Saudi Arabia Digital Diabetes Management Market Size, Share, Trends and Forecast by Product Type, Device Type, and Region, 2026-2034

Saudi Arabia Digital Diabetes Management Market Overview:

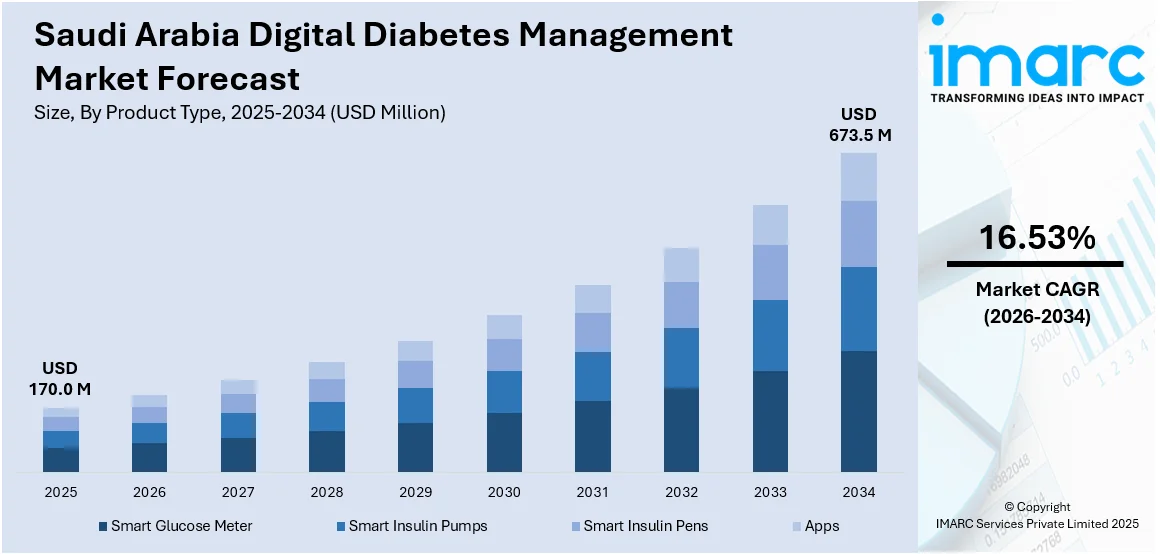

The Saudi Arabia digital diabetes management market size reached USD 170.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 673.5 Million by 2034, exhibiting a growth rate (CAGR) of 16.53% during 2026-2034. Rising diabetes prevalence, increasing smartphone penetration, expanding telemedicine adoption, government health initiatives, growing awareness of digital health tools, innovations in mobile apps, continuous glucose monitoring, and remote patient monitoring are factors bolstering the Saudi Arabia digital diabetes management market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 170.0 Million |

| Market Forecast in 2034 | USD 673.5 Million |

| Market Growth Rate 2026-2034 | 16.53% |

Saudi Arabia Digital Diabetes Management Market Trends:

Rising Prevalence of Diabetes in Saudi Arabia

Saudi Arabia is witnessing a sustained rise in diabetes incidence, positioning the disease as one of the country’s most pressing public health concerns. In 2024, Saudi Arabia faces a significant and growing diabetes burden. The prevalence of diabetes among adults aged 20–79 is projected to rise from 18.7% in 2021 to 21.4% by 2045 . Approximately 5.3 million adults are living with diabetes in the country. This increasing burden is placing significant strain on the healthcare system, prompting a shift toward more efficient, scalable management solutions. Digital diabetes tools, including glucose monitoring apps and telehealth consultations, are gaining traction as they enable early detection, routine tracking, and better glycemic control. Hospitals and clinics are under pressure to adopt digital platforms that can handle the growing caseload without overextending their infrastructure. Furthermore, public health authorities are encouraging preventive care approaches, accelerating demand for digital tools that support lifestyle management and long-term monitoring, which is driving the Saudi Arabia digital diabetes management market growth.

To get more information on this market Request Sample

Expanding Smartphone Penetration and Digital Infrastructure

Saudi Arabia’s high rate of smartphone usage provides a solid foundation for the growth of digital health applications, particularly in diabetes management. This widespread access enables seamless integration of app-based glucose tracking, lifestyle coaching, and medication reminders into users' daily routines. The country’s robust digital infrastructure, underpinned by strong fourth and fifth-generation (4G/5G) connectivity and ongoing cloud computing investments, supports real-time data synchronization and remote patient monitoring. Healthcare providers are capitalizing on this infrastructure to deploy mobile health platforms that connect patients with specialists and nutritionists, reducing the need for frequent in-person visits. Furthermore, increasing digital literacy among the general population enhances patient engagement, improving adherence to care plans. The alignment of digital infrastructure expansion with healthcare modernization efforts, particularly under Vision 2030, makes mobile-based diabetes solutions both viable and scalable across urban and rural populations.

Government-Led e-Health Initiatives and Reforms

The Saudi government has made digital transformation in healthcare a national priority, with a series of reforms and strategic initiatives accelerating the uptake of digital diabetes management tools. Through programs under Vision 2030 and the National Transformation Program, authorities are investing heavily in telemedicine platforms, electronic health records, and artificial intelligence (AI) driven health analytics. In line with this, the Ministry of Health has launched public awareness campaigns and mobile applications aimed at diabetes screening, self-care education, and virtual consultations. Regulatory support for digital health startups and partnerships with global med-tech companies are facilitating the rollout of certified digital diabetes products across healthcare settings.

Saudi Arabia Digital Diabetes Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on product type and device type.

Product Type Insights:

- Smart Glucose Meter

- Smart Insulin Pumps

- Smart Insulin Pens

- Apps

The report has provided a detailed breakup and analysis of the market based on the product type. This includes smart glucose meter, smart insulin pumps, smart insulin pens, and apps.

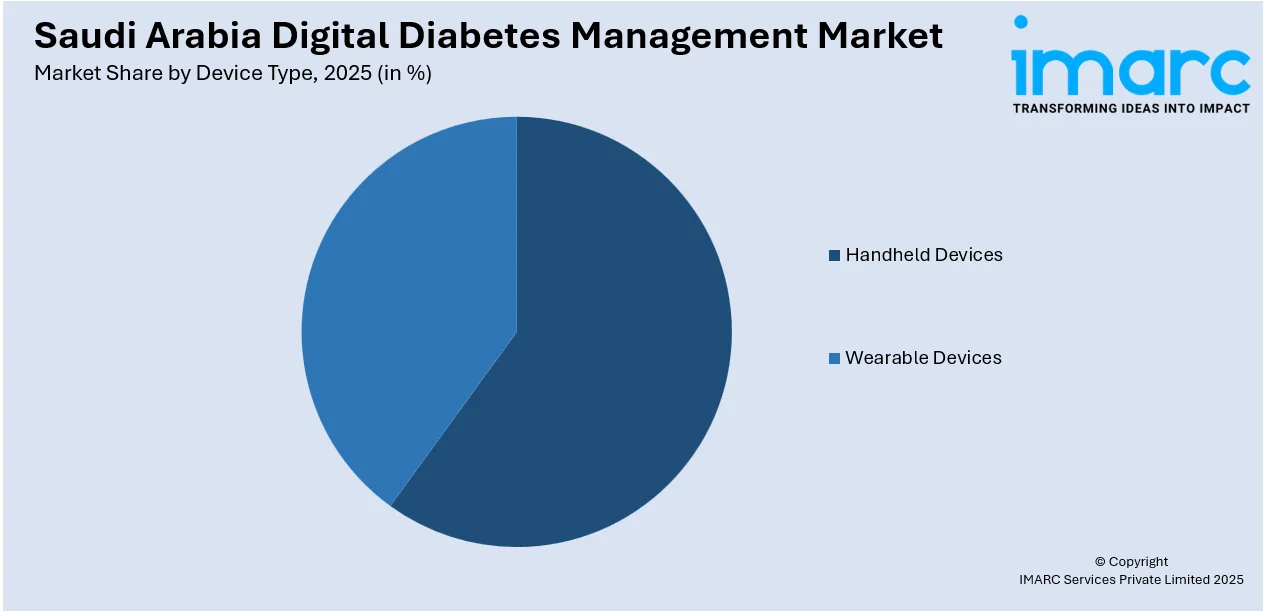

Device Type Insights:

Access the comprehensive market breakdown Request Sample

- Handheld Devices

- Wearable Devices

A detailed breakup and analysis of the market based on the device type have also been provided in the report. This includes handheld devices and wearable devices.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Digital Diabetes Management Market News:

- In 2024, Saudi Arabia’s the Ministry of Health signed a memorandum of understanding (MoU) with Ithnain, a prominent digital health coaching platform. This collaboration reflects the growing importance of innovation in tackling medical challenges and showcases the role of Saudi-founded ventures in supporting the goals of Vision 2030.

Saudi Arabia Digital Diabetes Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Smart Glucose Meter, Smart Insulin Pumps, Smart Insulin Pens, Apps |

| Device Types Covered | Handheld Devices, Wearable Devices |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia digital diabetes management market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia digital diabetes management market on the basis of product type?

- What is the breakup of the Saudi Arabia digital diabetes management market on the basis of device type?

- What is the breakup of the Saudi Arabia digital diabetes management market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia digital diabetes management market?

- What are the key driving factors and challenges in the Saudi Arabia digital diabetes management market?

- What is the structure of the Saudi Arabia digital diabetes management market and who are the key players?

- What is the degree of competition in the Saudi Arabia digital diabetes management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia digital diabetes management market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia digital diabetes management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia digital diabetes management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)