Saudi Arabia Digital OOH Advertising Market Size, Share, Trends and Forecast by Format Type, Application, End Use Industry, and Region, 2026-2034

Saudi Arabia Digital OOH Advertising Market Size and Share:

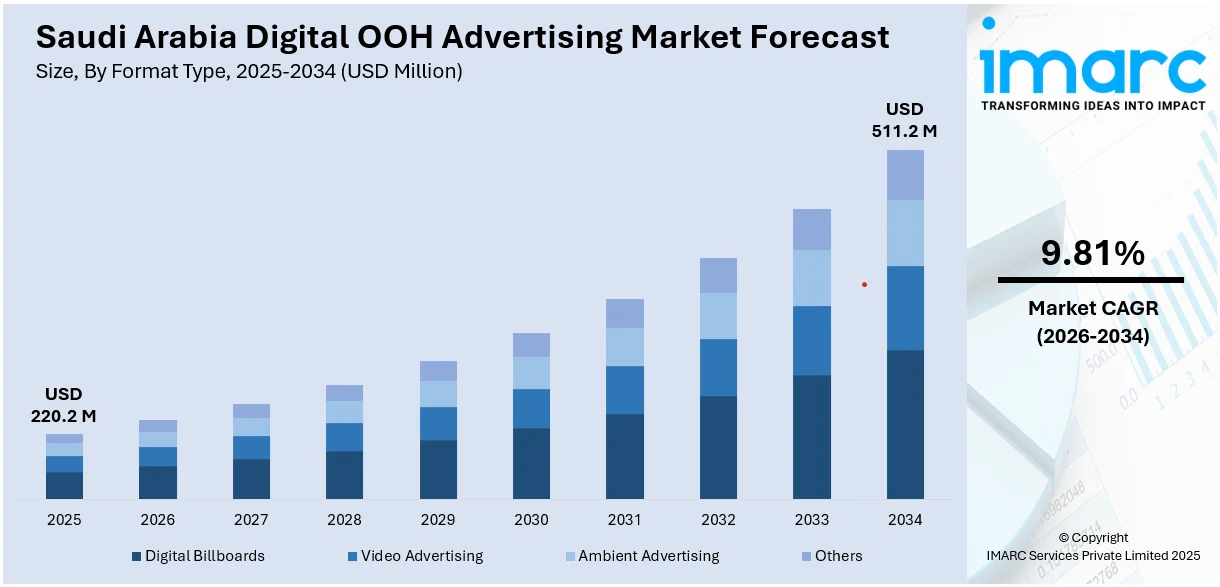

The Saudi Arabia digital OOH advertising market size reached USD 220.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 511.2 Million by 2034, exhibiting a growth rate (CAGR) of 9.81% during 2026-2034. Government-led digital transformation efforts under Vision 2030 and strategic collaborations between advertisers and tech firms are jointly accelerating the growth of Saudi Arabia DOOH advertising market by enabling advanced technologies, regulatory clarity, infrastructure investment, and more targeted, interactive advertising capabilities across urban environments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 220.2 Million |

| Market Forecast in 2034 | USD 511.2 Million |

| Market Growth Rate 2026-2034 | 9.81% |

Saudi Arabia Digital OOH Advertising Market Trends:

Government Initiatives and Regulatory Support

Support from the governing body and strategic national initiatives are essential in supporting the expansion of the digital out-of-home (DOOH) advertising sector in Saudi Arabia. Vision 2030, the long-term development roadmap for Saudi Arabia, strongly focuses on digital transformation and upgrading infrastructure, which directly relates to the growth of digital advertising networks market. The continuous initiatives of the governing authority to create smart cities and improve urban areas are establishing favorable condition for installing digital screens in prominent, busy spots. These initiatives benefit from revised regulatory frameworks that not only relax advertising restrictions but also promote the use of digital display technologies by providing clear guidelines on content standards and placement. This clear regulation enables advertisers and media operators to strategize and invest with assurance. In 2025, Saudi Arabia pledged another $20 billion to improve its digital infrastructure, expanding on a prior $25 billion investment. This significant financial investment highlights the aim of Saudi Arabia to establish itself as a worldwide leader in technology and innovation. These investments are enhancing digital connectivity as well as facilitating the deployment of sophisticated DOOH solutions, such as real-time content delivery and interactive formats. By creating a digitally nurturing atmosphere and committing to long-term change, the governing body is establishing a robust base for ongoing development in the digital advertising industry.

To get more information on this market, Request Sample

Strategic Partnerships and Collaborations with Tech Companies

Collaborative alliances among advertising agencies, tech companies, and media players are greatly improving the DOOH advertising environment in Saudi Arabia. These partnerships are providing access to state-of-the-art tools like real-time content management systems, programmatic ad distribution, and advanced audience insights, enabling advertisers to develop more intelligent, agile, and scalable campaigns. Through the incorporation of artificial intelligence (AI) and data-oriented solutions, these partnerships facilitate real-time content modifications driven by user behavior and location data, improving both interaction and advertisement effectiveness. As tech companies keep innovating, advertising agencies are progressively utilizing these partnerships to implement focused, impactful DOOH strategies in prominent city areas. For instance, in 2023, AlArabia Outdoor Advertising partnered with the Saudi Artificial Intelligence Company (SCAI) to establish and operate digital billboards in Riyadh. The project integrated AI and advanced technologies to enhance outdoor advertising, improve the city's urban landscape, and contribute to Saudi Arabia's Vision 2030 goals. The initiative also included smart city solutions such as digital apps, smart lighting, and innovative public spaces, showcasing the way tech-marketing collaborations are altering urban environments and public interaction. Such collaborative initiatives are propelling the development of the DOOH market, establishing Saudi Arabia as a regional frontrunner in digitally enhanced advertising infrastructure.

Saudi Arabia Digital OOH Advertising Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on format type, application, and end use industry.

Format Type Insights:

- Digital Billboards

- Video Advertising

- Ambient Advertising

- Others

The report has provided a detailed breakup and analysis of the market based on the format type. This includes digital billboards, video advertising, ambient advertising, and others.

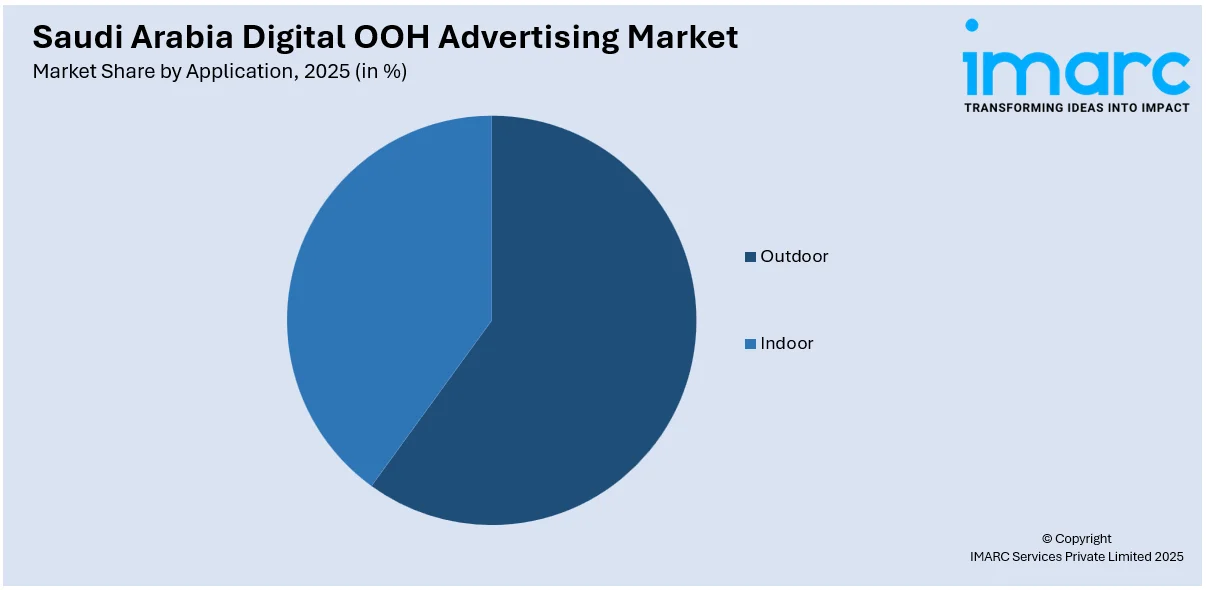

Application Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Outdoor

- Indoor

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes outdoor and indoor.

End Use Industry Insights:

- Retail

- Recreation

- Banking

- Transportation

- Education

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes retail, recreation, banking, transportation, education, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Digital OOH Advertising Market News:

- In March 2025, MRC Saudi and Adspective announced a strategic partnership to revolutionize audience measurement and ad personalization in Saudi Arabia. The collaboration combines MRC Saudi's media analytics expertise with Adspective's AI-driven solutions, optimizing ad placements across TV, digital, and out-of-home media. This initiative aligns with Saudi Arabia’s Vision 2030, focusing on enhancing media and advertising through innovative technologies.

- In January 2025, GymNation launched the GymNation Media Network in partnership with The Media Connector. This platform offers digital out-of-home advertising across multiple channels, including in-gym TV screens, radio, experiential activations, and digital platforms like the GymNation app and website. With locations in Saudi Arabia and the UAE, the network targets health-conscious individuals in the GCC region, leveraging GymNation’s 110,000+ members and high foot traffic.

Saudi Arabia Digital OOH Advertising Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Format Types Covered | Digital Billboards, Video Advertising, Ambient Advertising, Others |

| Applications Covered | Outdoor, Indoor |

| End Use Industries Covered | Retail, Recreation, Banking, Transportation, Education, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia digital OOH advertising market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia digital OOH advertising market on the basis of format type?

- What is the breakup of the Saudi Arabia digital OOH advertising market on the basis of application?

- What is the breakup of the Saudi Arabia digital OOH advertising market on the basis of end use industry?

- What is the breakup of the Saudi Arabia digital OOH advertising market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia digital OOH advertising market?

- What are the key driving factors and challenges in the Saudi Arabia digital OOH advertising market?

- What is the structure of the Saudi Arabia digital OOH advertising market and who are the key players?

- What is the degree of competition in the Saudi Arabia digital OOH advertising market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia digital OOH advertising market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia digital OOH advertising market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia digital OOH advertising industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)