Saudi Arabia Education Computing Devices Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2026-2034

Saudi Arabia Education Computing Devices Market Overview:

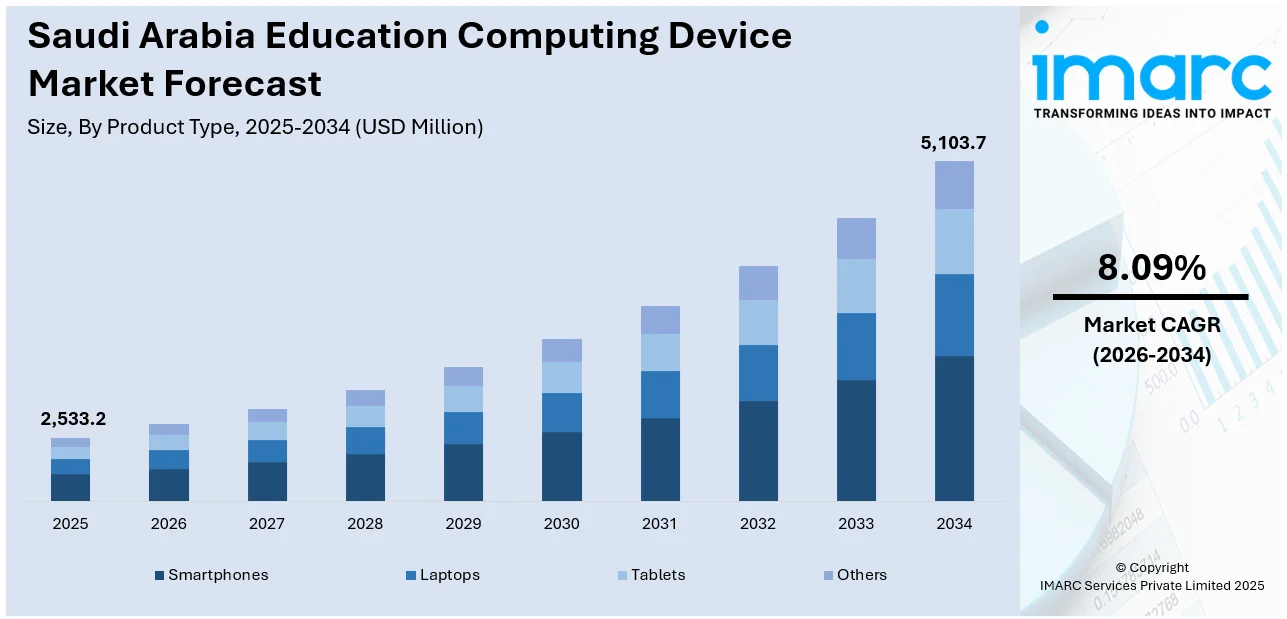

The Saudi Arabia education computing devices market size reached USD 2,533.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 5,103.7 Million by 2034, exhibiting a growth rate (CAGR) of 8.09% during 2026-2034. Increasing digital transformation in schools, government-led smart education initiatives, growing e-learning adoption, rising student populations, and demand for portable, affordable devices like tablets and laptops to support blended and remote learning models across the Kingdom are some of the factors contributing to Saudi Arabia education computing devices market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2,533.2 Million |

| Market Forecast in 2034 | USD 5,103.7 Million |

| Market Growth Rate 2026-2034 | 8.09% |

Saudi Arabia Education Computing Devices Market Trends:

Push for Digital Literacy Driving Device Uptake

Saudi Arabia is witnessing a sharp rise in demand for education computing devices as large-scale AI and digital skills initiatives take hold. Training programs targeting students and citizens are accelerating the adoption of smart classrooms and personalized learning environments. With thousands of learners being equipped in artificial intelligence, machine learning, and related domains, institutions are increasingly integrating laptops, tablets, and supporting digital infrastructure. These shifts align closely with the broader national objective of fostering a knowledge-based economy and transforming the educational system to match global technological standards. The rollout of strategic programs under Vision 2030 is not only reshaping curriculum delivery but also creating a scalable market for education-focused computing solutions across schools, universities, and training centers. These factors are intensifying the Saudi Arabia education computing devices market growth. For example, as of December 2024 , Saudi Arabia’s Future Intelligence Program is training 30,000 students in AI, machine learning, and smart technologies, while the SAMAI initiative targets digital upskilling for 1 Million Saudis. These efforts are boosting demand for education computing devices to support personalized learning and digital classrooms, reinforcing the Kingdom’s push for a tech-driven education model under Vision 2030.

To get more information on this market Request Sample

Local Manufacturing Strengthening Device Availability

Saudi Arabia is advancing its digital education goals by localizing the production of computing devices. The establishment of a new desktop PC manufacturing center supports the broader objective of building a resilient, self-sufficient supply chain for educational hardware. This move is set to reduce reliance on imports, lower device costs, and speed up distribution to schools and training institutions. Alongside this, the launch of a regional AI research facility highlights the Kingdom’s growing focus on innovation and digital capability-building. These developments are aligned with national efforts to expand digital learning and make modern computing tools more accessible across educational settings, enhancing both infrastructure and local expertise in support of Vision 2030’s technology-driven education vision. For instance, in February 2025 , HP announced plans to build desktop PCs in Saudi Arabia as part of its “Made in Saudi” initiative, launching a manufacturing center in Riyadh. The company would also open an AI research facility in Dhahran to support local demand and expand across neighboring countries, boosting access to computing devices essential for Saudi Arabia’s digital education goals.

Saudi Arabia Education Computing Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type and end user.

Product Type Insights:

- Smartphones

- Laptops

- Tablets

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes smartphones, laptops, tablets, and others.

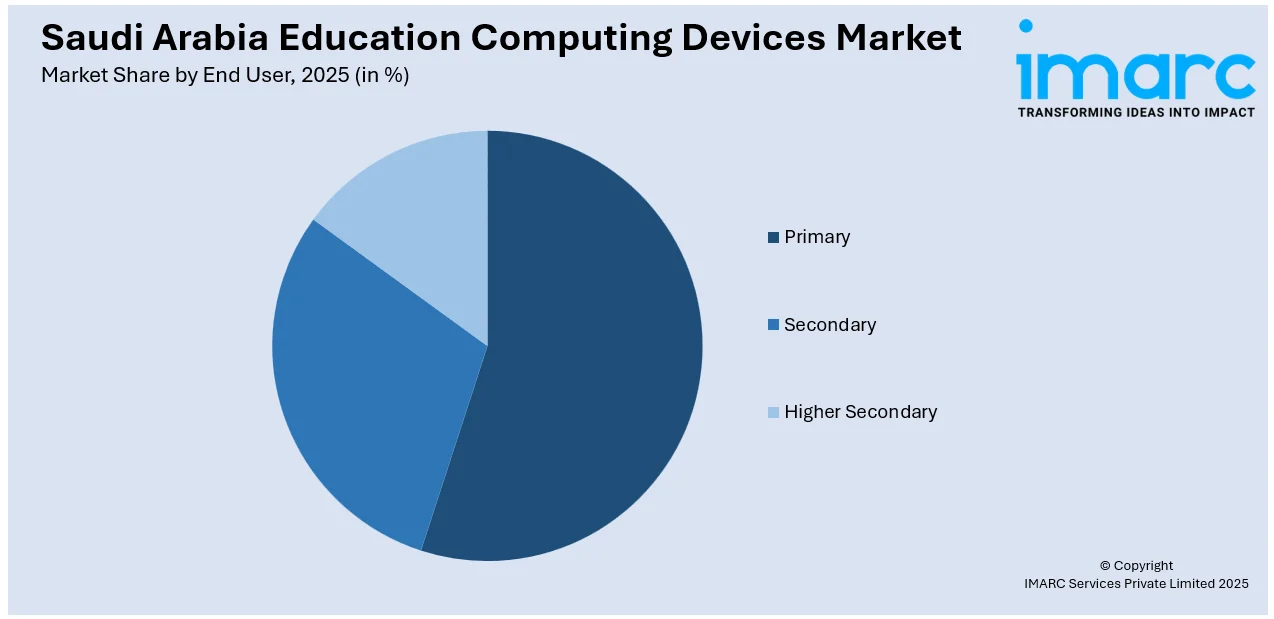

End User Insights:

Access the comprehensive market breakdown Request Sample

- Primary

- Secondary

- Higher Secondary

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes primary, secondary, and higher secondary.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Education Computing Devices Market News:

- In April 2025, Saudi Arabia’s Ministry of Education hosted EDGEx 2025 in Riyadh, emphasizing digital transformation in education. The event showcased cutting-edge computing devices and smart classroom technologies from global tech firms, aligning with the Kingdom’s Vision 2030 goals. It highlighted the government's commitment to integrating advanced learning tools and promoting innovation-driven partnerships to enhance digital education across schools and universities.

- In January 2025, Lenovo finalized a USD 2 Billion investment deal with Saudi Arabia’s Alat to set up a regional headquarters and a manufacturing facility for PCs and servers in the Kingdom. Initially announced in May 2024, the deal aims to produce “Saudi Made” computing devices by 2026, supporting local innovation and expanding educational tech infrastructure aligned with Vision 2030.

Saudi Arabia Education Computing Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Smartphones, Laptops, Tablets, Others |

| End Users Covered | Primary, Secondary, Higher Secondary |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia education computing devices market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia education computing devices market on the basis of product type?

- What is the breakup of the Saudi Arabia education computing devices market on the basis of end user?

- What is the breakup of the Saudi Arabia education computing devices market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia education computing devices market?

- What are the key driving factors and challenges in the Saudi Arabia education computing devices market?

- What is the structure of the Saudi Arabia education computing devices market and who are the key players?

- What is the degree of competition in the Saudi Arabia education computing devices market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia education computing devices market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia education computing devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia education computing devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)