Saudi Arabia Distributed Energy Market Size, Share, Trends and Forecast by Technology, End Use Industry, and Region, 2026-2034

Saudi Arabia Distributed Energy Market Overview:

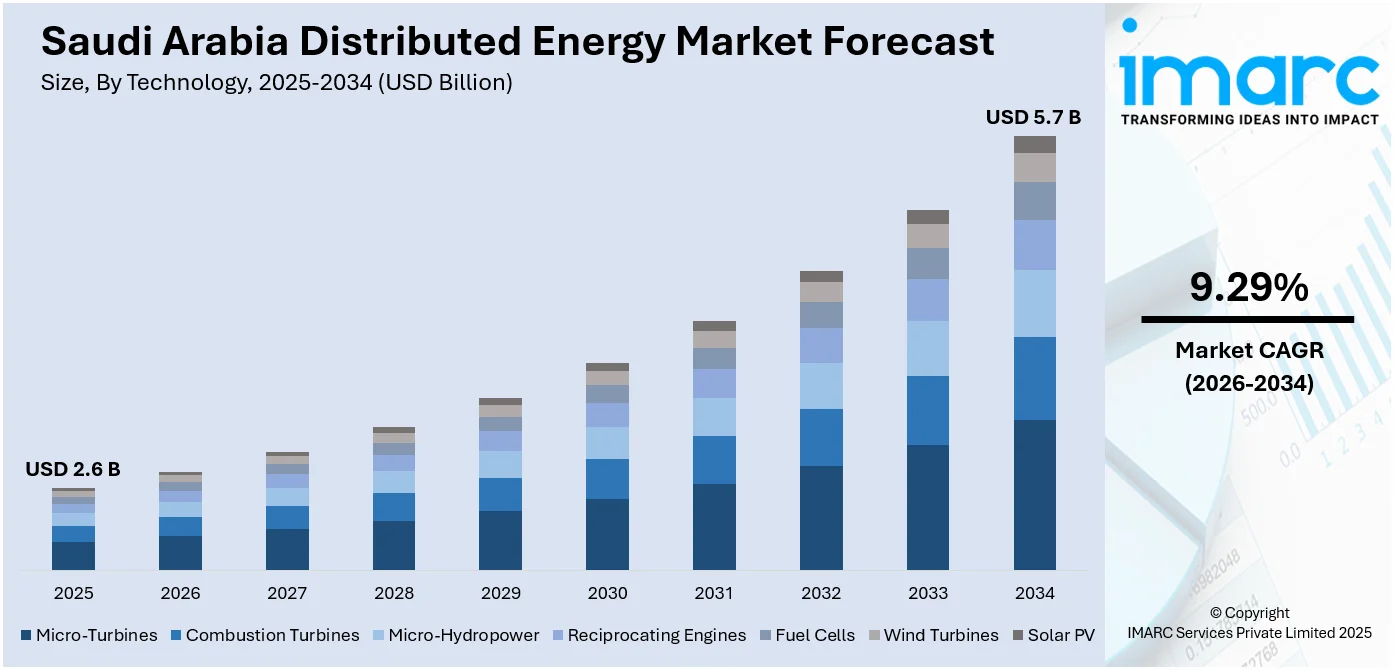

The Saudi Arabia distributed energy market size reached USD 2.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 5.7 Billion by 2034, exhibiting a growth rate (CAGR) of 9.29% during 2026-2034. The growing demand for reliable off-grid power, supportive government policies under Vision 2030, rising industrial and commercial energy needs, increasing adoption of renewable energy sources, advancements in energy storage technologies, and cost reductions in solar PV and battery systems are some of the key factors driving the market in Saudi Arabia.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.6 Billion |

| Market Forecast in 2034 | USD 5.7 Billion |

| Market Growth Rate 2026-2034 | 9.29% |

Saudi Arabia Distributed Energy Market Trends:

Development of Microgrids

The deployment of microgrids in Saudi Arabia is progressing rapidly as a strategic approach to strengthen energy security, lower operational costs, and support the integration of renewable energy sources. This is positively impacting Saudi Arabia distributed energy market outlook. For instance, on August 21, 2024, Saudi Arabia initiated the construction of the world's largest solar-powered microgrid under The Red Sea Project. This off-grid system, developed by ACWA Power, comprises a 400 MW solar photovoltaic installation coupled with 1.3 GWh of battery energy storage. Designed to deliver uninterrupted renewable power around the clock, it forms a critical component of Saudi Arabia's Vision 2030 agenda, particularly in its ambition to foster low-carbon, sustainable tourism infrastructure. Beyond high-profile projects, microgrids are being established at industrial parks, educational institutions, healthcare facilities, and airports, where continuous and high-quality power is essential. These installations typically integrate solar PV, battery systems, and occasionally diesel generators, orchestrated through advanced energy management systems that enable real-time monitoring and control. The growing prevalence of microgrids reflects a broader shift toward decentralized, resilient, and sustainable energy solutions within the Kingdom's evolving electricity landscape.

To get more information on this market Request Sample

Private Sector Participation and Energy-as-a-Service (EaaS) Models

Private sector participation in market is accelerating, fueled by policy liberalization, high per capita energy consumption, and increasing demand for decentralized clean power solutions. As of 2023, the country's energy usage per capita stood at 7.5 toe, with electricity consumption averaging 9.2 MWh. This scenario is catalyzing the adoption of energy-as-a-service (EaaS) models, where third-party providers finance, install, operate, and maintain distributed energy systems on behalf of end users. Players offering EaaS are also augmenting the Saudi Arabia distributed energy market share as more organizations seek low-risk, scalable energy solutions aligned with sustainability targets. These EaaS models eliminate the need for upfront capital expenditure, making solar PV, battery energy storage systems (BESS), and hybrid solutions accessible to a broader commercial and industrial user base. Strong uptake is observed in energy-intensive sectors such as logistics centers, retail complexes, industrial units, and data centers. Multinational service providers are forming joint ventures with local firms to deliver turnkey distributed energy solutions, including performance-based contracting and guaranteed savings. Regulatory bodies such as the Saudi Energy Efficiency Center and the Ministry of Energy are streamlining licensing protocols and encouraged market entry, reinforcing Vision 2030's aim of expanding private sector roles in national infrastructure. The continued EaaS expansion as more enterprises decarbonize and seek grid independence through modular, service-based energy models is facilitating Saudi Arabia distributed energy market growth.

Saudi Arabia Distributed Energy Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on technology and end use industry.

Technology Insights:

- Micro-Turbines

- Combustion Turbines

- Micro-Hydropower

- Reciprocating Engines

- Fuel Cells

- Wind Turbines

- Solar PV

The report has provided a detailed breakup and analysis of the market based on the technology. This includes micro-turbines, combustion turbines, micro-hydropower, reciprocating engines, fuel cells, wind turbines, and solar PV.

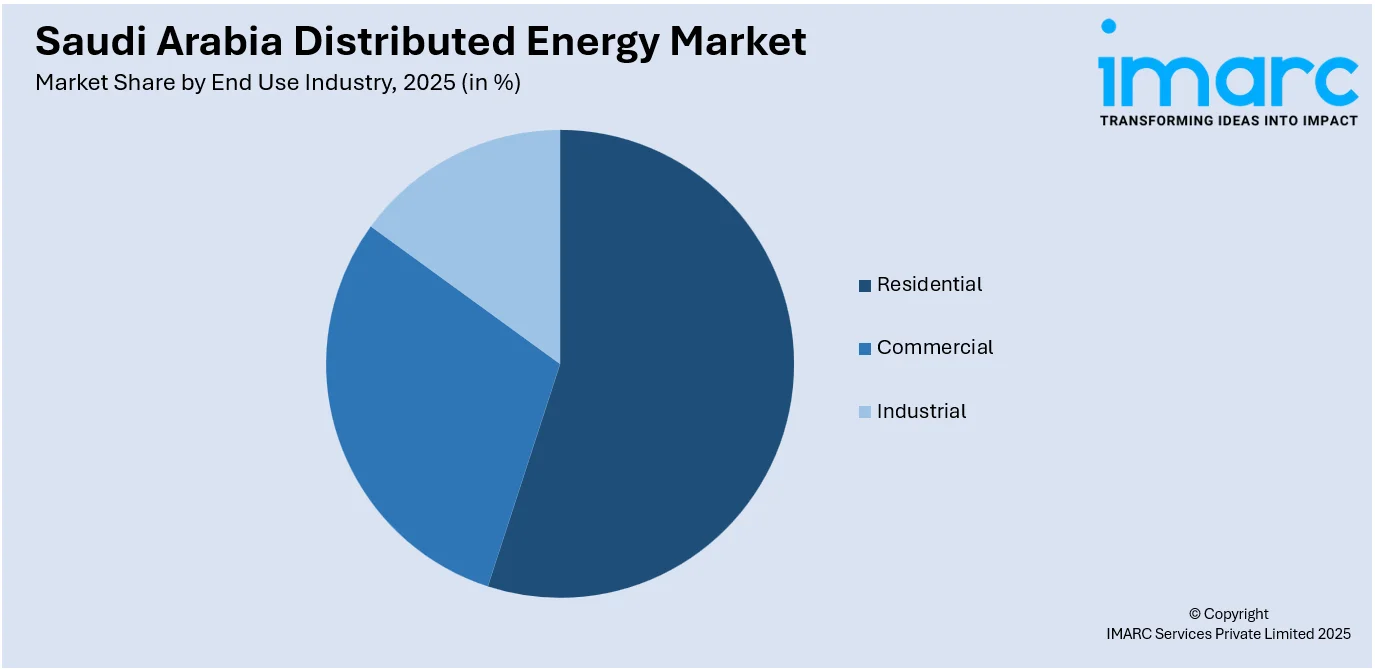

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes residential, commercial, and industrial.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Distributed Energy Market News:

- On December 17, 2024, Saudi Arabia's Energy Minister, announced that the Kingdom aims to automate 40% of its electricity distribution network by the end of 2025, having already achieved 32% of this target. This initiative, unveiled at the 12th Saudi Arabia Smart Grid 2024 Conference in Riyadh, involves the deployment of over 11 million smart meters since 2021 and the planned establishment of nine advanced control centers by 2026 to enhance grid efficiency and support renewable energy integration.

Saudi Arabia Distributed Energy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Micro-Turbines, Combustion Turbines, Micro-Hydropower, Reciprocating Engines, Fuel Cells, Wind Turbines, Solar PV |

| End Use Industries Covered | Residential, Commercial, Industrial |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia distributed energy market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia distributed energy market on the basis of technology?

- What is the breakup of the Saudi Arabia distributed energy market on the basis of end use industry?

- What is the breakup of the Saudi Arabia distributed energy market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia distributed energy market?

- What are the key driving factors and challenges in the Saudi Arabia distributed energy market?

- What is the structure of the Saudi Arabia distributed energy market and who are the key players?

- What is the degree of competition in the Saudi Arabia distributed energy market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia distributed energy market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia distributed energy market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia distributed energy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)