Saudi Arabia Domestic Air Cargo Transport Market Size, Share, Trends and Forecast by Service Type, Cargo Type, Aircraft Type, End-User Industry, and Region, 2026-2034

Saudi Arabia Domestic Air Cargo Transport Market Overview:

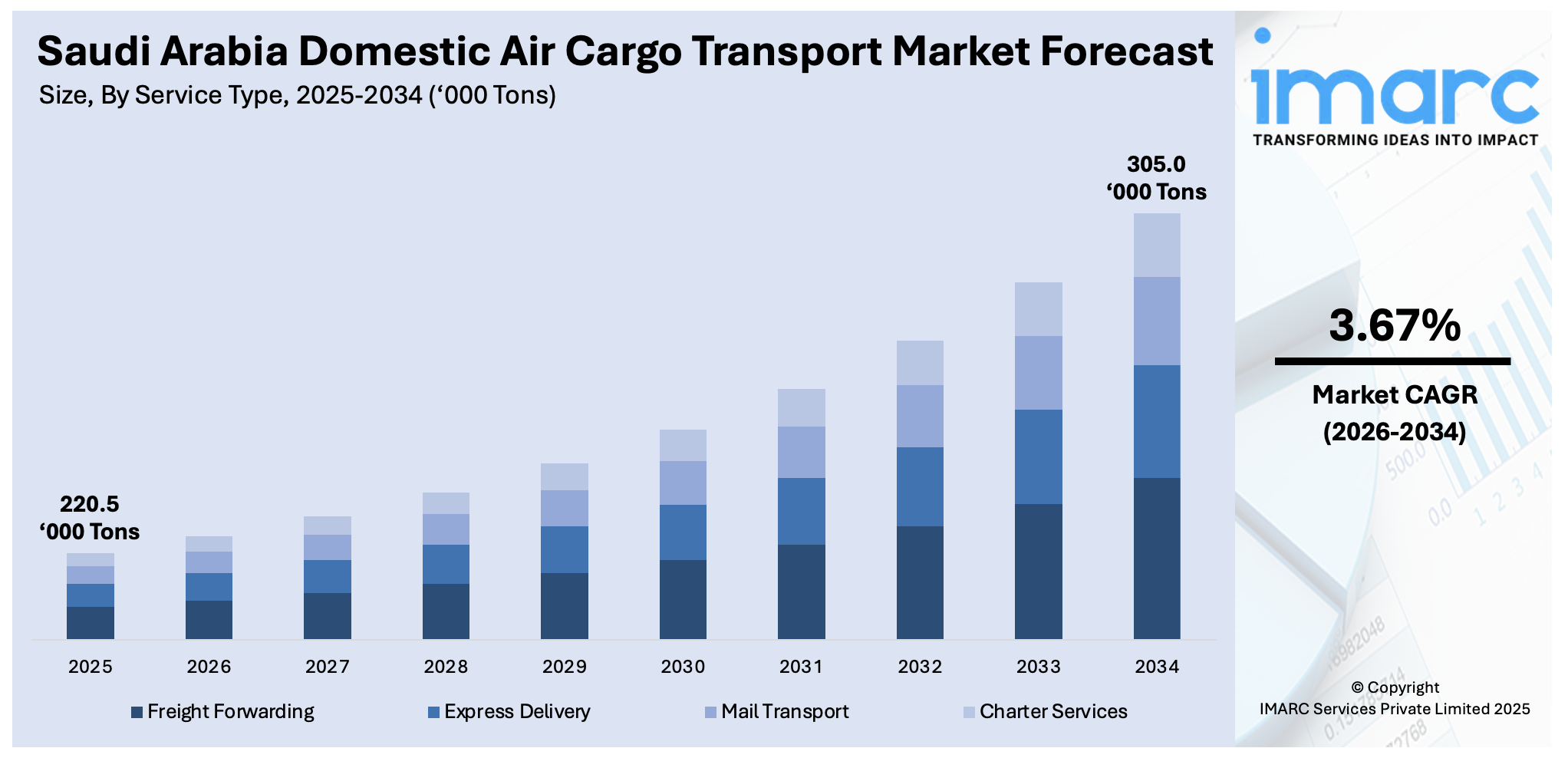

The Saudi Arabia domestic air cargo transport market size reached 220.5 Thousand Metric Tons in 2025. Looking forward, IMARC Group expects the market to reach 305.0 Thousand Metric Tons by 2034, exhibiting a growth rate (CAGR) of 3.67% during 2026-2034. Robust economic growth, increasing e-commerce demand, advancements in logistics infrastructure, and government support through Vision 2030 are some of the factors contributing to Saudi Arabia domestic air cargo transport market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 220.5 Thousand Metric Tons |

| Market Forecast in 2034 | 305.0 Thousand Metric Tons |

| Market Growth Rate 2026-2034 | 3.67% |

Saudi Arabia Domestic Air Cargo Transport Market Trends:

Growth in Agricultural Exports through Air Cargo

Saudi Arabia’s domestic air cargo transport sector is experiencing significant growth, particularly in the export of agricultural products like dates. The sector benefits from advanced cold chain technologies, ensuring efficient and safe transportation of perishable goods. This growth is driven by the increasing demand for fast and reliable delivery solutions, with an expanding network that connects the Kingdom's producers to global markets. As the country continues to prioritize economic diversification, the air cargo sector plays a crucial role in facilitating exports and supporting agricultural industries. The combination of robust infrastructure and a focus on sustainability is helping to position Saudi Arabia as a competitive player in the global agricultural export market, especially with the rise in air freight capacity dedicated to perishable goods. These factors are intensifying the Saudi Arabia domestic air cargo transport market growth. For example, in 2024, Saudia Cargo, a key player in Saudi Arabia's air cargo sector, saw a 64% growth in date exports, reaching nearly 1.5 Million Kilograms. The airline's extensive air cargo network connects Saudi date producers with over 45 global destinations, ensuring fast and quality deliveries. With advanced cold chain technologies, Saudia Cargo supports the Kingdom's agricultural exports while aligning with sustainability goals, contributing to Saudi Arabia's economic diversification through efficient air transport solutions.

To get more information on this market Request Sample

Economic Impact of Aviation

Aviation plays a crucial role in Saudi Arabia's economy, significantly contributing to the nation's GDP and employment. The sector supports a wide range of economic activities, facilitating both passenger and air cargo transportation. It generates substantial employment, with a considerable number of individuals directly working within airlines and related industries. The air cargo segment, in particular, is essential for moving goods both domestically and internationally, strengthening the country’s position in global trade. As Saudi Arabia continues to expand its aviation infrastructure, the sector remains a cornerstone in its economic diversification efforts, enhancing connectivity and supporting broader growth across various industries. For instance, in May 2025, the International Air Transport Association (IATA) highlighted the significant economic contributions of aviation in Saudi Arabia at the IATA Aviation Day MENA. The 2023 report shows that aviation supports USD 90.6 Billion in economic activity, accounting for 8.5% of GDP. It also facilitates 1.4 Million jobs, with 62,000 directly employed by airlines, and handles 713,600 tons of air cargo, underlining the sector's crucial role in the Kingdom's economy.

Saudi Arabia Domestic Air Cargo Transport Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on service type, cargo type, aircraft type, and end-user industry.

Service Type Insights:

- Freight Forwarding

- Express Delivery

- Mail Transport

- Charter Services

The report has provided a detailed breakup and analysis of the market based on the service type. This includes freight forwarding, express delivery, mail transport, and charter services.

Cargo Type Insights:

- General Cargo

- Perishable Goods

- Pharmaceuticals and Healthcare Products

- Electronics and High-Value Goods

- E-commerce Shipments

- Automotive Parts and Machinery

A detailed breakup and analysis of the market based on the cargo type have also been provided in the report. This includes general cargo, perishable goods, pharmaceuticals and healthcare products, electronics and high-value goods, e-commerce shipments, and automotive parts and machinery.

Aircraft Type Insights:

- Dedicated Freighters

- Passenger Belly Cargo

- UAVs (Drones)

The report has provided a detailed breakup and analysis of the market based on the aircraft type. This includes dedicated freighters, passenger belly cargo, and UAVs (drones).

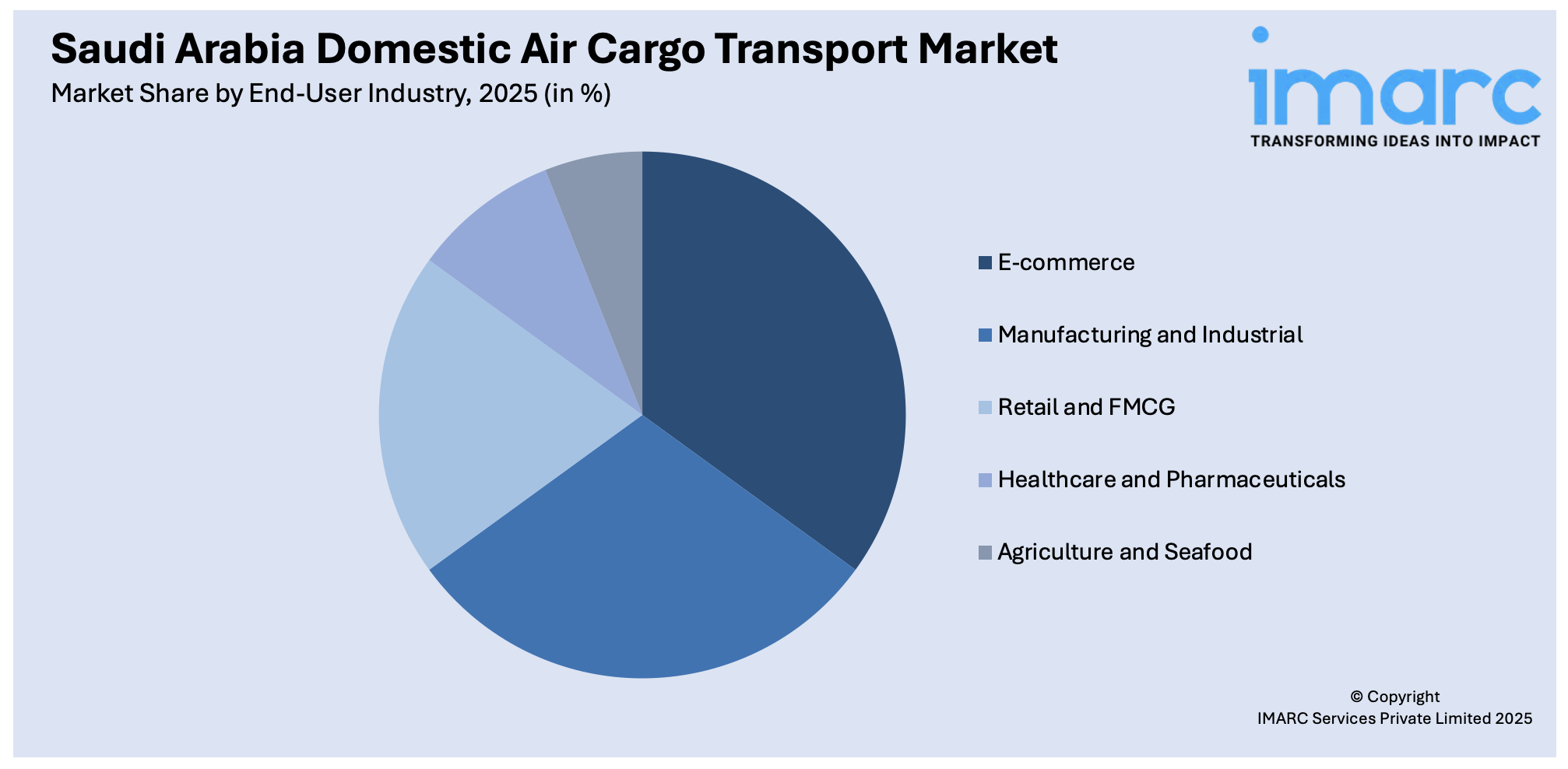

End-User Industry Insights:

Access the comprehensive market breakdown Request Sample

- E-commerce

- Manufacturing and Industrial

- Retail and FMCG

- Healthcare and Pharmaceuticals

- Agriculture and Seafood

A detailed breakup and analysis of the market based on the end-user industry have also been provided in the report. This includes e-commerce, manufacturing and industrial, retail and FMCG, healthcare and pharmaceuticals, and agriculture and seafood.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Domestic Air Cargo Transport Market News:

- In May 2025, Saudi Arabia’s General Authority of Civil Aviation (GACA) lifted cabotage restrictions on charter flight operations. This move supports Saudi Arabia's goal to become a global aviation hub and boost the private aviation sector. The policy change is part of the General Aviation Roadmap, aiming to grow the sector into a USD 2 Billion industry by 2030, with significant investments and regulatory reforms to attract international operators and investors.

Saudi Arabia Domestic Air Cargo Transport Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Thousand Metric Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Freight Forwarding, Express Delivery, Mail Transport, Charter Services |

| Cargo Types Covered | General Cargo, Perishable Goods, Pharmaceuticals and Healthcare Products, Electronics and High-Value Goods, E-commerce Shipments, Automotive Parts and Machinery |

| Aircraft Types Covered | Dedicated Freighters, Passenger Belly Cargo, UAVs (Drones) |

| End-User Industries Covered | E-commerce, Manufacturing and Industrial, Retail and FMCG, Healthcare and Pharmaceuticals, Agriculture and Seafood |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia domestic air cargo transport market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia domestic air cargo transport market on the basis of service type?

- What is the breakup of the Saudi Arabia domestic air cargo transport market on the basis of cargo type?

- What is the breakup of the Saudi Arabia domestic air cargo transport market on the basis of aircraft type?

- What is the breakup of the Saudi Arabia domestic air cargo transport market on the basis of end-user industry?

- What is the breakup of the Saudi Arabia domestic air cargo transport market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia domestic air cargo transport market?

- What are the key driving factors and challenges in the Saudi Arabia domestic air cargo transport market?

- What is the structure of the Saudi Arabia domestic air cargo transport market and who are the key players?

- What is the degree of competition in the Saudi Arabia domestic air cargo transport market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia domestic air cargo transport market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia domestic air cargo transport market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia domestic air cargo transport industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)