Saudi Arabia Docking Station Market Size, Share, Trends and Forecast by Type, Technology, Application, Distribution Channel, and Region, 2026-2034

Saudi Arabia Docking Station Market Summary:

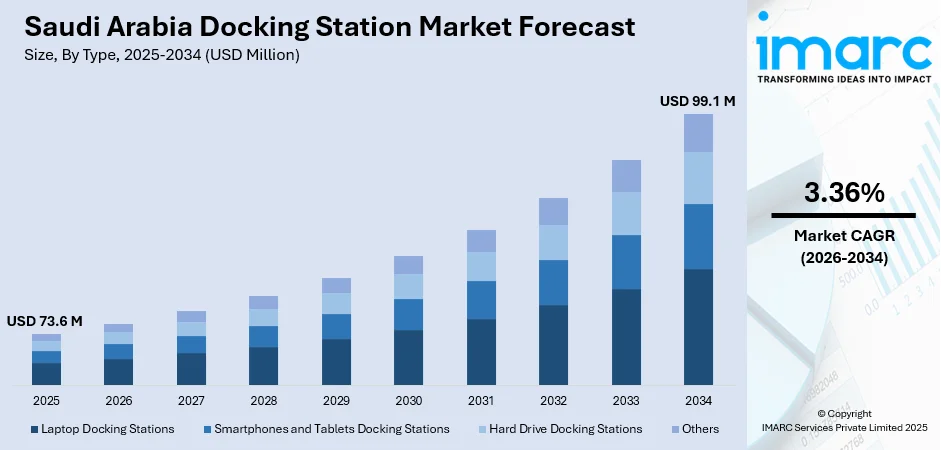

The Saudi Arabia docking station market size was valued at USD 73.6 Million in 2025 and is projected to reach USD 99.1 Million by 2034, growing at a compound annual growth rate of 3.36% from 2026-2034.

The Saudi Arabia docking station market is experiencing steady growth driven by the Kingdom's accelerated digital transformation under Vision 2030 and the widespread adoption of hybrid work models across corporate sectors. Rising demand for enhanced connectivity solutions, expanding enterprise information technology (IT) infrastructure investments, and increasing penetration of portable computing devices are strengthening market dynamics. The convergence of advanced USB-C and Thunderbolt technologies with growing educational technology initiatives is creating substantial opportunities for market participants.

Key Takeaways and Insights:

- By Type: Laptop docking stations dominate the market with a share of 68.44% in 2025, owing to rising demand for unified connectivity, expanded workstation flexibility, and seamless integration across modern corporate and educational environments.

- By Technology: Wired docks lead the market with a share of 82.65% in 2025, driven by consistent data transfer speeds, reduced connectivity interruptions, and stronger compatibility with enterprise-grade hardware systems.

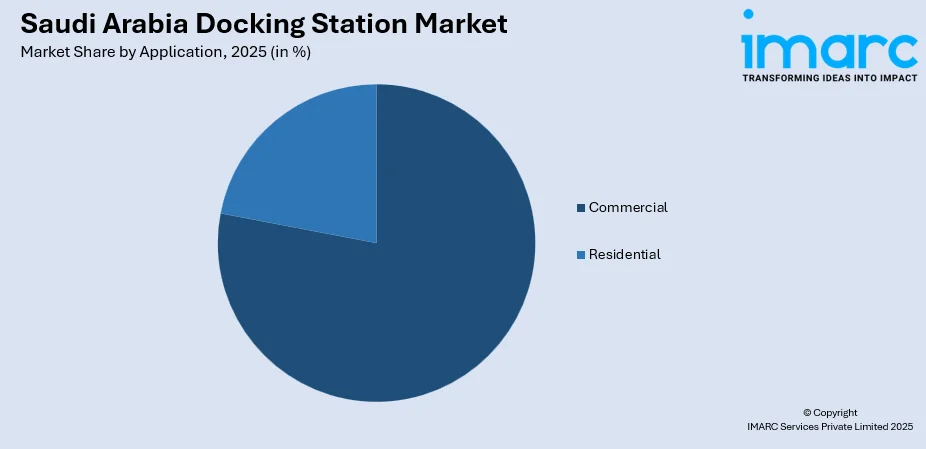

- By Application: Commercial represents the largest segment with a market share of 78.12% in 2025, supported by widespread office deployments, remote-work infrastructure expansion, and organizational preference for standardized device-management solutions.

- By Distribution Channel: Offline dominate the market with a share of 80.35% in 2025, due to client reliance on in-person product demonstrations, technical guidance, and assured after-sales installation support.

- By Region: Eastern Region lead the market with a share of 35.4% in 2025, owing to its concentration of major businesses, technology hubs, and higher adoption of productivity-enhancing IT peripherals.

- Key Players: The Saudi Arabia docking station market exhibits moderate competitive intensity, with multinational technology corporations competing alongside regional distributors across price segments and application categories.

To get more information on this market Request Sample

The Saudi Arabia docking station market growth is supported by the Kingdom’s accelerating digital transformation, rising reliance on portable computing, and the widespread adoption of hybrid work structures across public and private sectors. Organizations are upgrading IT environments to improve workflow efficiency, strengthen device connectivity, and ensure smooth transitions between mobile and desk-based setups. This shift is reinforced by large-scale national technology investments. In 2025, Google Cloud and the Public Investment Fund announced a USD 10 billion commitment to establish a major AI hub in the Kingdom, highlighting the country’s growing role in advanced digital infrastructure. As cloud usage, AI applications, and modern workplace tools continue to grow, demand rises for docking stations that support dependable power delivery, faster data transfer, and unified multi-device operation. Furthermore, expanding use of cloud platforms, virtual collaboration tools, and data-intensive applications increases the need for stable, high-bandwidth workstation setups, making docking stations essential for enhancing productivity and maintaining consistent performance.

Saudi Arabia Docking Station Market Trends:

Advancement of High-Speed Connectivity Infrastructure

As Saudi Arabia strengthens its digital infrastructure with faster internet speeds, advanced wireless-fidelity (Wi-Fi) standards, and high-bandwidth communication networks, the need for docking stations capable of supporting rapid data transfer and stable connectivity is rising. Users increasingly expect seamless device integration and uninterrupted performance for cloud computing, collaboration, and multimedia workloads. This shift is supported by national connectivity progress. According to the Saudi Internet Report 2024 issued by the Communications, Space and Technology Commission (CST), internet penetration has reached 99% across the Kingdom. As digital capabilities expand, docking stations equipped with USB-C, Thunderbolt, and gigabit networking play a vital role in enabling efficient, high-performance work environments.

Increasing Integration of Cloud-Based Workflows Across Industries

Organizations in Saudi Arabia are transitioning to cloud-based workflows, replacing traditional storage and processing models with scalable digital environments. Docking stations support this shift by providing stable, secure connections that enhance access to cloud applications, collaboration tools, and remote computing resources. This reliance on cloud-native operations is further reinforced by national technology partnerships. In 2025, Accenture and Google Cloud announced a collaboration to expand sovereign cloud and generative AI adoption in the Kingdom, strengthening digital infrastructure and workforce capabilities. As cloud integration deepens across industries, docking stations become essential for ensuring smooth device transitions, reliable network performance, and efficient workstation functionality in modern digital workplaces.

Expansion of Remote Training, Digital Workshops, and Virtual Skill Development

The growing adoption of virtual training programs and digital learning platforms is strengthening demand for docking stations that support stable, multi-device computing environments. As employees and students engage in extended online sessions, reliable connections to webcams, microphones, monitors, and interactive tools become essential for effective participation. This shift is reinforced by national upskilling initiatives. In 2025, Saudi Arabia launched an AI-powered National Skills Platform designed to train more than 3 million workers through personalized, data-driven modules. With remote learning expanding across corporate and educational sectors, docking stations provide consistent performance and improved usability, ensuring uninterrupted access to digital training resources and supporting long-term workforce development efforts.

How Vision 2030 is Transforming the Saudi Arabia Docking Station Market:

Vision 2030 is reshaping the Saudi Arabia docking station market by accelerating nationwide digital transformation, fostering technology adoption across public and private sectors, and promoting modern workplace infrastructure. As organizations advance toward smarter, more efficient operational models, demand grows for docking stations that support seamless device connectivity, hybrid work environments, and integrated IT ecosystems. Government-led initiatives to expand digital government services, enhance educational technology, and strengthen corporate productivity tools further reinforce this shift. The growing emphasis on knowledge-based industries and innovation-driven economic diversification encourages enterprises to invest in advanced workstation solutions, positioning docking stations as essential tools within Saudi Arabia’s evolving digital landscape.

Market Outlook 2026-2034:

The Saudi Arabia docking station market is positioned for notable growth, supported by ongoing digital transformation efforts and changing workplace technology needs across corporate and institutional environments. Demand is rising as organizations adopt flexible work models, enhance device connectivity, and upgrade IT infrastructure. The market generated a revenue of USD 73.6 Million in 2025 and is projected to reach a revenue of USD 99.1 Million by 2034, growing at a compound annual growth rate of 3.36% from 2026-2034.

Saudi Arabia Docking Station Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Laptop Docking Stations | 68.44% |

| Technology | Wired Docks | 82.65% |

| Application | Commercial | 78.12% |

| Distribution Channel | Offline | 80.35% |

| Region | Eastern Region | 35.4% |

Type Insights:

- Laptop Docking Stations

- Smartphones and Tablets Docking Stations

- Hard Drive Docking Stations

- Others

Laptop docking stations dominate with a market share of 68.44% of the total Saudi Arabia docking station market in 2025.

Laptop docking stations dominate the market because users increasingly need multi-port connectivity to support monitors, peripherals, and charging through a single interface. This demand is strongest in offices and educational settings where flexible workstation setups are essential.

Their popularity also reflects the shift toward mobile computing. Employees using lightweight laptops rely on docking stations to create full desktop-style environments, improving productivity and easing transitions between remote and on-site work.

Technology Insights:

- Wired Docks

- Wireless Docks

Wired docking stations lead with a market share of 82.65% of the total Saudi Arabia docking station market in 2025.

Wired docks represent the largest segment, as they provide stable connections, faster data transfer, and consistent power delivery for multiple devices. These features make them highly dependable for daily professional use.

Their strong position is further supported by broad compatibility with enterprise hardware. Organizations prefer wired systems to avoid signal disruptions, ensuring reliable performance during meetings, data transfers, and multitasking across numerous applications.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Commercial

- Residential

Commercial exhibits a clear dominance with a 78.12% share of the total Saudi Arabia docking station market in 2025.

Commercial leads the market owing to widespread adoption of docking stations in corporate offices, government institutions, and large organizations that require standardized workstations. This ensures smooth device management and uniform employee setups.

The market demand is also driven by hybrid work practices. Companies invest in docking systems to help employees shift between office desks and remote environments while maintaining consistent productivity and device functionality.

Distribution Channel Insights:

- Offline

- Online

Offline dominates with a market share of 80.35% of the total Saudi Arabia docking station market in 2025.

Offline holds the biggest market share, as buyers often prefer inspecting devices in person, receiving expert guidance, and confirming compatibility before purchase. Professional installation support offered by physical outlets also builds customer confidence.

Many enterprises procure through offline vendors to secure reliable after-sales service. These stores provide tailored recommendations, ensuring large-scale buyers receive products suited to their existing IT infrastructure and workflow needs.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Eastern Region leads with a market share of 35.4% of the total Saudi Arabia docking station market in 2025.

Eastern Region leads the market due to its concentration of corporate hubs, universities, and technology-driven workplaces that require advanced docking systems to support daily operations. Higher digital adoption fuels consistent demand.

Its strong economic activity and dense business presence encourage ongoing investment in IT hardware. Organizations across the region prioritize productivity tools, making docking stations a standard component of modern workstation setups.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Docking Station Market Growing?

Growing Employment of Laptop and Portable Computing

The rapid adoption of laptop and portable computing in Saudi Arabia is significantly increasing the need for docking station solutions that enhance productivity, connectivity, and workstation efficiency. This trend is supported by the Kingdom’s expanding device ecosystem, as the Saudi Arabia laptop market reached USD 1.27 billion in 2024 and is forecasted to rise to USD 2.71 billion by 2033, as per the IMARC Group, creating a large installed base requiring advanced peripheral support. The growing reliance on remote and hybrid work models, rising integration of educational technology, widespread internet availability, and a youthful population favoring mobile computing all contribute to heightened demand for docking stations as essential tools for modern digital workflows.

Youth-Dominated Workforce Accelerating Digital Device Integration

Saudi Arabia’s young population is significantly influencing the docking station market, as a digitally proficient and tech-driven workforce increasingly depends on multi-device productivity tools. According to GASTAT's 2024 report, 71% of Saudi citizens are below the age of 35, with an average age of 26.6 years and a median age of 23.5 years, creating a strong demographic foundation for rapid adoption of modern digital infrastructure. Younger professionals expect seamless connectivity, efficient workspace setups, and portable computing solutions that support hybrid and mobile work habits. This demographic shift reinforces sustained demand for docking stations across corporate, educational, and entrepreneurial environments.

Rising Adoption of Digital Creative Workflows Across Industries

Digital creative work in Saudi Arabia increasingly relies on high-performance, multi-device setups that require fast data handling, large display connectivity, and stable power delivery. Docking stations enable these workflows by supporting external drives, professional input tools, and advanced audio–visual equipment. The Kingdom’s growing focus on creative industries further strengthens this need. The Saudi Animation Forum 2025, scheduled in Riyadh, highlights national efforts to develop a competitive animation ecosystem by fostering talent, attracting global studios, and advancing digital production capabilities. As creative sectors expand across gaming, entertainment, and corporate media, demand for robust docking solutions continues to rise, reinforcing their role in modern content-creation environments.

Market Restraints:

What Challenges the Saudi Arabia Docking Station Market is Facing?

High Upfront Investment for Enterprise Deployment

Enterprise-wide workstation upgrades involving docking stations, monitors, power solutions, and compatible peripherals can require sizable capital investment. Budget-sensitive organizations may delay modernization initiatives when cost benefits accrue gradually rather than immediately. This financial hesitation particularly affects small and mid-sized firms, ultimately slowing the overall pace of docking station adoption across the commercial landscape.

Limited Technical Support and Configuration Expertise

Successful deployment of advanced docking systems requires skilled IT personnel capable of handling configuration, troubleshooting, and integration with enterprise networks. Many organizations, particularly smaller ones, lack specialized expertise, resulting in user frustrations, connectivity issues, and reduced system efficiency. Insufficient technical support becomes a barrier that discourages widespread adoption of docking solutions.

Rising Cybersecurity and Data Protection Requirements

As docking stations integrate more deeply with corporate networks, they must comply with strict cybersecurity protocols to prevent unauthorized access or data compromise. Ensuring secure connectivity increases engineering complexity and raises certification requirements for manufacturers. Organizations may approach adoption cautiously due to heightened security expectations, risk assessments, and compliance-related concerns.

Competitive Landscape:

The Saudi Arabia docking station market exhibits moderate competitive intensity, shaped by the presence of global technology brands alongside regional distributors that cater to expanding corporate and individual demand. Competition is defined by innovation in connectivity features, compatibility with diverse device ecosystems, and the growing need for reliable multi-port solutions that support hybrid work environments. Vendors focus on product differentiation through faster data transfer, improved power delivery, and compact designs suited to modern workstations. Partnerships with IT resellers, enterprise clients, and retail channels further influence market positioning. As digital adoption accelerates, companies enhance after-sales services, warranties, and pricing strategies to maintain relevance.

Saudi Arabia Docking Station Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Laptop Docking Stations, Smartphones and Tablets Docking Stations, Hard Drive Docking Stations, Others |

| Technologies Covered | Wired Docks, Wireless Docks |

| Applications Covered | Commercial, Residential |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia docking station market size was valued at USD 73.6 Million in 2025.

The Saudi Arabia docking station market is expected to grow at a compound annual growth rate of 3.36% from 2026-2034 to reach USD 99.1 Million by 2034.

Laptop docking stations dominate with the largest revenue share of 68.44% in 2025, driven by the expanding portable computing ecosystem, enterprise productivity requirements, and multi-display workstation configurations across corporate offices.

Key factors driving the Saudi Arabia docking station market include the Kingdom’s enhanced digital infrastructure, which requires docking stations that deliver fast data transfer and stable connectivity. With internet penetration reaching 99% as reported by CST in 2024, users now expect seamless integration for cloud work, collaboration, and high-performance digital tasks.

High deployment costs, limited technical expertise, and rising cybersecurity requirements collectively slow docking station adoption in Saudi Arabia. Budget constraints hinder upgrades, insufficient IT support complicates integration, and strict security expectations increase caution, causing many organizations to delay or scale back modernization efforts despite the growing digitalization needs.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)