Saudi Arabia E-Axle Market Size, Share, Trends and Forecast by Component Type, Vehicle Type, Drive Type, and Region, 2026-2034

Saudi Arabia E-Axle Market Summary:

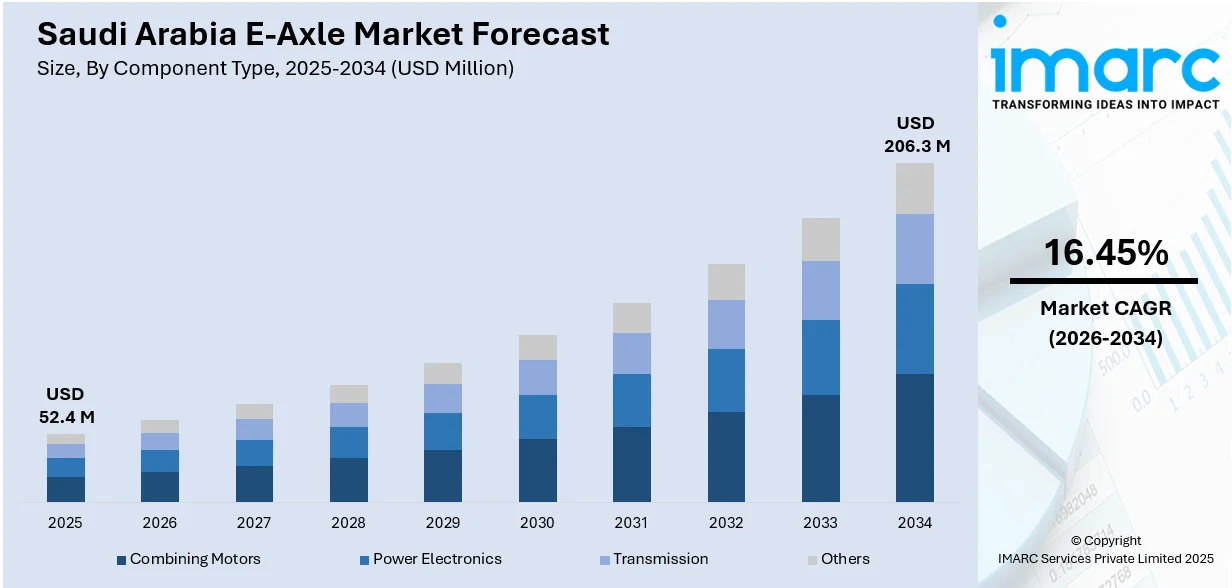

The Saudi Arabia e-axle market size was valued at USD 52.4 Million in 2025 and is projected to reach USD 206.3 Million by 2034, growing at a compound annual growth rate of 16.45% from 2026-2034.

The Saudi Arabia e-axle market is experiencing robust expansion, as the Kingdom advances its electric mobility transformation under Vision 2030. Increasing investments in local electric vehicle (EV) manufacturing, strategic partnerships with global technology leaders, and favorable government initiatives supporting clean transportation are propelling demand for integrated electric drivetrain systems. The transition towards sustainable mobility solutions, combined with the establishment of domestic EV brands and manufacturing facilities, is creating significant opportunities across the e-axle value chain.

Key Takeaways and Insights:

- By Component Type: Transmission dominates the market with a share of 39.96% in 2025, driven by its critical role in converting electric motor output into optimal wheel torque and speed. Integrated transmission systems enhance vehicle efficiency while reducing energy losses, making them essential components in e-axle configurations across EV platforms.

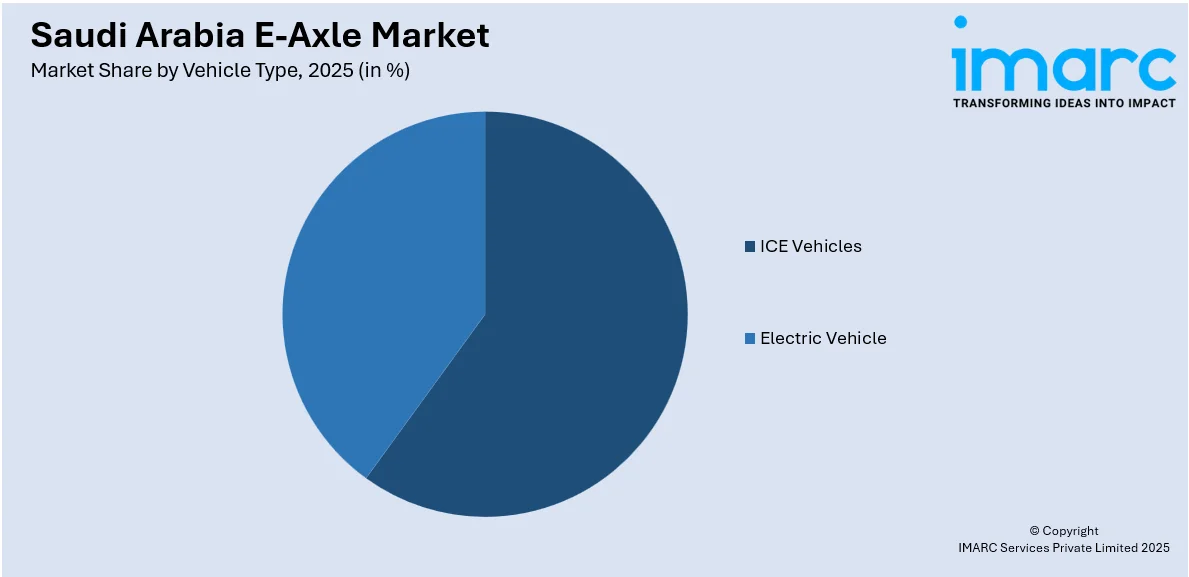

- By Vehicle Type: Electric vehicle leads the market with a share of 77.95% in 2025, reflecting Saudi Arabia's commitment to zero-emission transportation under Vision 2030. Growing consumer interest in sustainable mobility, expanding charging infrastructure, and local EV manufacturing initiatives are accelerating adoption.

- By Drive Type: Forward wheel drive exhibits a clear dominance with 44.93% share in 2025, owing to its cost-effectiveness, manufacturing simplicity, and suitability for passenger EVs. Urban commuter preferences and compact EV designs favor front-mounted drivetrain configurations.

- Key Players: Key players are driving the Saudi Arabia e-axle market by forming strategic partnerships with international technology suppliers, investing in localized manufacturing capabilities, and integrating advanced integrated drive systems into domestic EV production platforms to support Vision 2030 objectives.

To get more information on this market Request Sample

The Saudi Arabia e-axle market is witnessing transformative growth, as the Kingdom establishes itself as a regional hub for EV manufacturing. Strategic partnerships between domestic manufacturers and global technology leaders are accelerating the adoption of advanced integrated electric drive systems, combining motors, inverters, and reduction gears into compact, efficient units that optimize vehicle performance and energy consumption. In June 2024, Ceer signed a landmark USD 2.18 billion contract with Hyundai Transys for integrated EV drive systems. The government's commitment to achieving high EV penetration is driving substantial investments in charging infrastructure and local component manufacturing. This comprehensive ecosystem development approach, supported by Public Investment Fund initiatives, is creating favorable conditions for sustainable Saudi Arabia e-axle market growth throughout the forecast period.

Saudi Arabia E-Axle Market Trends:

Localization of Electric Drivetrain Manufacturing

The Kingdom is prioritizing the localization of electric drivetrain component production as part of its industrial diversification strategy. Domestic EV manufacturers are increasingly focusing on sourcing e-axle systems and components locally, driving stronger demand for homegrown production capabilities. In March 2024, Ceer awarded a USD 1.3 Billion contract to Modern Building Leaders (MBL) for constructing its electric car manufacturing complex, spanning over 1 million square meters in King Abdullah Economic City, establishing infrastructure for comprehensive vehicle production, including drivetrain assembly operations.

Adoption of Integrated Three-in-One E-Axle Systems

Automotive manufacturers operating in Saudi Arabia are increasingly adopting integrated three-in-one e-axle configurations that combine electric motors, inverters, and reduction gears into unified compact units. This architectural shift eliminates power losses typically associated with separate components while optimizing vehicle space configurations. The integration enhances overall drivetrain efficiency, improving energy utilization and extending vehicle range. It also simplifies assembly processes and reduces manufacturing complexity, lowering production costs for automakers. Furthermore, compact e-axle designs support lighter vehicle architecture, contributing to better performance, handling, and thermal management in EVs.

Expansion of EV Charging Infrastructure

The rapid development of EV charging infrastructure across Saudi Arabia is acting as a significant growth driver for the e-axle market. As per IMARC Group, the Saudi Arabia EV charging station market size reached USD 191.0 Million in 2025. Government and private-sector investments in fast-charging networks, urban charging hubs, and highway corridors are enhancing EV accessibility and usability, encouraging higher adoption rates. As consumers gain confidence in charging convenience and range reliability, demand for locally manufactured e-axles rises, supporting domestic production initiatives. Additionally, improved infrastructure enables fleet electrification for logistics, public transport, and corporate mobility, further reinforcing the need for high-performance, efficient drivetrain components in the growing EV ecosystem.

How Vision 2030 is Transforming the Saudi Arabia E-Axle Market:

Vision 2030 is transforming the Saudi Arabia e-axle market by accelerating electric mobility adoption and strengthening local automotive manufacturing capabilities. Government-led diversification efforts are encouraging investments in EV assembly, battery systems, and powertrain components, creating direct demand for advanced e-axle solutions. Large-scale infrastructure development, including nationwide charging networks and smart city projects, is improving EV usability and boosting consumer confidence. Incentives for clean transportation fleets, particularly in public transport and logistics, are further supporting market expansion. Vision 2030 also emphasizes localization and technology transfer, prompting global suppliers to establish regional partnerships and production facilities.

Market Outlook 2026-2034:

The Saudi Arabia e-axle market is positioned for significant expansion, as the Kingdom accelerates its EV manufacturing ambitions and charging infrastructure deployment. Government initiatives under Vision 2030 are creating a conducive environment for drivetrain component localization, with substantial investments flowing into advanced manufacturing capabilities and skilled workforce development programs. The market generated a revenue of USD 52.4 Million in 2025 and is projected to reach a revenue of USD 206.3 Million by 2034, growing at a compound annual growth rate of 16.45% from 2026-2034. Strategic partnerships between domestic automotive brands and international technology suppliers are enhancing product offerings while supporting localization objectives. The establishment of comprehensive EV manufacturing ecosystems in economic cities is expected to drive sustained demand for integrated e-axle systems throughout the forecast period.

Saudi Arabia E-Axle Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Component Type |

Transmission |

39.96% |

|

Vehicle Type |

Electric Vehicle |

77.95% |

|

Drive Type |

Forward Wheel Drive |

44.93% |

Component Type Insights:

- Combining Motors

- Power Electronics

- Transmission

- Others

Transmission dominates with a market share of 39.96% of the total Saudi Arabia e-axle market in 2025.

The transmission segment maintains its leading position within the Saudi Arabia e-axle market due to its fundamental role in converting electric motor output into the precise torque and speed requirements for vehicle propulsion. Integrated transmission systems optimize power delivery efficiency while minimizing energy losses, making them indispensable components in modern e-axle configurations. Manufacturers are increasingly incorporating single-speed and multi-speed transmission configurations to address diverse vehicle performance requirements and driving conditions.

The growing focus on performance optimization and energy efficiency is further reinforcing the transmission segment’s dominance in the market. Advanced designs, including lightweight materials and precision gearing, enhance durability while reducing overall vehicle weight. Integration with regenerative braking systems allows improved energy recapture, extending EV range. Additionally, automakers are prioritizing compact transmission architectures to maximize cabin and battery space without compromising power delivery. Continuous innovations in transmission technology ensure compatibility with both passenger and commercial EVs, solidifying its critical role in the Kingdom’s expanding EV ecosystem.

Vehicle Type Insights:

Access the comprehensive market breakdown Request Sample

- ICE Vehicles

- Passenger Vehicle

- Commercial Vehicle

- Electric Vehicle

Electric vehicle leads with a share of 77.95% of the total Saudi Arabia e-axle market in 2025.

The electric vehicle segment commands the dominant share of the Saudi Arabia e-axle market, driven by the Kingdom's ambitious electrification targets and substantial government investments in sustainable transportation infrastructure. Vision 2030 objectives mandate 30% EV penetration in Riyadh by 2030, creating sustained demand for integrated electric drivetrain systems. The establishment of domestic EV manufacturing facilities is generating significant requirements for locally sourced e-axle components. The growing consumer preference for environment-friendly vehicles and advanced mobility solutions further strengthens the segment’s market leadership.

In addition, the rise of corporate and government fleet electrification initiatives is boosting e-axle demand in commercial and public transport segments. Fleet operators are increasingly adopting electric buses, delivery vans, and utility vehicles to reduce operational costs and meet sustainability mandates. This trend encourages manufacturers to develop high-efficiency, durable e-axle systems capable of supporting diverse load and range requirements. Combined with expanding charging infrastructure, these developments are driving sustained growth for the EV-focused e-axle industry in Saudi Arabia.

Drive Type Insights:

- Forward Wheel Drive

- Rear Wheel Drive

- All Wheel Drive

Forward wheel drive comprises the leading segment with a 44.93% share of the total Saudi Arabia e-axle market in 2025.

The forward wheel drive segment continues to lead in the Saudi Arabia e-axle market due to its cost-effectiveness, ease of manufacturing, and suitability for mass-market passenger EVs. Forward wheel drive models have better packaging efficiency owing to the integration of the e-axle system at the front of the vehicle, which enables optimal use of space and reduced production costs. This suits the preferences of consumers who are looking for functional and affordable EVs that are suitable for urban driving patterns in major Saudi Arabian cities.

In addition, the forward wheel drive models have reduced maintenance needs and improved overall reliability, making them suitable for both individual and fleet purchases. The manufacturers of the EVs also benefit from simplified assembly and reduced component costs, which enable them to offer competitive pricing in the emerging EV market. With the continued promotion of EV adoption in Saudi Arabia through incentives, urban development, and awareness campaigns, forward wheel drive e-axle systems will continue to be the model of choice for mass-market EVs.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Northern and Central Region has importance in the market because of greater urbanization, stronger purchasing power, and the presence of car dealers and fleet operators. Government-supported EV projects, electrification of public transport, and smart city projects are fueling demand, while improved charging infrastructure availability is encouraging quicker adoption of electric drivetrain technology.

The Western Region is registering a stable growth rate in the market because of the increasing number of tourists, logistics operations, and public transport networks in and around major cities. Rising use of electric buses and commercial EVs for urban mobility, along with improvements in infrastructure, is gradually boosting demand for efficient and compact e-axle solutions.

The Eastern Region is registering growth because of industrial diversification, corporate fleet electrification, and greater use of commercial vehicles. Rising use of EVs in industrial areas and ports, along with investments in clean mobility solutions by large corporations, is supporting stable demand for robust and high-performance e-axle solutions.

Southern Region represents an emerging market for e-axles, with growth supported by improving road connectivity and gradual EV awareness. While adoption remains slower than other regions, government infrastructure development programs and rising interest in cost-efficient electric mobility are creating long-term demand potential.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia E-Axle Market Growing?

Saudi Vision 2030 Economic Diversification Initiatives

The Kingdom's comprehensive economic transformation strategy under Vision 2030 is fundamentally reshaping the automotive sector and driving demand for e-axle systems. Government initiatives are directing substantial investments towards establishing a complete EV manufacturing ecosystem, ranging from component production to vehicle assembly and aftermarket services. In January 2024, EVIQ inaugurated its first public fast-charging site at Roshn Front in Riyadh, marking a significant step toward deploying 5,000 chargers across 1,000 locations by 2030. These coordinated investments are creating the foundational infrastructure necessary for sustainable e-axle market expansion. The increasing availability of charging infrastructure is boosting consumer confidence in EV adoption, encouraging both individual and fleet purchases. Automakers are responding by scaling local e-axle production to meet anticipated demand, supporting supply chain localization goals.

Strategic Technology Partnerships with Global Suppliers

Saudi automotive manufacturers are establishing landmark partnerships with leading international technology suppliers to access advanced electric drivetrain systems and accelerate domestic EV development. These collaborations are bringing cutting-edge e-axle technologies to the Kingdom while supporting knowledge transfer and local capability building. In November 2024, Ceer partnered with Rimac Technology for high-performance electric drive systems for flagship vehicles, marking Rimac's first major project in the GCC region. These partnerships demonstrate the commitment to deploying world-class e-axle technologies in Saudi-manufactured EVs. These strategic alliances also help Saudi manufacturers reduce development timelines and bring innovative EV models to market more quickly. Collaborations foster local engineering expertise, enabling the Kingdom to build a skilled workforce capable of supporting advanced drivetrain production. As technology transfer continues, domestic suppliers are increasingly equipped to produce high-quality e-axle components.

Increasing Focus on Vehicle Performance and Efficiency

Automakers in Saudi Arabia are emphasizing vehicle performance and energy efficiency as critical drivers for the e-axle market. Integrated e-axle systems allow optimized power delivery, reduced energy losses, and improved torque management, enhancing the overall driving experience in EVs. Lightweight designs and compact architectures support better range, thermal management, and handling, making e-axles an essential component for high-performance EVs. Manufacturers are also leveraging advanced control systems and software integration to maximize efficiency across diverse driving conditions, from urban commuting to long-distance travel. As consumer expectations for range, reliability, and vehicle responsiveness rise, automakers are increasingly investing in locally produced, technologically advanced e-axles. This focus on performance not only strengthens the competitiveness of Saudi-manufactured EVs but also supports sustainable growth in the e-axle segment by meeting evolving market and regulatory requirements.

Market Restraints:

What Challenges the Saudi Arabia E-Axle Market is Facing?

Limited Local Component Manufacturing Capabilities

Despite substantial investments in vehicle assembly facilities, Saudi Arabia's local manufacturing capabilities for complex e-axle components remain limited. The Kingdom currently relies heavily on imported drivetrain systems from international suppliers, creating supply chain vulnerabilities and extending lead times. Building domestic capabilities for producing precision components, such as electric motors, power electronics, and integrated reduction gears, requires significant technical expertise, specialized equipment, and workforce development that takes time to establish.

High Initial Technology Investment Requirements

The establishment of comprehensive e-axle manufacturing capabilities demands substantial capital investments in advanced production equipment, quality control systems, and specialized facilities. New market entrants face significant financial barriers when attempting to compete with established global suppliers that benefit from economies of scale and mature production processes. These investment requirements can limit the pace of market development and restrict the entry of smaller domestic suppliers into the value chain.

Extreme Climate Operational Considerations

Saudi Arabia's extreme temperature conditions present unique challenges for electric drivetrain system performance and reliability. E-axle components must withstand elevated ambient temperatures that can exceed standard global specifications, requiring enhanced thermal management solutions and specialized materials. Field tests indicate significant energy consumption increases when ambient temperatures rise substantially, impacting vehicle range and drivetrain efficiency while necessitating robust cooling systems that add complexity and cost to e-axle designs.

Competitive Landscape:

The Saudi Arabia e-axle market competitive landscape is characterized by strategic partnerships between domestic vehicle manufacturers and established international drivetrain technology suppliers. Major global players and tier-one automotive suppliers are establishing supply relationships with Saudi EV manufacturers, bringing advanced integrated electric drive systems to the Kingdom. Competition centers on technology capabilities, integration expertise, and the ability to meet localization requirements aligned with Vision 2030 objectives. The market structure is evolving from pure import dependence towards collaborative partnerships that support knowledge transfer and local capability building while delivering world-class drivetrain solutions for emerging Saudi EV platforms.

Saudi Arabia E-Axle Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered | Combining Motors, Power Electronics, Transmission, Others |

| Vehicle Types Covered |

|

| Drive Types Covered | Forward Wheel Drive, Rear Wheel Drive, All Wheel Drive |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia e-axle market size was valued at USD 52.4 Million in 2025.

The Saudi Arabia e-axle market is expected to grow at a compound annual growth rate of 16.45% from 2026-2034 to reach USD 206.3 Million by 2034.

Transmission dominated the market with a share of 39.96%, driven by its essential role in converting electric motor output into optimal wheel torque and speed, enhancing vehicle efficiency and performance in EVs.

Key factors driving the Saudi Arabia e-axle market include Vision 2030 economic diversification initiatives, expanding domestic EV manufacturing ecosystem, strategic technology partnerships with global suppliers, and government investments in charging infrastructure.

Major challenges include limited local component manufacturing capabilities, high initial technology investment requirements, extreme climate operational considerations, dependency on imported drivetrain systems, and the need for specialized workforce development.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)