Saudi Arabia Eco Friendly Bricks Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Saudi Arabia Eco Friendly Bricks Market Summary:

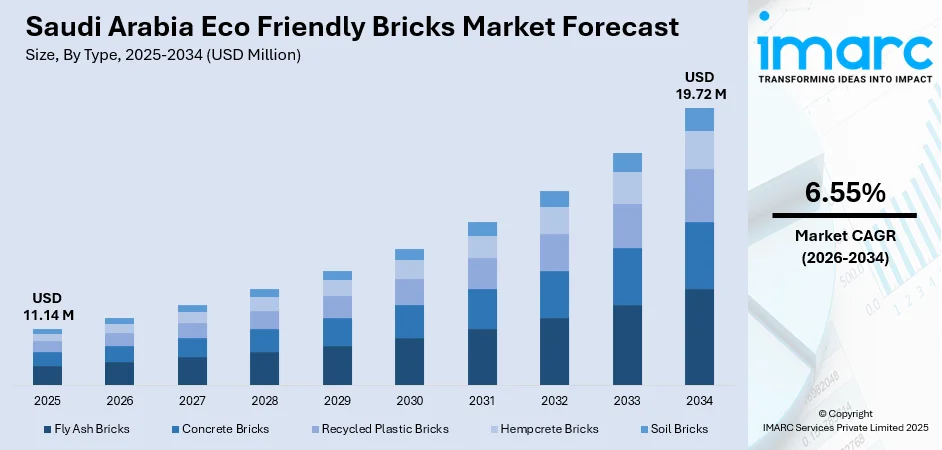

The Saudi Arabia eco friendly bricks market size was valued at USD 11.14 Million in 2025 and is projected to reach USD 19.72 Million by 2034, growing at a compound annual growth rate of 6.55% from 2026-2034.

The Saudi Arabia eco friendly bricks market is experiencing significant expansion driven by the Kingdom's commitment to sustainable construction practices under Vision 2030. The market benefits from increasing government emphasis on environmentally responsible building materials, stringent green building codes including the MOSTADAM certification system, and substantial infrastructure investments across residential, commercial, and industrial sectors. Rising urbanization, population growth, and the development of giga-projects utilizing low-carbon materials are accelerating the adoption of eco friendly brick solutions across the Saudi Arabia eco friendly bricks market share.

Key Takeaways and Insights:

- By Type: Concrete bricks dominate the market with a share of 38% in 2025, driven by their superior durability, cost-effectiveness, and compatibility with sustainable construction practices utilizing recycled aggregates and low-carbon cement alternatives.

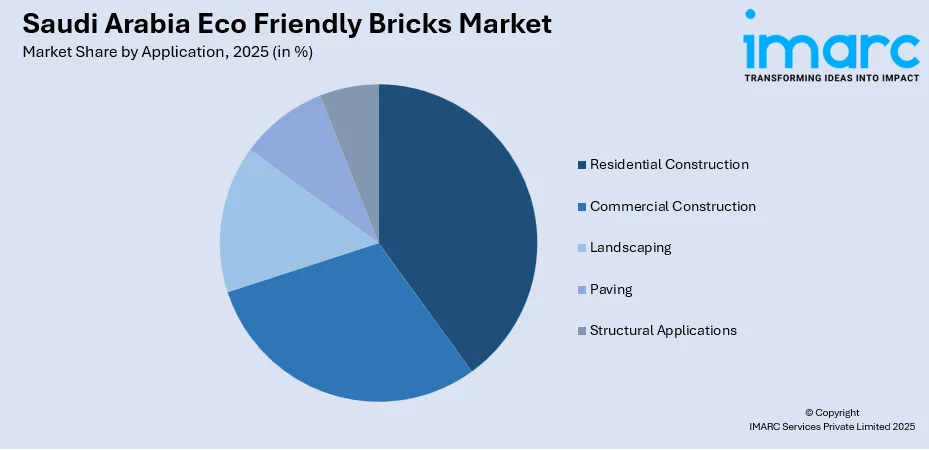

- By Application: Residential construction leads the market with a share of 40% in 2025, supported by Vision 2030 housing initiatives targeting homeownership and the National Housing Company's delivery of sustainable integrated communities.

- Key Players: The Saudi Arabia eco friendly bricks market exhibits a competitive landscape characterized by a mix of established regional manufacturers and emerging players specializing in sustainable building materials, with companies focusing on innovative production technologies incorporating fly ash, recycled aggregates, and geopolymer alternatives.

To get more information on this market Request Sample

The market is witnessing transformational growth as Saudi Arabia accelerates its sustainable construction agenda. The Saudi Green Building Code (SgBC 1001) mandates eco-friendly construction practices, while the MOSTADAM certification system ensures buildings meet stringent sustainability standards. Major infrastructure developments are driving unprecedented demand for sustainable building materials. In October 2024, NEOM partnered with Asas Al-Mohileb to establish a SAR 700 Million ready-mix concrete facility with daily production capacity exceeding 20,000 cubic meters of eco-friendly concrete, incorporating carbon capture and utilization technology to serve THE LINE construction.

Saudi Arabia Eco Friendly Bricks Market Trends:

Integration of Industrial By-Products in Brick Manufacturing

Saudi Arabian manufacturers are increasingly incorporating industrial by-products such as fly ash, ground granulated blast-furnace slag, and recycled construction demolition waste into brick production processes. This trend aligns with the Kingdom's circular economy objectives and waste-to-value strategies. The Saudi fly ash market is projected to surpass USD 190 million by 2030, with applications in bricks and blocks representing a significant consumption segment. In September 2024, AlKifah Ready Mix & Blocks advanced Saudi Arabia's green construction efforts by promoting ultra-sustainable products including ConGreen and BloGreen eco-friendly concrete and block solutions aligned with giga-project requirements.

Adoption of Geopolymer-Based Sustainable Alternatives

Geopolymer technology is emerging as a significant trend in Saudi Arabia's eco friendly bricks market, offering substantial reductions in carbon emissions compared to traditional cement-based products. In March 2024, Spherical Block and Geopolymer International engaged with Saudi stakeholders to introduce geopolymer-based construction materials, developing high-strength blocks and mortar offering reduced carbon dioxide emissions and superior durability.

Green Building Certification Driving Premium Material Demand

The proliferation of green building certifications including LEED, MOSTADAM, and the Saudi Green Building Code is creating strong demand for certified eco friendly construction materials. Saudi Arabia has registered 2,000 of the 5,000 green building projects across the Arab world, demonstrating regional leadership in sustainable construction. The Saudi Arabia green building materials market size reached USD 239.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 711.01 Million by 2033, exhibiting a growth rate (CAGR) of 11.50% during 2025-2033. This certification-driven demand is encouraging brick manufacturers to develop products meeting stringent environmental performance criteria.

How Vision 2030 is Transforming the Saudi Arabia Eco Friendly Bricks Market:

Saudi Arabia's Vision 2030 is reshaping the eco friendly bricks market by prioritizing sustainable construction practices and positioning the Kingdom as a regional leader in green building materials. Mega-projects such as NEOM, the Red Sea Global developments, Qiddiya, and Diriyah are driving unprecedented demand for environmentally responsible building materials including sustainable bricks and blocks. Regulatory reforms, including the Saudi Green Building Code, MOSTADAM certification requirements, and stringent environmental mandates, have boosted adoption of eco friendly construction solutions. Riyadh's rapid urbanization and the ambitious target of increased Saudi homeownership by 2030 are accelerating residential construction utilizing sustainable materials, while integrated communities developed by ROSHN and the National Housing Company are creating substantial demand for energy-efficient, low-carbon brick products across the Kingdom.

Market Outlook 2026-2034:

The Saudi Arabia eco friendly bricks market demonstrates strong growth potential supported by Vision 2030's sustainability mandates and the Kingdom's infrastructure development pipeline. The construction sector awarded contracts, with residential and sustainable construction segments showing particularly robust activity. Giga-projects including NEOM, Qiddiya, and Red Sea developments are incorporating eco-friendly building materials as core requirements, while housing initiatives targeting new units are driving residential demand. The market generated a revenue of USD 11.14 Million in 2025 and is projected to reach a revenue of USD 19.72 Million by 2034, growing at a compound annual growth rate of 6.55% from 2026-2034.

Saudi Arabia Eco Friendly Bricks Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Concrete Bricks | 38% |

| Application | Residential Construction | 40% |

Type Insights:

- Fly Ash Bricks

- Concrete Bricks

- Recycled Plastic Bricks

- Hempcrete Bricks

- Soil Bricks

The concrete bricks segment dominates with a market share of 38% of the total Saudi Arabia eco friendly bricks market in 2025.

Concrete bricks have established market leadership owing to their exceptional structural properties, versatility in construction applications, and compatibility with sustainable manufacturing practices. These products offer superior compressive strength, dimensional stability, and resistance to extreme weather conditions prevalent in Saudi Arabia's climate. Manufacturers are increasingly incorporating fly ash, ground granulated blast-furnace slag, and recycled aggregates to reduce environmental impact while maintaining performance standards.

The segment benefits from continuous innovation in production technologies and material science. Manufacturers are piloting solar-integrated precast concrete panels for smart city developments, contributing to building energy efficiency. The adoption of carbon capture and utilization technology in concrete production facilities represents a significant advancement, with NEOM's new concrete plant incorporating these sustainable technologies. The Saudi Arabia precast concrete market reached USD 1.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.5 Billion by 2033, exhibiting a growth rate (CAGR) of 7.6% during 2025-2033, with manufacturers focusing on incorporating recycled aggregates and low-carbon cement alternatives to meet Vision 2030 sustainability objectives.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential Construction

- Commercial Construction

- Landscaping

- Paving

- Structural Applications

The residential construction segment leads with a share of 40% of the total Saudi Arabia eco friendly bricks market in 2025.

Residential construction dominates eco friendly brick consumption driven by Vision 2030's ambitious housing program targeting increased homeownership among Saudi nationals. The National Housing Company is delivering substantial volumes of new homes through large-scale projects across multiple cities, with sustainability integrated into master planning and material selection. These developments prioritize environmentally responsible building materials, energy-efficient designs, and green spaces, reflecting the Kingdom's commitment to creating modern, sustainable communities for future generations.

The residential segment's growth is further supported by the launch of sustainable housing communities with emphasis on green spaces, energy efficiency, and environmentally responsible construction materials. In April 2024, ROSHN launched ALDANAH in Dhahran's Eastern Province covering over 1.7 million square meters, featuring more than 2,500 homes built with ultra-low U-value concrete providing exemplary energy conservation. The residential real estate sector performed strongly, reflecting sustained demand for quality housing constructed with sustainable materials across the Kingdom.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Northern and Central Region is dominated by Riyadh's extensive residential and commercial development activities. The region benefits from concentration of Vision 2030 giga-projects. Riyadh also witnessed construction activity in 2024, with the residential sector featuring projects like ROSHN's SEDRA community delivering 30,000 units utilizing sustainable construction materials and energy-efficient designs.

The Western Region is experiencing rapid growth driven by Jeddah's transformation and major construction projects including Jeddah Central, Jeddah Tower, and ROSHN's MARAFY and ALAROUS sustainable residential communities.

The Eastern Region demonstrates significant growth potential driven by its strategic importance to Saudi Arabia's energy industry, King Salman Energy Park development, and ROSHN's ALDANAH and ALFULWA sustainable residential communities.

The Southern Region presents emerging opportunities led by the Aseer Development Strategy, Soudah Peaks luxury tourism development, and growing investment creating demand for eco friendly bricks compatible with traditional architecture.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Eco Friendly Bricks Market Growing?

Vision 2030 Infrastructure Development and Giga-Projects

Saudi Arabia's Vision 2030 initiative has catalyzed unprecedented infrastructure investment, creating substantial demand for sustainable construction materials. The Kingdom has launched USD 1.3 Trillion in real estate and infrastructure projects over the past eight years, with the construction sector expected to expand in near future. The Public Investment Fund's portfolio includes transformational developments such as NEOM, Red Sea Global, and Qiddiya, all incorporating eco-friendly building materials as core requirements. The residential sector target new units with sustainability-focused design specifications is generating consistent demand for environmentally responsible brick solutions across the Kingdom.

Stringent Green Building Regulations and Certification Requirements

The regulatory environment strongly supports eco friendly brick adoption through comprehensive building codes and certification systems. The Saudi Green Building Code (SgBC 1001) mandates construction according to provisions minimizing ecological footprint and boosting sustainability initiatives. The MOSTADAM certification system encompasses essential sustainability dimensions fundamental to the Kingdom's identity, requiring developers to utilize certified sustainable materials. This regulatory framework creates mandatory compliance requirements driving material specification toward eco friendly alternatives, while providing market differentiation opportunities for manufacturers meeting certification criteria.

Urbanization and Housing Demand Acceleration

Rapid urbanization and population growth are generating sustained housing demand requiring substantial construction material consumption. Riyadh's population is projected to reach 9.6 million by 2030, while the Housing Program managed through the Sakani platform has successfully increased homeownership to 65.4% toward the 70% target. The residential real estate market size reached USD 71.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 130.8 Billion by 2033, exhibiting a growth rate (CAGR) of 6.9% during 2025-2033. Metropolitan areas including Riyadh, Jeddah, and Dammam absorb the bulk of new residents, amplifying demand for sustainable building materials like eco friendly bricks in transit-linked housing developments.

Market Restraints:

What Challenges the Saudi Arabia Eco Friendly Bricks Market is Facing?

Higher Production Costs Compared to Conventional Materials

Eco friendly brick manufacturing typically involves higher production costs due to specialized raw materials, advanced processing technologies, and certification requirements. These cost pressures challenge price-sensitive market segments and require manufacturers to demonstrate long-term value propositions including reduced maintenance and energy efficiency benefits.

Limited Availability of Specialized Raw Materials

The production of eco friendly bricks requires consistent supply of specialized inputs including quality-controlled fly ash, ground granulated blast-furnace slag, and recycled aggregates. Saudi Arabia's reliance on imported raw materials for certain sustainable brick formulations creates supply chain vulnerabilities and cost fluctuations. The Kingdom's ongoing efforts to develop domestic circular economy infrastructure and waste processing capabilities are addressing these constraints progressively.

Technical Knowledge and Skilled Workforce Gaps

The transition to sustainable construction materials requires specialized technical knowledge across the construction value chain. Labor shortages are intensifying challenges, with demand for skilled trades driving up wages and affecting project timelines. Construction firms require training programs to effectively specify, handle, and install eco friendly brick products while ensuring compliance with green building certification requirements and performance standards.

Competitive Landscape:

The Saudi Arabia eco friendly bricks market features a diverse competitive environment combining established regional building materials manufacturers with emerging sustainable construction specialists. Competition centers on product innovation incorporating industrial by-products, achievement of green building certifications, and capability to serve large-scale giga-project requirements. Leading players are investing in advanced production technologies including carbon capture utilization, geopolymer formulations, and recycled aggregate processing. Innovation adoption is being accelerated by strategic alliances between domestic producers and foreign technology suppliers. The market's fragmented nature provides opportunities for differentiation through specialized sustainable product offerings, while large-scale projects favor manufacturers demonstrating consistent supply capability and quality assurance across multiple facilities.

Recent Developments:

- September 2024: By pushing ultra-sustainable goods like ConGreen and BloGreen eco-friendly concrete and block solutions, AlKifah Ready Mix & Blocks enhanced Saudi Arabia's green building initiatives. These goods increase local adoption of geopolymer substitutes while meeting giga-project criteria and increasing demand for low-carbon materials.

Saudi Arabia Eco Friendly Bricks Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fly Ash Bricks, Concrete Bricks, Recycled Plastic Bricks, Hempcrete Bricks, Soil Bricks |

| Applications Covered | Residential Construction, Commercial Construction, Landscaping, Paving, Structural Applications |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia eco friendly bricks market size was valued at USD 11.14 Million in 2025.

The Saudi Arabia eco friendly bricks market is expected to grow at a compound annual growth rate of 6.55% from 2026-2034 to reach USD 19.72 Million by 2034.

Concrete bricks dominated the market with a 38% share in 2025, driven by their superior durability, cost-effectiveness, compatibility with sustainable manufacturing practices, and widespread application across Vision 2030 giga-projects requiring environmentally responsible construction materials.

Key factors driving the Saudi Arabia eco friendly bricks market include Vision 2030 infrastructure development initiatives, stringent green building regulations including MOSTADAM certification requirements, rapid urbanization and housing demand, government sustainability mandates, and growing adoption of circular economy principles in construction.

Major challenges include higher production costs compared to conventional materials, limited availability of specialized raw materials, technical knowledge and skilled workforce gaps, fluctuating energy costs affecting manufacturing, and the need for expanded domestic recycling infrastructure to support sustainable material supply chains.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)