Saudi Arabia Drone Software Market Size, Share, Trends and Forecast by Solution, Architecture, Deployment, Application, Industry Vertical, Type, End Use, and Region, 2026-2034

Saudi Arabia Drone Software Market Overview:

The Saudi Arabia drone software market size reached USD 89.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 346.4 Million by 2034, exhibiting a growth rate (CAGR) of 16.24% during 2026-2034. The market is stimulated by continuous advancements in AI incorporation, rising usage of products in infrastructure inspection and monitoring, augmented usage in defense applications for security and surveillance, heightened demand in agricultural monitoring and precision agriculture, and growth in drone delivery services for logistics and retail.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 89.4 Million |

| Market Forecast in 2034 | USD 346.4 Million |

| Market Growth Rate (2026-2034) | 16.24% |

Saudi Arabia Drone Software Market Trends:

AI Integration and Autonomous Capabilities

The Saudi Arabian drone software market is experiencing rapid growth due to advances in AI integration. According to Saudi Press Agency, The SDAIA Readiness and Adoption Survey, in 2024, identified that 39% of government organizations are utilizing or testing AI. Furthermore, 81% of such organizations indicated improved delivery of services due to the use of AI. The integration of AI technology is advancing the autonomous function of drones to perform sophisticated operations with minimal intervention. AI-powered software is enhancing real-time data analysis, making drones more efficient in adapting to different environments and tasks. The trend is highly advantageous for industries like oil and gas, where drones are used for essential monitoring and inspections. The capability of utilizing AI in high-level navigation and decision-making increases operational performance and safety and thus makes drone software a choice solution for risk-prone sectors. Saudi firms are investing in AI-driven drone solutions to maintain big-ticket projects and infrastructure creation in line with the nation's Vision 2030 objectives in terms of innovation in technology as well as diversification of its economy.

Expansion in Infrastructure and Construction Applications

The Saudi Arabian drone software industry is being driven by growing use in the construction and infrastructure industries. The requirement for effective site mapping, tracking of progress, and safety checks has necessitated the use of drones in these sectors. Drone software with functionalities such as detailed 3D mapping, automated reports, and accurate measurements enables massive-scale projects to be handled, saving time and capital for manual checks. This follows Saudi Arabia's long-term urban development plans, such as building smart cities like NEOM. Incorporating drones with sophisticated software into the build process allows businesses to have greater control and enhanced project management. The growing use of these applications is assisting in streamlining processes, reducing risk, and speeding up timelines, which will be vital to achieve the ambitious levels outlined in government infrastructure plans.

Growing Demand for Agricultural Monitoring

The Saudi Arabian agricultural industry starts to become one of the largest users of drone software to improve crop management and resource allocation. This need for intelligent agriculture coincides with the growing necessity to maximize water usage, crop health monitoring, and yield improvement through arid climate applications. The multispectral analysis and high-resolution image processing ability of drones have enabled farmers to identify issues much earlier in terms of pest infestation or nutrient lack. This would propel sustainable agriculture, minimize wastage, and optimize productivity. The need for such innovation in agriculture is timely because it could lead to the country's overall aspiration: ensuring food security within its borders sustainably. By gathering accurate data and actionable information using drone technology, farmers are able to make the correct decision in a timely manner. This is initiating the market for specialty agricultural drone software that enhances the productivity and resilience of the agricultural sector.

Saudi Arabia Drone Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on solution, architecture, deployment, application, industry vertical, type, and end use.

Solution Insights:

- System

- Application

- Flight Planning, Operations & Management

- Data Capture

- Data Processing and Analytics

- Others

The report has provided a detailed breakup and analysis of the market based on the solution. This includes system and application (flight planning, operations & management, data capture, data processing and analytics, and others).

Architecture Insights:

- Open Source

- Closed Source

The report has provided a detailed breakup and analysis of the market based on the architecture. This includes open source and closed source.

Deployment Insights:

- Onboard

- Ground-Based

A detailed breakup and analysis of the market based on the deployment have also been provided in the report. This includes onboard and ground-based.

Application Insights:

- Filming & Photography

- Inspection & Maintenance

- Mapping & Surveying

- Precision Agriculture

- Surveillance & Monitoring

- Search & Rescue

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes filming & photography, inspection & maintenance, mapping & surveying, precision agriculture, surveillance & monitoring, search & rescue, and others.

Industry Vertical Insights:

- Agriculture

- Construction and Mining

- Defense and Government

- Energy and Utilities

- Media and Entertainment

- Logistics and Transportation

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes agriculture, construction and mining, defense and government, energy and utilities, media and entertainment, logistics and transportation, and others.

Type Insights:

- Fixed Wing

- Rotary Blade

- Hybrid

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes fixed wing, rotary blade, and hybrid.

End Use Insights:

- Commercial

- Consumer

- Military

The report has provided a detailed breakup and analysis of the market based on the end use. This includes commercial, consumer, and military.

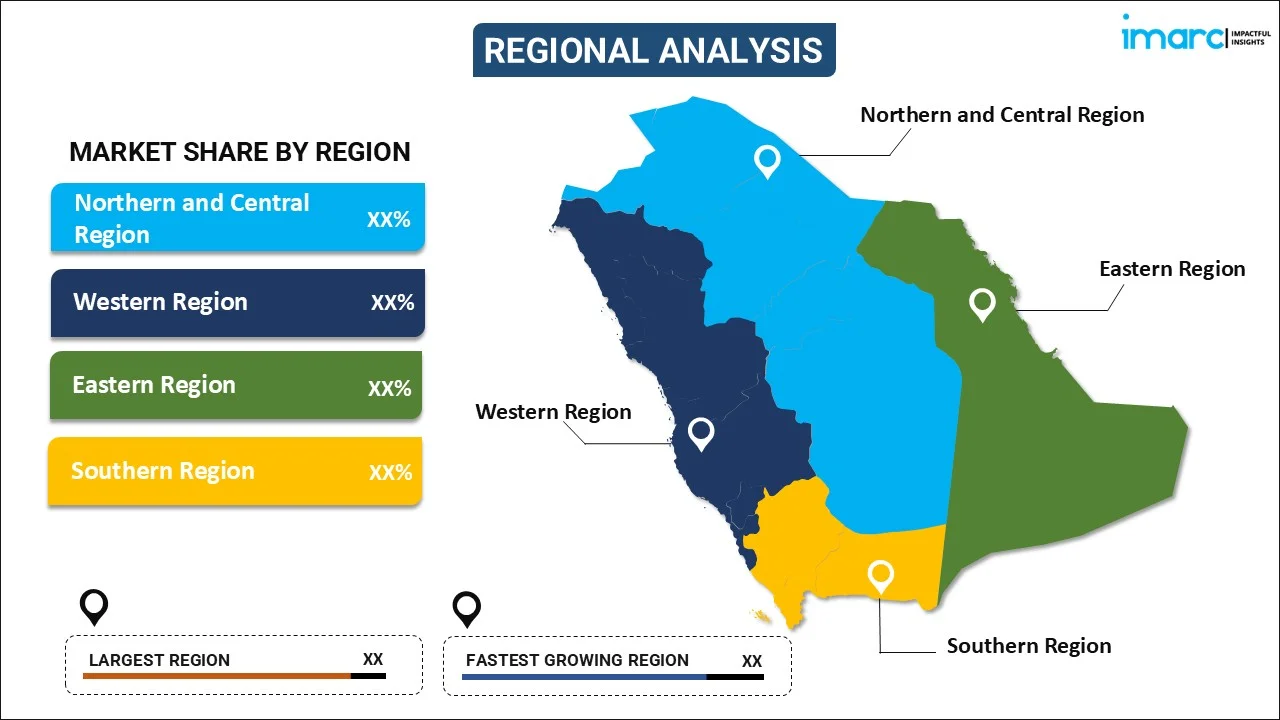

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central region, Western region, Eastern region, and Southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Drone Software Market News:

- In August 2023, Ondas Holdings Inc., a leading provider of commercial drone and automated data and private industrial wireless networks solutions, and Saudi Excellence Holding Company, affiliated with Al-Ramez International Group, announced a Strategic Alliance Agreement with Ondas’ subsidiary Airobotics Ltd. The collaboration aims to establish a joint local office in the Kingdom of Saudi Arabia (KSA) to localize Airobotics’ autonomous drone systems and offer aerial data solutions tailored for local government and commercial sectors.

Saudi Arabia Drone Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered |

|

| Architectures Covered | Open Source, Closed Source |

| Deployments Covered | Onboard, Ground-Based |

| Applications Covered | Filming & Photography, Inspection & Maintenance, Mapping & Surveying, Precision Agriculture, Surveillance & Monitoring, Search & Rescue, Others |

| Industry Verticals Covered | Agriculture, Construction and Mining, Defense and Government, Energy and Utilities, Media and Entertainment, Logistics and Transportation, Others |

| Types Covered | Fixed Wing, Rotary Blade, Hybrid |

| End Uses Covered | Commercial, Consumer, Military |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia drone software market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia drone software market on the basis of solution?

- What is the breakup of the Saudi Arabia drone software market on the basis of architecture?

- What is the breakup of the Saudi Arabia drone software market on the basis of deployment?

- What is the breakup of the Saudi Arabia drone software market on the basis of application?

- What is the breakup of the Saudi Arabia drone software market on the basis of industry vertical?

- What is the breakup of the Saudi Arabia drone software market on the basis of type?

- What is the breakup of the Saudi Arabia drone software market on the basis of end use?

- What is the breakup of the Saudi Arabia drone software market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia drone software market?

- What are the key driving factors and challenges in the Saudi Arabia drone software?

- What is the structure of the Saudi Arabia drone software market and who are the key players?

- What is the degree of competition in the Saudi Arabia drone software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia drone software market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia drone software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia drone software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)