Saudi Arabia Electric Kettle Market Size, Share, Trends and Forecast by Raw Material, Application, and Region, 2026-2034

Saudi Arabia Electric Kettle Market Overview:

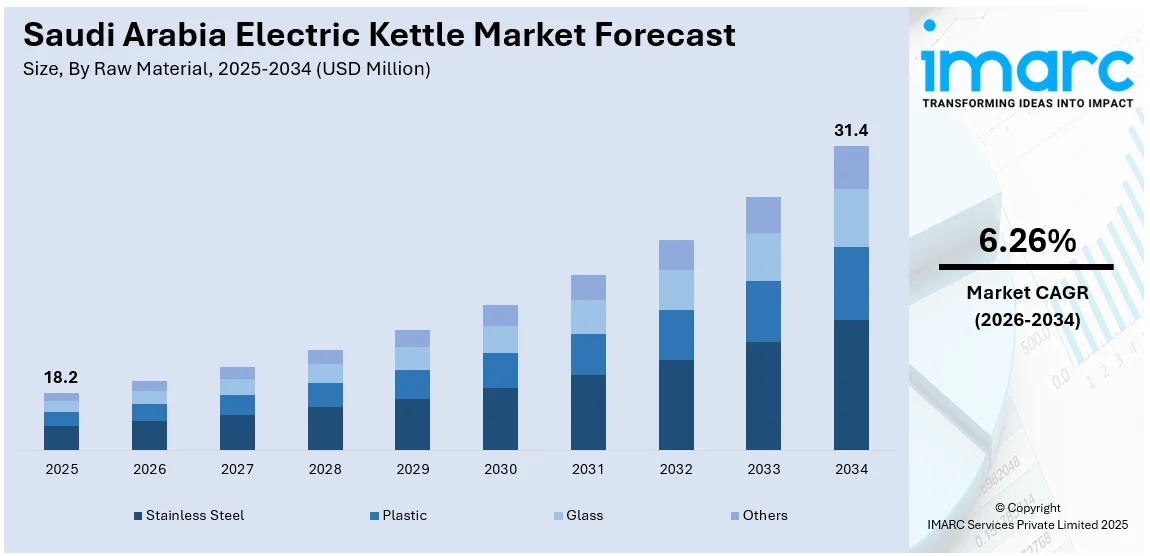

The Saudi Arabia electric kettle market size reached USD 18.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 31.4 Million by 2034, exhibiting a growth rate (CAGR) of 6.26% during 2026-2034. The market is witnessing significant growth due to increasing demand for energy-efficient and convenient kitchen appliances. Consumers are opting for models with advanced features such as temperature control, fast boiling capabilities, and modern designs. The rising trend of smart home devices, boosting innovation and performance, also enhances the Saudi Arabia electric kettle market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 18.2 Million |

| Market Forecast in 2034 | USD 31.4 Million |

| Market Growth Rate 2026-2034 | 6.26% |

Saudi Arabia Electric Kettle Market Trends:

Rising Demand for Energy-Efficient Models

As consumers become more environmentally conscious the demand for energy-efficient electric kettles in Saudi Arabia is rising. These kettles are designed to reduce electricity consumption while providing quick boiling times making them ideal for households and offices looking to minimize energy costs. Features such as fast-heating elements and improved insulation technology help to achieve quick boiling without excessive power use. Energy-efficient kettles often include additional functions like automatic shut-off and boil-dry protection, further reducing unnecessary energy consumption. With rising electricity prices and a growing awareness of environmental impact, consumers are increasingly prioritizing appliances that balance high performance with sustainability. Manufacturers are responding to this shift by developing more advanced, energy-efficient models that meet consumer needs for both functionality and eco-friendliness. This growing demand for energy-efficient electric kettles is expected to continue shaping the Saudi Arabia electric kettle market, encouraging further innovations in energy-saving technology.

To get more information on this market Request Sample

Integration of Smart Features

The convergence of smart home technology is playing a major role in fueling the popularity of electric kettles in Saudi Arabia. Customers are making more and more use of kettles with Wi-Fi connectivity, app control, and voice control, which provide enhanced convenience and control. These intelligent features enable control and monitoring of electric kettles remotely through smartphones or smart home controllers such as Amazon Alexa or Google Assistant, with features like scheduling boiling time or setting precise temperature levels. With increasing adoption of smart home devices, customers hope their kitchen appliances provide easy integration into their smart living environments. This trend is contributing to Saudi Arabia electric kettle market growth, as manufacturers introduce advanced models that combine traditional kettle functionality with innovative smart features. With the growing adoption of smart home technology, the market for smart electric kettles is poised for expansion, catering to the tech-savvy consumer's needs for convenience and efficiency.

Compact and Space-Saving Designs

With the increasing trend of smaller living spaces, especially in the urban sector, consumers in Saudi Arabia are increasingly looking for compact and portable electric kettles. Most consumers are residing in apartments or houses with constrained kitchen counter space, which has led to a desire for devices that are space-efficient yet occupy little space. Portable electric kettles are meant to occupy minimal space while being highly efficient, providing speedy boiling times without taking up precious kitchen space. Portable designs also find customers who have the need to travel from place to place or require a travel kettle. Portable kettles usually come with minimalist, sleek designs constructed from robust materials such as glass and stainless steel, balancing functionality with appearance. The increasing demand for smaller spaces and convenience is fueling the use of mini electric kettles, and thus it has become a necessity for kitchens in Saudi Arabia.

Saudi Arabia Electric Kettle Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on raw material and application.

Raw Material Insights:

- Stainless Steel

- Plastic

- Glass

- Others

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes stainless steel, plastic, glass, and others.

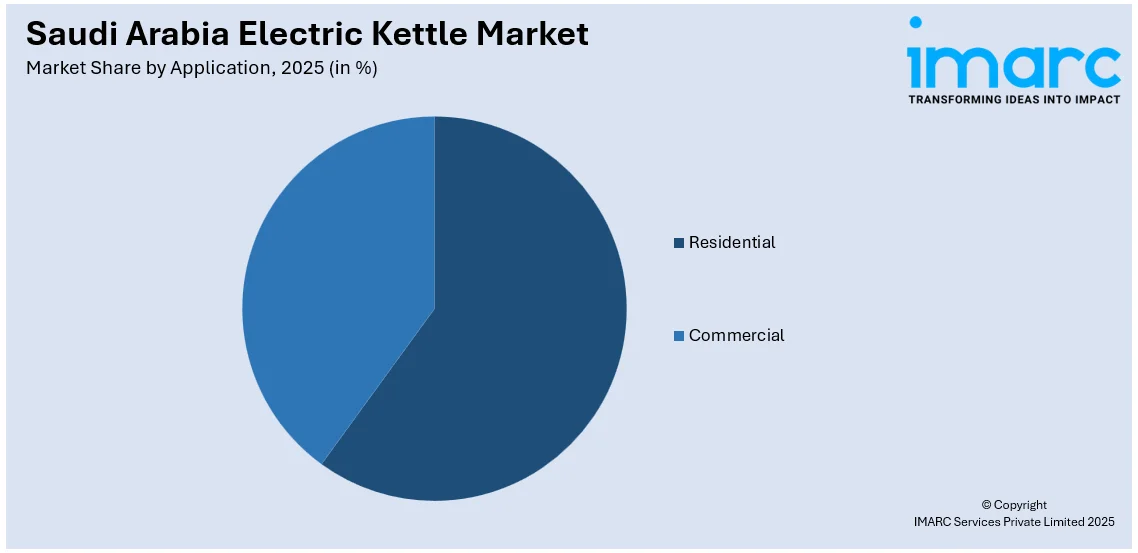

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential and commercial.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Electric Kettle Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Stainless Steel, Plastic, Glass, Others |

| Applications Covered | Residential, Commercial |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia electric kettle market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia electric kettle market on the basis of raw material?

- What is the breakup of the Saudi Arabia electric kettle market on the basis of application?

- What is the breakup of the Saudi Arabia electric kettle market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia electric kettle market?

- What are the key driving factors and challenges in the Saudi Arabia electric kettle market?

- What is the structure of the Saudi Arabia electric kettle market and who are the key players?

- What is the degree of competition in the Saudi Arabia electric kettle market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia electric kettle market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia electric kettle market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia electric kettle industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)