Saudi Arabia Eco Friendly Cleaning Solutions Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, Form, and Region, 2026-2034

Saudi Arabia Eco Friendly Cleaning Solutions Market Summary:

The Saudi Arabia eco friendly cleaning solutions market size was valued at USD 347.1 Million in 2025 and is projected to reach USD 931.30 Million by 2034, growing at a compound annual growth rate of 11.59% from 2026-2034.

The Saudi Arabia eco friendly cleaning solutions market is experiencing robust growth driven by heightened environmental awareness among consumers and alignment with the Kingdom's Vision 2030 sustainability objectives. Rising health consciousness, increasing demand for non-toxic and biodegradable formulations, and the expansion of modern retail channels are propelling market expansion. Government initiatives promoting green products and sustainable manufacturing practices further strengthen market dynamics, while the growing preference for halal-certified and plant-based cleaning alternatives continues to shape consumer purchasing patterns across the Saudi Arabia eco friendly cleaning solutions market share.

Key Takeaways and Insights:

-

By Product Type: Biodegradable cleaning agents dominate the market with a share of 28.02% in 2025, driven by increasing consumer preference for environmentally safe formulations that decompose naturally without harming ecosystems, coupled with growing regulatory support for sustainable cleaning products.

-

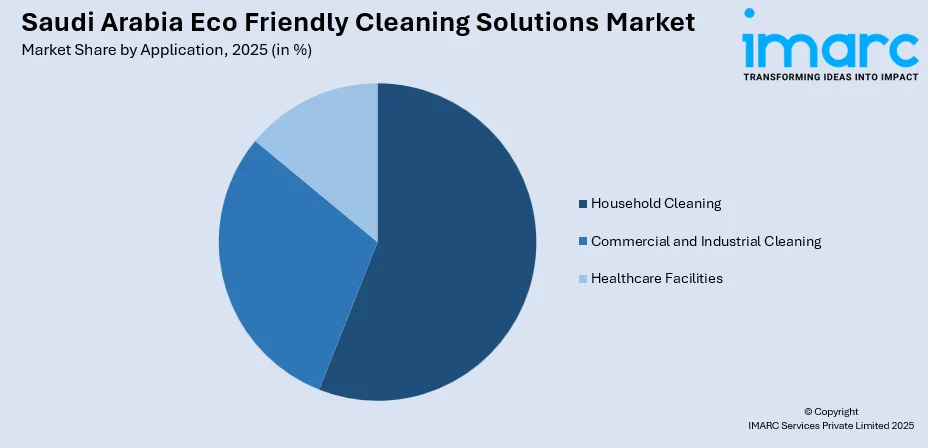

By Application: Household cleaning leads the market with a share of 55.12% in 2025, attributed to rising urbanization, growing middle-class population, and increasing awareness about maintaining healthy indoor environments using non-toxic cleaning alternatives.

-

By Distribution Channel: Offline represents the largest segment with a market share of 60.10% in 2025, supported by the extensive presence of supermarkets, hypermarkets, and specialty stores offering diverse eco friendly product ranges with consumer trust in physical retail experiences.

-

By Form: Liquid cleaners hold the largest share of 50.15% in 2025, owing to ease of application, versatility across multiple cleaning surfaces, superior mixing capabilities, and consumer preference for ready-to-use formulations.

-

Key Players: The Saudi Arabia eco friendly cleaning solutions market exhibits moderate competitive intensity, with multinational consumer goods corporations competing alongside regional manufacturers. Players focus on product innovation, sustainable packaging initiatives, and strategic partnerships with retail chains to strengthen market positioning.

To get more information on this market Request Sample

The Saudi Arabia eco friendly cleaning solutions market is witnessing transformational growth as sustainability becomes central to consumer purchasing decisions and government policy frameworks. Vision 2030's emphasis on environmental stewardship has significantly accelerated the adoption of green cleaning products across residential, commercial, and institutional sectors throughout the Kingdom. Consumer behavior is shifting notably, with health-conscious households increasingly prioritizing non-toxic, biodegradable, and halal-certified cleaning solutions that align with both environmental values and cultural preferences. Young Saudi consumers demonstrate particular receptiveness to sustainable alternatives, influenced by global environmental movements and social media awareness campaigns. The convergence of regulatory support, rising disposable incomes, expanding retail infrastructure, and heightened ecological awareness creates a favorable ecosystem for eco friendly cleaning product manufacturers seeking to establish strong market presence in the Kingdom.

Saudi Arabia Eco Friendly Cleaning Solutions Market Trends:

Rising Consumer Preference for Plant-Based and Natural Formulations

Saudi consumers are increasingly gravitating toward plant-based cleaning products that eliminate harsh synthetic chemicals while maintaining superior cleaning efficacy. This trend reflects broader wellness priorities and heightened environmental consciousness among urban households seeking healthier indoor environments. The growing preference for natural ingredients aligns with cultural values emphasizing family health and safety. Manufacturers are responding by reformulating products with botanical ingredients, emphasizing label transparency, securing eco-certifications, and developing halal-compliant formulations that resonate with environmentally aware and health-conscious Saudi consumers across household and commercial applications.

Integration of Digital Retail Channels and E-Commerce Expansion

The digital transformation of Saudi Arabia's retail landscape is reshaping how consumers access eco friendly cleaning products. E-commerce platforms now offer unprecedented product variety, competitive pricing, and doorstep delivery convenience. According to the Saudi Central Bank data, electronic payments accounted for 79% of all retail transactions in 2024, up significantly from 70% in 2023. The detergents e-commerce market in Saudi Arabia is reflecting growing consumer comfort with online purchasing of household cleaning supplies and the expansion of digital payment infrastructure.

Emphasis on Halal Certification and Cultural Compliance

Cultural and religious considerations significantly influence purchasing decisions in Saudi Arabia's cleaning products market. Manufacturers are increasingly pursuing halal certifications for eco friendly cleaning solutions, ensuring products comply with Islamic principles while meeting sustainability standards. This dual focus on religious compliance and environmental responsibility resonates strongly with Saudi consumers who seek products aligning with their values. The trend extends to ingredient sourcing transparency, with brands emphasizing cruelty-free testing methods and ethically derived plant-based components that meet both halal requirements and sustainability criteria.

How Vision 2030 is Transforming the Saudi Arabia Eco Friendly Cleaning Solutions Market:

Saudi Arabia's Vision 2030 is reshaping the eco friendly cleaning solutions market by prioritizing environmental sustainability and positioning the Kingdom as a regional leader in green consumer products. Regulatory reforms, including the Technical Regulation for Detergents and Cleaning Products enacted by SASO in 2023 mandating biodegradable surfactants, have accelerated adoption of environmentally responsible cleaning solutions. Mega-projects such as NEOM's zero-carbon cities, the Red Sea Global sustainable tourism developments, and Diriyah's heritage district are creating substantial demand for eco friendly cleaning products meeting stringent environmental standards for hospitality and facility management operations. Riyadh's rapid urbanization and the expansion of modern retail infrastructure are establishing robust distribution channels for sustainable cleaning alternatives, while the Kingdom's commitment to achieving net-zero emissions by 2060 continues driving consumer preference shifts toward non-toxic, halal-certified, and environmentally conscious cleaning products across Saudi Arabia.

Market Outlook 2026-2034:

The Saudi Arabia eco friendly cleaning solutions market outlook remains highly positive as environmental sustainability becomes embedded in national development priorities and consumer consciousness. Government regulatory frameworks increasingly favor biodegradable formulations and non-toxic ingredients, while retail infrastructure expansion enhances product accessibility across urban and semi-urban areas. The convergence of Vision 2030 sustainability goals, rising health awareness, and growing preference for environmentally responsible products positions the market for sustained long-term growth. The market generated a revenue of USD 347.1 Million in 2025 and is projected to reach a revenue of USD 931.30 Million by 2034, growing at a compound annual growth rate of 11.59% from 2026-2034.

Saudi Arabia Eco Friendly Cleaning Solutions Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Biodegradable Cleaning Agents |

28.02% |

|

Application |

Household Cleaning |

55.12% |

|

Distribution Channel |

Offline |

60.10% |

|

Form |

Liquid Cleaners |

50.15% |

Product Type Insights:

- Biodegradable Cleaning Agents

- Plant-Based Cleaners

- Organic Cleaning Solutions

- Natural Disinfectants

- Eco-Friendly Cleaning Tools

The biodegradable cleaning agents dominate with a market share of 28.02% of the total Saudi Arabia eco friendly cleaning solutions market in 2025.

Biodegradable cleaning agents have emerged as the preferred choice among Saudi consumers seeking environmentally responsible cleaning solutions that decompose naturally without leaving harmful residues. These products utilize surfactants and active ingredients derived from renewable resources that break down efficiently in wastewater treatment processes. In September 2023, the bio-tech startup WAYAKIT, a spinout of King Abdullah University of Science and Technology (KAUST), has teamed up with Saudi Ground Services (SGS) to offer environmentally friendly cleaning solutions for the aircraft sector. The collaboration will lead to a notable decrease in the usage of poisonous and dangerous products for maintaining cleanliness.

The segment's growth is further supported by regulatory developments mandating biodegradable surfactant usage in cleaning products. Consumer education initiatives highlighting the environmental benefits of biodegradable formulations have strengthened demand across household and commercial applications. Manufacturers are investing in research and development to enhance cleaning efficacy while maintaining biodegradability standards, addressing historical perceptions that eco friendly products compromise cleaning performance.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Household Cleaning

- Commercial and Industrial Cleaning

- Healthcare Facilities

The household cleaning leads with a share of 55.12% of the total Saudi Arabia eco friendly cleaning solutions market in 2025.

Household cleaning represents the dominant application segment as Saudi families increasingly prioritize safe, non-toxic cleaning environments for their homes. The segment benefits from rising urbanization rates across the Kingdom, growing nuclear family formations in major metropolitan areas, and heightened awareness about indoor air quality and chemical exposure risks. Expanding residential developments under Vision 2030 initiatives further accelerate demand for household cleaning products that align with modern lifestyle expectations and health-conscious consumer preferences.

Consumer preferences within the household segment increasingly favor multipurpose eco friendly cleaners that simplify cleaning routines while reducing product clutter. Young Saudi households demonstrate particular receptiveness to sustainable cleaning alternatives, influenced by social media awareness campaigns and international brand exposure. The presence of children and elderly family members motivates many households to select non-toxic formulations that minimize health risks associated with conventional chemical cleaners, driving sustained demand growth.

Distribution Channel Insights:

- Online

- Offline

The offline channel holds the largest share of 60.10% of the total Saudi Arabia eco friendly cleaning solutions market in 2025.

Offline retail channels maintain market dominance through the extensive presence of supermarkets, hypermarkets, and specialty stores across Saudi Arabia's urban landscape. Major retail chains continue expanding their footprints in key metropolitan areas, providing consumers convenient access to diverse eco friendly cleaning product selections. The established retail infrastructure benefits from high foot traffic in shopping destinations and integrated mall environments that support impulse purchasing behavior.

Physical retail environments enable consumers to examine product labels, compare formulations, and seek guidance from store personnel regarding eco friendly cleaning alternatives. Supermarkets and hypermarkets provide dedicated shelf space for natural and organic cleaning products, improving category visibility and consumer access. The trust associated with established retail chains and the immediacy of in-store purchasing continue supporting offline channel preferences among Saudi consumers, particularly older demographics.

Form Insights:

- Liquid Cleaners

- Powder Cleaners

- Spray Cleaners

The liquid cleaners hold the highest revenue with a 50.15% share of the total Saudi Arabia eco friendly cleaning solutions market in 2025.

Liquid cleaners dominate form preferences due to their versatility, ease of application, and superior dilution capabilities across diverse cleaning tasks. These products offer ready-to-use convenience while enabling precise dosage control for concentrated formulations. The Saudi Arabia household cleaners market size is projected to reach USD 498.53 Million by 2033, exhibiting a growth rate (CAGR) of 3.71% during 2025-2033, with liquid formats capturing substantial share across surface cleaners, floor cleaners, and multipurpose cleaning categories favored by modern households.

Eco friendly liquid cleaners benefit from packaging innovations including recyclable bottles and concentrated refill options that significantly reduce plastic waste. Leading manufacturers are developing plant-based liquid formulations with natural fragrances derived from essential oils that appeal to environmentally conscious consumers seeking effective yet gentle cleaning solutions. The liquid format's versatile compatibility with spray mechanisms and modern dispensing systems enhances application convenience and dosage control, supporting the segment's continued market leadership.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Northern and Central Region is driven by Riyadh's status as the capital city and largest metropolitan area in the Kingdom. This region accounts for the largest share of Saudi Arabia's organized retail activities, featuring extensive supermarket and hypermarket networks including major chains that provide widespread access to eco friendly cleaning products. Urban households in this region demonstrate strong purchasing power and receptiveness to premium sustainable cleaning solutions.

The Western Region represents a significant market driven by Jeddah's commercial importance and the holy cities of Mecca and Medina attracting millions of pilgrims annually. This multicultural hub demonstrates strong consumer receptiveness to international eco friendly brands, commanding substantial market share in national retail distribution with diverse product offerings. The region's tourism-driven hospitality sector creates additional demand for environmentally responsible cleaning solutions across hotels and accommodations.

The Eastern Region leverages its industrial base centered on Dammam, Dhahran, and Al Khobar alongside proximity to oil sector operations requiring specialized cleaning solutions. New residential developments and expatriate population influx have spurred significant retail expansion throughout the province. The region demonstrates growing demand for sustainable cleaning alternatives, supported by affluent consumer segments and increasing environmental awareness among educated professional communities working in petrochemical industries.

The Southern Region presents emerging growth opportunities as infrastructure investments enhance retail accessibility in cities like Abha and Jizan. Although traditionally characterized by lower retail penetration, increasing government development initiatives and rising disposable incomes are gradually strengthening consumer demand for premium eco friendly cleaning products in this region.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Eco Friendly Cleaning Solutions Market Growing?

Government Sustainability Initiatives and Regulatory Support

The Saudi government's commitment to environmental sustainability under Vision 2030 is creating favorable conditions for eco friendly cleaning product adoption. Regulatory frameworks increasingly mandate biodegradable formulations, with technical regulations enacted by the Saudi Standards, Metrology and Quality Organization setting compliance thresholds for biodegradable surfactants and incentivizing sustainable manufacturing practices. These policy measures signal long-term governmental support for the eco friendly cleaning sector, encouraging manufacturers to invest in greener product development.

Rising Health and Environmental Consciousness Among Consumers

Saudi consumers demonstrate increasing awareness regarding the health implications of conventional chemical-based cleaning products and their environmental impact. Growing concerns about indoor air quality, chemical sensitivities, and ecosystem protection are driving demand for non-toxic, biodegradable alternatives. Educational campaigns by health organizations and environmental groups have amplified consumer understanding of eco friendly product benefits, while social media platforms accelerate information sharing about sustainable lifestyle choices among younger demographics.

Expansion of Modern Retail Infrastructure and E-Commerce Channels

The rapid development of Saudi Arabia's retail landscape is enhancing consumer access to diverse eco friendly cleaning products through multiple purchasing channels. The Saudi Arabia retail market size is expected to reach USD 411.7 Billion by 2034, exhibiting a CAGR of 3.83% during 2026-2034, according to the estimates by the IMARC Group. Supermarket chains are expanding store networks while dedicating shelf space to natural and organic product categories. Simultaneously, e-commerce platforms offer unprecedented product variety and delivery convenience.

Market Restraints:

What Challenges the Saudi Arabia Eco Friendly Cleaning Solutions Market is Facing?

Premium Pricing Compared to Conventional Alternatives

Eco friendly cleaning products typically command higher price points than conventional chemical-based alternatives due to costlier raw materials, specialized manufacturing processes, and certification requirements. Price-sensitive consumers may opt for lower-cost conventional products, particularly during economic uncertainties. This pricing disparity challenges market penetration among budget-conscious households and limits adoption in price-competitive commercial cleaning applications.

Consumer Skepticism Regarding Cleaning Efficacy

Some consumers maintain perceptions that eco friendly cleaning products deliver inferior cleaning performance compared to traditional chemical formulations. This skepticism, often based on earlier generation product experiences, creates adoption barriers despite significant improvements in green cleaning technology. Manufacturers must invest substantially in consumer education and product demonstrations to overcome efficacy concerns and build confidence in sustainable alternatives.

Limited Awareness in Non-Urban Markets

Environmental awareness and eco friendly product knowledge remain concentrated in major urban centers, with rural and semi-urban populations demonstrating lower familiarity with sustainable cleaning alternatives. Limited retail infrastructure and marketing reach in non-metropolitan areas restrict product availability and consumer education. Addressing this awareness gap requires targeted outreach efforts and expanded distribution networks beyond primary city markets.

Competitive Landscape:

The Saudi Arabia eco friendly cleaning solutions market exhibits a moderately fragmented competitive structure featuring both multinational consumer goods corporations and regional manufacturers. Global players leverage established brand recognition, extensive research capabilities, and broad distribution networks to maintain market positioning across premium segments. Regional manufacturers compete through competitive pricing, localized product formulations addressing cultural preferences, and agile responses to emerging consumer trends. Strategic partnerships between international brands and local distributors enhance market reach and product availability. Manufacturers are increasingly differentiating through sustainability certifications, halal compliance credentials, and innovative packaging solutions including recyclable materials and concentrated refill options. The competitive environment encourages continuous product innovation and marketing investments targeting environmentally conscious consumer segments.

Recent Developments:

-

August 2024: CloroxPro announced the expansion of the Clorox EcoClean product platform with the launch of Clorox EcoClean Disinfecting Wipes globally. These ready-to-use wipes feature 100% plant-based substrate and naturally-derived citric acid active ingredient that kills 99.9% of germs without bleach, ammonia, or alcohol.

Saudi Arabia Eco Friendly Cleaning Solutions Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Biodegradable Cleaning Agents, Plant-Based Cleaners, Organic Cleaning Solutions, Natural Disinfectants, Eco-Friendly Cleaning Tools |

| Applications Covered | Household Cleaning, Commercial and Industrial Cleaning, Healthcare Facilities |

| Distribution Channels Covered | Online, Offline |

| Forms Covered | Liquid Cleaners, Powder Cleaners, Spray Cleaners |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia eco friendly cleaning solutions market size was valued at USD 347.1 Million in 2025.

The Saudi Arabia eco friendly cleaning solutions market is expected to grow at a compound annual growth rate of 11.59% from 2026-2034 to reach USD 931.30 Million by 2034.

Biodegradable cleaning agents dominated with 28.02% market share in 2025, driven by regulatory mandates for biodegradable surfactants, increasing consumer environmental awareness, and growing preference for cleaning products that decompose naturally without ecosystem harm.

Key factors driving the Saudi Arabia eco friendly cleaning solutions market include government sustainability initiatives under Vision 2030, rising consumer health and environmental consciousness, regulatory support for biodegradable formulations, expanding modern retail infrastructure, and growing e-commerce penetration.

Major challenges include premium pricing compared to conventional alternatives limiting adoption among price-sensitive consumers, persistent skepticism regarding cleaning efficacy of eco-friendly products, limited awareness and retail infrastructure in non-urban areas, and supply chain complexities for sustainable raw materials.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)