Saudi Arabia Digital Signage Market Size, Share, Trends and Forecast by Type, Component, Technology, Application, Location, Size, and Region, 2026-2034

Saudi Arabia Digital Signage Market Overview:

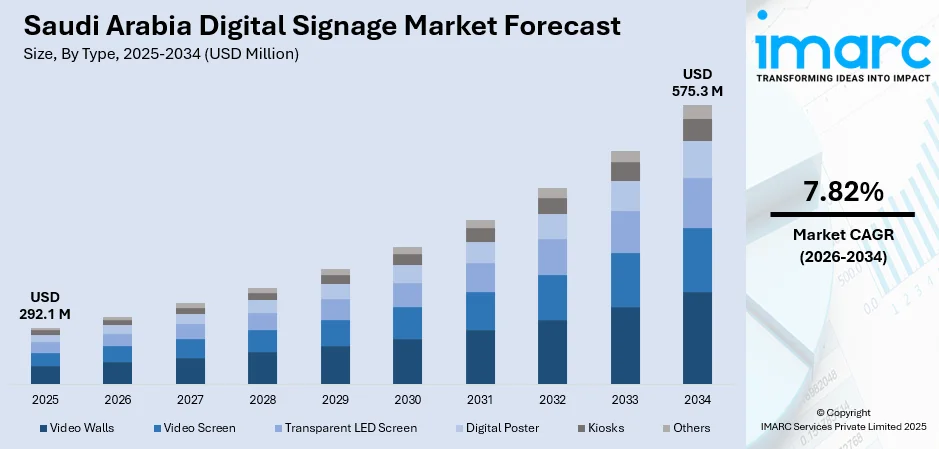

The Saudi Arabia digital signage market size reached USD 292.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 575.3 Million by 2034, exhibiting a growth rate (CAGR) of 7.82% during 2026-2034. The market growth is driven by expanding entertainment events and venues requiring dynamic communication tools, along with rapid technological advancements that enhance display quality, interactivity, and integration capabilities across industries focused on client engagement and operational efficiency.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 292.1 Million |

| Market Forecast in 2034 | USD 575.3 Million |

| Market Growth Rate 2026-2034 | 7.82% |

Saudi Arabia Digital Signage Market Trends:

Growth of the Event and Entertainment Industry

The fast growth of Saudi Arabia's event and entertainment sector is catalyzing the need for sophisticated digital signage solutions at a rapid pace. With Saudi Arabia emerging as a regional concert, sporting event, cultural festival, and large exhibition hub, organizers are seeking digital signage to provide real-time information, wayfinding directions, event timings, and promotional messaging. These dynamic signs are not only adding to the overall visitor experience but also facilitating smoother crowd control and more effective communication at peak-traffic events. Entertainment venues, such as cinemas, amusement parks, and live performance venues, are also incorporating digital signage for ticketing, advertising, and interactive functionality contributing to immersive and contemporary environments. The technology requirements of the sector are changing with Vision 2030, which is transforming Saudi Arabia into a world hub for entertainment and tourism. In March 2025, Technology West Group (TWG) ventured into the Saudi market with a strategic alliance with H.R.H. Prince Abdulaziz bin Abdullah, aimed at providing audiovisual solutions including digital signage, immersive systems, and network integration. This effort bolsters the vision by outfitting entertainment and hospitality establishments with advanced technologies. As investment remains in infrastructure and foreign event hosting, the position of digital signage as a method of communication and engagement is becoming increasingly central.

To get more information on this market, Request Sample

Technological Advancements and Integration

Development of digital display technologies is significantly driving the market in Saudi Arabia. Enhanced features such as ultra-high-definition screens, organic light-emitting diode (OLED) displays, touch-sensitive interactive functions, and power-saving technologies are increasingly making digital signage more dynamic, visually appealing, and flexible for various applications. The integration of emerging technologies like artificial intelligence (AI), the internet of things (IoT), and cloud-based content management is increasing the performance of these systems, allowing real-time updates, targeted messaging, and remote monitoring. These technologies are useful especially in sectors like retail, healthcare, transportation, and hospitality, where audience interaction, rapid responsiveness, and operational effectiveness matter most. Firms are increasingly employing digital signage for displaying content as well as for interactive advertisement, analytics tracking, and integrated social media interaction. To keep pace with this growing interest, dmg events launched the Saudi Signage Expo in March 2023 and scheduled it to take place in January 2024 at the Riyadh International Convention & Exhibition Centre. The conference aimed to put the expansion of Saudi Arabia's sign industry, particularly the digital segment, in the limelight and featured over 100 visitors. It was expected to bring together over 7,000 visitors from leading sectors such as advertising, hospitality, and retail. The expo reflected on the lively market movement and underlined how continuous technological developments are shaping the demand for digital signage.

Sustained Growth of Retail Industry

The Saudi Arabia digital signage market is experiencing robust growth as the retail industry is consistently growing and evolving. Big shopping malls, hypermarkets, and specialty stores are increasingly using digital signage to engage customers, market products, and deliver immersive shopping experiences. Retailers are consistently investing in cutting-edge display technologies to entice and retain customers, particularly as competition in the market is on the rise. Digital signage is being touted as an essential marketing tool for customized and dynamic advertising, overtaking static posters and conventional display techniques. With the retail industry supporting Saudi Vision 2030 initiatives, shopping malls are being redeveloped as lifestyle and entertainment hubs, thus driving demand of high-quality digital displays. Retailers are also embracing digital signage for wayfinding, interactive kiosks, and targeted marketing, which is constantly creating a need in this category and defining shopper expectations in a digitally focused retail environment. IMARC Group predicts that the Saudi Arabia retail market is expected to reach USD 402.7 Billion by 2033.

Saudi Arabia Digital Signage Market Growth Drivers:

Increase in Smart City Projects

Saudi Arabia is presently embarking on extensive smart city projects, the most prominent being NEOM, that is constantly generating demand for digital signage solutions. These smart city developments are converging the latest technologies in infrastructure, entertainment, retail, and public services, thus offering multiple opportunities to adopt digital display. In smart city surroundings, digital signage is increasingly being used for traffic control, public address systems, interactive information systems, and outdoor advertising. With urban areas becoming more connected and digital-centric, stakeholders are increasingly depending on signage solutions to facilitate better communication as well as enhance citizen engagement. Government policies are making urban development projects go hand-in-hand with sustainability and technology adoption, leading to mass adoption of energy-saving LED signage and interactive digital billboards.

Growing Demand in Tourism and Hospitality

The Saudi Arabian hospitality and tourism industry is growing at a considerable pace, driven by the Vision 2030 diversification initiative. Hotels, resorts, airports, and entertainment hubs are embracing digital signage more and more, utilizing it to upgrade guest experiences, optimize operations, and provide dynamic content. Digital signage is applied for wayfinding, event marketing, check-in support, and in-room entertainment, and this contributes to overall customer satisfaction improvement. As Saudi Arabia is increasingly welcoming more international travelers, the need for multilingual, dynamic, and visually engaging display solutions is steadily rising. The Kingdom is becoming an international tourist destination, holding huge cultural, sporting, and entertainment events, further fueling the uptake of cutting-edge display technologies. Digital signage is being rolled out throughout airports and transportation centers to enhance passenger movement and deliver real-time information, consistent with the industry's focus on digital transformation.

Government Policies and Vision 2030 Efforts

The government of Saudi Arabia is persistently pushing digital transformation programs under Vision 2030, which is positively influencing the market. Infrastructure, tourism, retail, and entertainment investments are fueling the uptake of digital display solutions across various industry verticals. Policies that favor modernization, smart cities, and global tourism are offering a robust infrastructure for the incorporation of digital signage within public environments, airports, shopping malls, and governmental institutions. The focus on establishing a knowledge-intensive and technologically sophisticated economy is encouraging firms to invest in digital-first models, such as sophisticated signage systems. Government-funded mega-events and international exhibitions are also increasing the demand for large-scale dynamic displays. Besides this, energy-efficient and environmentally friendly technology-friendly regulations are driving LED signage solutions adoption. Complying with such policies, the market is witnessing rapid growth, with companies and institutions increasingly using digital signage to address changing developmental and regulatory needs.

Saudi Arabia Digital Signage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. our report has categorized the market based on type, component, technology, application, location, and size.

Type Insights:

- Video Walls

- Video Screen

- Transparent LED Screen

- Digital Poster

- Kiosks

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes video walls, video screen, transparent LED screen, digital poster, kiosks, and others.

Component Insights:

- Hardware

- Software

- Service

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes hardware, software, and service.

Technology Insights:

- LCD/LED

- Projection

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes LCD/LED, projection, and others.

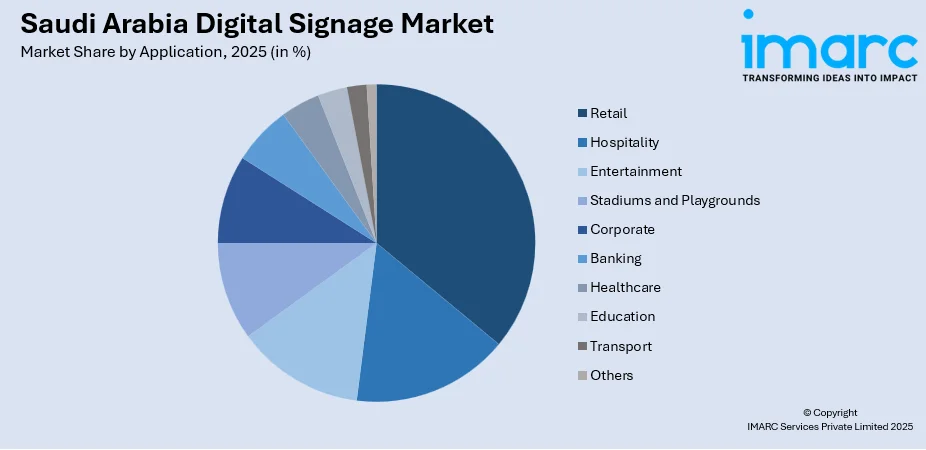

Application Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Retail

- Hospitality

- Entertainment

- Stadiums and Playgrounds

- Corporate

- Banking

- Healthcare

- Education

- Transport

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes retail, hospitality, entertainment, stadiums and playgrounds, corporate, banking, healthcare, education, transport, and others.

Location Insights:

- Indoor

- Outdoor

The report has provided a detailed breakup and analysis of the market based on the location. This includes indoor and outdoor.

Size Insights:

- Below 32 Inches

- 32 to 52 Inches

- More than 52 Inches

A detailed breakup and analysis of the market based on the size have also been provided in the report. This includes below 32 inches, 32 to 52 inches, and more than 52 inches.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Digital Signage Market News:

- In May 2025, Arabian Contracting Services Co. (Al Arabia) revealed that its fully owned subsidiary, Faden Media, has entered into a contract valued at SAR 309.6 million for the construction, operation, and maintenance of billboards on empty land along key roads in Jeddah (the initial contract). Faden Media aims to grow its billboard network and incorporate new technologies and marketing solutions in the digital advertising field, specifically in Jeddah. This will subsequently aid in diversifying and aiming at new advertiser segments, enhancing brand awareness, and reinforcing market influence.

- In April 2025, SRMG, the largest integrated media group in the MENA region, announced on Tuesday the introduction of SRMG Media Solutions (SMS), a cutting-edge, data-centric media solutions firm aimed at providing innovative, results-oriented advertising strategies. Leveraging the 35-year legacy of Al Khaleejiah, a leader in enhancing revenue and cultivating strategic alliances, SMS enables brands to reach more than 170 million users globally via advanced digital, social, TV, audio, and print mediums.

- In February 2025, JCDecaux, a company specializing in outdoor advertising, has renewed and expanded its exclusive advertising contract with Dammam Airports Company (DACO). This decade-long agreement includes King Fahd International Airport in Dammam, Al-Ahsa International Airport, and Al Qaisumah International Airport.

- In February 2025, M-Cube designed and installed bespoke digital signage for the new Dolce&Gabbana flagship store in Diriyah, Saudi Arabia, which is part of the Vision 2030 initiative. The store, the largest Dolce&Gabbana boutique in the Gulf, features custom LED solutions integrated with a real-time content management system to create an immersive, dynamic shopping experience.

- In February 2025, the Digital Signage Expo Riyadh will take place from August 24-26, 2025, at the Riyadh International Convention & Exhibition Center. The event will showcase innovations in digital signage, aligning with Saudi Arabia's Vision 2030 to boost smart communication technologies across sectors like retail, hospitality, and entertainment. It's a key opportunity for professionals to engage with the latest trends in visual communication.

Saudi Arabia Digital Signage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Video Walls, Video Screen, Transparent LED Screen, Digital Poster, Kiosks, Others |

| Components Covered | Hardware, Software, Service |

| Technologies Covered | LCD/LED, Projection, Others |

| Applications Covered | Retail, Hospitality, Entertainment, Stadiums and Playgrounds, Corporate, Banking, Healthcare, Education, Transport, Others |

| Locations Covered | Indoor, Outdoor |

| Sizes Covered | Below 32 Inches, 32 to 52 Inches, More than 52 Inches |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia digital signage market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia digital signage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia digital signage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The digital signage market in Saudi Arabia was valued at USD 292.1 Million in 2025.

The Saudi Arabia digital signage market is projected to exhibit a CAGR of 7.82% during 2026-2034, reaching a value of USD 575.3 Million by 2034.

The Saudi Arabia digital signage market is driven by the rapid growth of the retail sector, expansion of smart city projects, rising demand in hospitality and tourism, increasing adoption of digital advertising, technological advancements in display solutions, and supportive government initiatives under Vision 2030.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)