Saudi Arabia Doors Market Size, Share, Trends and Forecast by Type, Material, Mechanism, Application, End User, and Region, 2026-2034

Saudi Arabia Doors Market Overview:

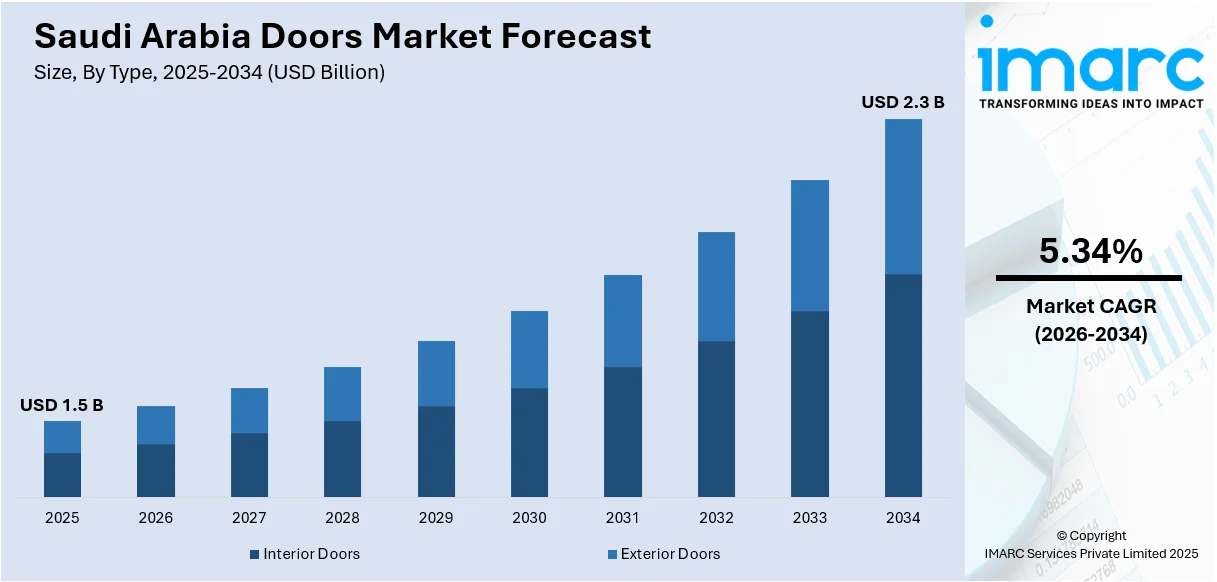

The Saudi Arabia doors market size reached USD 1.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 2.3 Billion by 2034, exhibiting a growth rate (CAGR) of 5.34% during 2026-2034. The market is propelled by high urbanization, residential and commercial building growth, and government-initiated infrastructure development under Vision 2030. Rising demand for high-quality, energy-efficient, and smart door solutions, as well as mounting renovation activity and contemporary architectural designs, also accelerates the market growth throughout the Kingdom.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.5 Billion |

| Market Forecast in 2034 | USD 2.3 Billion |

| Market Growth Rate 2026-2034 | 5.34% |

Saudi Arabia Doors Market Trends:

Rising Demand for Energy-Efficient and Smart Doors

One of the key trends defining the Saudi Arabia doors market is the growing need for energy-efficient and smart doors. With sustainability emerging as a national agenda through initiatives like Vision 2030, customers and developers alike are choosing doors that provide superior insulation, cut down on energy usage, and improve building efficiency. In June 2024, Technal introduced Circal in Saudi Arabia, an innovative aluminum alloy made up of at least 75% recycled post-consumer aluminum waste to focus on low-carbon and energy-efficient windows and doors. This innovative material greatly improves the sustainability attributes of their products, aiding in the prevention of 1.5 million tons of embodied CO2 emissions over 500 projects. Apart from this, smart doors with digital locks, biometric systems, and automated opening and closing mechanisms are becoming increasingly popular in residential as well as commercial applications. These doors offer greater security while also resonating with the Kingdom's increased emphasis on smart city development. Energy-efficient materials like insulated steel, fiberglass, and uPVC are being widely employed to enable sustainable building practices. With increasing electricity prices and a requirement for temperature regulation in extreme weather, energy-efficient doors are becoming a must. This is a reflection of the Kingdom's transition toward eco-friendly construction and its adoption of innovation in building materials and home automation.

To get more information on this market Request Sample

Growth in Residential and Commercial Construction

The quick expansion of residential and commercial development is having a strong impact on the Saudi Arabia doors market share. Mega-projects such as NEOM, the Red Sea Project, and Qiddiya are generating a boom in demand for high-quality, long-lasting, and good-looking doors. In residential markets, new housing projects are propelling demand for fashionable, customizable door solutions that match modern architectural styles. At the same time, commercial properties like office buildings, shopping centers, hotels, and hospitals need an array of door types from fire-rated and acoustic doors to automated glass and metal doors in order to satisfy safety, functionality, and design requirements. Public investment and private sector participation in infrastructure development are fueling construction activity in the country as a whole, which is driving demand for interior and exterior doors. As the real estate industry continues to expand, especially in city centers, demand for doors in different applications is likely to stay robust, placing construction expansion as a prime market driver.

Increasing Adoption of Premium and Customizable Door Designs

Another leading trend influencing the Saudi Arabia doors market outlook is the growing demand for premium, high-end, and customized door styles. Consumers are looking for doors that, besides providing functionality and security, make their spaces more visually appealing. This trend is mostly notable in luxury villas, high-end commercial complexes, and hotels where design refinement and material finish are given top priority. Exquisitely carved wooden doors, sleek metal doors with contemporary finishes, and tastefully designed glass doors with patterns are hot commodities. Customization in size, color, texture, and technology embedding—like smart access control and automation—becomes an ideal proposition for sale. Domestic players and foreign companies are responding by providing a large range of design possibilities, finishes, and made-to-measure offerings. The is consistent with a greater cultural movement toward luxury living and personalization, supporting the changing lifestyle in the Kingdom along with rising disposable incomes.

Saudi Arabia Doors Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on type, material, mechanism, application, and end user.

Type Insights:

- Interior Doors

- Exterior Doors

The report has provided a detailed breakup and analysis of the market based on the type. This includes interior doors and exterior doors.

Material Insights:

- Wood

- Glass

- Metal

- Plastic

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes wood, glass, metal, plastic, and others.

Mechanism Insights:

- Swinging

- Sliding

- Folding

- Revolving

- Others

The report has provided a detailed breakup and analysis of the market based on the mechanism. This includes swinging, sliding, folding, revolving, and others.

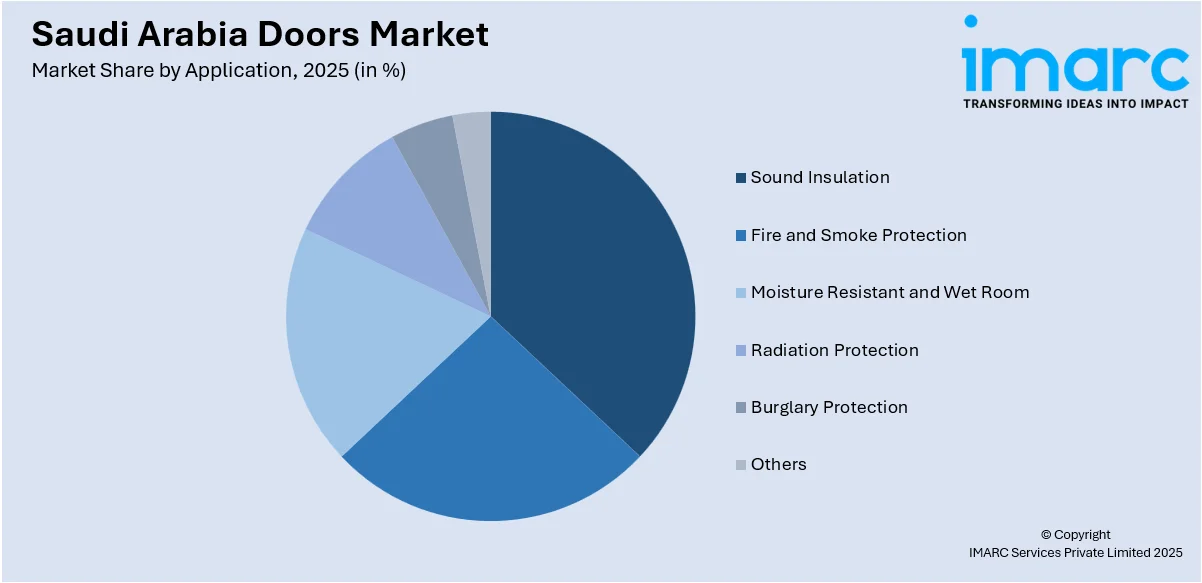

Application Insights:

Access the comprehensive market breakdown Request Sample

- Sound Insulation

- Fire and Smoke Protection

- Moisture Resistant and Wet Room

- Radiation Protection

- Burglary Protection

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes sound insulation, fire and smoke protection, moisture resistant and wet room, radiation protection, burglary protection, and others.

End User Insights:

- Residential

- Non-Residential

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential and non-residential.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Doors Market News:

- In July 2024, Universal Building Supplies Merchants Co. Ltd. (UBM) in Riyadh entered into a ‘Strategic Alliance Agreement’ with ASSA ABLOY Security Solutions Middle East (ASSA ABLOY), a prominent producer of door opening solutions. The contract was executed by Raghunath Sadasivam, chairman of UBM's Advisory Board; whereas Nassim Abu Yousef, CEO, signed the Strategic Alliance Agreement for ASSA ABLOY.

Saudi Arabia Doors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Interior Doors, Exterior Doors |

| Materials Covered | Wood, Glass, Metal, Plastic, Others |

| Mechanisms Covered | Swinging, Sliding, Folding, Revolving, Others |

| Applications Channels | Sound Insulation, Fire and Smoke Protection, Moisture Resistant and Wet Room, Radiation Protection, Burglary Protection, Others |

| End Users Covered | Residential, Non-residential |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia doors market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia doors market on the basis of type?

- What is the breakup of the Saudi Arabia doors market on the basis of material?

- What is the breakup of the Saudi Arabia doors market on the basis of mechanism?

- What is the breakup of the Saudi Arabia doors market on the basis of application?

- What is the breakup of the Saudi Arabia doors market on the basis of end user?

- What is the breakup of the Saudi Arabia doors market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia doors market?

- What are the key driving factors and challenges in the Saudi Arabia doors market?

- What is the structure of the Saudi Arabia doors market and who are the key players?

- What is the degree of competition in the Saudi Arabia doors market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia doors market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia doors market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia doors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)