Saudi Arabia Electric Substation Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Saudi Arabia Electric Substation Market Overview:

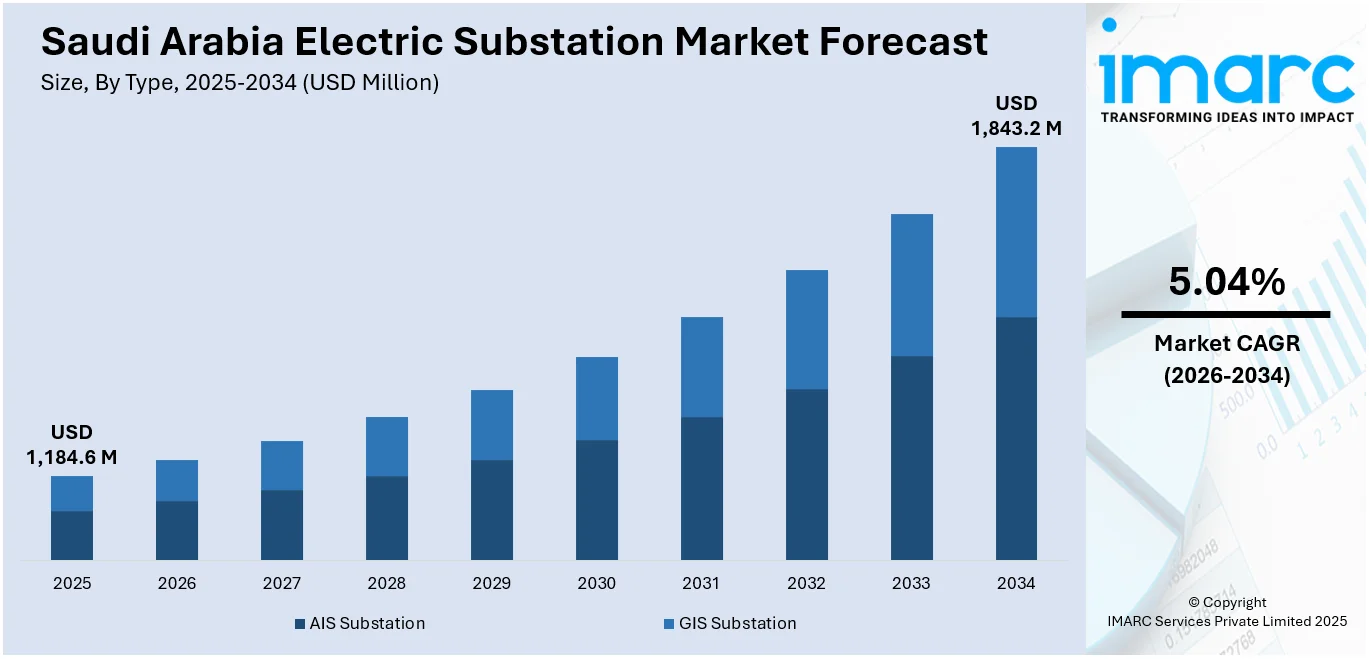

The Saudi Arabia electric substation market size reached USD 1,184.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,843.2 Million by 2034, exhibiting a growth rate (CAGR) of 5.04% during 2026-2034. Grid modernization efforts, rising electricity demand from industrial and residential sectors, renewable energy integration under Vision 2030, and government investments in transmission infrastructure to support urban expansion, smart cities, and energy diversification goals are some of the factors contributing to Saudi Arabia electric substation market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 1,184.6 Million |

|

Market Forecast in 2034

|

USD 1,843.2 Million |

| Market Growth Rate 2026-2034 | 5.04% |

Saudi Arabia Electric Substation Market Trends:

Expansion of GIS Substations to Support Grid Reliability

Saudi Arabia is placing greater focus on expanding high-voltage gas-insulated substations to strengthen its power transmission network. These substations are favored for their reliability, compact footprint, and suitability in dense or challenging environments. Development projects now commonly involve end-to-end execution, covering everything from design and civil works to automation and commissioning. This integrated approach helps streamline timelines and supports efficient integration of new power generation sources into the national grid. Emphasis is also being placed on incorporating advanced switchgear systems and localized components, aligning with broader objectives for infrastructure modernization and energy security. The expansion of such facilities plays a critical role in improving grid performance, accommodating future load demand, and supporting the energy transition underway across the country. These factors are intensifying the Saudi Arabia electric substation market growth. For example, in June 2024, Linxon was awarded a turnkey contract by Saudi Electricity Company to build the 380 kV Taibah GIS substation in Madinah. This project supports power evacuation from the 3.6 GW Taibah IPP and includes design, engineering, and equipment supply from Hitachi Energy. The substation enhances grid reliability and aligns with Saudi Arabia’s energy mix and infrastructure goals. Completion is scheduled within 26 months under SEC supervision.

To get more information on this market Request Sample

Strengthening Grid Infrastructure for Renewable Integration

Saudi Arabia is advancing the development of high-capacity gas-insulated substations to reinforce its transmission backbone and enable smoother integration of renewable energy sources. These projects typically include components such as reactors and hybrid GIS bays, designed to enhance system flexibility and reliability. The increasing scale and complexity of substation contracts reflect a national drive to create a more resilient and efficient grid capable of supporting diverse energy inputs. Strategic investments in such infrastructure aim to ensure stable power delivery to key regions while accommodating the evolving generation mix. This push also aligns with efforts to localize capabilities and accelerate the deployment of advanced technologies within the country’s power transmission ecosystem. For instance, in March 2025, Larsen & Toubro’s Power Transmission & Distribution unit secured a major contract in Saudi Arabia for a 380 kV gas insulated substation (GIS), including reactors and hybrid GIS bays. Classified as a ‘large’ order, it highlights L&T’s role in advancing Saudi Arabia’s grid infrastructure and renewable energy integration.

Saudi Arabia Electric Substation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

- AIS Substation

- GIS Substation

The report has provided a detailed breakup and analysis of the market based on the type. This includes AIS substation and GIS substation.

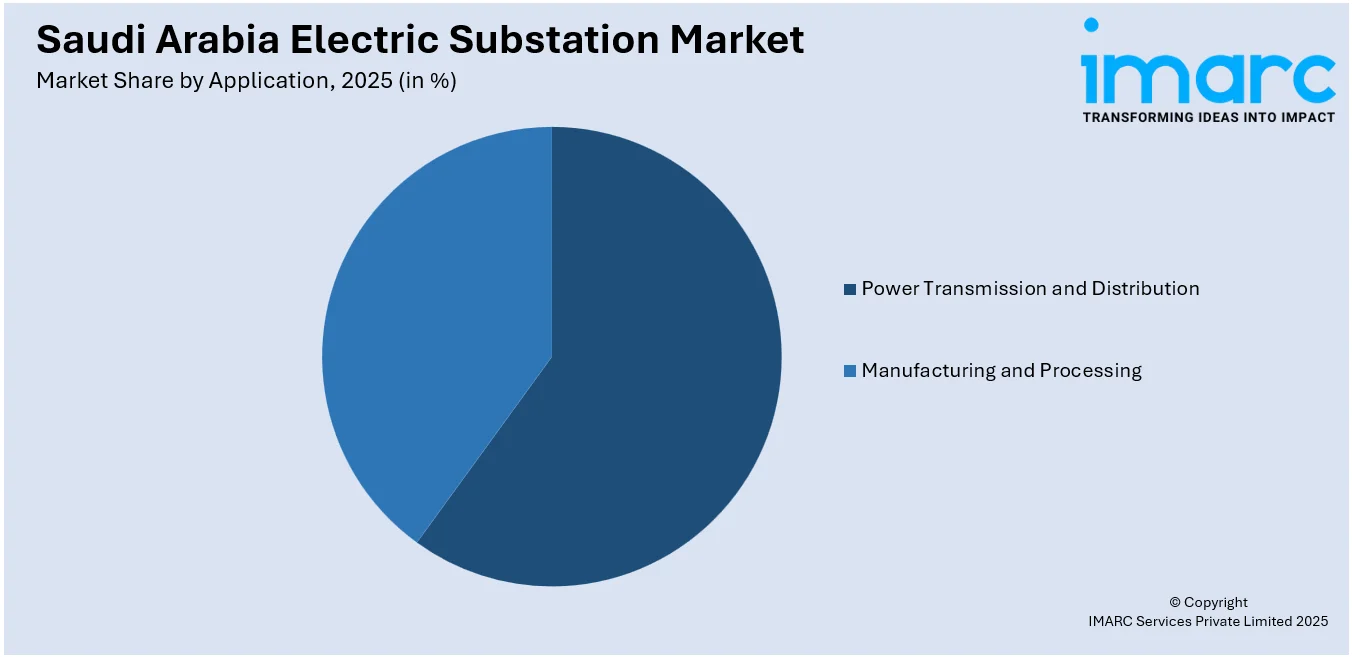

Application Insights:

Access the comprehensive market breakdown Request Sample

- Power Transmission and Distribution

- Manufacturing and Processing

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes power transmission and distribution and manufacturing and processing.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Electric Substation Market News:

- In April 2025, Saudi Electricity Company (SEC) advanced the electric substation market with a planned 380 kV substation at Mawqaq to support renewable energy integration. The USD 158 Million contract saw the lowest bid from Trading & Development Partnership, while Alfanar Projects bid USD 42.3 Million for the connecting overhead transmission line. These infrastructure upgrades are key to enhancing grid capacity for large-scale clean energy under Saudi Arabia’s Vision 2030 strategy.

Saudi Arabia Electric Substation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | AIS Substation, GIS Substation |

| Applications Covered | Power Transmission and Distribution, Manufacturing and Processing |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, and Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia electric substation market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia electric substation market on the basis of type?

- What is the breakup of the Saudi Arabia electric substation market on the basis of application?

- What is the breakup of the Saudi Arabia electric substation market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia electric substation market?

- What are the key driving factors and challenges in the Saudi Arabia electric substation market?

- What is the structure of the Saudi Arabia electric substation market and who are the key players?

- What is the degree of competition in the Saudi Arabia electric substation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia electric substation market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia electric substation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia electric substation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)