Saudi Arabia Duty-Free and Travel Retail Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

Saudi Arabia Duty-Free and Travel Retail Market Overview:

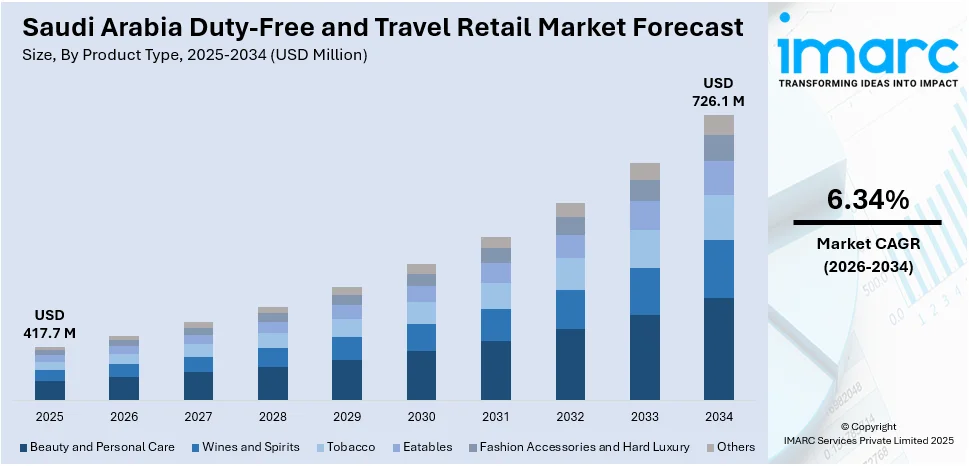

The Saudi Arabia duty-free and travel retail market size reached USD 417.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 726.1 Million by 2034, exhibiting a growth rate (CAGR) of 6.34% during 2026-2034. The market is driven by the expansion of international brand partnerships, growing air travel connectivity, and investments in airport infrastructure, all of which increase retail traffic, attract high-spending tourists, and enhance the overall shopping experience for travelers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 417.7 Million |

| Market Forecast in 2034 | USD 726.1 Million |

| Market Growth Rate 2026-2034 | 6.34% |

Saudi Arabia Duty-Free and Travel Retail Market Trends:

Government-Vision and Policy Initiatives

The Saudi government is persevering with its Vision 2030 initiative, and this is serving as the driving force behind the duty-free and travel retail sector. By implementing aggressive tourism and travel targets, the government is making sure that reforms, investments, and incentives are constantly entering the sector. As per the Ministry of Tourism Saudi Arabia, the nation has recorded unprecedented growth in international tourist spending in the first quarter of 2025, reflecting a 9.7% rise compared to the corresponding period in 2024. New visa policies are being implemented, public-private collaborations are being promoted, and the overall climate for international retailers is becoming more inviting. The state is also persisting in initiating projects like the establishment of national duty-free players who are redefining the business and creating new standards. These initiatives are instilling confidence among international and domestic brands as well as making travel retail an even more organized and competitive channel. Effectively, policy guidance is not just driving demand but also building a long-term platform that is supporting growth in the Saudi travel retail and duty-free market.

To get more information on this market, Request Sample

Impressive Tourism and Air Traffic

Saudi Arabia is going through a boom in domestic as well as international tourism, and this boom is being directly translated into increasing demand for duty-free and travel retail services. Millions of religious pilgrims are arriving for Hajj and Umrah, while increased leisure and business travelers are also coming from the newly introduced tourism visas and increased airline connectivity. Domestic air traffic is also increasing as citizens and residents are increasingly traveling within the country. As volumes of passengers are rising, airport and border point duty-free shops are experiencing increased traffic, boosting overall sales potential. The growing airline network also provides chances for inflight retail and collaborations with international brands. Since tourism is being positioned as a key economic pillar, the consistent flow of tourists is ensuring that travel retail demand continues to grow year after year. In 2025, Boeing, the US aircraft manufacturer, has signed a deal with Saudi Arabia to investigate partnerships and investments in the advanced air mobility field. A delegation from the Kingdom's civil aviation sector, headed by Abdulaziz Al-Duailej, president of the General Authority of Civil Aviation, signed a memorandum of understanding in Washington, D.C., as stated in a press release.

Infrastructure Growth and Upgradation

Large investments are being aimed at upgrading Saudi Arabia's travel and transportation infrastructure, and this is having a direct impact on the extent of travel retailing and duty-free. New airports are being built, old ones are being enlarged, and passenger terminals are being reconfigured to deal with more travelers in greater comfort and efficiency. This modernization is also generating new commercial space that is being assigned for duty-free stores, lounges, and shopping experiences. It is not just about the capacity but also the quality, as airport terminal design is being brought at par with international standards to promote longer passenger dwell times. Modernized facilities are giving passengers better access to shops, improved navigation, and improved amenities, which are leading to impulse purchases and repeat expenditures. Through ongoing growth of infrastructure, Saudi Arabia is developing a long-term vehicle for duty-free retail operators to expand and diversify their product offerings. In 2024, The Zakat, Tax and Customs Authority (ZATCA) authorized the criteria for exemption from customs duties and taxes for duty-free shops in the arrival lounges at all land, sea, and air customs ports. These stipulations establish the highest allowable purchase limits and quantities for travelers entering Saudi Arabia.

Saudi Arabia Duty-Free and Travel Retail Market Growth Drivers:

Rise Of a National Duty-Free Operator

Creation of a national duty-free operator in Saudi Arabia is drastically altering the marketplace dynamics. This operator is growing through various channels such as airports, border crossings, seaports, and even inflight shopping, and is adding a more unified, professional face to travel retail. With its focus on both international luxury brands as well as local goods, it is crafting an exclusive mix of retail that offers global standards, yet emphasizes Saudi culture. The national provider is also spending money on digital platforms, tailored experiences, and customer interaction strategies that are elevating the whole industry. Competition is heating up, as global competitors are being pushed to keep up with this new intensity of innovation and integration. This change is not merely enhancing the overall customer experience but also helping to keep duty-free revenues within the local economy, supporting national economic objectives as it drives market development.

Increased Consumer Wealth and Shifting Preferences

Saudi Arabia's socio-economic profile is changing fast, and increasing disposable incomes are altering customer behavior. Younger, wealthier travelers are traveling more, and these shoppers are looking for higher-end products, special services, and luxury shopping experiences while abroad. People are no longer content with bare-minimum duty-free offerings and are anticipating higher-quality perfumes, fashion items, electronics, and tailored retail services. The industry is also witnessing rising interest in lifestyle and experiential shopping, where consumers are linking purchases with status and identity. Retailers are reacting by broadening assortments, editing global luxury brands, and elevating the overall store architecture to attract these changing tastes. This trend is making sure that transaction values are increasing on average and that duty-free settings are more aspirational. Consequently, consumer wealth and taste are dictating the direction of Saudi Arabian travel retail development.

Technology Innovation and Digitization

Travel retail and duty-free operators are proactively embracing technology to refine operations and enhance travel experiences. Digital payment methods, mobile apps, and self-checkouts are being put in place to enable smooth shopping experiences for tourists who have limited time available. Customer insights and data analytics are being used to personalize promotions, suggest products, and offer promotions that appeal to various segments of travelers. Virtual shelves, touch interfaces, and augmented reality platforms are being launched to construct interactive and immersive shopping spaces. Such digital technologies are driving impulse purchases as well as brand retention. Meanwhile, the backend systems are also becoming more streamlined, with inventory management and supply chain operations being technologized for optimization. Through ongoing incorporation of digital tools into retail processes, Saudi Arabia's duty-free industry is making sure that convenience and interaction continue to be at the forefront of the shopper experience for travelers.

Saudi Arabia Duty-Free and Travel Retail Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Beauty and Personal Care

- Wines and Spirits

- Tobacco

- Eatables

- Fashion Accessories and Hard Luxury

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes beauty and personal care, wines and spirits, tobacco, eatables, fashion accessories and hard luxury, and others.

Distribution Channel Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Airports

- Airlines

- Ferries

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes airports, airlines, ferries, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Duty-Free and Travel Retail Market News:

- In September 2025, Travelers passing through Jeddah airport will encounter a new duty-free area, featuring international and domestic brands as Saudi Arabia develops its aviation industry. The project is overseen by JAH Arabia International Duty-Free LLC, a partnership between Germany's Gebr. Heinemann, Astra Group of Saudi Arabia, and Duty-Free Shops of Jordan. The organization possesses a seven-year permit to manage the duty-free store in Terminal 1 and the North Terminal at King Abdulaziz International Airport.

- In August 2025, Lagardère Travel Retail has commenced duty-free and dining activities at two major airports in the Kingdom of Saudi Arabia (KSA) – Prince Sultan bin Abdulaziz International Airport (TUU) in Tabuk and Prince Mohammad bin Abdulaziz International Airport (MED) in Madinah.

- In May 2025, The Airport Cluster2 has opened a duty-free store at Prince Naif bin Abdulaziz International Airport located in Qassim. It offers a full range of services that improve the experience for travelers arriving and departing from the airport. The launch of the duty-free store will offer a remarkable shopping opportunity for global travelers at the Qassim airport.

- In March 2025, Saudi Arabia's Public Investment Fund (PIF) introduced Al Waha Duty Free Operating Co., the inaugural duty-free firm owned by Saudis. This action seeks to gain a greater portion of the travel retail market and enhance the tourism industry. Al Waha plans to provide luxury goods and distinctive items, aiding Saudi Arabia's objective to bring in 150 million tourists by 2030.

- In October 2024, Gebr. Heinemann, alongside Jordanian duty-free Shops and Astra, obtained a duty-free agreement for 11,500 sq m of retail area at King Abdulaziz International Airport (KAIA) in Jeddah. The area concentrated on fragrances, beauty products, sweets, tobacco, and regional items. The expansion sought to improve retail options and address the increasing need for travel retail services in Saudi Arabia.

Saudi Arabia Duty-Free and Travel Retail Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Beauty and Personal Care, Wines and Spirits, Tobacco, Eatables, Fashion Accessories and Hard Luxury, Others |

| Distribution Channels Covered | Airports, Airlines, Ferries, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia duty-free and travel retail market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia duty-free and travel retail market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia duty-free and travel retail industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The duty-free and travel retail market in Saudi Arabia was valued at USD 417.7 Million in 2025.

The Saudi Arabia duty-free and travel retail market is projected to exhibit a CAGR of 6.34% during 2026-2034, reaching a value of USD 726.1 Million by 2034.

The Saudi Arabia duty-free and travel retail market is being driven by Vision 2030 reforms, rapid growth in tourism and air traffic, large-scale airport expansions, the launch of a national duty-free operator, rising consumer affluence, evolving shopper preferences, and increasing adoption of digital technologies enhancing retail experiences.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)