing substantial market share, default to cloud platforms absent compelling technical justifications for on-premise alternatives. The establishment of the Cloud Computing Special Economic Zone in 2023 provides a flexible regulatory framework specifically designed to attract international cloud service providers while supporting domestic innovation.

Hyperscale technology providers have committed unprecedented capital to Saudi Arabia cloud infrastructure, with Amazon Web Services announcing investing for a new cloud region and Microsoft completing construction of three data center facilities in 2024. These investments provide the foundational infrastructure supporting enterprise-grade cloud DAM deployments with requisite performance, security, and compliance capabilities. Organizations favor cloud deployment for its flexibility, scalability, reduced capital expenditure requirements, and ability to support remote workforce collaboration, increasingly important as enterprises adopt hybrid work models. Data sovereignty requirements are addressed through in-country cloud regions enabling organizations to maintain compliance with local data protection regulations while accessing global cloud platform capabilities and innovation.

Organization Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

Large enterprises exhibit a clear dominance with a 62.1% share of the total Saudi Arabia digital asset management market in 2025.

Large enterprises represent the primary adopters of digital asset management solutions in Saudi Arabia, reflecting their complex content management requirements, substantial digital asset volumes, and regulatory compliance obligations. Major corporations operating across sectors including banking, telecommunications, energy, healthcare, and retail generate vast quantities of digital content requiring centralized management, version control, and governed distribution. Large organizations face heightened regulatory scrutiny under frameworks including the Personal Data Protection Law and National Cybersecurity Authority's Essential Cybersecurity Controls, necessitating enterprise-grade DAM platforms with comprehensive audit trails, access controls, and data protection features.

The segment benefits from large enterprises' substantial IT budgets enabling investment in sophisticated platforms, professional implementation services, and ongoing optimization initiatives. Major Saudi corporations increasingly recognize digital assets as strategic resources requiring professional management disciplines paralleling physical and financial asset governance. Large enterprises' complex organizational structures spanning multiple divisions, geographies, and brands demand DAM platforms supporting granular permission structures, workflow customization, and extensive integration capabilities with marketing automation, customer relationship management, and enterprise resource planning systems. As Saudi Arabia's largest corporations pursue digital transformation initiatives aligned with Vision 2030 objectives, investment in professional digital asset management infrastructure represents a foundational enabler of broader modernization agendas.

End-Use Sector Insights:

- Media and Entertainment

- Banking, Financial Services and Insurance (BFSI)

- Retail

- Manufacturing

- Healthcare and Life Sciences

- Education

- Travel and Tourism

- Others

Media and entertainment lead with a share of 37.68% of the total Saudi Arabia digital asset management market in 2025.

Media and entertainment represent the largest end-use segment in the Saudi Arabia Digital Asset Management (DAM) market, driven by the country’s rapidly expanding digital content industry. With major investments under Vision 2030 in film production, streaming platforms, gaming, and live entertainment, organizations are generating high volumes of digital assets, including videos, promotional creatives, audio files, and branded materials. Managing this growing content library efficiently has become essential for broadcasters, studios, and event organizers, making DAM solutions a critical tool for storage, retrieval, and secure distribution.

The segment’s dominance is also supported by rising demand for localized Arabic content, increasing social media engagement, and the need for faster multi-channel publishing. Media companies in Saudi Arabia are adopting DAM platforms to streamline collaboration across production teams, ensure consistent branding, and protect intellectual property through controlled access and rights management. As the entertainment ecosystem matures with new cinemas, festivals, and digital campaigns, DAM adoption in this sector is expected to remain strong, reinforcing its leading role in the country’s market growth.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Saudi Arabia, anchored by Riyadh, is a major hub for government, corporate, and media activities. High adoption of digital technologies and increasing investments in smart infrastructure are driving demand for Digital Asset Management solutions across enterprises, supporting efficient content storage, brand management, and collaboration.

The Western Region, home to Jeddah and Makkah, benefits from strong tourism, hospitality, and event-driven economic activity. Growing entertainment projects and cultural initiatives increase the need for managing large volumes of digital content. DAM platforms support marketing campaigns, media production, and secure distribution across stakeholders.

The Eastern Region, led by Dammam and Khobar, is dominated by the oil and gas sector and industrial enterprises. Companies are increasingly adopting DAM systems to manage technical documentation, corporate branding assets, and digital communications. Expanding industrial digitization and business modernization strengthen regional market growth.

Southern Saudi Arabia is witnessing gradual digital transformation supported by infrastructure development and regional economic diversification. With rising adoption in education, government services, and local businesses, demand for Digital Asset Management tools is growing. DAM solutions help organize digital resources, improve access, and enable consistent communication.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Digital Asset Management Market Growing?

Vision 2030 Digital Transformation Mandate

Saudi Arabia's comprehensive Vision 2030 initiative establishes digital transformation as a fundamental pillar of national economic diversification strategy, creating sustained demand for digital asset management infrastructure across public and private sectors. The government successfully digitized a major percentage of government services by 2024, representing one of the world's most aggressive digitization campaigns and necessitating sophisticated content management capabilities supporting diverse service delivery channels. Saudi Arabia's remarkable progression in the UN E-Government Development Index reflects systematic investment in digital infrastructure, governance frameworks, and supporting technologies including DAM platforms. The Kingdom allocated more than USD 10 billion to information and communications technology infrastructure in 2024, representing an increase from the previous year and underscoring government commitment to digital ecosystem development.

Expanding Data Center and Cloud Infrastructure

The rapid expansion of hyperscale data center infrastructure and cloud computing capabilities in Saudi Arabia provides the foundational technology supporting widespread digital asset management adoption. IMARC Group predicts that Saudi Arabia data center market is projected to grow from USD 2.43 Billion in 2024 to USD 8.49 Billion by 2034 at a compound annual growth rate of 14.93%, representing unprecedented infrastructure investment creating favorable conditions for cloud-based DAM deployment. In 2024, ICS Arabia commenced construction on the Desert Dragon data center project representing USD 1.9 billion investment across multiple Saudi cities including Riyadh, Jeddah, Dammam, and NEOM, with first phase operations expected by March 2026. These hyperscale facilities provide the computing power, storage capacity, and network connectivity necessary for managing increasingly large digital asset libraries and supporting bandwidth-intensive operations including high-resolution video processing and AI-powered content analysis.

Growing Demand for Brand Consistency in Digital Economy

Organizations face mounting pressure to maintain rigorous brand consistency across proliferating digital channels, driving investment in centralized digital asset management platforms enabling controlled content distribution and governance. Saudi Arabia's digital content creation market is experiencing rapid growth, reflecting organizations' accelerating content production to serve diverse marketing channels, customer touchpoints, and digital experiences. The Kingdom's young demographic comprising 70% of citizens under the age of 35 demonstrates exceptionally high digital engagement, with mobile connections creating dynamic consumer markets demanding sophisticated brand experiences.

Market Restraints:

What Challenges the Saudi Arabia Digital Asset Management Market is Facing?

Data Security and Compliance Complexity

Organizations face significant challenges navigating increasingly complex cybersecurity threats and regulatory compliance requirements when implementing digital asset management systems. Cyberattacks in Saudi Arabia increased in 2024, leading to substantial financial losses and reputational damage for affected businesses while heightening executive concern regarding digital infrastructure security. Organizations must ensure DAM platforms incorporate comprehensive security controls including encryption, access management, audit logging, and threat detection capabilities addressing sophisticated attack vectors. The regulatory landscape adds complexity, with companies required to demonstrate compliance with frameworks including the Personal Data Protection Law, National Cybersecurity Authority's Essential Cybersecurity Controls, and Critical Systems Cybersecurity Controls. These requirements necessitate substantial investment in security infrastructure, compliance monitoring, and professional expertise, creating adoption barriers particularly for mid-market organizations with limited cybersecurity resources.

Integration with Legacy Systems

Saudi organizations struggle with aligning new digital asset management platforms with existing enterprise systems including customer relationship management, marketing automation, enterprise resource planning, and content management systems. Innumerable of companies globally report significant difficulty integrating DAM solutions with existing technology infrastructure, with challenges including incompatible data formats, conflicting workflow logic, limited API capabilities, and insufficient technical documentation. Legacy on-premise systems deployed by Saudi enterprises over previous decades often lack modern integration capabilities, requiring custom development, middleware deployment, or complete system replacement. Organizations face risk of creating disconnected technology silos undermining DAM investment value when platforms cannot seamlessly exchange data with systems used by marketing, sales, product management, and customer service teams requiring asset access.

Skilled Workforce Shortage

The Saudi Arabia digital asset management market faces constrained growth due to insufficient availability of qualified professionals possessing expertise in DAM platform configuration, content workflow optimization, metadata management, and ongoing system administration. The Saudi Technical and Vocational Training Corporation revealed a 25% shortage of skilled engineers and technicians in data center operations and advanced technologies at the beginning of 2024, with the gap particularly acute for specialized roles including DAM administrators and digital content managers. Organizations report difficulty recruiting personnel with combined expertise spanning information technology, marketing operations, and content production, the interdisciplinary skill set necessary for effective DAM implementation. This talent constraint limits adoption rates, extends implementation timelines, and elevates operating costs as organizations compete for limited qualified professionals.

Competitive Landscape:

The Saudi Arabia digital asset management market exhibits moderate competitive intensity, with global enterprise software providers competing alongside regional technology integrators and emerging local specialists. Major international vendors leverage established platforms, extensive partner ecosystems, and brand recognition built through global customer deployments to capture enterprise customers. These providers benefit from comprehensive feature sets supporting diverse use cases, proven scalability, and integration capabilities with widely-deployed enterprise applications. Regional system integrators focus on implementation services, localization capabilities, and customer support optimized for Saudi organizations' specific requirements including Arabic language support and cultural considerations. Emerging local technology companies target specific vertical markets or deployment scenarios where they can differentiate through specialized functionality or competitive pricing. Cloud infrastructure providers are increasingly bundling basic DAM capabilities within broader platform offerings, creating indirect competitive pressure on standalone solutions. Organizations evaluate vendors based on security certifications, compliance capabilities, scalability, integration options, pricing models, and proven track records managing mission-critical content repositories.

Recent Developments:

- In January 2026, Investcorp Saudi Arabia Financial Investments Company (alongside its affiliates, “Investcorp”), a prominent global alternative investment manager, has expanded its digital platform services via a distribution agreement with Stake, the top digital real-estate investment platform in the MENA region. The collaboration offers investors the chance to explore chosen global real estate options through the Stake digital app, merging Investcorp’s institutional investment proficiency and thorough due diligence with Stake’s superior technology-driven user experience.

- In October 2025, Saudi fintech company Sarmad has introduced thamar, a platform aimed at enhancing the digital customer experience for asset management companies. The solution transforms both customer and employee activities into digital form, links asset managers with distributors, and aids in regulatory compliance to enhance operations. Its goal is to deliver a smooth experience for investors while improving distribution abilities. In line with the Financial Sector Development Program as part of Vision 2030, thamar promotes initiatives to enhance investment literacy and foster a more inclusive, digital economy.

Saudi Arabia Digital Asset Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Brand Asset Management Systems, Library Asset Management Systems, Production Asset Management Systems |

| Components Covered |

|

| Applications Covered | Sales and Marketing, Broadcast and Publishing, Others |

| Deployments Covered | On-premises, Cloud |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| End-Use Sectors Covered | Media and Entertainment, Banking, Financial Services and Insurance (BFSI), Retail, Manufacturing, Healthcare and Life Sciences, Education, Travel and Tourism, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia digital asset management market size was valued at USD 86.42 Million in 2025.

The Saudi Arabia digital asset management market is expected to grow at a compound annual growth rate of 17.49% from 2026-2034 to reach USD 368.74 Million by 2034.

Brand asset management systems dominated the market with approximately 38.06% share in 2025, driven by organizations' focus on maintaining consistent brand identity across proliferating digital channels. The segment benefits from heightened marketing investment in digital advertising, social media engagement, and omnichannel customer experiences requiring centralized brand asset governance and distribution controls.

Key factors driving the Saudi Arabia digital asset management market include Vision 2030's comprehensive digital transformation mandate driving government and enterprise digitization, rapid expansion of cloud infrastructure and data center capacity enabling scalable DAM deployment, and growing organizational focus on brand consistency across digital channels. Additional drivers include increasing content production volumes, regulatory compliance requirements, and integration of AI capabilities enhancing content management efficiency.

Major challenges include escalating cybersecurity threats and complex regulatory compliance requirements necessitating substantial security investments, difficulties integrating DAM platforms with existing enterprise systems and legacy infrastructure, talent shortages limiting availability of qualified DAM administrators and digital content managers, and organizations' hesitancy regarding substantial upfront implementation costs and change management requirements associated with enterprise DAM deployments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)