Saudi Arabia Digital Printing Market Size, Share, Trends and Forecast by Type, Ink Type, Application, and Region, 2026-2034

Saudi Arabia Digital Printing Market Summary:

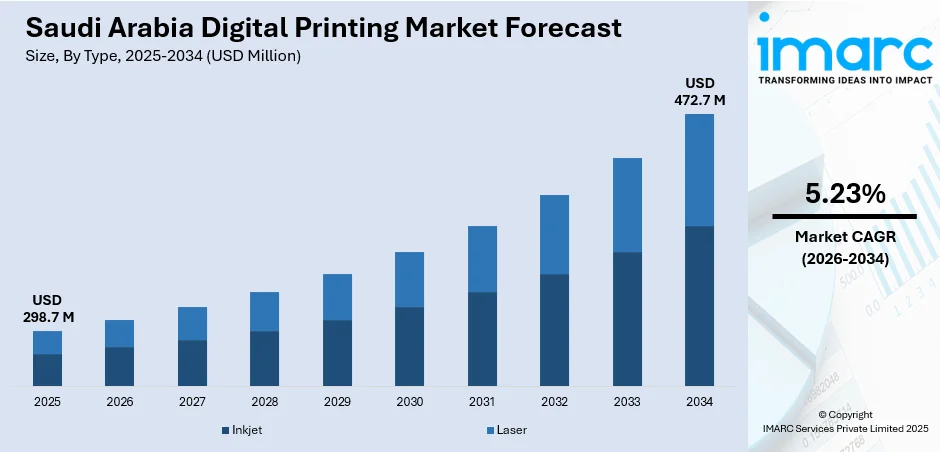

The Saudi Arabia digital printing market size was valued at USD 298.7 Million in 2025 and is projected to reach USD 472.7 Million by 2034, growing at a compound annual growth rate of 5.23% from 2026-2034.

The market is primarily propelled by the Kingdom's Vision 2030 economic diversification initiative, which is driving substantial investments across non-oil sectors including printing and publishing. The government's strategic focus on digital transformation, coupled with rising demand from e-commerce, retail, and advertising sectors, is creating robust growth opportunities for digital printing services. Furthermore, technological advancements in inkjet printing systems, ultraviolet (UV)-cured ink formulations, and fabric printing applications are enhancing production efficiency and enabling customized, high-quality outputs that cater to diverse industrial requirements, thereby expanding the Saudi Arabia digital printing market share.

Key Takeaways and Insights:

-

By Type: Inkjet dominates the market with a share of 76% in 2025, as it dominates with versatility, superior quality, and cost-effectiveness for variable-data applications across commercial and packaging sectors.

-

By Ink Type: UV-cured ink leads the market with a share of 30% in 2025, owing to its instant curing properties, environmental advantages, and exceptional adhesion to diverse substrate materials.

-

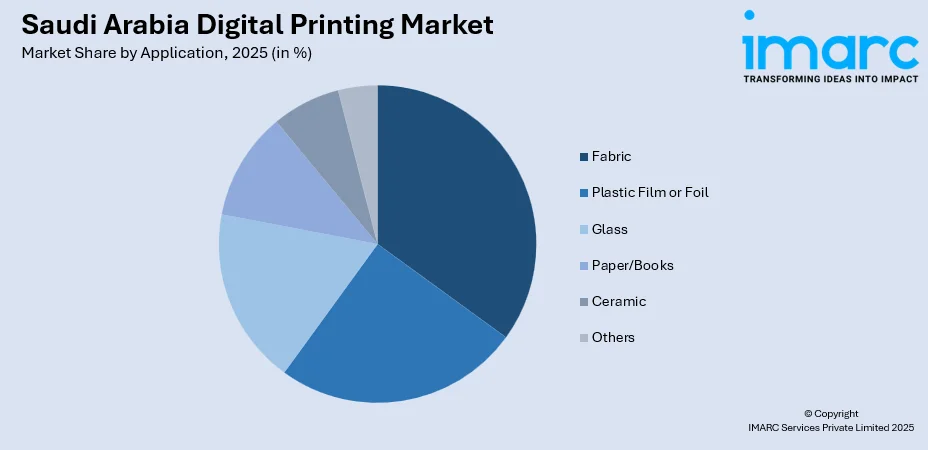

By Application: Fabric represents the largest segment with a market share of 23% in 2025, since fabric printing is growing strongly via expanding textile manufacturing, fashion development, and increasing demand for customized apparel products.

-

By Region: Northern and central region leads the market with a share of 42% in 2025, owing to the presence of various key market players in the region, rise in investment in infrastructure development, and heightened focus on the implementation of digital advancements.

-

Key Players: Major players are adopting advanced technologies, expanding local operations, partnering with global brands, and offering customized large-format, UV, and eco-friendly solutions. They’re also targeting retail, events, and packaging segments while building distribution networks and after-sales support across Saudi Arabia.

To get more information on this market Request Sample

The Saudi Arabia digital printing market is experiencing significant transformation driven by Vision 2030's economic diversification objectives and substantial infrastructure investments. The imaging and printing market is projected experience robust growth, fueled by increasing consumer demand and a surge in businesses establishing operations within the Kingdom. In September 2024, Tenaui inaugurated the Middle East's largest digital commercial printing press in Riyadh, powered by Canon's advanced inkjet technology, with capacity to a massive number of prints monthly and supporting diverse applications from books to commercial materials. This facility represents a strategic alignment with Vision 2030 goals for technological advancement and local manufacturing capabilities. The event underscores the growing confidence in Saudi Arabia's digital printing sector, with the plastics packaging market and e-commerce experiencing significant growth, generating substantial demand for customized packaging and promotional materials across retail, fashion, and consumer products sectors.

Saudi Arabia Digital Printing Market Trends:

Accelerating Digital Transformation Under Vision 2030 Framework

Saudi Arabia's ambitious Vision 2030 initiative is fundamentally reshaping the digital printing landscape through targeted investments in technological infrastructure and economic diversification away from oil dependence. The government has committed massive funds into various projects, including futuristic developments that demand advanced printing solutions for construction, advertising, and commercial applications. At the epicenter of this change is the Fourth Industrial Revolution (4IR), which is transforming manufacturing via automation and digital technologies like artificial intelligence (AI), the Internet of Things (IoT), and 3D printing. These tools are improving productivity, optimizing supply chains, and facilitating smarter, more efficient industrial processes throughout the Kingdom. The National Industrial Strategy supports these priorities with initiatives like the Future Factories Program, which seeks to convert 4,000 conventional facilities into smart factories that comply with global standards. The Fourth Industrial Revolution serves as a foundational element of Saudi Arabia's strategy for a vibrant, competitive, and varied industrial economy.

Rapid E-commerce Expansion Driving Customized Packaging Demand

The explosive growth of Saudi Arabia's e-commerce sector is generating unprecedented demand for digital printing services, particularly in customized packaging, promotional materials, and marketing collateral. Saudi Arabia’s online shopping sector is set for ongoing expansion. By 2024, the total of internet users in Saudi Arabia engaging in e-commerce (both selling and buying) is projected to hit 33.6 million, marking a 42 percent rise since 2019. This expansion is particularly pronounced in fashion, beauty, and consumer products categories, where businesses depend on digital printing to create packaging that simultaneously protects items and enhances aesthetic appeal and customer experience. E-commerce businesses increasingly leverage digital printing for product labels, hangtags, and marketing materials that complement their online presence, effectively bridging digital and physical customer interactions.

Advanced Printing Technologies Enabling Enhanced Customization Capabilities

Technological innovations in digital printing equipment are revolutionizing production capabilities across Saudi Arabia's commercial printing sector, enabling businesses to deliver high-quality, customized outputs with unprecedented speed and efficiency. Canon presented cutting-edge digital printing technologies at Gulf Print & Pack 2025 in Riyadh, unveiling products including Arizona, Colorado M-series, imagePRESS, and ColorStream systems that serve multiple sectors such as décor, publishing, and commercial printing. These advancements offer companies increased flexibility to address immediate and short-term printing requirements while maintaining superior quality standards. The scalability of contemporary digital printing technologies enables companies to expand operations without significant infrastructure investments, while innovations in UV printing, inkjet technology, and substrate formulation enhance quality and production efficiency.

How Vision 2030 is Transforming the Saudi Arabia Digital Printing Market:

Saudi Vision 2030 is reshaping the digital printing market by pushing diversification, local manufacturing, and smart technologies. Large investments in retail, tourism, construction, and events have lifted demand for signage, packaging, textiles, and promotional prints. Government-backed programs encourage SMEs and foreign players to set up advanced print facilities, accelerating adoption of inkjet, UV, and large-format printing. Sustainability targets under Vision 2030 are also driving the shift toward eco-friendly inks, reduced waste, and on-demand printing. At the same time, growth in e-commerce and branding across new giga-projects is expanding the need for fast, customized, high-quality digital print solutions across the Kingdom.

Market Outlook 2026-2034:

The Saudi Arabia digital printing market is positioned for sustained expansion over the forecast period, driven by continued economic diversification, technological advancement, and rising consumption across multiple industrial sectors. The market generated a revenue of USD 298.7 Million in 2025 and is projected to reach a revenue of USD 472.7 Million by 2034, growing at a compound annual growth rate of 5.23% from 2026-2034. The convergence of digital marketing and e-commerce growth will sustain demand for digital printing services, as businesses require swift, tailored printing solutions for packaging and promotional materials.

Saudi Arabia Digital Printing Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Inkjet |

76% |

|

Ink Type |

UV-Cured Ink |

30% |

|

Application |

Fabric |

23% |

|

Region |

Northern and Central Region |

42% |

Type Insights:

- Inkjet

- Laser

Inkjet printing dominates with a market share of 76% of the total Saudi Arabia digital printing market in 2025.

Inkjet printing technology leads the Saudi Arabia digital printing market due to its exceptional versatility, superior print quality, and cost-effectiveness for variable-data applications across commercial, packaging, and textile sectors. The technology's ability to handle diverse substrate materials without requiring printing plates makes it ideal for short-run productions and personalized printing jobs that characterize modern marketing and e-commerce requirements. Fujifilm presented a Jetpress area where our leading inkjet products, the Jetpress JP750S and FP790, were unveiled to customers at the Gulf Print & Pack 2025 in Riyadh.

These high-volume inkjet solutions deliver outstanding image quality while maintaining cost advantages, particularly beneficial for commercial printing applications including books, magazines, flyers, and brochures. The technology's scalability enables businesses to expand operations without substantial infrastructure investments, while continuous innovations in inkjet printheads, ink formulations, and substrate compatibility enhance production speed and output quality. Furthermore, inkjet systems require minimal setup time compared to traditional printing methods, enabling rapid job changeovers that suit the growing demand for customized packaging and promotional materials driven by e-commerce expansion and brand differentiation strategies.

Ink Type Insights:

- Aqueous Ink

- UV-Cured Ink

- Solvent Ink

- Latex Ink

- Dye Sublimation Ink

UV-cured ink leads with a share of 30% of the total Saudi Arabia digital printing market in 2025.

UV-cured ink technology commands substantial market share in Saudi Arabia's digital printing sector through its exceptional curing properties, environmental advantages, and ability to adhere to diverse substrate materials including non-porous surfaces unsuitable for traditional water-based or solvent-based inks. These inks cure instantly upon exposure to ultraviolet light, eliminating drying time and enabling immediate post-processing, which significantly enhances production efficiency and throughput for commercial printers serving tight deadlines. The technology produces minimal volatile organic compound emissions compared to solvent-based alternatives, aligning with Saudi Arabia's increasing emphasis on sustainability and environmentally responsible printing processes as the Kingdom pursues Vision 2030 environmental objectives.

UV-cured inks deliver superior scratch resistance, color vibrancy, and durability, making them particularly suitable for outdoor signage, packaging materials, and promotional items requiring weather resistance and extended lifespan. The ink’s ability to print on diverse materials including plastics, metals, glass, and textiles expands application possibilities for businesses seeking versatile printing solutions that serve multiple market segments from packaging to décor applications. Continuous research and development (R&D) investments in UV-cured ink formulations, with annual R&D spending increasing industry-wide, ensure ongoing improvements in color gamut, adhesion properties, and curing efficiency that maintain the technology's competitive advantages.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Plastic Film or Foil

- Fabric

- Glass

- Paper/Books

- Ceramic

- Others

Fabric exhibits a clear dominance with a 23% share of the total Saudi Arabia digital printing market in 2025.

Fabric printing applications demonstrate robust growth in Saudi Arabia's digital printing market driven by expanding textile manufacturing, fashion industry development, and increasing demand for customized apparel and home furnishing products. The digital textile printing market in Saudi Arabia generated a significant revenue, reflecting strong demand for personalized and short-run fabric printing solutions across fashion, sportswear, and interior decoration segments. Digital fabric printing technology enables designers and manufacturers to produce complex patterns, vibrant colors, and customized designs without the setup costs and minimum order quantities associated with traditional screen printing methods.

The technology's environmental advantages including reduced water consumption and minimal chemical usage align with Saudi Arabia's sustainability objectives under Vision 2030, making it increasingly attractive for textile manufacturers seeking to minimize environmental impact while maintaining production efficiency. The direct-to-fabric printing process accounts for a major prtion of the digital textile printing segment, demonstrating its dominance for large-format fabric production including curtains, upholstery, and decorative materials serving the Kingdom's expanding hospitality and residential construction sectors. Furthermore, the fashion industry's shift toward fast fashion and personalized products drives demand for digital fabric printing capabilities that enable rapid design iterations and small-batch productions catering to evolving consumer preferences and seasonal trends.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and central region leads with a share of 42% of the total Saudi Arabia digital printing market in 2025.

The Northern and Central Region dominates Saudi Arabia's digital printing market through Riyadh's position as the Kingdom's political and commercial capital, concentrating major government institutions, corporate headquarters, and retail establishments that generate substantial demand for printing services. Riyadh serves as the strategic hub for Vision 2030 implementation, hosting major infrastructure projects, business conferences, and economic events that require extensive printing support for promotional materials, documentation, and marketing collateral.

The region's dense population concentration and high purchasing power create robust markets for advertising, packaging, and commercial printing services serving retail chains, shopping malls, and corporate offices requiring continuous supply of printed materials. In 2025, Riyadh hosted the inaugural Gulf Print & Pack exhibition at Riyadh Front Exhibition Conference Center, attracting over 150 international exhibitors including Canon, Fujifilm, Konica Minolta, and BOBST, validating the city's emergence as a regional printing and packaging technology hub. The presence of advanced fulfillment nodes ensures sophisticated logistics infrastructure supporting rapid delivery and distribution of printed materials across the region. Furthermore, government digitalization initiatives and smart city developments generate substantial requirements for signage, wayfinding systems, and visual communication materials that utilize digital printing technologies for customization and rapid deployment.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Digital Printing Market Growing?

Vision 2030 Economic Diversification Initiative Catalyzing Industrial Transformation

Saudi Arabia's comprehensive Vision 2030 framework represents the primary catalyst driving digital printing market expansion through its strategic focus on economic diversification, technological advancement, and non-oil sector development creating substantial opportunities for printing industry growth. The Saudi Industrial Development Fund has sanctioned approximately 5,000 projects, accounting for nearly 40 percent of the Kingdom’s industrial sector, with an overall investment amount approaching SR200 billion ($53.3 billion). The fund, which celebrated its 50th anniversary last year, has transitioned from its conventional role of funding industry to a wider mandate encompassing industry, energy, mining, and logistics, noting that this expansion necessitated a thorough strategic change in lending methods, services, and programs available to these new sectors. The government's digitization initiative targeting 4,000 factories demonstrates commitment to technological transformation, encouraging businesses to adopt automated and digitized printing solutions that enhance efficiency, reduce waste, and improve product quality through integrated quality control systems.

E-commerce Proliferation Generating Unprecedented Packaging and Marketing Demand

The explosive expansion of Saudi Arabia's e-commerce sector constitutes a fundamental growth driver for digital printing services through escalating requirements for customized packaging, promotional materials, and marketing collateral that support online retail operations and enhance customer experiences. The e-commerce market in Saudi Arabia is projected to reach USD 708.7 Billion by 2033, exhibiting a growth rate (CAGR) of 12.8% during 2025-2033, according IMARC Group, creating corresponding demand for packaging solutions that protect products during transit while delivering compelling brand experiences. The convergence of digital marketing and e-commerce creates synergistic demand for printed materials that complement online campaigns, including product labels, hangtags, instruction manuals, and promotional inserts that bridge digital and physical customer touchpoints, effectively reinforcing brand identity and product messaging throughout the customer journey.

Technological Innovations Enhancing Production Capabilities and Cost Efficiencies

Continuous advancements in digital printing technologies represent a critical growth driver through enhanced production capabilities, superior output quality, and improved cost efficiencies that enable businesses to serve diverse applications with greater flexibility and competitiveness. The scalability of contemporary digital printing technologies enables companies to expand operations without significant infrastructure investments, as modular systems allow incremental capacity additions aligned with demand growth rather than requiring substantial upfront capital commitments typical of traditional offset printing installations. Innovations in UV printing deliver superior adhesion to diverse substrates including plastics, metals, and glass, expanding application possibilities beyond paper and paperboard to serve packaging, signage, and décor markets with weather-resistant, durable outputs suitable for outdoor and industrial environments. In 2024, PRONEXT Saudi Arabia, in collaboration with PRO TECHnology, created a significant impression at the Saudi Signage Expo, that took place from March 5 to 7, 2024. The firm formally commenced its activities in the Kingdom of Saudi Arabia while presenting advanced innovative printing solutions throughout the three-day exhibition. PRONEXT introduced several innovative products for the first time in Saudi Arabia at the signage expo: the Direct Color Systems UV44-DTS Midformat UV Flatbed Printer, LSINC’s PeriOne Cylindrical 360-Degree printer, and the IMAGO Food Decorator. These groundbreaking technologies offer outstanding print quality, flexibility, and efficiency, catering to various requirements within the printing industry in the Kingdom.

Market Restraints:

What Challenges the Saudi Arabia Digital Printing Market is Facing?

High Initial Capital Investment Requirements Limiting SME Market Entry

The substantial upfront investment required for advanced digital printing equipment represents a significant barrier to market entry, particularly for small and medium enterprises seeking to establish or expand printing operations within Saudi Arabia's competitive landscape. State-of-the-art digital printing systems including high-volume inkjet presses, UV-curing equipment, and finishing machinery can require capital outlays ranging from hundreds of thousands to several million dollars, depending on production capacity and technological sophistication required to serve commercial clients effectively. These costs encompass not only primary printing equipment but also ancillary infrastructure including climate-controlled facilities, color management systems, prepress software, and finishing equipment necessary for delivering complete printing solutions that meet client quality expectations and production timelines.

Skilled Labor Shortages Constraining Production Quality and Operational Efficiency

The shortage of technically qualified personnel possessing expertise in digital printing technologies, color management, and production optimization constitutes a significant operational challenge limiting market growth and service quality standards across Saudi Arabia's printing sector. Digital printing operations require specialized knowledge encompassing prepress workflows, color calibration, substrate handling, and equipment maintenance that differs substantially from traditional printing methods, creating training requirements for existing workforce while the educational system gradually develops curricula aligned with contemporary printing technologies. The scarcity of qualified press operators, color management specialists, and maintenance technicians increases labor costs and constrains production capacity as businesses compete for limited talent pools, particularly affecting smaller operators lacking resources to offer competitive compensation packages or structured training programs that develop internal capabilities. This skills gap becomes particularly pronounced with advanced technologies including UV-curable inks, direct-to-textile printing, and AI-integrated quality control systems requiring specialized technical knowledge that traditional printing personnel may lack, necessitating external training investments or recruitment of expensive international experts to establish and maintain production capabilities.

Raw Material Price Volatility Impacting Profitability and Competitive Positioning

Fluctuations in raw material costs including substrates, inks, and consumables represent an ongoing challenge affecting profitability margins and competitive positioning within Saudi Arabia's digital printing market, as businesses struggle to absorb price increases without passing costs to price-sensitive customers or sacrificing profit margins in competitive bidding environments. Energy subsidy reforms lifted industrial electricity rates, directly impacting operational expenses particularly for high-volume production facilities operating multi-shift schedules to maximize equipment utilization and amortize capital investments. Import dependence for specialized substrates, premium inks, and replacement components exposes businesses to international price volatility, currency exchange fluctuations, and supply chain disruptions that complicate long-term pricing strategies and contract fulfillment commitments, particularly affecting businesses serving government contracts or corporate accounts with fixed-price agreements extending multiple years requiring price stability guarantees.

Competitive Landscape:

The Saudi Arabia digital printing market demonstrates increasing competitive intensity characterized by strategic partnerships between international technology providers and local service providers, substantial infrastructure investments by market leaders, and technology transfer initiatives supporting Vision 2030 localization objectives. Major international equipment manufacturers maintain strong market presence through regional offices, authorized distributors, and technology partnerships that facilitate equipment sales, technical support, and training services supporting market development. Local printing service providers are leveraging these partnerships to acquire cutting-edge technologies. The competitive landscape features increasing consolidation as larger operators acquire smaller competitors to expand geographic coverage and service capabilities, while simultaneously witnessing new market entrants attracted by growth opportunities generated by Vision 2030 initiatives and e-commerce expansion. Industry associations and trade exhibitions including Gulf Print & Pack play crucial roles in knowledge transfer, technology demonstration, and business relationship development that support market maturation and competitive evolution.

Recent Developments:

-

In May 2025, Tasnee’s Digital Transformation Project for Local Manufacturing of Spare Parts held an exhibition to celebrate the successful adoption of the initial 3D printing technology. The exhibition took place in Jubail Industrial City from May 19 to 27, 2025. It aimed to highlight the project's distinct accomplishments in utilizing 3D printing technology for local manufacturing, in partnership with various company sectors such as the Technology and Innovation Center, the Maintenance Department, the Operations Department, the Technical Department, the Procurement Department, and the Information Technology Department.

Saudi Arabia Digital Printing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Inkjet, Laser |

| Ink Types Covered | Aqueous Ink, UV-Cured Ink, Solvent Ink, Latex Ink, Dye Sublimation Ink |

| Applications Covered | Plastic Film or Foil, Fabric, Glass, Paper/Books, Ceramic, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia digital printing market size was valued at USD 298.7 Million in 2025.

The Saudi Arabia digital printing market is expected to grow at a compound annual growth rate of 5.23% from 2026-2034 to reach USD 472.7 Million by 2034.

Inkjet dominates the Saudi Arabia digital printing market with 76% share, attributed to its exceptional versatility in handling diverse substrate materials, superior print quality for variable-data applications, and cost-effectiveness for short-run productions that characterize modern marketing and e-commerce requirements across commercial, packaging, and textile sectors

The primary growth drivers include Saudi Arabia's Vision 2030 economic diversification initiative catalyzing substantial investments across non-oil sectors, rapid e-commerce expansion generating unprecedented demand for customized packaging and promotional materials, and continuous technological innovations in inkjet systems and UV-cured inks enhancing production capabilities and cost efficiencies enabling businesses to serve diverse applications with superior quality and flexibility.

Major challenges include high equipment costs, dependence on imported machinery and inks, limited skilled operators, price competition among printers, and pressure to meet sustainability standards while maintaining consistent print quality and fast turnaround times.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)