Saudi Arabia Electric Truck Market Size, Share, Trends and Forecast by Vehicle Type, Propulsion, Range, Application, and Region, 2026-2034

Saudi Arabia Electric Truck Market Overview:

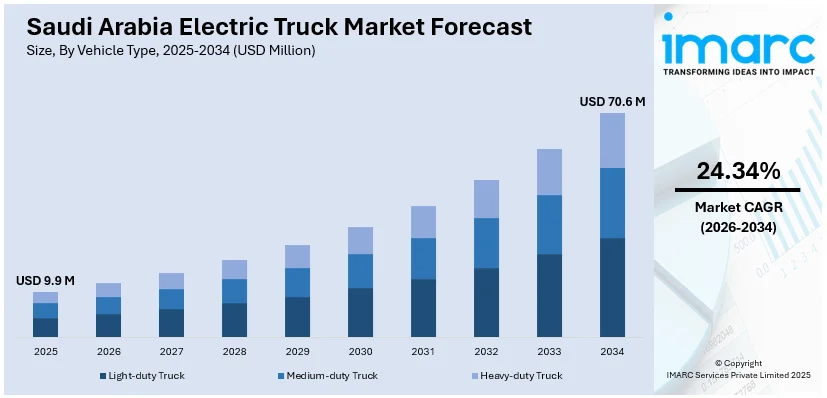

The Saudi Arabia electric truck market size reached USD 9.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 70.6 Million by 2034, exhibiting a growth rate (CAGR) of 24.34% during 2026-2034. The growth of the electric truck market in Saudi Arabia is driven by the focus on sustainable urban transport, corporate sustainability goals, and the expansion of electric vehicle (EV) charging infrastructure, all aligning with the Vision 2030 to reduce emissions, improve air quality, and promote eco-friendly logistics solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 9.9 Million |

| Market Forecast in 2034 | USD 70.6 Million |

| Market Growth Rate 2026-2034 | 24.34% |

Saudi Arabia Electric Truck Market Trends:

Growing Focus on Sustainable Urban Transport

Sustainable urban transport is a critical factor driving the growth of the electric truck market in Saudi Arabia. As cities continue to expand and urbanization accelerates, the demand for cleaner, more efficient transportation solutions is increasing. Electric trucks provide a solution for the rising problems of traffic congestion, air pollution, and carbon emissions in cities. They offer a more environment-friendly option compared to conventional diesel vehicles, in line with worldwide movements toward sustainable urban transportation. Additionally, integrating electric trucks into last-mile delivery and urban logistics allows cities to lessen their environmental footprint and enhance air quality. This shift towards sustainable urban transport is not only a response to regulatory pressure but also reflects a growing awareness among businesses and individuals about the environmental and health benefits of clean mobility. In 2023, Quantron AG and Petromin Corporation announced the delivery of 50 QUANTRON QARGO 4 EV battery-electric trucks in Saudi Arabia, marking the largest deployment of zero-emission trucks. These trucks, serving customers like PepsiCo and Red Sea Global, supported the decarbonization efforts in line with Vision 2030. The partnership aimed to revolutionize sustainable urban transport and last-mile delivery.

To get more information on this market, Request Sample

Shift Toward Corporate Sustainability Goals

Businesses are progressively aligning their strategies with eco-friendly objectives, emphasizing the reduction of their carbon emissions and the incorporation of sustainable technologies. By switching to electric trucks, companies can greatly cut emissions, decrease fuel expenses, and satisfy the growing need for environment-friendly options in transportation. Numerous companies are establishing ambitious targets as a facet of their corporate social responsibility (CSR) initiatives. This not only improves their reputation and brand identity but also demonstrates a wider dedication to supporting national sustainability objectives, like those stated in Saudi Vision 2030. As corporate accountability and sustainability become more significant, the need for electric trucks is increasing, fostering the development of a more eco-friendly and efficient transportation industry. In 2023, NAQEL Express launched its first fleet of electric transport trucks in Saudi Arabia as part of its commitment to sustainability. This initiative, in partnership with National Transportation Solutions Company, aligned with Saudi Vision 2030 and aimed to transition the entire fleet to electric by 2040. The company’s new "Green with Care" tagline emphasized its dedication to reducing environmental impact.

Expansion of EV Charging Infrastructure

With the expansion of charging stations in both urban and rural locations, the practical feasibility of utilizing electric trucks rises, especially for long-haul freight and logistics activities. A strong and easily accessible charging network guarantees that businesses and fleet operators receive the essential support to embrace electric trucks without worries about insufficient charging options or range fear. As both the governing body and private sector invest in rapid-charging stations, the shift to electric vehicles becomes smoother and more affordable. For instance, in 2025, EVIQ, Saudi Arabia's leading EV infrastructure provider, signed an MoU with Remat Al-Riyadh to install a network of EV charging stations across Riyadh. This partnership aims to enhance urban mobility and support Saudi Vision 2030's sustainability goals. EVIQ plans to establish over 5,000 fast chargers nationwide by 2030 to promote electric vehicle adoption. This expanding infrastructure improves urban mobility and also advances the broader aims of Vision 2030 by promoting the transition to sustainable transportation options, ultimately positioning electric trucks as a vital element of Saudi Arabia's future logistics and freight frameworks.

Saudi Arabia Electric Truck Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on vehicle type, propulsion, range, and application.

Vehicle Type Insights:

- Light-duty Truck

- Medium-duty Truck

- Heavy-duty Truck

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes light-duty truck, medium-duty truck, and heavy-duty truck.

Propulsion Insights:

- Battery Electric Truck

- Hybrid Electric Truck

- Plug-in Hybrid Electric Truck

- Fuel Cell Electric Truck

A detailed breakup and analysis of the market based on the propulsion have also been provided in the report. This includes battery electric truck, hybrid electric truck, plug-in hybrid electric truck, and fuel cell electric truck.

Range Insights:

- 0-150 Miles

- 151-300 Miles

- Above 300 Miles

The report has provided a detailed breakup and analysis of the market based on the range. This includes 0-150 miles, 151-300 miles, and above 300 miles.

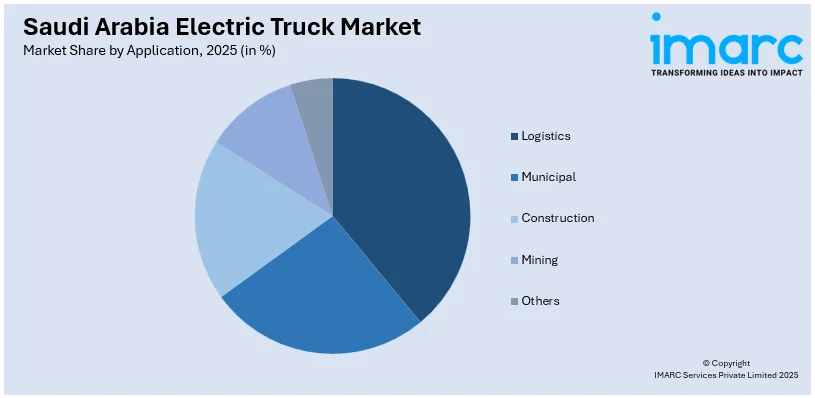

Application Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Logistics

- Municipal

- Construction

- Mining

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes logistics, municipal, construction, mining, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Electric Truck Market News:

- In May 2024, Newrizon established a dealership agreement with Al Yemni Group in Saudi Arabia to introduce its electric trucks to the GCC area, making Al Yemni the sole dealer. This collaboration advanced Saudi Arabia's sustainability objectives by encouraging zero-emission trucks and battery exchange technology.

- In October 2023, Juffali Commercial Vehicles launched the Mercedes-Benz eActros 300 L 4x2, marking Saudi Arabia's first battery-electric heavy-duty truck. This launch promoted sustainable transportation objectives and aligned with the goals of Saudi Vision 2030. The eActros included cutting-edge safety and comfort features, a 336 kWh battery, and a range that extends to 300 km.

Saudi Arabia Electric Truck Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Light-duty Truck, Medium-duty Truck, Heavy-duty Truck |

| Propulsions Covered | Battery Electric Truck, Hybrid Electric Truck, Plug-in Hybrid Electric Truck, Fuel Cell Electric Truck |

| Ranges Covered | 0-150 Miles, 151-300 Miles, Above 300 Miles |

| Applications Covered | Logistics, Municipal, Construction, Mining, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia electric truck market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia electric truck market on the basis of vehicle type?

- What is the breakup of the Saudi Arabia electric truck market on the basis of propulsion?

- What is the breakup of the Saudi Arabia electric truck market on the basis of range?

- What is the breakup of the Saudi Arabia electric truck market on the basis of application?

- What is the breakup of the Saudi Arabia electric truck market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia electric truck market?

- What are the key driving factors and challenges in the Saudi Arabia electric truck market?

- What is the structure of the Saudi Arabia electric truck market and who are the key players?

- What is the degree of competition in the Saudi Arabia electric truck market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia electric truck market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia electric truck market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia electric truck industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)