Saudi Arabia Electric Vehicle Component Market Size, Share, Trends and Forecast by Component, Distribution, and Region, 2026-2034

Saudi Arabia Electric Vehicle Component Market Overview:

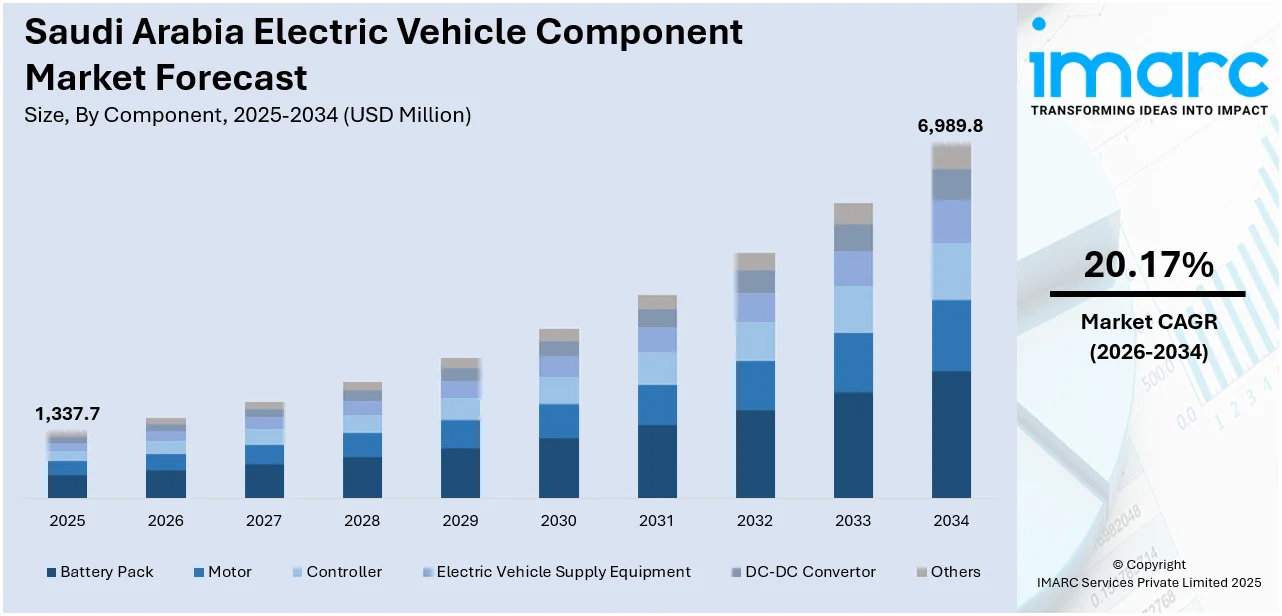

The Saudi Arabia electric vehicle component market size reached USD 1,337.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 6,989.8 Million by 2034, exhibiting a growth rate (CAGR) of 20.17% during 2026-2034. Government incentives for EV adoption, growing environmental awareness, investments in renewable energy, advancements in EV technology, increasing demand for sustainable transportation, and expansion of charging infrastructure across the country are some of the factors contributing to Saudi Arabia electric vehicle component market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,337.7 Million |

| Market Forecast in 2034 | USD 6,989.8 Million |

| Market Growth Rate 2026-2034 | 20.17% |

Saudi Arabia Electric Vehicle Component Market Trends:

Rising Interest in Electrified Vehicles

In Saudi Arabia, more people are becoming interested in electrified cars, with a sizable section of the population exploring a change to sustainable mobility. The preference for hybrid technology is particularly noteworthy, reflecting the country's rising emphasis on environmentally friendly mobility alternatives. This transition is consistent with the Kingdom's overall goals of diversifying its car sector and reducing reliance on fossil fuels. The growing demand for electric and hybrid cars reflects shifting customer preferences that support the transition to an all-electric future. As a result, the market is growing more appealing to both domestic and international manufacturers, creating several prospects for investment and growth in Saudi Arabia's automotive sector. These factors are intensifying the Saudi Arabia electric vehicle component market growth. For example, in October 2024, a Ford Motor Company survey revealed that over 40% of Saudi Arabia residents were considering purchasing an electrified vehicle within the next year, with a preference for hybrid technology. This interest aligns with Ford's commitment to supporting Saudi Arabia’s Vision 2030 and its transition to an all-electric future, as the company enhances its understanding of the local market's readiness for electrified vehicles.

To get more information on this market Request Sample

Growing Localization in EV Market

Saudi Arabia's electric car market is growing rapidly, with a heavy emphasis on local manufacture and supply chain development. A large share of new market agreements are committed to local enterprises, with a focus on producing critical EV components such as subframes and plastic parts. To lessen dependency on imports, the Kingdom aims to achieve a high level of localization in line with its Vision 2030 objectives. The creation of advanced manufacturing units, such as those in King Abdullah Economic City, would help to enhance the automotive ecosystem. Saudi Arabia intends to construct a strong EV infrastructure in collaboration with global suppliers and local partners, establishing itself as a prominent participant in the regional electric car industry. For instance, in February 2025, Ceer, Saudi Arabia’s first homegrown electric vehicle brand, secured SAR 5.5 Billion (USD 1.4 Billion) in deals, with over 80% of agreements involving local companies. These deals support Ceer’s 45% localization target and the Kingdom’s Vision 2030 goals. Key agreements focus on manufacturing, including components like subframes and plastic parts. Ceer’s King Abdullah Economic City plant would develop a robust local supply chain, enhancing the automotive ecosystem with global tier-one suppliers.

Saudi Arabia Electric Vehicle Component Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on component and distribution.

Component Insights:

- Battery Pack

- Motor

- Controller

- Electric Vehicle Supply Equipment

- DC-DC Convertor

- Others

The report has provided a detailed breakup and analysis of the market based on the component. This includes battery pack, motor, controller, electric vehicle supply equipment, DC-DC convertor, and others.

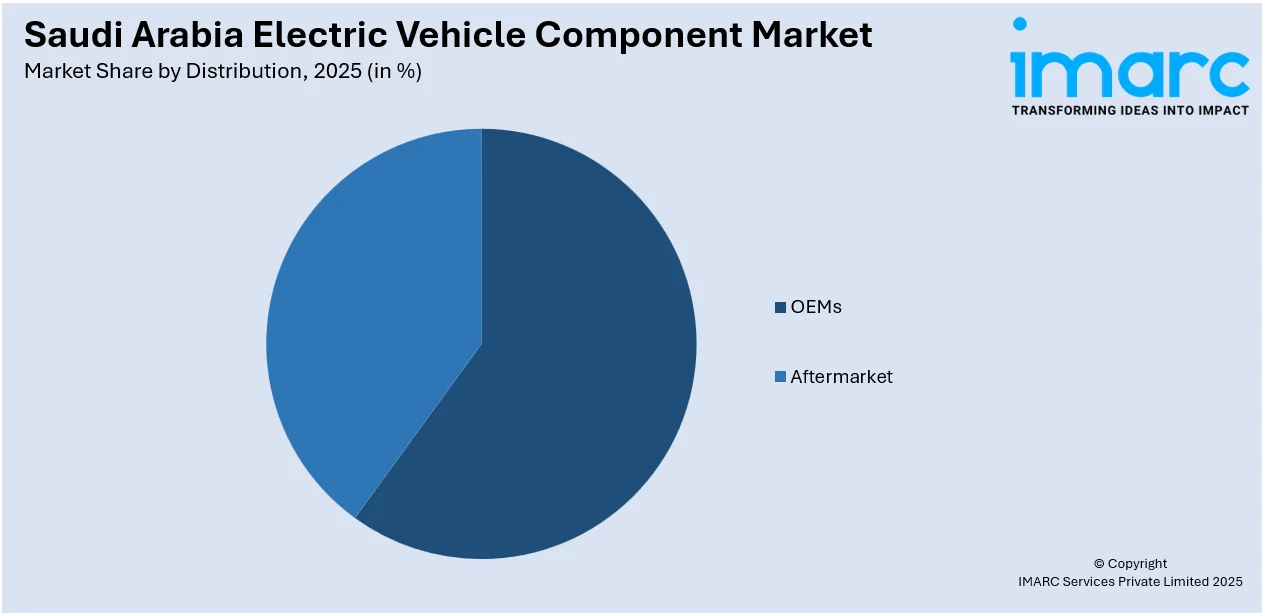

Distribution Insights:

Access the comprehensive market breakdown Request Sample

- OEMs

- Aftermarket

A detailed breakup and analysis of the market based on the distribution have also been provided in the report. This includes OEMs and aftermarket.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Electric Vehicle Component Market News:

- In March 2025, EVIQ, Saudi Arabia's leading EV infrastructure provider, launched its first highway EV charging station at SASCO Aljazeera on the Riyadh-Qassim highway. This marks the beginning of a nationwide EV charging network, with plans to deploy over 5,000 fast chargers by 2030. EVIQ's collaboration with SASCO is crucial for supporting the Kingdom's transition to electric mobility, offering efficient charging infrastructure along key highways and contributing to Saudi Arabia’s sustainability goals.

Saudi Arabia Electric Vehicle Component Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Battery Pack, Motor, Controller, Electric Vehicle Supply Equipment, DC-DC Convertor, Others |

| Distributions Covered | OEMs, Aftermarket |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia electric vehicle component market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia electric vehicle component market on the basis of component?

- What is the breakup of the Saudi Arabia electric vehicle component market on the basis of distribution?

- What is the breakup of the Saudi Arabia electric vehicle component market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia electric vehicle component market?

- What are the key driving factors and challenges in the Saudi Arabia electric vehicle component market?

- What is the structure of the Saudi Arabia electric vehicle component market and who are the key players?

- What is the degree of competition in the Saudi Arabia electric vehicle component market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia electric vehicle component market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia electric vehicle component market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia electric vehicle component industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)