Saudi Arabia E-Bike Battery Market Size, Share, Trends and Forecast by Battery Type, Battery Pack Position Type, and Region, 2026-2034

Saudi Arabia E-Bike Battery Market Overview:

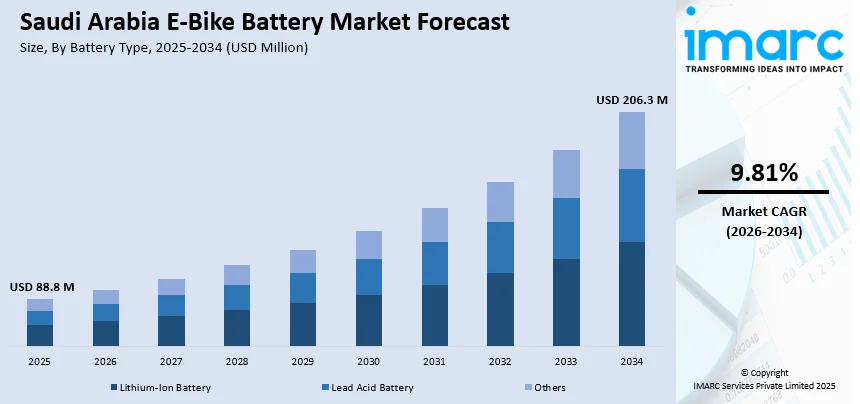

The Saudi Arabia e-bike battery market size reached USD 88.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 206.3 Million by 2034, exhibiting a growth rate (CAGR) of 9.81% during 2026-2034. Government initiatives supporting sustainable transportation, partnerships with international manufacturers, and the growing popularity of eco-friendly tourism are driving the market. Investments in infrastructure and collaborative efforts with international e-bike producers are expanding e-bike adoption. Additionally, the rising popularity of eco-tourism, which requires reliable, high-performance batteries, is contributing to the expansion of the Saudi Arabia e-bike battery market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 88.8 Million |

| Market Forecast in 2034 | USD 206.3 Million |

| Market Growth Rate 2026-2034 | 9.81% |

Saudi Arabia E-Bike Battery Market Trends:

Government Support for Sustainable Transportation Initiatives

The increasing initiatives by the governing body that are aimed at encouraging sustainable transportation, especially through the use of e-bikes, is bolstering the market growth. In alignment with Saudi Vision 2030, the governing authority is investing in infrastructure to promote electric mobility solutions. A significant instance is the introduction of a bike-sharing program in Medina in 2024, which rolled out 500 e-bikes and 60 charging stations through a collaboration between PBSC and Careem. This project aimed to offer eco-friendly travel choices for countless pilgrims arriving in the city. The program's effectiveness was clear during Ramadan, as ridership increased significantly, demonstrating the growing demand and the cultural embrace of e-bikes as a practical transport option. These government-supported initiatives not only encourage the employment of e-bikes but also enhance the demand for high-performance batteries.

To get more information on this market Request Sample

Collaborations with International Manufacturers

The increasing partnerships between domestic distributors and international e-bike producers is a crucial factor impelling the Saudi Arabia e-bike battery market growth. As global demand for electric mobility continues to grow, international brands are enhancing their footprint in Saudi Arabia by introducing cutting-edge e-bike models and high-performance batteries to the regional market. Such partnerships improve the diversity and technological capabilities of existing e-bikes, increasing their attractiveness to users. For instance, in 2024, Green Launch Company collaborated with Shenzhen Mixing Factory from China to set up Saudi Arabia's inaugural electric bicycle factory in Sudair City, spanning 10,000 m². Production is anticipated to commence by 2026 with a yearly capacity of 50,000 bicycles. Such initiatives are catalyzing the demand for dependable e-bike batteries, as these global collaborations enhance the criteria for both e-bike quality and battery efficiency in Saudi Arabia, further strengthening the market growth.

Growing Popularity of Eco-Friendly Tourism

The rising trend of eco-friendly tourism in Saudi Arabia is driving the demand for e-bikes, especially for sustainable travel options in natural and heritage sites. As tourism in the region expands, there is a stronger focus on minimizing environmental impact. E-bikes are becoming a preferred method for tourists to explore eco-tourism destinations, providing a cleaner and quieter alternative to traditional vehicles. With more tourist sites offering e-bike rentals, the need for durable and efficient e-bike batteries is growing. The governing authority in Saudi Arabia is supporting this trend through initiatives, such as the Tourism Investment Enabler Program (TIEP), launched in March 2024, which streamlined the licensing process for tourism-related businesses to just five days. These efforts encourage further investment in sustainable tourism infrastructure, enhancing the demand for e-bikes and their associated battery solutions as eco-tourism continues to thrive in the Kingdom.

Saudi Arabia E-Bike Battery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on battery type and battery pack position type.

Battery Type Insights:

- Lithium-Ion Battery

- Lead Acid Battery

- Others

The report has provided a detailed breakup and analysis of the market based on the battery type. This includes lithium-ion battery, lead acid battery, and others.

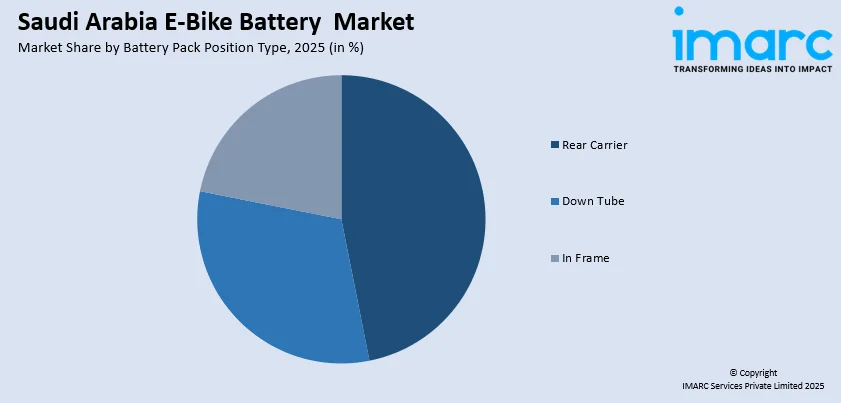

Battery Pack Position Type Insights:

Access the comprehensive market breakdown Request Sample

- Rear Carrier

- Down Tube

- In Frame

A detailed breakup and analysis of the market based on the battery pack position type have also been provided in the report. This includes rear carrier, down tube, and in frame.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia E-Bike Battery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Battery Types Covered | Lithium-Ion Battery, Lead Acid Battery, Others |

| Battery Pack Position Types Covered | Rear Carrier, Down Tube, In Frame |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia e-bike battery market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia e-bike battery market on the basis of battery type?

- What is the breakup of the Saudi Arabia e-bike battery market on the basis of battery pack position type?

- What is the breakup of the Saudi Arabia e-bike battery market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia e-bike battery market?

- What are the key driving factors and challenges in the Saudi Arabia e-bike battery market?

- What is the structure of the Saudi Arabia e-bike battery market and who are the key players?

- What is the degree of competition in the Saudi Arabia e-bike battery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia e-bike battery market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia e-bike battery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia e-bike battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)