Saudi Arabia Dimethyl Ether Market Size, Share, Trends and Forecast by Raw Material, Application, End-Use Industry, and Region, 2026-2034

Saudi Arabia Dimethyl Ether Market Summary:

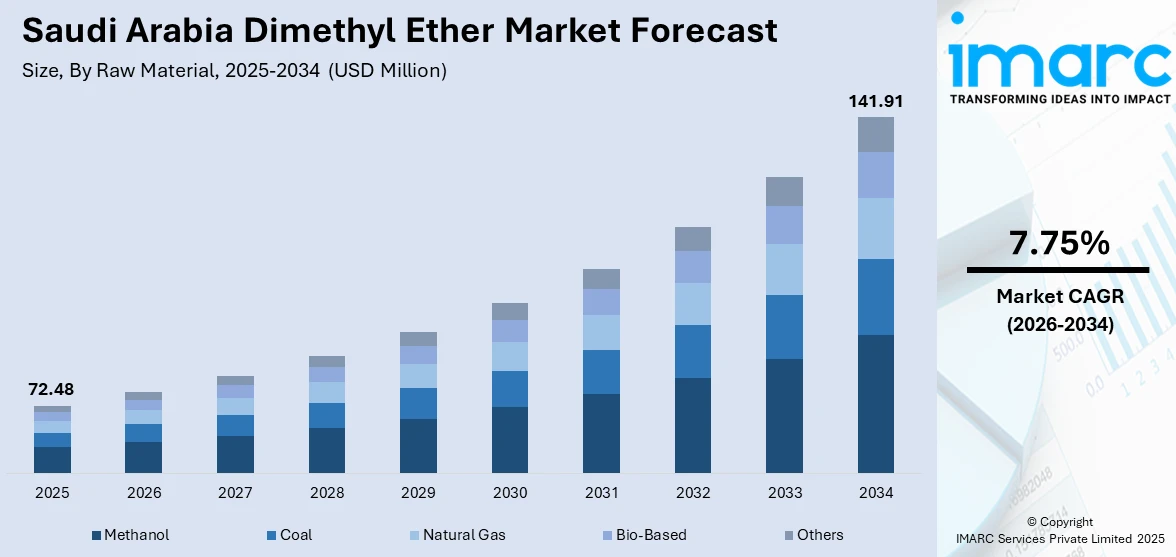

The Saudi Arabia dimethyl ether market size was valued at USD 72.48 Million in 2025 and is projected to reach USD 141.91 Million by 2034, growing at a compound annual growth rate of 7.75% from 2026-2034.

The Saudi Arabia dimethyl ether market is experiencing substantial expansion, driven by the Kingdom's strategic pivot toward cleaner energy alternatives and sustainable fuel solutions under Vision 2030. The growing emphasis on reducing carbon emissions across the industrial and transportation sectors is accelerating demand for dimethyl ether (DME) as a viable substitute for conventional diesel fuels. Additionally, the robust development of petrochemical infrastructure, including major projects in Jubail and Yanbu industrial cities, is strengthening the domestic production capabilities.

Key Takeaways and Insights:

- By Raw Material: Methanol dominates the market with a share of 45% in 2025, driven by the Kingdom's substantial methanol production capacity and the established cost-effective conversion technologies that leverage abundant natural gas feedstock to synthesize high-purity DME.

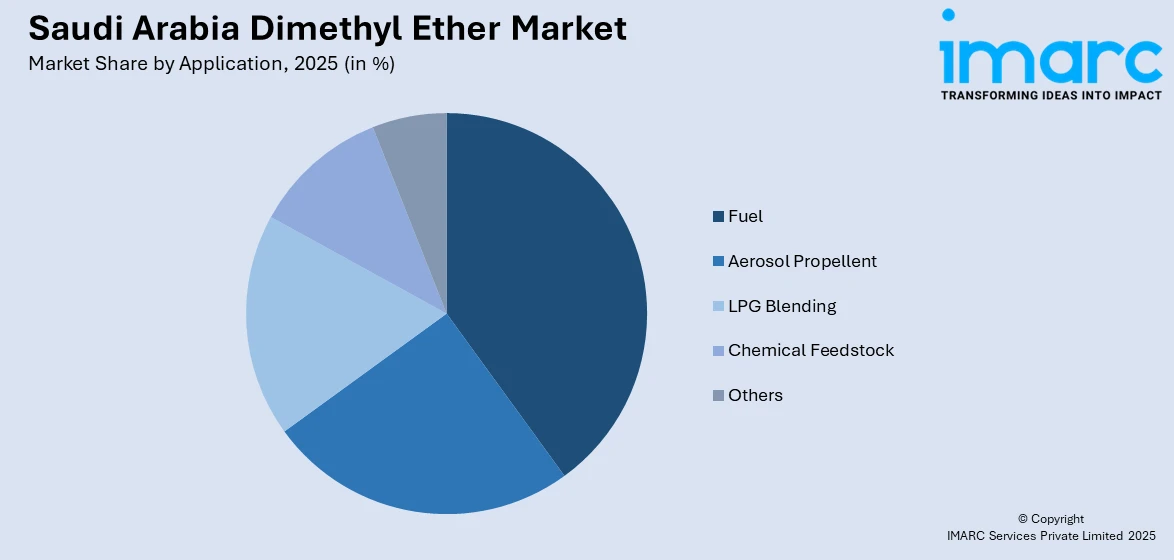

- By Application: Fuel leads the market with a share of 40% in 2025, reflecting the growing adoption of DME as a clean-burning alternative transportation fuel characterized by minimal particulate matter emissions and high cetane numbers suitable for compression ignition engines.

- By End-Use Industry: Oil and gas represent the largest segment with a market share of 35% in 2025, supported by the sector's extensive operational footprint across upstream, midstream, and downstream activities requiring cleaner fuel alternatives and chemical feedstocks.

- By Region: Northern and Central Region comprises the largest region with 32% share in 2025, attributed to the concentration of major industrial hubs, including Jubail petrochemical complex, and the presence of key energy infrastructure supporting DME production and distribution networks.

- Key Players: Leading companies in the market are focusing on expanding production capacities, developing advanced conversion technologies, and establishing strategic partnerships with international firms to enhance operational efficiency and strengthen market positioning.

To get more information on this market Request Sample

The Saudi Arabia dimethyl ether market continues to gain momentum, as the Kingdom accelerates its economic diversification agenda while maintaining its position as a global energy powerhouse. Saudi Arabia's abundant natural gas reserves provide a competitive advantage for methanol-based DME production, enabling cost-effective manufacturing processes. The ongoing expansion of mega-projects, including Red Sea Project and Qiddiya, is creating additional consumption opportunities, while the development of storage and distribution facilities ensures efficient product accessibility throughout the Kingdom. In October 2025, Saudi officials revealed an extensive multipurpose initiative surrounding the Grand Mosque in Islam's sacred city, which entailed building high towers close to the holy location for worship, lodging, and hospitality, capable of accommodating approximately 900,000 prayer areas, both indoors and outdoors. Rising government support for cleaner fuels and sustainable energy solutions further drives DME adoption across industrial, transportation, and power generation applications, positioning the market for steady growth. Strategic partnerships with international technology providers and investments in research and development (R&D) activities are also enhancing production efficiency and product innovations.

Saudi Arabia Dimethyl Ether Market Trends:

Vision 2030 Driving Clean Fuel Transition

Saudi Arabia's Vision 2030 framework is catalyzing a fundamental shift towards sustainable energy solutions across the industrial landscape. The government plans to generate 50% of electricity from renewable sources by 2030, fostering favorable conditions for cleaner fuels like DME. This focus is encouraging investments in advanced production technologies and infrastructure to support DME integration. Industrial sectors are increasingly adopting DME as a low-emission alternative to conventional fuels. Additionally, public-private partnerships (PPPs) are facilitating innovation, scaling production, and expanding the domestic and export market potential for DME.

Integration with Expanding Petrochemical Infrastructure

The Kingdom's petrochemical sector is undergoing significant transformation with multiple world-scale projects enhancing DME production capabilities. As per IMARC Group, the Saudi Arabia petrochemicals market size reached USD 6.3 Billion in 2025. Investments in advanced methanol-to-DME conversion technologies are improving efficiency and output. Expansion of downstream facilities ensures seamless distribution and integration with industrial and transportation applications. Growing collaborations with global technology providers are also driving innovations and supporting the Kingdom’s strategic goal of establishing a sustainable and diversified chemical industry.

Growing Demand for Environment-Friendly Propellants

Increasing demand for environment-friendly propellants is fueling the market growth in Saudi Arabia by positioning DME as a low-emission alternative to conventional aerosol propellants. With increasing regulatory focus on reducing volatile organic compounds (VOCs) and greenhouse gas emissions, industries, such as cosmetics, personal care, and household products, are shifting towards DME-based formulations. Its non-toxic, clean-burning properties make it ideal for sustainable applications, while compatibility with existing spray technologies ensures easy adoption. This trend is accelerating DME consumption, supporting market expansion and reinforcing Saudi Arabia’s role in producing greener chemical solutions.

How Vision 2030 is Transforming the Saudi Arabia Dimethyl Ether Market:

Vision 2030 is transforming the market by accelerating diversification away from crude oil and promoting cleaner, value-added petrochemical products. The policy emphasis on energy efficiency, industrial localization, and low-emission fuels supports DME adoption as an alternative to liquified petroleum gas (LPG) and diesel in cooking, power generation, and transportation. Investments in downstream petrochemicals, gas utilization, and advanced conversion technologies strengthen domestic DME production potential. Infrastructure upgrades, including logistics, storage, and distribution networks, further improve market accessibility. Vision 2030’s focus on sustainability and circular carbon economy principles also encourages the use of DME derived from natural gas and captured CO₂. Additionally, PPPs and foreign investment incentives enhance technology transfer and scale-up opportunities, positioning DME as a strategic fuel and chemical feedstock supporting Saudi Arabia’s long-term industrial and environmental objectives.

Market Outlook 2026-2034:

The Saudi Arabia dimethyl ether market demonstrates robust growth prospects, supported by sustained government investments in clean energy infrastructure and industrial diversification initiatives. The accelerating transition towards sustainable fuels across transportation and power generation sectors is expected to drive significant demand expansion throughout the forecast period. The market generated a revenue of USD 72.48 Million in 2025 and is projected to reach a revenue of USD 141.91 Million by 2034, growing at a compound annual growth rate of 7.75% from 2026-2034. Strategic collaborations between domestic producers and international technology providers are enhancing production efficiency while reducing carbon intensity. The ongoing development of mega-projects across tourism, urban development, and transportation networks under Vision 2030 creates substantial consumption opportunities for DME-based applications, positioning the market for sustained long-term expansion.

Saudi Arabia Dimethyl Ether Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Raw Material |

Methanol |

45% |

|

Application |

Fuel |

40% |

|

End-Use Industry |

Oil and Gas |

35% |

|

Region |

Northern and Central Region |

32% |

Raw Material Insights:

- Methanol

- Coal

- Natural Gas

- Bio-Based

- Others

Methanol dominates with a market share of 45% of the total Saudi Arabia dimethyl ether market in 2025.

Methanol serves as the predominant raw material for DME production in Saudi Arabia, owing to the Kingdom's established methanol manufacturing infrastructure and abundant natural gas feedstock availability. The catalytic dehydration process converting methanol to DME offers superior conversion efficiency and lower production costs compared to alternative feedstocks. This approach also ensures consistent product quality and scalability to meet growing domestic and export demand. Furthermore, the use of methanol aligns with sustainable production practices by enabling cleaner fuel alternatives and reducing overall carbon emissions.

The methanol-to-DME pathway benefits from well-established technology platforms and existing infrastructure that minimize capital requirements for production expansion. Companies operate integrated facilities, enabling seamless feedstock supply for DME synthesis. The availability of competitively priced natural gas as primary methanol feedstock provides Saudi producers with significant cost advantages in the global market. Additionally, ongoing investments in methanol derivative production capacity, including formaldehyde and acetic acid plants, create synergies that strengthen the overall value chain supporting DME manufacturing operations throughout the Kingdom.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Fuel

- Aerosol Propellent

- LPG Blending

- Chemical Feedstock

- Others

Fuel leads with a share of 40% of the total Saudi Arabia dimethyl ether market in 2025.

Fuel dominates the market, due to its versatile applications and alignment with the Kingdom’s sustainability goals under Vision 2030. DME as a fuel offers clean-burning properties, producing lower particulate matter, sulfur, and nitrogen oxide emissions compared to conventional diesel. Its high cetane number and efficient combustion improve engine performance and energy utilization, making it suitable for industrial, power generation, and transport applications. The demand for low-emission energy sources drives widespread adoption, positioning fuel as the most significant segment in the market.

Additionally, fuel benefits from compatibility with existing infrastructure and engine technologies, allowing seamless integration without extensive retrofitting. DME’s safety, low toxicity, and ease of storage enhance operational efficiency for end users. Growing environmental awareness, coupled with government incentives for cleaner energy solutions, reinforces DME fuel adoption. Rising investments in production and distribution capacity ensure reliable supply, further solidifying fuel’s dominant position in the Saudi Arabia dimethyl ether market.

End-Use Industry Insights:

- Oil and Gas

- Automotive

- Power Generation

- Cosmetics

- Others

Oil and gas exhibit a clear dominance with a 35% share of the total Saudi Arabia dimethyl ether market in 2025.

Oil and gas represent the primary end-use industry for DME consumption in Saudi Arabia, leveraging DME across various operational applications, including fuel substitution and chemical synthesis processes. The Saudi Arabian Oil Company (Aramco) operates extensive infrastructure spanning upstream exploration, midstream transportation, and downstream refining operations that collectively drive substantial DME demand. The company committed to investments between USD 48 Billion and USD 58 Billion in 2024, with significant allocation towards gas expansion projects. These infrastructure developments support growing feedstock requirements for DME production.

The sector's focus on reducing operational carbon intensity is accelerating DME adoption as a cleaner alternative to conventional diesel fuels for equipment and generator applications across production facilities. Ongoing modernization of refineries and petrochemical plants further increases DME integration opportunities. Advanced R&D initiatives are enhancing production efficiency and fuel quality. Strategic collaborations with international technology providers are also supporting the scale-up of DME-based solutions across the oil and gas industry.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region represents the leading segment with a 32% share of the total Saudi Arabia dimethyl ether market in 2025.

Northern and Central Region maintains market leadership, driven by the strategic presence of Riyadh, the Kingdom's capital city and primary economic center, alongside developing industrial zones supporting chemical manufacturing activities. This region benefits from comprehensive transportation infrastructure connecting production facilities to consumption centers across the country. The proximity to key logistics hubs facilitates efficient distribution of DME to diverse end use applications, spanning the industrial, commercial, and transportation sectors, throughout this economically vital territory.

The region's growing urbanization and infrastructure development activities create sustained demand for DME-based products across construction, automotive, and consumer applications. Rapid industrialization initiatives are establishing new manufacturing facilities requiring cleaner fuel alternatives for operational equipment and power generation. Increased government-led renewable energy projects in the region further support DME adoption and market expansion. Additionally, strategic clustering of petrochemical companies across the region enhances collaboration and supply chain efficiency.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Dimethyl Ether Market Growing?

Government Initiatives Supporting Clean Energy Transition

The widespread government initiatives executed in Saudi Arabia under Vision 2030 and the Saudi Green Initiative are resulting in considerable impetus for market growth. The Kingdom has established ambitious targets, including intentions to achieve net-zero greenhouse gas emissions by 2060. The government policies are situating DME as a crucial component in the clean energy transition because of its low-emission properties and compatibility with established infrastructure. Additionally, economic diversification efforts aim to decrease domestic reliance on crude oil consumption, creating favorable conditions for alternative fuels adoption across the transportation and industrial sectors. The overall energy plan includes establishing vital value chains from petrochemicals to specialty chemicals, such as DME. Strong PPPs are further accelerating investment and technological development in the DME sector in Saudi Arabia.

Expanding Petrochemical Infrastructure and Production Capacity

The Kingdom's aggressive investments in petrochemical infrastructure are significantly enhancing DME production capabilities and supply chain efficiency. Major development projects are strengthening integration between refining and chemical production, ensuring reliable methanol supply as the primary DME feedstock. Large-scale ventures in gas development and petrochemical complexes are improving operational efficiency, creating robust distribution networks, and enabling seamless connectivity between production facilities and end-use sectors. These initiatives support scalability in DME manufacturing while fostering innovations in chemical synthesis processes. By reinforcing the Kingdom’s position as a global energy and petrochemical leader, these infrastructure investments encourage private and international collaboration, enhance technological capabilities, and build the foundation for long-term market expansion. The focus on modern, integrated facilities also aligns with sustainability objectives, improving energy efficiency and reducing environmental impact across production operations.

Rising Demand from Oil and Gas Sector Operations

The oil and gas sector’s extensive operational activities across Saudi Arabia are driving significant DME consumption for fuel substitution and chemical process applications. Expansion of upstream, midstream, and downstream projects is increasing the availability of natural gas and methanol feedstock, supporting downstream DME manufacturing. Investments in cleaner technologies, modern pipeline systems, and integrated distribution infrastructure are improving operational efficiency and enabling broader adoption of DME across petroleum operations. The sector’s focus on reducing carbon intensity and implementing sustainable energy solutions is reinforcing DME’s role as a low-emission alternative. By aligning production and distribution with industrial and energy diversification goals, the oil and gas industry is creating a strong and consistent demand base for DME, positioning the fuel as a strategic component in the Kingdom’s transition towards cleaner, more sustainable operations.

Market Restraints:

What Challenges the Saudi Arabia Dimethyl Ether Market is Facing?

Production Efficiency and Cost-Effectiveness Challenges

The industry is facing ongoing challenges related to optimizing production efficiency and achieving cost parity with conventional fuels. High capital expenditures required for establishing DME production facilities and maintaining operational efficiency create barriers for market expansion. The conversion process from methanol to DME demands sophisticated catalytic technologies and energy-intensive operations that impact overall production economics. Additionally, fluctuations in crude oil and natural gas prices directly influence feedstock costs, creating uncertainty in DME pricing competitiveness against traditional petroleum-based alternatives.

Limited Distribution Infrastructure and Storage Facilities

The underdeveloped distribution infrastructure for DME presents significant challenges limiting market penetration across Saudi Arabia. DME requires specialized storage and handling equipment due to its physical properties, including moderate pressure liquefaction requirements that differ from conventional fuel distribution systems. The Kingdom's existing fuel distribution network is primarily designed for gasoline and diesel products, necessitating substantial investments to accommodate DME supply chains. Furthermore, the limited number of refueling stations and blending facilities restricts commercial vehicle operators from transitioning to DME-based fuels.

Low Consumer Awareness and Market Adoption Barriers

The lack of widespread consumer awareness regarding DME as a viable alternative fuel presents barriers to market adoption throughout Saudi Arabia. End users across the transportation and industrial sectors often possess limited understanding of DME's environmental benefits and operational compatibility with existing equipment. The absence of comprehensive educational initiatives and demonstration programs slows the transition from conventional fuels. Additionally, uncertainty regarding long-term fuel availability and regulatory support creates hesitation among commercial fleet operators considering DME adoption for their transportation requirements.

Competitive Landscape:

The Saudi Arabia dimethyl ether market exhibits a moderately consolidated competitive landscape, characterized by the presence of established domestic petrochemical producers alongside international technology providers. Leading market participants are focusing on expanding production capacities, enhancing operational efficiency through advanced conversion technologies, and establishing strategic partnerships to strengthen market positioning. Companies are investing in R&D initiatives to optimize methanol-to-DME conversion processes while reducing carbon intensity. The integration of renewable energy sources into production operations is emerging as a key competitive differentiator as sustainability becomes increasingly important. Strategic collaborations between domestic producers and global technology firms are facilitating knowledge transfer and accelerating market development.

Saudi Arabia Dimethyl Ether Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Methanol, Coal, Natural Gas, Bio-Based, Others |

| Applications Covered | Fuel, Aerosol Propellent, LPG Blending, Chemical Feedstock, Others |

| End-Use Industries Covered | Oil And Gas, Automotive, Power Generation, Cosmetics, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia dimethyl ether market size was valued at USD 72.48 Million in 2025.

The Saudi Arabia dimethyl ether market is expected to grow at a compound annual growth rate of 7.75% from 2026-2034 to reach USD 141.91 Million by 2034.

Methanol dominated the market with a share of 45%, driven by Saudi Arabia's substantial methanol production capacity and cost-effective and efficient conversion technologies leveraging abundant natural gas feedstock availability.

Key factors driving the Saudi Arabia dimethyl ether market include government initiatives supporting clean energy transition under Vision 2030, expanding petrochemical infrastructure investments, and rising demand from the oil and gas sector for cleaner fuel alternatives.

Major challenges include production efficiency and cost-effectiveness concerns, limited distribution infrastructure and storage facilities for DME handling, low consumer awareness about DME as an alternative fuel, and the need for specialized equipment investments to support market adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)