Saudi Arabia Electric Vehicle Battery Market Size, Share, Trends and Forecast by Battery Type, Propulsion Type, Vehicle Type, and Region, 2026-2034

Saudi Arabia Electric Vehicle Battery Market Overview:

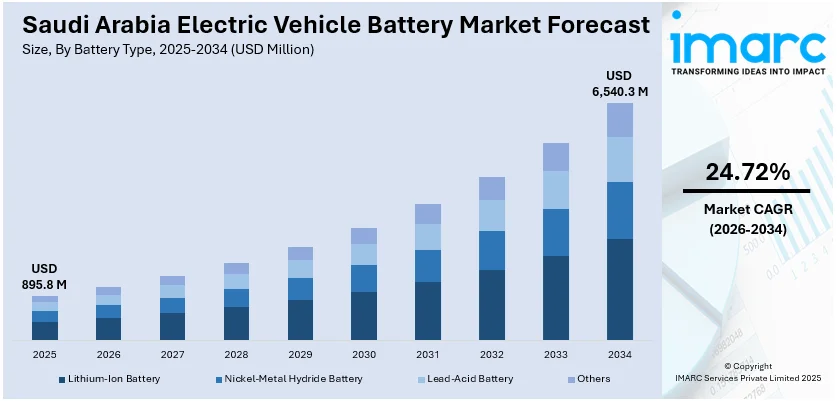

The Saudi Arabia electric vehicle battery market size reached USD 895.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 6,540.3 Million by 2034, exhibiting a growth rate (CAGR) of 24.72% during 2026-2034. Government policies, strategic investment initiatives, Vision 2030 alignment, urban expansion, rising disposable income, changing consumer mobility preferences, regulatory support, deployment of EV infrastructure, collaborative ventures, fast-charging technologies, local manufacturing, non-oil economic diversification, and favorable industrial environment are some of the factors positively impacting the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 895.8 Million |

| Market Forecast in 2034 | USD 6,540.3 Million |

| Market Growth Rate 2026-2034 | 24.72% |

Saudi Arabia Electric Vehicle Battery Market Trends:

Government Policy and Strategic Investment Initiatives

Saudi Arabia’s Vision 2030 has been instrumental in creating a long-term framework that prioritizes the diversification of the economy and the reduction of dependence on hydrocarbons. As part of this national agenda, the government is encouraging the development of a sustainable transportation network, including electric mobility. Policies have been enacted to incentivize local and international manufacturers to establish battery production units within the Kingdom. Saudi Arabia’s battery energy storage capacity is projected to grow from under 10 MW in 2022 to over 1.2 GW by 2030, backed by USD 1.8 Billion in planned investments—reinforcing the Saudi Arabia EV battery market through aligned infrastructure growth, technology synergies, and expanded energy storage capabilities essential for large-scale EV deployment. Furthermore, the Public Investment Fund (PIF) is allocating substantial capital toward joint ventures and green mobility programs. These efforts are intended to localize critical parts of the electric vehicle supply chain, including lithium-ion battery assembly, to minimize reliance on imports and develop domestic capabilities. The implementation of such targeted policies has started shaping the competitive landscape and contributed to increasing Saudi Arabia electric vehicle battery market share among regional players and global participants. These investments are aligned with broader economic objectives, including job creation in high-technology industries and the strengthening of non-oil GDP. Major players in the automotive and energy storage industries are now exploring partnerships and manufacturing operations in Saudi Arabia, drawn by the favorable policy environment and streamlined regulatory procedures. The strategic nature of these developments ensures consistent demand for battery technologies tailored to desert climates, long-range efficiency, and integration with smart grid infrastructure. Such institutional backing acts as a powerful force for Saudi Arabia electric vehicle battery market growth through long-term capital inflow, R&D incentives, and technology licensing agreements that anchor the sector within the national industrial ecosystem.

To get more information on this market Request Sample

Rapid Urbanization and Shifts in Consumer Mobility Preferences

The demographic transformation of major Saudi cities, marked by urban expansion, rising disposable income, and heightened environmental awareness, is significantly altering vehicle ownership patterns. Residents are increasingly exploring electric vehicles as viable alternatives to internal combustion engine models, driven by considerations such as energy cost efficiency, reduced maintenance, and regulatory compliance in emission-restricted zones. These shifts are reinforced by rising fuel prices, congestion in urban corridors, and a rising number of younger consumers who prioritize innovation, sustainability, and connected driving technologies. On October 1, 2024, Arthur D. Little released a report outlining future mobility trends in Saudi Arabia, revealing that 35% of consumers are considering electric vehicles for their next purchase. This growing consumer interest signals rising demand for supporting technologies. The demand for reliable, high-capacity battery systems has accelerated as consumers seek vehicles that offer performance parity with conventional counterparts while ensuring long-term cost advantages. Supporting infrastructure such as fast-charging stations, battery swapping systems, and integrated digital platforms are being rolled out in high-density areas, ensuring seamless adoption of electric mobility. Local enterprises are collaborating with global EV manufacturers to adapt battery technologies to regional driving conditions, particularly heat resistance and charging cycle durability. As these developments align with user demand and infrastructural modernization, the Saudi Arabia electric vehicle battery market outlook is becoming increasingly favorable to long-term scalability, supported by complementary innovation ecosystems and private sector engagement.

Saudi Arabia Electric Vehicle Battery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on battery type, propulsion type, and vehicle type.

Battery Type Insights:

- Lithium-Ion Battery

- Nickel-Metal Hydride Battery

- Lead-Acid Battery

- Others

The report has provided a detailed breakup and analysis of the market based on the battery type. This includes lithium-ion battery, nickel-metal hydride battery, lead-acid battery, and others.

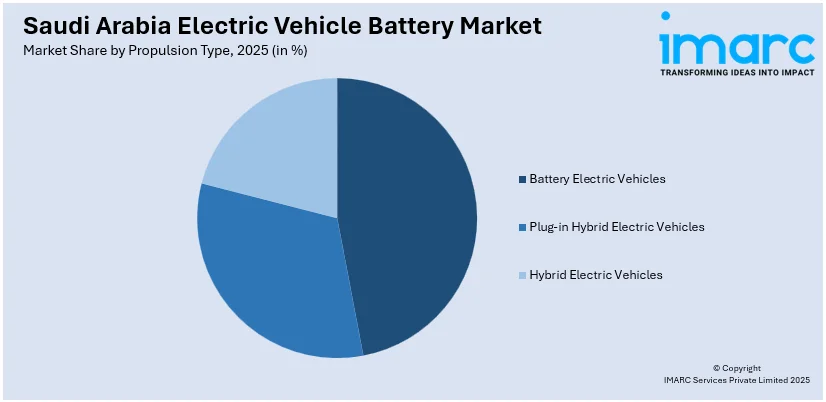

Propulsion Type Insights:

Access the comprehensive market breakdown Request Sample

- Battery Electric Vehicles

- Plug-in Hybrid Electric Vehicles

- Hybrid Electric Vehicles

The report has provided a detailed breakup and analysis of the market based on the propulsion type. This includes battery electric vehicles, plug-in hybrid electric vehicles, and hybrid electric vehicles.

Vehicle Type Insights:

- Passenger Car

- Commercial Vehicles

- Two-Wheeler

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger car, commercial vehicles, and two-wheeler.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Electric Vehicle Battery Market News:

- On April 10, 2025, Tesla launched its first showroom and service center in Riyadh, marking its official entry into the Saudi Arabian market. This move is expected to drive demand for high-performance EV components, strengthening the Saudi Arabia EV battery market through increased consumer exposure and expanding infrastructure for electric mobility.

Saudi Arabia Electric Vehicle Battery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Battery Types Covered | Lithium-Ion Battery, Nickel-Metal Hydride Battery, Lead-Acid Battery, Others |

| Propulsion Types Covered | Battery Electric Vehicles, Plug-In Hybrid Electric Vehicles, Hybrid Electric Vehicles |

| Vehicle Types Covered | Passenger Car, Commercial Vehicles, Two-Wheeler |

| Regions Covered | Northern And Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia electric vehicle battery market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia electric vehicle battery market on the basis of battery type?

- What is the breakup of the Saudi Arabia electric vehicle battery market on the basis of propulsion type?

- What is the breakup of the Saudi Arabia electric vehicle battery market on the basis of vehicle type?

- What is the breakup of the Saudi Arabia electric vehicle battery market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia electric vehicle battery market?

- What are the key driving factors and challenges in the Saudi Arabia electric vehicle battery market?

- What is the structure of the Saudi Arabia electric vehicle battery market and who are the key players?

- What is the degree of competition in the Saudi Arabia electric vehicle battery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia electric vehicle battery market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia electric vehicle battery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia electric vehicle battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)