Saudi Arabia Driver Assistance Systems Market Size, Share, Trends and Forecast by Type, Technology, Vehicle Type, and Region, 2026-2034

Saudi Arabia Driver Assistance Systems Market Overview:

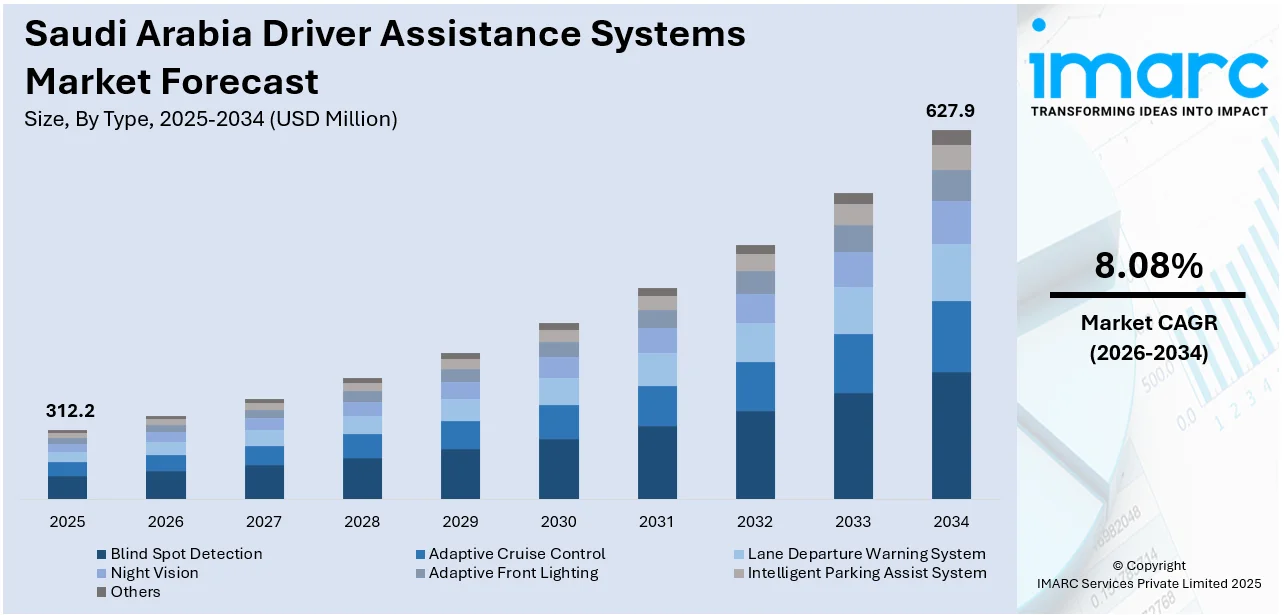

The Saudi Arabia driver assistance systems market size reached USD 312.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 627.9 Million by 2034, exhibiting a growth rate (CAGR) of 8.08% during 2026-2034. The market is driven by regulatory mandates and public-sector safety programs that embed driver assistance into transport policy. Also, the rapid growth of Saudi Arabia’s luxury car segment is pushing automation features into the mainstream. Additionally, localization of automotive technology, with tailored ADAS innovations suited to desert climates and urban roads, is reinforcing industry growth. Strong consumer interest in high-spec vehicles, strategic industrial partnerships, and formal vehicle safety norms are further augmenting the Saudi Arabia driver assistance systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 312.2 Million |

| Market Forecast in 2034 | USD 627.9 Million |

| Market Growth Rate 2026-2034 | 8.08% |

Saudi Arabia Driver Assistance Systems Market Trends:

Road Safety Mandates and Regulatory Reinforcement

The Kingdom of Saudi Arabia has been intensifying its commitment to road safety reform through a combination of regulatory enforcement and long-term strategic planning under Vision 2030. This shift has elevated the importance of technologies that reduce human error in driving, such as lane departure warning systems, adaptive cruise control, and automatic emergency braking. With growing emphasis on intelligent transport systems (ITS), the integration of driver assistance components is becoming a legal and operational requirement for both passenger and commercial vehicles. Vehicle import regulations increasingly require compliance with international safety standards, encouraging OEMs and suppliers to embed advanced assistance systems in their offerings. As part of its comprehensive traffic accident reduction strategy, the Saudi government has initiated public-private partnerships to modernize road infrastructure with vehicle-to-infrastructure (V2I) support capabilities. Public awareness campaigns are further educating consumers about the long-term value of semi-autonomous safety features. The gradual alignment of insurance premium structures with vehicle safety ratings has incentivized buyers to opt for enhanced assistance technologies. These interconnected shifts, ranging from legal mandates to market expectations, are reinforcing adoption. These changes are central to Saudi Arabia driver assistance systems market growth by formalizing demand through infrastructure and regulation.

To get more information on this market Request Sample

Luxury Automotive Segment Expansion

The Kingdom’s premium vehicle market continues to experience substantial growth, driven by shifting lifestyle aspirations and increased purchasing power among urban consumers. Luxury automakers, both established German brands and newer entrants from Asia, are aggressively competing to offer feature-rich models equipped with comprehensive driver assistance packages. Features such as traffic sign recognition, 360-degree parking cameras, and blind-spot detection are no longer seen as add-ons, but as baseline offerings in the luxury segment. Saudi consumers, especially in Riyadh and Jeddah, have shown a marked preference for technology-infused vehicles that reflect status, safety, and comfort. Retail showrooms are emphasizing the safety and convenience attributes of Level 1 and Level 2 autonomous features, while digital retail platforms highlight the role of ADAS in driving experience enhancement. Additionally, government incentives aimed at encouraging electric vehicle (EV) adoption are indirectly strengthening demand for integrated ADAS modules, as most EVs come equipped with such systems by default. As luxury EVs and hybrid models enter the mainstream market, the standardization of assistance technologies is accelerating. This evolution is gradually extending to mid-tier models, driven by consumer expectations formed through luxury market experiences, further diversifying the scope of deployment for driver assistance technologies.

Localization of Automotive Assembly and Tech Partnerships

In line with Vision 2030's industrial diversification strategy, Saudi Arabia is laying the groundwork for localized automotive assembly, particularly through initiatives facilitated by the Ministry of Industry and Mineral Resources and the Public Investment Fund. This emerging ecosystem has prompted global automotive players and Tier 1 technology providers to explore partnerships and establish ADAS manufacturing and R&D capacities within the Kingdom. Localization not only reduces supply chain risks but also enables system customization aligned with the region’s unique driving conditions and climate. The Kingdom's collaboration with leading firms in automotive electronics and sensors is facilitating the integration of regionally relevant driver assistance solutions, including dust-optimized LiDAR, thermal sensors for high-heat environments, and off-road detection tools. These investments are improving the availability and affordability of ADAS solutions across vehicle segments, moving the conversation from import dependence to domestic innovation. Moreover, strategic knowledge transfers and local workforce training initiatives are building foundational expertise in ADAS software and systems engineering. With Saudi Arabia gradually positioning itself as a regional automotive hub, the cumulative benefits of local production, tailored innovation, and cost efficiency are contributing materially to the expansion of the national driver assistance systems market.

Saudi Arabia Driver Assistance Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, technology, and vehicle type.

Type Insights:

- Blind Spot Detection

- Adaptive Cruise Control

- Lane Departure Warning System

- Night Vision

- Adaptive Front Lighting

- Intelligent Parking Assist System

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes blind spot detection, adaptive cruise control, lane departure warning system, night vision, adaptive front lighting, intelligent parking assist system, and others.

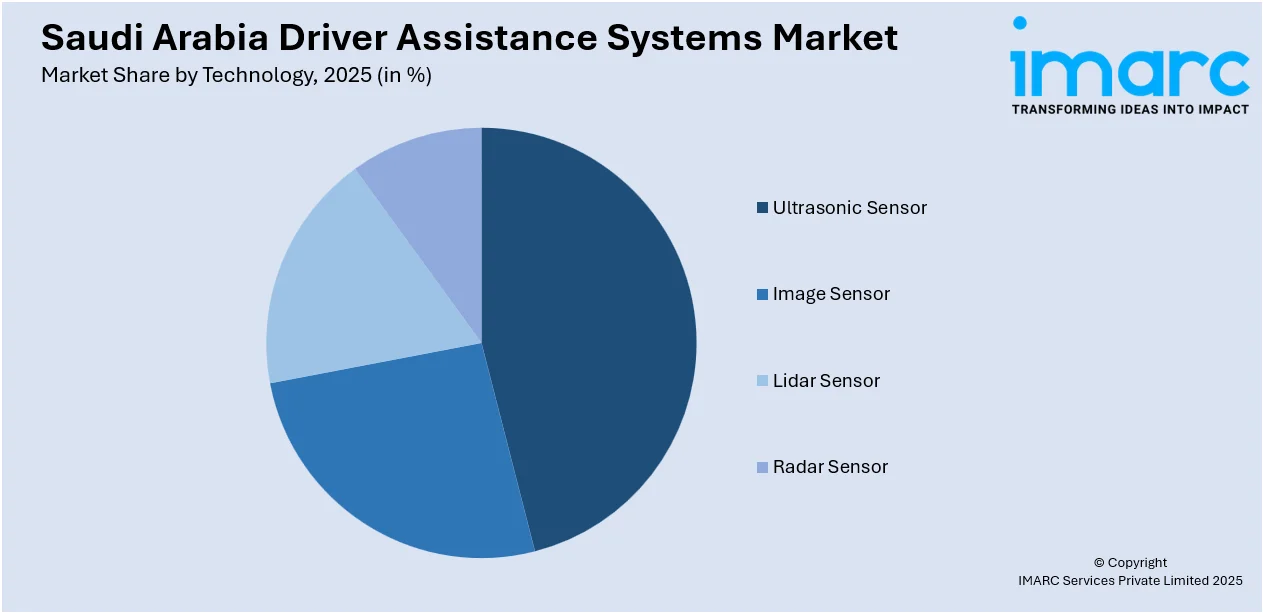

Technology Insights:

Access the comprehensive market breakdown Request Sample

- Ultrasonic Sensor

- Image Sensor

- Lidar Sensor

- Radar Sensor

The report has provided a detailed breakup and analysis of the market based on the technology. This includes ultrasonic sensor, image sensor, lidar sensor, and radar sensor.

Vehicle Type Insights:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger cars, light commercial vehicles, and heavy commercial vehicles.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Driver Assistance Systems Market News:

- On May 5, 2025, Lucid Group and Saudi Arabia’s King Abdullah University of Science and Technology (KAUST) announced a strategic partnership to enhance electric vehicle (EV) innovation and expand autonomous driving and driver assistance systems capabilities. This collaboration grants Lucid access to KAUST’s supercomputing infrastructure to accelerate research in AI training, digital twin development, crash simulation, and advanced materials engineering. The joint effort strengthens Saudi Arabia’s mobility technology ecosystem and reinforces long-term investment in driver assistance R&D.

Saudi Arabia Driver Assistance Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Blind Spot Detection, Adaptive Cruise Control, Lane Departure Warning System, Night Vision, Adaptive Front Lighting, Intelligent Parking Assist System, Others |

| Technologies Covered | Ultrasonic Sensor, Image Sensor, Lidar Sensor, Radar Sensor |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia driver assistance systems market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia driver assistance systems market on the basis of type?

- What is the breakup of the Saudi Arabia driver assistance systems market on the basis of technology?

- What is the breakup of the Saudi Arabia driver assistance systems market on the basis of vehicle type?

- What is the breakup of the Saudi Arabia driver assistance systems market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia driver assistance systems market?

- What are the key driving factors and challenges in the Saudi Arabia driver assistance systems market?

- What is the structure of the Saudi Arabia driver assistance systems market and who are the key players?

- What is the degree of competition in the Saudi Arabia driver assistance systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia driver assistance systems market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia driver assistance systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia driver assistance systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)