Saudi Arabia E-commerce Shipping Market Size, Share, Trends and Forecast by Service, Business, Destination, End-Use Industry, and Region, 2026-2034

Saudi Arabia E-commerce Shipping Market Overview:

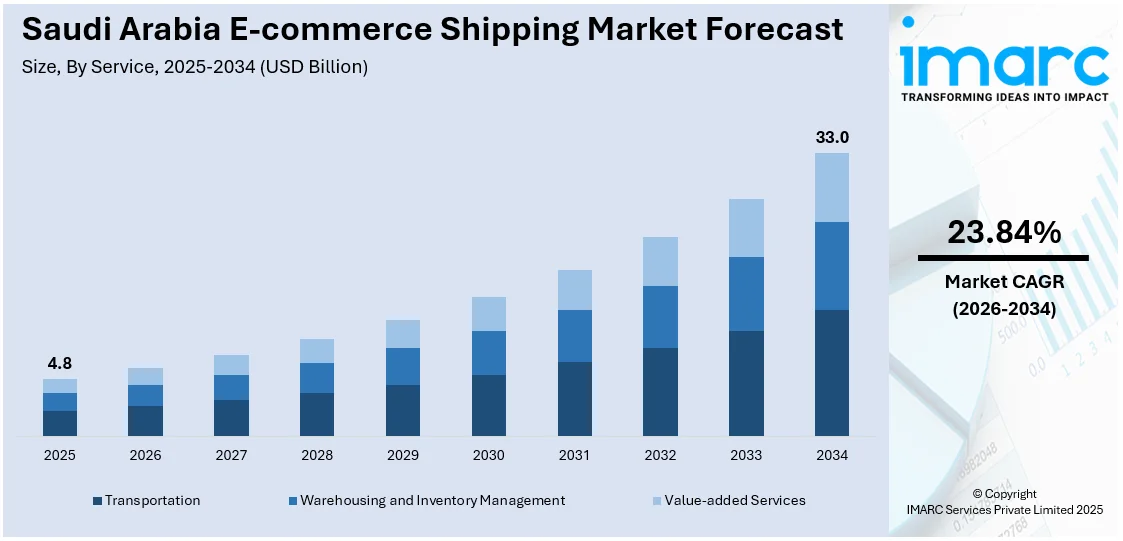

The Saudi Arabia e-commerce shipping market size reached USD 4.8 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 33.0 Billion by 2034, exhibiting a growth rate (CAGR) of 23.84% during 2026-2034. Presently, with the government and private entities focusing on improving road infrastructure, intelligent warehouses, and last-mile delivery services, the overall effectiveness of shipping operations is increasing. Besides this, the growing employment of tracking technologies, which aid in enhancing transparency, speed, and reliability in deliveries, is contributing to the expansion of the Saudi Arabia e-commerce shipping market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4.8 Billion |

| Market Forecast in 2034 | USD 33.0 Billion |

| Market Growth Rate 2026-2034 | 23.84% |

Saudi Arabia E-commerce Shipping Market Trends:

Rising investments in logistics and transportation networks

Increasing expenditure on logistics and transportation networks is positively influencing the market. As the government and private players are wagering on expanding road infrastructure, smart warehouses, and last-mile delivery services, the overall efficiency of shipping operations is improving. These investments reduce transit times, minimize delivery errors, and support same-day or next-day delivery services, which appeal to modern users. Companies can handle a higher volume of orders and reach remote areas more effectively due to better transportation routes and upgraded logistics hubs. Advanced transportation networks also aid in lowering operational costs by optimizing delivery paths and fuel usage. As warehousing facilities are getting modernized, order fulfillment is becoming faster and more accurate. Investments in automation and digital logistics tools enhance coordination across the supply chain, ensuring smoother operations. These improvements are encouraging businesses to adopt e-commerce models, knowing they can depend on a robust shipping infrastructure. Improved logistics also build customer trust, as buyers receive products faster and in better condition. Retailers, especially small and medium enterprises (SMEs), are benefiting from broader market access and scalability. Overall, increased investments in the logistics and transportation sectors are strengthening the market. According to the IMARC Group, the Saudi Arabia logistics market size is projected to exhibit a CAGR of 4.9% from 2025-2033.

To get more information on this market Request Sample

Emergence of tracking technologies

The emergence of tracking technologies is impelling the Saudi Arabia e-commerce shipping market growth. These technologies allow customers to monitor their shipments in real time, which increases trust and satisfaction. Businesses use tracking systems to streamline operations, minimize errors, and plan efficient delivery routes. This leads to faster shipments and fewer delays, which boost customer loyalty. Tracking also helps reduce theft and misplaced packages, creating a more secure supply chain. With better visibility, companies handle returns more smoothly and resolve customer complaints faster. IoT plays a significant role by connecting devices and systems that share real-time delivery data. According to the International Data Corporation (IDC), Saudi Arabia’s IoT market is set to attain USD 2.9 Billion by 2025 with an annual growth rate of 12.8%. These smart systems improve coordination between warehouses, delivery vehicles, and end customers. The detailed insights gained from tracking technologies also assist companies in analyzing performance and identifying areas for improvement. As user expectations are rising, the demand for accurate and timely updates is becoming essential, stimulating the market growth.

Saudi Arabia E-commerce Shipping Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on service, business, destination, and end-use industry.

Service Insights:

- Transportation

- Warehousing and Inventory Management

- Value-added Services

- Labeling

- Packaging

The report has provided a detailed breakup and analysis of the market based on the service. This includes transportation, warehousing and inventory management, and value-added services (labeling and packaging).

Business Insights:

- B2B

- B2C

A detailed breakup and analysis of the market based on the business have also been provided in the report. This includes B2B and B2C.

Destination Insights:

- Domestic

- International/Cross Border

The report has provided a detailed breakup and analysis of the market based on the destination. This includes domestic and international/cross border.

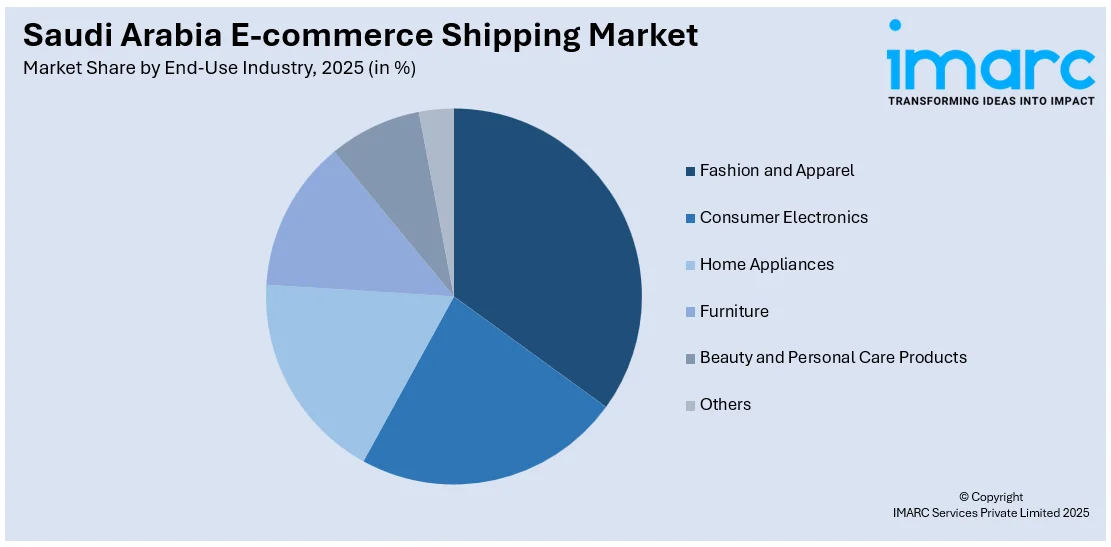

End-Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Fashion and Apparel

- Consumer Electronics

- Home Appliances

- Furniture

- Beauty and Personal Care Products

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes fashion and apparel, consumer electronics, home appliances, furniture, beauty and personal care products, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia E-commerce Shipping Market News:

- In February 2025, DHL eCommerce formed a joint venture with AJEX Logistics Services to obtain a minority share in the parcel logistics company based in Saudi Arabia. AJEX, supported by the investment company Ajlan & Bros Holding, hired 1,500 staff members and offered domestic parcel handling and shipping via a network comprising over 50 facilities and a fleet exceeding 900 vehicles. The firm, due to its dedication to quality and strong customer emphasis, along with a highly driven team, was the ideal partner to assist DHL eCommerce in growing its e-commerce-oriented parcel business in the country.

- In January 2025, Federal Express Corporation (FedEx), the top express transportation company worldwide, unveiled FedEx® International Connect Plus (FICP) in the United Arab Emirates (UAE) and Saudi Arabia, an ideal shipping choice for e-commerce parcels that weighed no more than 20 kg. This service ensured delivery within a guaranteed timeframe, combining speedy shipments with competitive pricing. The launch of FICP enhanced FedEx's e-commerce functionality, as online merchants were seeking more diverse and economical solutions to cater to their customers' changing requirements.

Saudi Arabia E-commerce Shipping Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered |

|

| Businesses Covered | B2B, B2C |

| Destinations Covered | Domestic, International/Cross Border |

| End-Use Industries Covered | Fashion and Apparel, Consumer Electronics, Home Appliances, Furniture, Beauty and Personal Care Products, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia e-commerce shipping market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia e-commerce shipping market on the basis of service?

- What is the breakup of the Saudi Arabia e-commerce shipping market on the basis of business?

- What is the breakup of the Saudi Arabia e-commerce shipping market on the basis of destination?

- What is the breakup of the Saudi Arabia e-commerce shipping market on the basis of end-use industry?

- What is the breakup of the Saudi Arabia e-commerce shipping market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia e-commerce shipping market?

- What are the key driving factors and challenges in the Saudi Arabia e-commerce shipping market?

- What is the structure of the Saudi Arabia e-commerce shipping market and who are the key players?

- What is the degree of competition in the Saudi Arabia e-commerce shipping market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia e-commerce shipping market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia e-commerce shipping market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia e-commerce shipping industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)