Saudi Arabia Electric Commercial Vehicles Market Size, Share, Trends and Forecast by Vehicle Type, Propulsion Type, Battery Capacity, End User, and Region, 2026-2034

Saudi Arabia Electric Commercial Vehicles Market Overview:

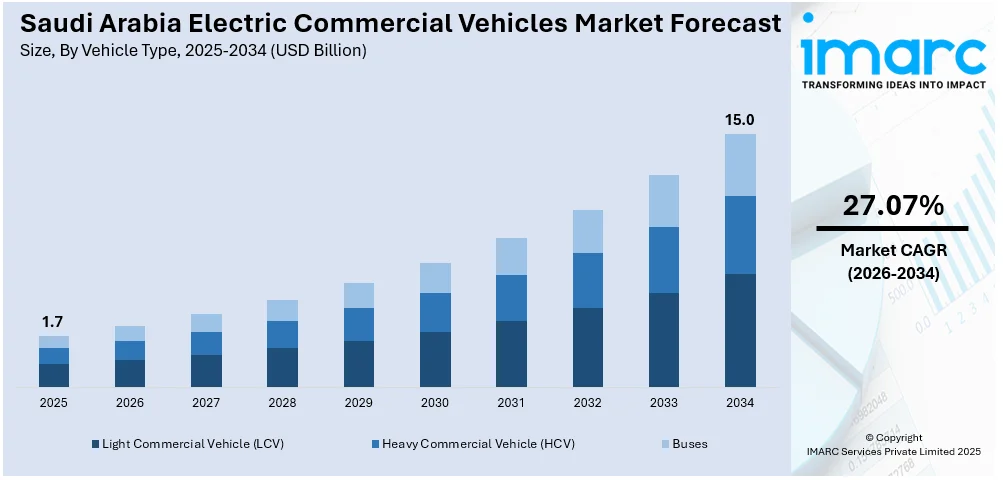

The Saudi Arabia electric commercial vehicles market size reached USD 1.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 15.0 Billion by 2034, exhibiting a growth rate (CAGR) of 27.07% during 2026-2034. At present, the government of Saudi Arabia is introducing a series of policies that will encourage the uptake of electric vehicles (EVs) within the business sector. This, along with the growing demand for cost-efficient and environment-friendly transportation solutions is offering a favorable market outlook. Moreover, technological innovation is expanding the Saudi Arabia electric commercial vehicles market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.7 Billion |

| Market Forecast in 2034 | USD 15.0 Billion |

| Market Growth Rate 2026-2034 | 27.07% |

Saudi Arabia Electric Commercial Vehicles Market Trends:

Government Support and Policies Facilitating Adoption of EVs

The government of Saudi Arabia is introducing a series of policies that will encourage the uptake of electric vehicles (EVs) within the business sector. It is providing financial incentives, in the form of subsidies and tax relief, to companies that adopt electric commercial vehicles. The government is also introducing legislation limiting the emissions from conventional internal combustion engine vehicles, encouraging companies to adopt cleaner technology. The National Industrial Development and Logistics Program (NIDLP) is supporting the local manufacturing of EVs, as well as initiatives to develop a strong EV infrastructure such as extensive charging points. By supporting sustainability and continuing with Vision 2030 policies, the government is facilitating the drive towards electric commercial vehicles. These initiatives are not only improving the overall business climate but also promoting private sector investments, and thus making a huge contribution to the growth of the electric commercial vehicle sector in Saudi Arabia. In 2025, the kingdom allocated $9 Billion for materials related to EVs, comprising $900 million from EV metals and $126 million from Ivanhoe Electric, demonstrate that the Kingdom is utilizing its $2.5 trillion in unexploited mineral reserves to secure access to essential capitals required for production.

To get more information on this market Request Sample

Growing Demand for Cost-Efficient and Environment-Friendly Transportation Solutions

Firms in Saudi Arabia are increasingly turning to electric commercial vehicles because they promise lower operating expenses and helping drive sustainability. The reduced operating expenses on EVs, combined with the saving on fuel, are presenting firms with a strong fiscal case. YallaMotor stated that in 2025 diesel prices in Saudi Arabia is 1.66 SAR per liter, showing a 44% increment from the earlier price. With oil prices being unpredictable and global supply chains being under pressure, cost savings on electric cars are a solution that is beginning to appeal to commercial fleets. Also, the environmental advantages of EVs are being acknowledged in a region that is determined to diversify its economy and enhance environmental standards. Moreover, the rising focus on improving the sustainability of businesses is impelling the Saudi Arabia electric commercial vehicles market growth. The transformation is encouraging businesses to address regulatory needs as well as customer demand for cleaner business operations, consequently driving the electric vehicle market further.

Improvements in EV Tech and Charging Infrastructure

Technological innovation is propelling the market growth in Saudi Arabia. Manufacturers are constantly enhancing the performance, efficiency, and range of electric commercial vehicles to make them more appropriate for long-distance transportation and other commercial uses. The innovations are overcoming some of the historic drawbacks of EVs, including reduced battery life and extended charging times. Concurrently, the growth of charging infrastructure is alleviating range anxiety issues, making EVs increasingly viable for daily commercial applications. The deployment of high-speed charging networks and collaboration with private firms for developing charging stations are enhancing EV adoption in the commercial space. As vehicle technology and charging facilities improve, Saudi Arabia is seeing faster growth in its electric car market, supporting companies moving towards more environment friendly transport solutions. In 2025, EVIQ, the leading EV infrastructure provider in Saudi Arabia, has inaugurated its initial highway EV charging station at SASCO Aljazeera along the Riyadh-Qassim highway. This is a component of EVIQ's broader strategy to establish a nationwide EV charging infrastructure. The charging station is the initial one of numerous that EVIQ intends to set up nationwide. The organization plans to install more than 5,000 rapid chargers by the year 2030. It will provide top-performing charging solutions that are in line with Saudi Arabia’s sustainability objectives

Saudi Arabia Electric Commercial Vehicles Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on vehicle type, propulsion type, battery capacity, and end user.

Vehicle Type Insights:

- Light Commercial Vehicle (LCV)

- Heavy Commercial Vehicle (HCV)

- Buses

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes light commercial vehicle (LCV), heavy commercial vehicle (HCV), and buses.

Propulsion Type Insights:

- Battery Electric Vehicle (BEV)

- Plug in Hybrid Vehicle (PHEV)

- Fuel Cell Electric Vehicle (FCEV)

The report has provided a detailed breakup and analysis of the market based on the propulsion type. This includes battery electric vehicle (BEV), plug in hybrid vehicle (PHEV), and fuel cell electric vehicle (FCEV).

Battery Capacity Insights:

- <50kwh

- 50-150 kwh

- >150kwh

The report has provided a detailed breakup and analysis of the market based on the battery capacity. This includes <50kwh, 50-150 kwh, and >150kwh.

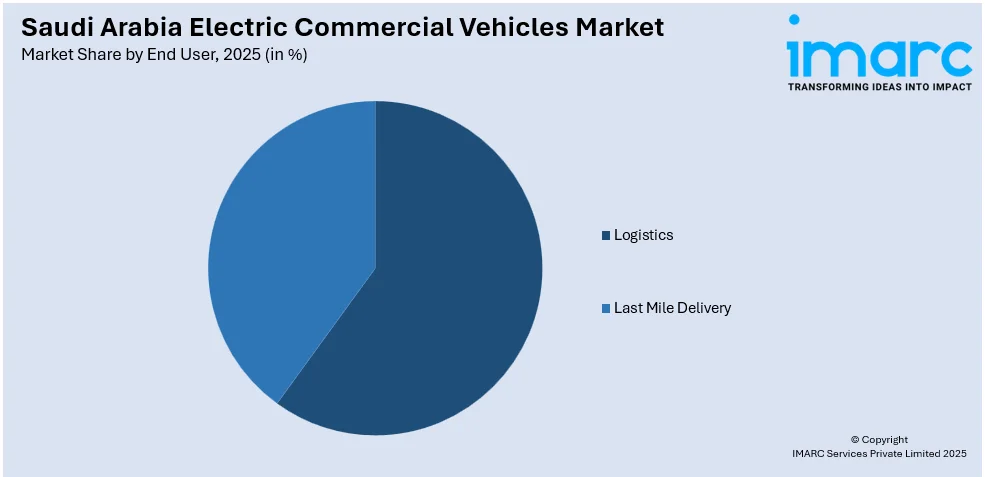

End User Insights:

Access the comprehensive market breakdown Request Sample

- Logistics

- Last Mile Delivery

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes logistics and last mile delivery.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Electric Commercial Vehicles Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Light Commercial Vehicle (LCV), Heavy Commercial Vehicle (HCV), Buses |

| Propulsion Types Covered | Battery Electric Vehicle (BEV), Plug in Hybrid Vehicle (PHEV), Fuel Cell Electric Vehicle (FCEV) |

| Battery Capacities Covered | <50kwh, 50-150 kwh, >150kwh |

| End Users Covered | Logistics, Last Mile Delivery |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia electric commercial vehicles market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia electric commercial vehicles market on the basis of vehicle type?

- What is the breakup of the Saudi Arabia electric commercial vehicles market on the basis of propulsion type?

- What is the breakup of the Saudi Arabia electric commercial vehicles market on the basis of battery capacity?

- What is the breakup of the Saudi Arabia electric commercial vehicles market on the basis of end user?

- What is the breakup of the Saudi Arabia electric commercial vehicles market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia electric commercial vehicles market?

- What are the key driving factors and challenges in the Saudi Arabia electric commercial vehicles market?

- What is the structure of the Saudi Arabia electric commercial vehicles market and who are the key players?

- What is the degree of competition in the Saudi Arabia electric commercial vehicles market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia electric commercial vehicles market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia electric commercial vehicles market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia electric commercial vehicles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)